Michael Vi

I have seen as many conflicting analyses on Palantir (NYSE:NYSE:PLTR) stock as maybe for no other stock previously. This is particularly interesting as the company has received so much attention despite still being relatively small from a revenue and market capitalization standpoint. With this increased attention, I feel many analyses, oftentimes on YouTube and elsewhere, objectivity has been chiefly lost along the way. Hence, with this article, I aim to create a solid foundation for any interested and existing shareholders to claim back some of that objectivity.

What makes Palantir so interesting is the area in which they operate, making data actionable, for which no holistic software solution exists in the market. While facing plenty of challenges, ranging from dilution to governance to growth, the answer to the problem of actionable data shows promising early signs, which is ultimately why I rate Palantir as “Buy”. Still, due to the company’s inherent potential, I can see the stock being a small position for investors seeking alpha (no pun intended). In initiating a rating, I am caught somewhere between “buy” and “hold” for reasons I will elaborate on further.

The Good

If you are familiar with the company/product, this might still be interesting, but I recommend reading on from ‘stock price’. I suppose many people would agree with me, proclaiming that artificial intelligence in the form of machine learning has enormous potential to drive significant growth in various areas, from better diagnosis in radiology to autonomous driving for automobiles. While public perception is mainly that of complicated algorithms coming up with a prediction, in reality, ~80-90% of the time is spent collecting and preparing the data for machine learning or general data analytics. What if the required data was already available? Many companies are in precisely this position that they have already collected the data, but integration and accessibility of this data are not guaranteed. This is the exact problem Palantir is solving for companies: making data actionable! While it remains to be seen, from my point of view, whether the company can deploy its solution in a scalable and thus financially beneficial way, Gotham and Foundry offer the best solution to the above-stated problem.

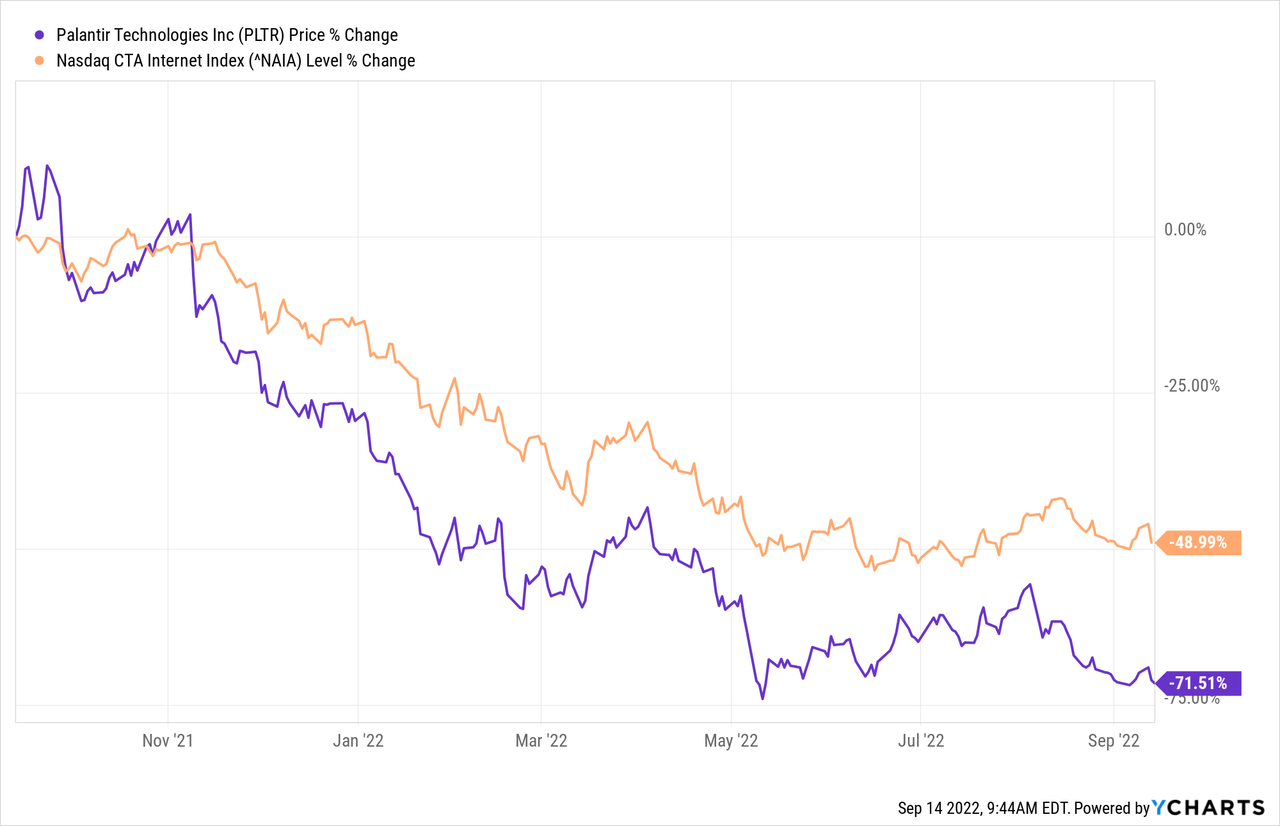

Stock price

Any company can execute however well and have a great product. Still, if the valuation is fundamentally decoupled from its probabilistic financial return, I would not consider an investment in such a company. Over the last 12 months, Palantir stock has dropped by more than ~70%. While any statements in hindsight are easy to make, I felt that this drop was due in time. However, while I feel like the stock price has reached levels closer to fair value than before, the fall to a price of $7.50 is too far, in my view, relative to the potential upside that exists. Currently, the stock trades at 8.5x its TTM revenue compared to an average in the software industry of 14x, as reported by Damodaran. Obviously, in isolation, that will not tell us much; however, at first sight, it appears odd due to the above-average growth and expected growth for the future, which likely will be above 20-25% for the coming years, compared to the average in the software industry that lies around 9%. In addition, the often regarded rule of 40 for SaaS companies is edging ever closer to the threshold of 40, amounting to 38.8 following Palantir’s Q2 2022 earnings due to increased FCF margin. The rule of 40 gives us a pretty good indication of a company’s balance between growth and profitability and any value above 40 is a positive sign for investors.

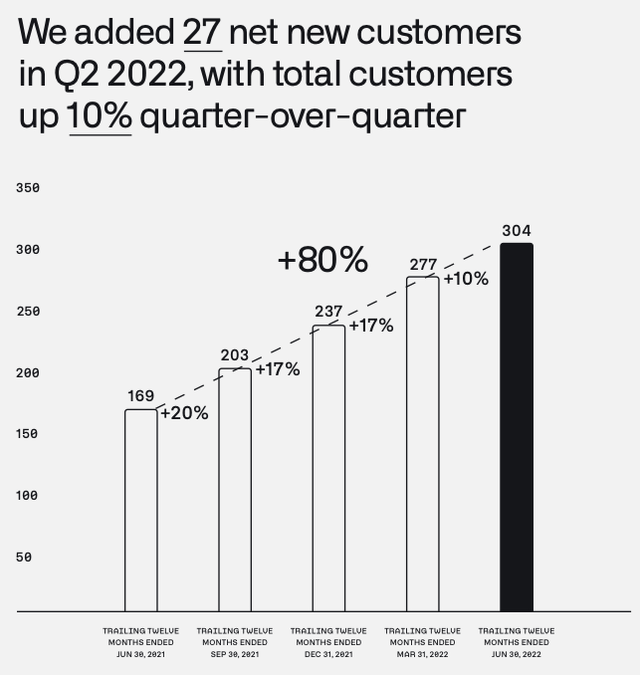

Customer Count (Palantir Q2 2022 Investor Presentation)

Positive numbers from Palantir’s Q2 earnings

The first positive part of earnings, particularly now that access to additional cash is becoming more restrictive, is the narrowing loss from operations which decreased from negative $146 million in Q2 2021 to negative $42 million in Q2 2022. One thing I liked about this is that management announced it would focus more on profitability, and they came true. While it is fair to say that management came through on their announcement, one has to remark that the narrowing is also significantly linked to the decrease in share price, which resulted in a lower amount in stock-based compensation (“SBC”). SBC is always discussed in the context of Palantir as it makes up a massive amount of Palantir employees’ compensation package. Year-over-year, SBC is diluting shareholders by 8%. However, there is some positive news on this front since SBC has decreased to just 0.83 quarter over quarter, which is in absolute terms meaning the number of shares, not the dollar amount. Lastly, the total customer count looks strong, still growing 80% YoY and 10% QoQ. Government revenue is also accelerating again, increasing 9.1% QoQ, and further growth should be observable over the next quarters once the NHS deal comes through.

The Bad

While government revenue is having a comeback, on the flip side, commercial revenue looks really depressing as of right now. On the surface, you still see 46% growth YoY, but perspective can be a pain in the… Palantir is charging their customers in rates on a recurring base, meaning one can rule out temporal revenue recognition on the commercial side. From Q1 to Q2, in absolute terms, revenue grew by just $5 million or a measly 2.4% on a quarterly basis. From a long-term perspective, the commercial segment has the potential to drive significant growth, so seeing this kind of growth is horrible. For Q3 earnings, this will become especially apparent since Q3 2021 numbers were solid. With management expecting Q3 figures to be in line with those of Q2, giving out revenue guidance of $474 million after revenue of $473 million in Q2, YoY numbers for commercial revenue growth will be around 20-22% for the third quarter of 2022.

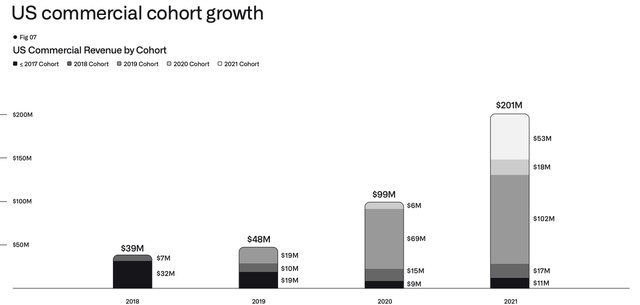

I asked myself what the possible reason for this slump in revenue growth could be when the need for actionable data becomes ever more apparent. In addition, customer count is still growing relatively fast, but the outstanding deal value has remained constant at $3.5 billion from the same time in 2021. Existing customers are expanding their contracts less and less, with net dollar retention decreasing from 131% in Q2 2021 to 119% in Q2 2022. This made me wonder if Palantir’s product is as great as many proclaim it to be. Interestingly enough, I stumbled on a graphic from the Q4 2021 presentation in which they illustrated US commercial cohort growth. There are several key insights this graphic communicates.

Palantir Customer Cohort (Palantir Q4 Investor Presentation)

First, the cohort of customers from before 2017 has shrunken to 1/3 of the deal value from 2018 to 2021. I find this very worrisome, mainly due to Alex Karp continuously iterating long-term partnerships with their customers. Especially in light of their partnership strategy, which consists of 3 phases: Acquire, Expand, and Scale; this trend questions the validity of long-term and expanding partnerships. You could argue that this strategy has been planned out just fine for the 2019 cohort; however if this 3-phase strategy were to be successful, why don’t we see exponential growth in 2022 after having acquired a massive 2021 cohort? Normally, one would now expect the customers to move on to the expansion or scale phase. However, as recent figures have shown, this does not appear to be the case, which only raises the question if the product is as great as many people claim it to be. One could also argue that the workforce is not sufficiently large enough to support the growth, justified by their recent announcement of intending to expand headcount by 25%. While this may play a part in the delay of the set-up of Foundry, it does not explain the limited spending expansion of existing customers.

Concluding Thoughts

In essence, the above shows that both sides of the argument have a valid case for having a bullish or bearish sentiment about the stock. For the short term, in particular Q3, I expect the stock to decline even further, mainly because of worse-than-expected inflation and the implied interest rate hike. Further, as said, commercial YoY figures will look horrible, tempting many retail investors, there are a lot of them in Palantir, to jump off the ship. I can see the stock price going as low as $5. However, in the long term, I can see the company’s sales efforts pay off and a reacceleration of revenue. The current times are perfect for Palantir, full of global crises and supply chain constraints. I advise interested investors to closely monitor net dollar retention rates and commercial QoQ growth for the Q3 and Q4 earnings results.

Be the first to comment