Michael Vi/iStock Editorial via Getty Images

Most of us are aware of Palantir Technologies (NYSE:PLTR) – a company that was heralded as the next big thing in data by famous investors like Cathie Wood. It all seemed too good to be true at one point, with the share price breaking $35 at one point last year. Even after a slight pullback, PLTR stock traded at about $20 and above for the most of 2021. Yet, we now see the share price at $8 (at the time of writing this article). Was this purely due to market sentiment, or do we have a deeper underlying problem here with Palantir Technologies? In this article, I’ll elaborate on the potential dangers of this company and explain how they impact my investment decision.

Data and controversy

In this section, we’ll discuss Palantir’s impressive data software, which is said to be the most advanced out there. We’ll also explore how controversial applications of it could lead to detrimental consequences.

Extremely powerful software

If you don’t already know, Palantir Technologies is a tech company that is heavily engaged in data collection and analysis. The firm was launched in 2013 with heavy backing from the CIA. Palantir has three main software platforms, namely Gotham, Foundry and Apollo. Each of these platforms plays an individual role in fulfilling Palantir’s mission of augmenting human intelligence through effective use of data. Today, its software is used by many organizations for various data-related operations, and the company is considered as one of the most valuable data companies in the world. On top of that, there is a good chance that Palantir’s software is one of the most advanced ones out there. It is noted on the company’s website that with Palantir’s solutions,

investigators are uncovering human trafficking rings, finding exploited children, and unraveling complex financial crimes.”

In more recent news, it is currently tracking and analyzing the spread of the Covid-19 virus. With the introduction of the Russia-Ukraine crisis, we may see even higher adoption of the company’s advanced software by US and its allies. It is evident that Palantir has put itself at the forefront of data software, and people are loving it – but there’s a catch.

A double-edged sword

While not many can question the effectiveness of Palantir’s methods of handling big data, there is a significant number of people who are concerned about certain ethical issues which may arise from using this type of technology at such a large scale. We see from this article on Yahoo Finance that the application of Palantir’s technology can sometimes be questionable. In particular,

Palantir’s technology has been used for a range of controversial projects including migrant surveillance systems, predictive policing, and battlefield software.”

The power of Palantir’s technology gives rise to multiple ethical concerns, and the consequences could be dire if it lands in the wrong hands. This article on BBC highlights that the company has the power to extract data like driving licenses, social media posts and DNA swabs. This is heavily frowned upon by many privacy experts, who believe that Palantir’s operations are in direct conflict with the privacy rights of the general public. In fact, Amnesty International, which is a non-governmental organization with goals to protect human rights, has spoken out against Palantir Technologies in a report stating that

the firm was failing its responsibility as a company to protect human rights with inadequate due diligence into who it is working for.”

Other human rights groups have also started investigating human rights violations related to Palantir Technologies. According to this article from Business and Human Rights Resource Centre,

Palantir’s products and services significantly enhance the capacity of the U.S. Immigration and Customs Enforcement Agency (ICE) to identify, detain and deport individuals and families, increasing the number of people subjected to human rights harms by ICE.”

It’s noteworthy that the usage of Palantir in conjunction with the ICE’s operations has been an ongoing ethical debate that seems to have no resolution. While one cannot know for certain, it’s important for investors to know the nature of the business when choosing to invest in a company. Palantir Technologies happens to be teetering between revolutionary data integration and potentially baneful exploitations, and the risk associated with this company is definitely not negligible.

Moving forward

We all know that data itself is a highly sensitive asset, and the scale at which Palantir is operating can be concerning. What we’d like to see is a secure system in which Palantir’s software thrives for the betterment of mankind. What we may get instead, however, is exploitation of data at levels we’ve never seen before. With that being said, which is the more likely outcome? My verdict is that while Palantir has a good chance of carrying out its company mission through its software, there’s simply no way to quantify the consequences if such advanced technology were to be exploited. In more recent developments, we see from this article on New York Times that

The health records of millions of people are now being funneled through Palantir’s software”,

which is a result of multiple countries (approximately a dozen) using Palantir’s software for Covid-19 tracking. The power to obtain and analyze such data is terrifying, and I expect future software developments to enable the company to do so at a much larger scale. Palantir Technologies CEO, Alex Karp, has admitted himself that the nature of Palantir’s work is “dangerous”. The company could open a Pandora’s box if its software is in the wrong hands. Yet, we also need to consider the potential good that the company’s offerings may bring in efforts of counter-terrorism, state security and efficient (and ethical) tracking. There isn’t any data company whose software comes close to what Palantir can offer – at least this is true at the current moment. I conclude that the risk and the reward are balanced, and both extremely substantial.

Palantir’s Financials

Now, let’s take a closer look at the company’s financials.

Profitability

We’ll first go over certain metrics which determine if the company is operating profitably.

Revenue growth

The company has gone from $595.41m in sales in 2018 to $1.54b in sales in 2021. The company has seen strong revenue growth over the recent period due to its increased adoption and impressive offerings. This is a good sign that the company is able to serve the most fundamental purpose of keeping it afloat – making money. However, revenue is only a part of the story. Let’s explore further.

Free cash flow

The company has gone from (54.42m) to 353.38m in free cash flow from 2018 to 2021. This is good as the company is generating more free cash which can be used for share buybacks, research and development or even dividend payments. It’s good to note, however, that we haven’t really seen a share buyback or dividends of any sort. Nonetheless, it’s nice to see that the company is generating more cash flow.

Bottom line

Here’s the catch. The company has had negative net income and earnings-per-share for the past few years. In its most recent annual financial report, the company has reported ($520.38m) in net income and (0.27) in diluted earnings-per-share. After so many years in operation, it’s concerning that we still don’t see a positive bottom line for Palantir. In comparison, Verint Systems (NASDAQ:VRNT), which is one of Palantir’s biggest competitors, has been reporting much healthier net incomes. While it can be argued that Palantir offers more advanced technology, it still does not justify so many years of negative earnings. A negative bottom line means that the company is making an overall loss, and this can be concerning for investors – especially if it persists over many years.

Care for investors

Another important thing to note is how much Palantir cares for its investors. A company typically ‘gives back’ to its investors through the issuing of dividends, or the buying back of shares.

Dividends

We see that Palantir does not issue a dividend. This is not a major cause for concern though, as many such tech companies do not do so and prefer to reinvest their cash flows or buy back shares.

Share dilution

Now, this is concerning. The company has gone from 1.73b to 1.92b in shares outstanding from 2018 to 2021, and this isn’t without reason. It is largely due to Palantir’s stock-based compensation policy – a practice where the company issues stock to its employees instead of paying them in cash. As a result, the new shares issued cause investors to own a smaller share of the pie. A rather concerning fact is that Palantir has issued more than $700m in stock to its employees in 2021, so the magnitude of shares issued is not negligible – and this certainly shows in the company’s financial statements. Unless we see a huge share buyback that breaks this trend, this could prove to be pretty concerning for those invested in the company.

Evaluation of financials

What we have here is a company that meets sales targets comfortably, but falls short in almost every other aspect. I believe that the main culprit is the company’s stock-based compensation policy. Let’s observe the effect of this on its performance.

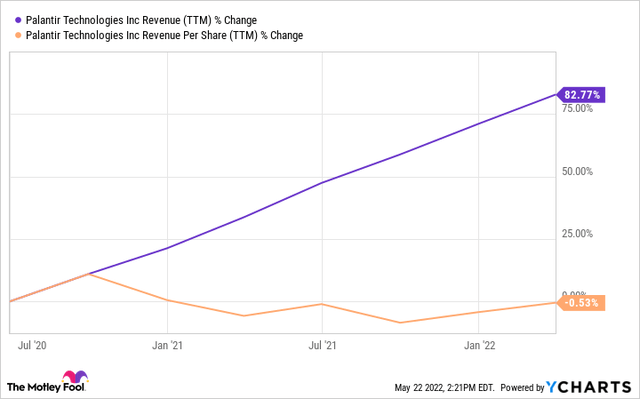

Palantir’s Revenue and Revenue-per-share (YCharts, The Motley Fool)

We see from the graph above that while revenue has been on a steady uptrend, the company’s revenue-per-share is trending in the opposite direction. The company’s definitely making more money, but it’s diluting its stock more than proportionately. The amount of stock issued is also a concern (over $700m in the past year), and is a contributing factor to the company’s worrying bottom line. Palantir is not operating profitably despite its strong revenue growth, and there’s no clear sign that it will anytime soon.

PLTR Stock valuation

Now that we’ve gone through the nature of the business and the company financials, the most important question remains – what should we pay for PLTR stock?

Valuation method

This is a tough one, and common valuation methods may not be that reliable because the company hasn’t been that consistent in its earnings. In addition, the nature of Palantir’s business makes such an investment extremely unpredictable. However, I’ll still put this through a 10-year EPS forecast model with some very conservative assumptions.

Metrics

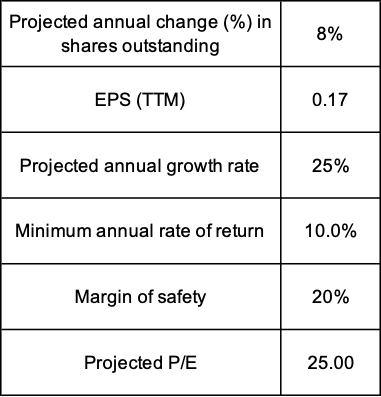

Relevant metrics used in EPS forecast model (Prepared by author)

I’ve gone for an average annual growth rate of 8% in shares outstanding, given the company’s aggressive issuing of shares for its stock-based compensation policy. I’ve also used the average projected EPS for year 2022, which is 0.17, as a reference point. As for the company’s earnings, I assume an average annual 25% growth rate, which I believe is reasonable. As for the desired annual return, I’m going conservative with 10%, which is just about what you’d expect from a good ETF. I’ve also gone for a P/E of 25, which is in line with the industry average. Finally, I’ve gone for a margin of safety of 20%, hence factoring in the uncertainty which arises from the nature of the business.

Price target

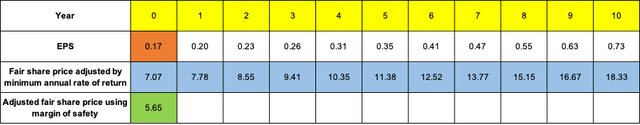

EPS Forecast Model for PLTR Stock (Prepared by author)

We’ve arrived at a price target of $5.65 a share. This means that by paying $5.65 a share, I’m expected to make a 10% return every year. While this may seem low, it’s good to note that the stock price wasn’t too far away from this price target a few days ago.

Institution price targets

We see pretty large variations in price targets set by renowned institutions. Morgan Stanley has a price target of $16, which was set on 7 March 2022. A more recent coverage would be the one initiated by RBC Capital Markets on 10 May 2022, which has led to a price target of $6.

Risk-to-reward

It’s imperative that we consider the risk-to-reward ratio associated with such an investment. As shown earlier in the article, the arguments for and against the usage of Palantir’s software are reasonably balanced. What tips the scale for me is the cost which Palantir bears for providing these services. The company is bleeding financially from its operations, and there seems to be no clear financial goal in sight. Sales alone is not enough to show that a company is financially healthy, and Palantir has a lot to do before I am convinced that it is able to stay afloat.

Conclusion

My personal conclusion, based on my own risk tolerance, would be that the company is not the best investment choice you can find at the moment.

Is this one of the, if not the best data company out there in terms of its software capabilities? Probably.

But can it do so profitably? No – at least not now.

I understand that there’s been a huge selloff, but this isn’t a bargain just yet. Based on the worrying financials, coupled with the risk associated with Palantir’s operations, I’d prefer to buy in at a much lower price than what it’s currently trading at. However, I do think there’s a reasonable chance that the company will do well in the long run if it overcomes the mentioned hurdles. As such, I will be issuing a price target of $5.65, and a ‘Hold’ rating on PLTR stock.

Be the first to comment