JohnnyPowell/E+ via Getty Images

Last week, Palantir Technologies (PLTR) reported its earnings and we dubbed the action in the stock a “great reset“. In that column, we laid out an argument for this stock being a buy, and outlined a specific play for traders. Without going too much into what we discussed, shares have been absolutely crushed. Performance was strong and ahead of consensus estimates. But the thing is that the company operates with no debt and has positive free cash flow. Yes, there is a dilution issue which is a major annoyance for shareholders and is a risk factor for valuation. Despite falling to levels not seen since shortly after the direct offering in 2020, the stock remains pretty expensive, but nowhere near where it was valued a year ago. With the growth the company is displaying and what appears to be a recognition of the need to get to profitability, we still like scaling in here. In this column we delve further into the company strengths and risk to highlight why we see shares as a buy, and to elaborate on risks that remain.

As we discussed previously, Palantir brings in its sales under two different reporting segments. As a reminder, these are the government and commercial segments. It is our opinion that the commercial revenue stream is really going to drive future growth, while the government revenues will be slower, they will be more stable sources of growth. You see, the commercial revenue stream has grown at a rapid rate over the last year, while government results and the outlook have been a bit mixed. We see this continuing in the near- to medium-term. It is worth reminding readers that to improve sales, Palantir has and will continue to expanded its sales team, which will work to secure new orders.

Keep in mind that performance was strong. Just to recap, we saw total revenue which grew 34% year-over-year to $433 million, beating estimates by almost $15 million. The commercial revenue continues to grow at a great pace, rising 132% in 2021, and up 47% in Q4 vs last year. Government revenues have slowed their growth but they still rose 26% from last year.

What we like about Palantir

Now, we feel it is important to understand where we see the company as doing well, and where it leaves something to be desired. When we consider the company’s fundamentals, we think that 2021 demonstrated strong performance that any software investor can appreciate, especially considering the size and scope of the company. So what kind of items are we discussing? First, we do like that the company continues to add customers. While there will always be churn, we are looking at net customer growth. In the quarter, the company added a total of 34 net new customers in the quarter across both segments. This is a positive.

We think it is also extremely important to acknowledge that this company is seeing very positive momentum in its margins. Movement in margins is important in a software company as it really highlights strengths, or weaknesses, in the way it distributes its products. If there are a lot of middlemen the company relies on, then it will cut into gross margins as those middlemen take there cut. Generally speaking when you have software companies with gross margins that are well over 50%, and approaching 60-70%, then generally the use of middlemen type companies is usually low or non-existent. Well, Palantir, and its sales team, clearly are executing direct sales as gross margins expanded to 78% in the last year which is up double-digits from the prior year’s quarters.

Given the growth in revenues and the margin expansion, we also saw expansion on EBITDA. We really like looking at EBITDA for a company of this nature. While the company lost $59 million, adjusted income from operations was $124 million. Adjusted EBITDA was $128 million, or a 30% margin for the quarter. This is solid margin expansion. It is worth pointing out that for the year the margin on EBITDA expanded to 32%. This is positive.

Going more into the risk

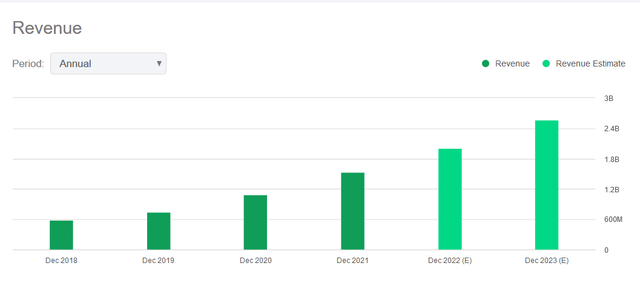

Some of the things we do not like? Well, we absolutely have to acknowledge the share based compensation issue, more deeply than our simple past mentioning of this. We believe that anyone, bull or bear, can agree that Palantir is growing fast and has a lot of promise. Please keep in mind that the growth in revenues is projected to continue:

Now, here is the thing. The company is just barely starting to make money. The company squeaked out a $0.02 adjusted EPS result. It is something, but barely profitable. This gets even worse though when we consider the stock based compensation. If all things were held equal, the value of the company is eroding as stock based compensation continues. New buyers look to the future, but even the future is being diluted. In the past, companies that have been addicted to stock based compensation have seen limited returns despite their growth, compared to companies that do not dilute. So why then does it do this? There are some issues that arise as to whether issuing stock which can then be sold to enrich already well-paid executives is ‘the right thing to do.’ There is an argument for such compensation to retain talent. Our argument in favor to stock based compensation is to keep technical experts on board. But even then, the cumulative impact of this dilution punishes shareholders, even when growth metrics are hit.

So why is the stock again a buy? When we factor in the current dilution, and future growth, we still shares as a buy here. This is coupled with CEO Alex Karp’s statement:

We’re not issuing a lot of new shares, I think it’s like in the $9 million range……… if you’re smart enough to invest in talent, you’re smart enough to figure out. There’s essentially – there’s the – how are we comping people, and there will be a normalization that will get us into a range where you would see in a software company within the next 18 months, latest 2 years. But there’s essentially – and that’s going to take a little time. It is going to happen, because it’s also very much linked to another question, which is how do you actually run the company so it’s profitable someday

We view this as a recognition that shareholders are pretty unhappy. A recognition that to get to profitability, this is weighing. However, this is also a simultaneous risky statement. This could possible mean, that Karp is acknowledging that people are not happy and its bad for the company log-term, but does not care. It will normalize, but continue. This is a near-term risk as we do not know how much expense there will be until it slows. And for now, this is the biggest risk.

That means the stock is expensive now, but could be expensive in the future even with ongoing growth. But for now, the company is free cash flow positive. For the year, adjusted free cash flow was $424 million. We love free cash flow. The bottom line is that at 15X sales, the stock is still expensive, factoring in the drop in shares to under $11 now, but getting into the buy range we like. While the value is much more reasonable compared to when the stock was in the $30s, high growth stocks like this tend to be more attractive at sub 10X. The company is working to get to being profitable and we do like the hidden positive of a 1.0X PEG ratio, but future dilution could continue to weigh.

Final thoughts

The market really drove this stock up on its promising future. It has now overshot to the downside in our opinion, even though there is some degree of risk with the dilution that has been ongoing. The stock remains in our buy zone as it hits the $10 range. Long-term, you can make a solid investment here, especially if management is serious about focusing on profitability.

Be the first to comment