Gwengoat/iStock via Getty Images

Introduction

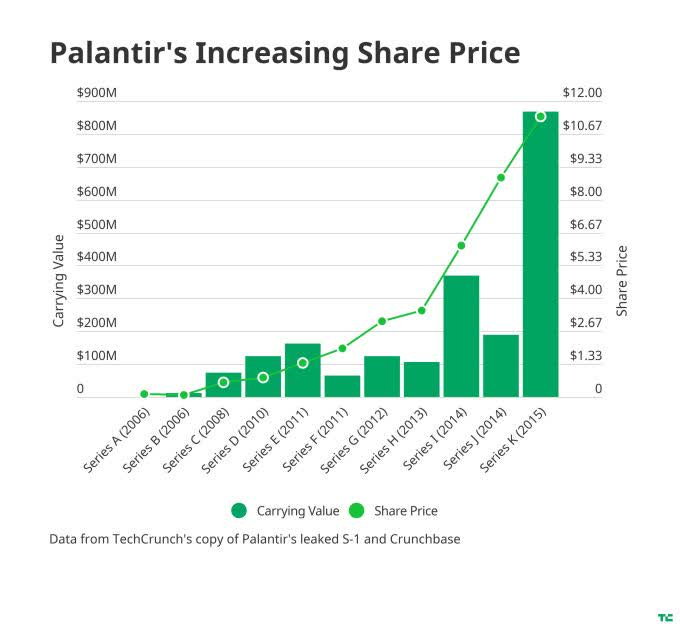

Palantir (NYSE:PLTR), Palantir, Palantir… a company that almost needs no introduction. Cofounded by the PayPal Alum Peter Theil, alongside Alex Karp and Stephen Cohen, Palantir experienced outsized growth as it helped western governmental agencies digitalize.

What started as a simple idea to reduce fraudulent online transactions quickly morphed into becoming a multi-billion-dollar behemoth we know today.

TechCrunch

Palantir has long claimed its main competitor is internal IT departments that want to build their own digital infrastructure. But what if I told you that Palantir does indeed have a competitor?

And what if I told you that one of those companies is a relatively unheard-of Polish Microcap with higher margins than Palantir that’s also growing faster?

That Company is Datawalk, listed on the Warsaw exchange with the ticker “WSE: DAT”. Palantir investors would be wise to watch out for this newcomer on the block.

Want to learn more?

Well within this article I’ll:

- Compare the Businesses Performance of both Palantir and Datawalk

- Asses their relative Financial Performance across a range of metrics

- Provide a valuation assessment

Palantir vs Datawalk: How similar are they?

To better understand what Datawalk does, and why Palantir investors need to pay attention, let’s turn to Datawalk’s company website:

“Datawalk utilizes unique software technology to enable our customers to solve difficult problems that are important to society. Our software platform is optimized for revealing patterns, relationships, and anomalies for large-scale, multi-source intelligence operations and data analysis. Using a massively scalable big-data engine, combined with user-friendly visual interfaces, Datawalk eliminates the restrictions of data silos, allowing government agencies and commercial enterprises to rapidly unify, access, visualize, analyze, and securely share data. Data is presented not only as cells in a table, but as understandable “objects” – such as people, transactions, or events – which are automatically interconnected in order to provide our customers with a holistic view of all their data.”

If I replaced the word “Datawalk” with “Palantir”, would you have even noticed?

Datawalk positions itself as a cheaper alternative to Palantir, and one with potentially less reputational risk. Given the number of negative articles written on Palantir, including here on Seeking Alpha, companies and governmental organizations may view Datawalk as a method to unlock some of the features offered by Palantir without generating the same amount of negative press.

As seen with Palantir’s NHS contract, public outcry can negatively impact business performance.

As a foreign company, trading just in Poland, Datawalk has largely gone under the radar, next to zero institutional coverage exists. Compare that to Palantir which is one of the most popular companies on Seeking Alpha, and usually sports incredibly high trading volume and a market cap of over $20B. But Palantir investors shouldn’t ignore, what I call, the polish threat.

Because, interestingly enough, according to their site, Datawalk targets the following verticals (many of which are shared targets of Palantir):

- Law Enforcement

- Anti Fraud

- Cryptocurrency

- Intelligence Agencies

- Anti-Money Laundering

And like Palantir, Datawalk has several contracts with large governmental agencies. Some of those include:

- The US Department of Defense

- The US Department of Justice

- A “Top-10” Police Department in North America

- The US Department of Homeland Security

- The US Department of Agriculture

You can read about more of those contracts here.

One can argue about the merits of one platform versus the other, but it seems clear to me that there is at least some overlap between their product offerings. If Datawalk is truly able to match the strength or even approach that of Gotham, for a lower price, Palantir may experience pricing pressure.

Financial Comparison

To kick the financial analysis off let me share with you the data I’ll be using from Yahoo finance.

Palantir Income Statement:

|

Breakdown |

TTM |

12/31/2021 |

12/31/2020 |

12/31/2019 |

12/31/2018 |

|

Total Revenue |

1,647,012 |

1,541,889 |

1,092,673 |

742,555 |

595,409 |

|

Cost of Revenue |

359,696 |

339,404 |

352,547 |

242,373 |

165,401 |

|

Gross Profit |

1,287,316 |

1,202,485 |

740,126 |

500,182 |

430,008 |

|

Operating Expense |

1,623,787 |

1,613,531 |

1,913,805 |

1,076,626 |

1,053,448 |

|

Operating Income |

-336,471 |

-411,046 |

-1,173,679 |

-576,444 |

-623,440 |

|

Diluted NI Available to Com Stockholders |

-498,284 |

-520,379 |

-1,171,874 |

-579,643 |

-637,078 |

|

Diluted Average Shares |

– |

1,923,617 |

979,330 |

1,389,930 |

716,027 |

Datawalk Income Statement:

|

Breakdown |

TTM |

12/31/2021 |

12/31/2020 |

12/31/2019 |

12/31/2018 |

|

Total Revenue |

29,577 |

28,859 |

14,765 |

3,426 |

1,684 |

|

Cost of Revenue |

1,535 |

1,344 |

1,073 |

874 |

114.81 |

|

Gross Profit |

28,042 |

27,515 |

13,692 |

2,552 |

1,569 |

|

Operating Expense |

36,108 |

33,578 |

20,157 |

13,352 |

15,184 |

|

Operating Income |

-8,066 |

-6,063 |

-6,465 |

-10,800 |

-13,615 |

|

Diluted NI Available to Com Stockholders |

-3,928 |

-1,648 |

-6,323 |

-11,044 |

-13,750 |

|

Diluted Average Shares |

– |

4,886 |

4,631 |

4,202 |

3,861 |

(Figures are in PLN)

Revenue Growth:

Yahoo Finance and Author’s Calculations

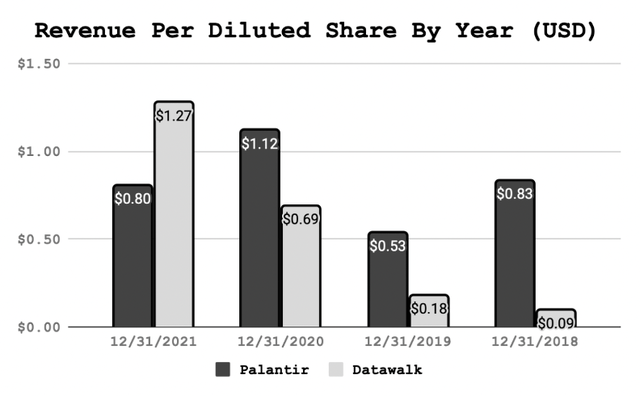

To control for share count fluctuations and currency conversions I’ve adjusted all figures for Datawalk to USD and chosen to highlight revenue per share, as opposed to total revenue. High-growth companies often issue shares to continue fueling their growth so looking at revenue growth in isolations obscures the dilutive effects of stock-based compensation and additional share issuances.

Both companies have experienced strong revenue growth, in Palantir’s case they’ve added around $1B in revenues from a roughly $600mm base in just 3 years whereas Datawalk grew from less than $1mm to more than $6mm USD. But on a per share basis, that translates to Palantir going from 83 cents in 2018, to just 80 cents at the end of 2021. Datawalk on the other hand has gone from 9 cents, up to $1.27!

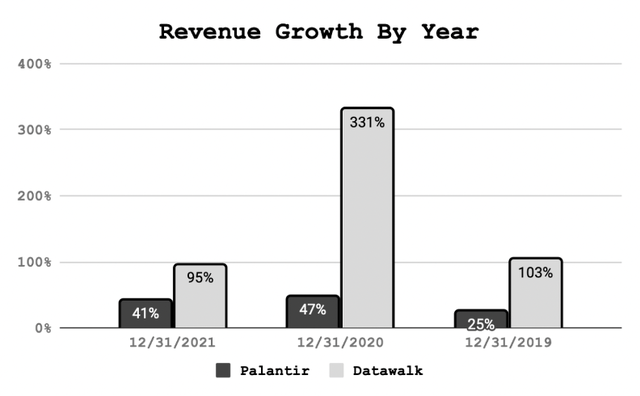

This stark contrast is still profound when one ignores the effect of share dilution, and looks at the overall revenue growth figures:

Yahoo Finance and Author’s Calculations

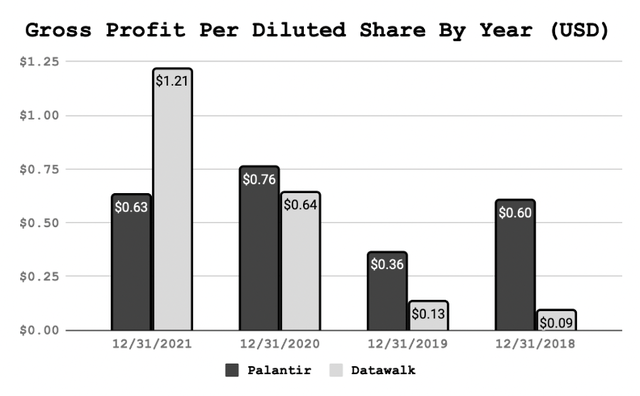

Gross Profit and Margins:

Yahoo Finance and Author’s Calculations

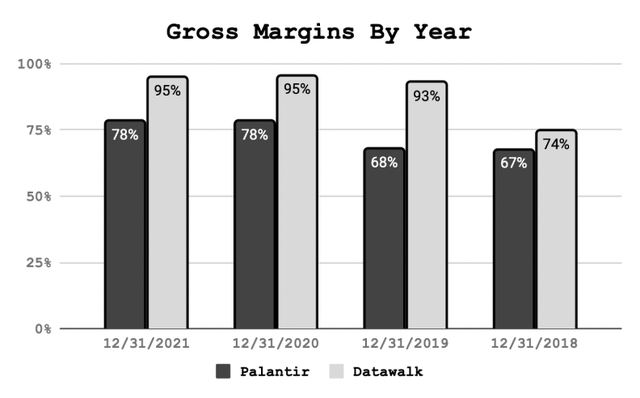

One of my prior complaints about Palantir has been the margin profile. In the last article, I wrote on the company I compared Palantir’s business to that of a hair stylist, or a consulting business, whereas other software companies are closer to an E-Book business model (low cost of replication).

In other words, Palantir’s model is innately lower margin because it relies so heavily on consultants which they call “Forward Deployed Engineers”, a phrase I believe is purely marketing.

Datawalk does not suffer from those same setbacks. Datawalk simply offers software for a recurring fee, the consulting business is outsourced to business partners. This frees up capital that would be spent on expensive consultants to be put into use for more software development. The result is higher margins.

78% Gross margins are nothing to scoff at but pale in comparison to Datawalk’s enviable 95% gross margin.

As you might have presumed this effect on gross margin also extends into gross profit per share growth…

Yahoo Finance and Author’s Calculations

Like revenue growth, Palantir’s gross profit per share has been effectively flat over the last 4 years. Datawalk on the other hand grew its gross profit per share by a factor greater than 10x. It’s clear to me that dilution is holding back the share performance of Palantir’s stock, on a per share basis, the company does not appear to be growing, at least based on gross profit and revenue.

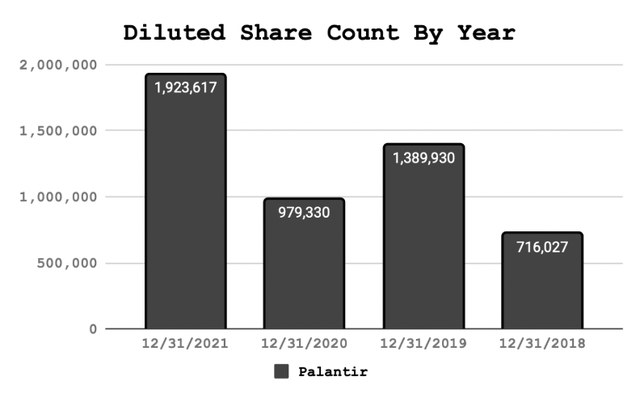

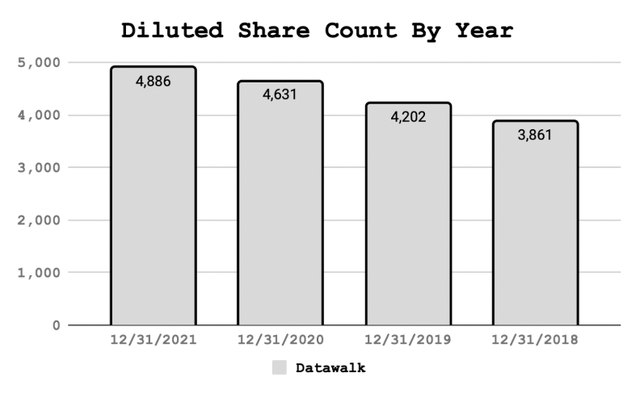

Dilution:

Yahoo Finance and Author’s Calculations Yahoo Finance and Author’s Calculations

Some charts just speak for themselves, don’t they? Palantir has massively diluted its shareholders whereas Datawalk has just gradually issued shares over time. I’m willing to chalk some of Palantir’s dilution up to its IPO and other “one-time” events, but not all of it. Palantir seems to have just a strong preference to issue more shares versus using internal capital to pay its employees. And honestly, with shares trading an over 8x forward P/S multiple I don’t blame them, it’s just a pity to see such a large amount of dilution in such a short time. As you’ll see in the next section, Datawalk trades at a higher price to sales multiple, but even so, they have diluted shareholders less over time.

Source: Yahoo Finance

Valuation

To value Palantir, I employed two methods, the price-to-sales method, and a discounted cash flow analysis.

In the case of Datawalk, I am just using the Price to Sales method for a couple of reasons. First, I feel that it would be irresponsible to forecast massive growth for such a small company. And secondly, the focus of this article is on Palantir, and why investors need to watch out for Datawalk, it’s not an investment thesis for Datawalk.

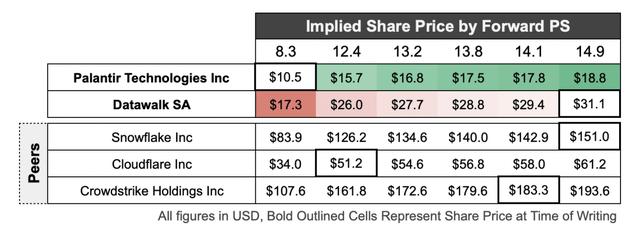

Price to Sales

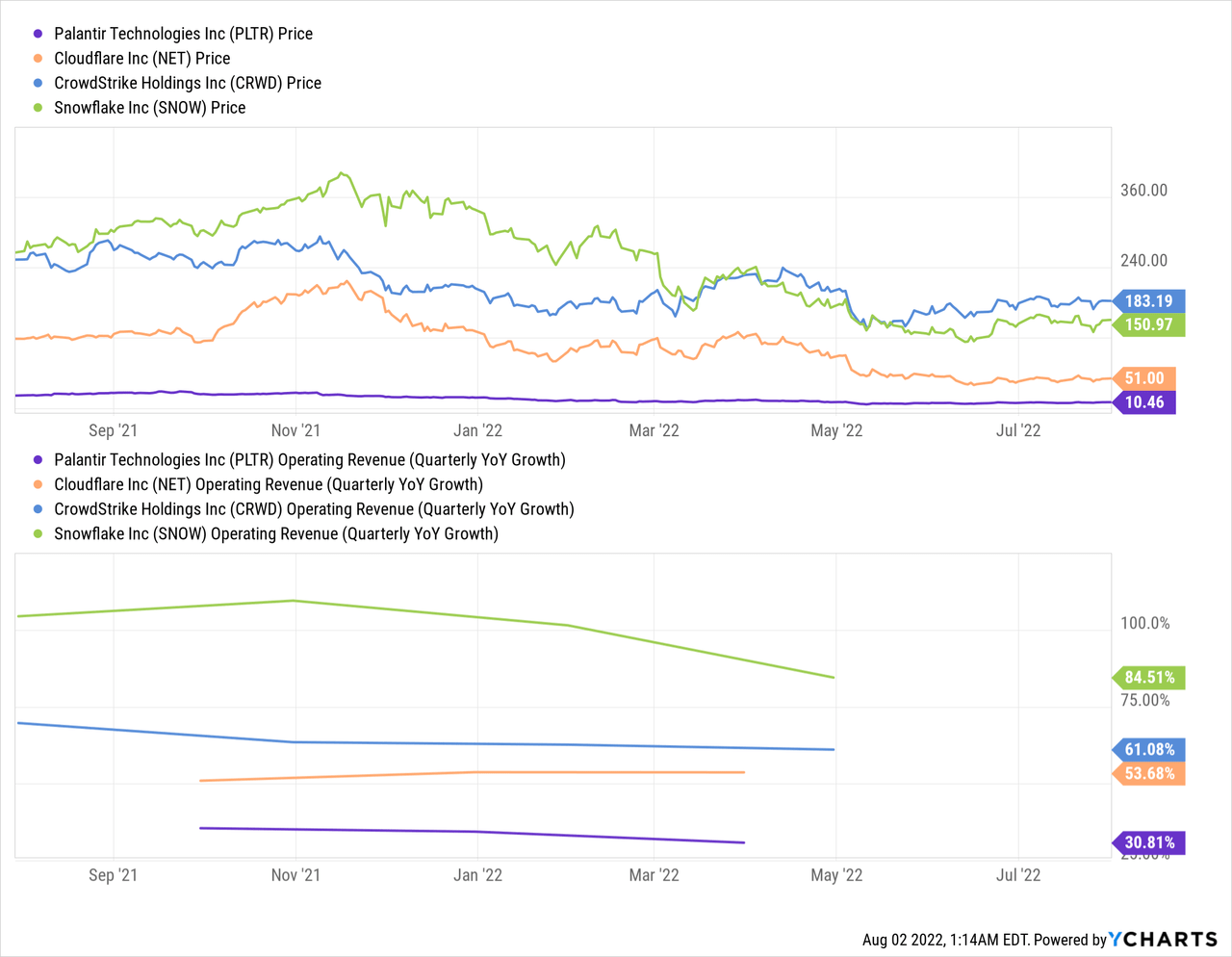

To run my price-to-sales comparative analysis I selected three other, fast-growing, enterprise software companies: Snowflake (SNOW), Cloudflare (NET), and CrowdStrike (CRWD). After selecting these companies, I used the consensus analyst expectation for next year’s sales, in the case of Datawalk, which lacks an analyst expectation, I selected $10mm which I believe is fair considering their historical growth rate and relatively low base.

|

Company |

Market Cap |

Next Year Sales Est. |

Next Year P/S |

|

WSE: DAT |

0.156 |

0.010 |

15.4 |

|

PLTR |

21.172 |

2.540 |

8.3 |

|

SNOW |

47.684 |

3.090 |

15.4 |

|

NET |

16.416 |

1.30 |

12.6 |

|

CRWD |

42.608 |

3.000 |

14.2 |

|

Average PS (excl. DAT, and PLTR) |

14.1 |

||

|

Average PS (excl. DAT, and PLTR) |

13.2 |

Source: Yahoo Finance and Author’s Calculations.

Market Cap and Sales Estimates are shown in Billions of US Dollars.

After identifying their respective forward price-to-sales ratios I created a table to compare the price of each respective company using the various price-to-sales ratios.

Yahoo Finance and Author’s Calculations

Based solely on this price-to-sales analysis, Palantir appears to be undervalued. But I would recommend taking that with a grain of salt as Palantir has a lower growth and margin profile compared to its peers so, in my opinion, a discount is deserved.

Given the outsized role that peer selection plays in any comparative analysis, I also ran a discounted cash flow analysis on Palantir to assess the future value of the business based on its internal ability to generate cashflows for the shareholder.

Palantir’s Discounted Cash Flow

|

Metrics |

Assumptions |

|

Discount Rate |

11.00% |

|

Revenue CAGR |

20% |

|

Terminal Growth |

2% |

|

Year |

2023 |

2024 |

2025 |

2026 |

|

Revenue |

$2,540.0 |

$3,048.0 |

$3,657.6 |

$4,389.1 |

|

Net Income |

$467.2 |

$588.7 |

$741.7 |

$934.6 |

|

Cash Flow |

$373.8 |

$470.9 |

$593.4 |

$747.7 |

|

Palantir Current Stock Price |

$10.35 |

|

DCF Implied Share Price: |

$6.26 |

Using a simple discounted cash flow analysis, one that assumes no dilution, Palantir’s shares appear overvalued. In my base case scenario, I expect to see Palantir’s shares fall by 40%.

Sensitivity Analysis

For the sake of fairness, I also ran a sensitivity analysis to estimate Palantir’s share prices across a few different assumptions, specifically the discount rate and the growth rate.

|

9% Discount Rate |

11% Discount Rate |

13% Discount Rate |

|

|

Bull Case: 30% Revenue Growth |

$13.3 |

$9.6 |

$7.3 |

|

Base Case: 20% Revenue Growth |

$8.6 |

$6.3 |

$4.8 |

|

Bear Case 10% Revenue Growth |

$5.4 |

$4.0 |

$3.1 |

Under the scenarios, I tested, only one yielded a positive result, 30% revenue growth, and a 9% discount rate. This, to me, means that if you’re comfortable accepting a lower margin of safety and have high growth expectations Palantir shares could, in an optimistic scenario, be a buy. But personally speaking, I’m not willing to give up my margin of safety and given the rise of competitors like Datawalk I have doubts their historical growth rates can be sustained.

Risks

Before I move to my conclusion and present my final price target for these two companies let me highlight a couple of risks investors should be aware of.

First, about Datawalk, this is a very small company. With a market cap of less than $200mm USD and less than $10mm in revenues, I would classify this company as a Microcap. Microcap companies are especially risky for a variety of reasons, one of the largest is difficulty in accessing data/research about the company. There are also executional risks, it’s one thing to go from $1mm to $6mm in revenues, but it’s another thing to reach $100mm, or $1B in revenues. Palantir has a major head start, and often with software the market has a winner takes most outcome. In Datawalk’s case, based on their contracts with major US government agencies, I have stronger faith in their ability to execute than I would otherwise. Another important factor to consider is that shares of Datawalk trade in Polish Zlotys on the Warsaw Exchange. Trading in other countries subjects you to a different set of restrictions and rules outside of the SEC and may expose you to currency fluctuation risks. Luckily for Datawalk, its contracts with the US government ensure a strong flow of USD, lessening the impact of currency fluctuations for US-based investors. The risks I highlighted are not all-encompassing, I would urge all potential Datawalk investors to read up on international trading rules and regulations and to do a deeper dive into the risks around trading microcap stocks generally. To reiterate, this article is not investment advice.

The last major risk I’d like to highlight in this article is the significance of interest rate expectations. As high-growth companies, Datawalk and Palantir are both expected by investors to generate large sums of (distant) future cash flow. This makes these companies “high-duration assets” meaning that their value can rapidly change if interest rates change. The war in Ukraine, global food shortage, inflation, and growing fears of layoffs make forecasting interest rates that much more difficult.

Conclusion

The myth that Palantir doesn’t have any competitors is just that, a myth. In reality Companies like Datawalk pose a growing risk for Palantir. While small in size now these risks shouldn’t be ignored by management or the shareholders.

Given its rich valuation and ongoing dilution, I rate Palantir a “Sell” with a 1-Year Price Target of $6.26.

I considered a “Strong-Sell” but given that at least one outcome in my sensitivity analysis was positive I decided to refrain.

Investors in Palantir would be wise to follow the development and growth of Datawalk, its early success with large government agencies may be a harbinger of what’s to come. Should Datawalk continue to scale they could exert pricing pressure on Palantir and weaken their market dominance.

Thank You

Again, thank you all for reading. I hope you found my article somewhat entertaining or informative. If you’d like to chat with me about either company, feel free to leave a comment below, I try to get back to all comments with a response. I wish you all the best!

Be the first to comment