Scott Olson

I was a Palantir (NYSE:PLTR) super bull until the morning of 8/8/22, when PLTR held its Q2 2022 earnings call. PLTR’s Q2 results were mixed, with some positive and negative aspects, but Alex Karp’s commentary was harmful to PLTR’s public image. As the CEO, you lead by example, and after listening to the conference call, again and again, I am reconsidering PLTR as a long-term position within my portfolio. I am questioning how much damage has been done publicly and behind closed doors as the negative stigma surrounding PLTR never seems to dissipate. I am conflicted because I see PLTR as a dominant software company, but there are aspects within the financials that are worrisome, such as stock-based compensation. I have always stated that I am not concerned about PLTR’s share price in the short term as I am looking 5-10 years into the future, but the latest conference has me reconsidering my position, and it has nothing to do with price. I am not selling my position today, and I will give PLTR 1 year to clean up its act, but if I don’t see some drastic changes, I could be persuaded to sell shares of a company I was truly proud to be a shareholder in.

My biggest concern behind what Alex Karp stated in his commentary is that growth is slowing in several critical aspects of the business

Stock-based compensation can be a great tool as it allows companies to grow without taking on debt, but it can also be a quite destroyer of shareholder value. It’s a simple concept, if you eat 1 slice of a pizza, you’re eating 1/8 of the pie. If I was to cut each slice in half, and then you take a slice, your now eating 1/16th of the pie due to dilution. It’s the same pie, but instead of 8 slices, there are now 16. The same goes for stocks. PLTR is 1 company, and each share owned represents an equity position in the company, which ultimately correlates to the revenue and earnings the business generates. To keep the math simple, I am going to use smaller numbers. If you own 100 shares of PLTR and there were 10,000 shares outstanding, you would own 1% of the company. If PLTR was to issue an additional 10,000 shares, it’s the same company, generating the same revenue and earnings, but your 100 shares now represent a .5% ownership position of the company. The revenue and earnings per share are now dividend across 20,000 shares, not 10,000, and your ownership position has been diluted.

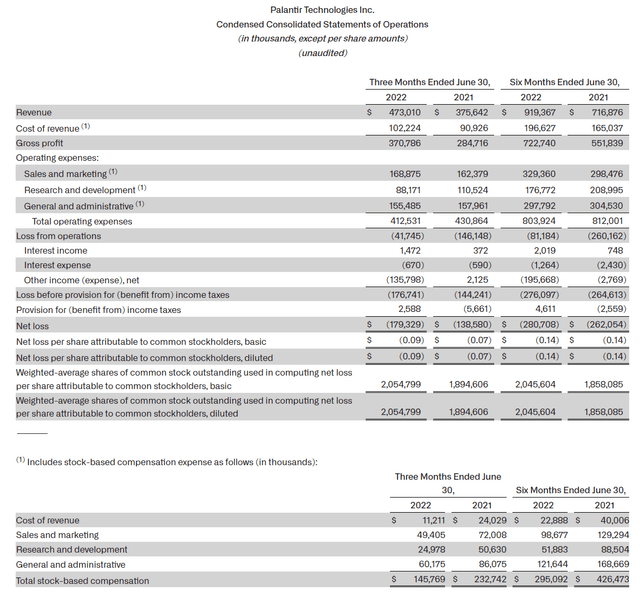

In PLTR’s Q2 press release they included the Q2 2022 financial summary, and I am irritated at the correlation between stock-based compensation and growth. Below is PLTR’s condensed consolidated statement of operations. On the cost of revenue line item, there is a (1) which relates to a footnote outlining how stock-based compensation is being utilized. PLTR provided a separate table indicating how much stock-based compensation is being allocated to each expense line item.

PLTR’s stock-based compensation is declining YoY, but there is a clear problem within the numbers. I hate dilution, but I am willing to put my feelings of dilution aside if it is used as a component to fuel growth and accomplish the common goal of creating shareholder value, even if my equity portion is decreased on a percentage basis. Please, put the YoY declining stock-based compensation numbers aside as I will outline why PLTR now has a problem.

| Palantir Q2 2022 Vs Q2 2021 | ||||

| 2021 | 2022 | YoY Difference | ||

| Cost of revenue | $90,926,000.00 | $102,224,000.00 | $11,298,000.00 | 12.43% |

| Sales and marketing | $162,379,000.00 | $168,875,000.00 | $6,496,000.00 | 4.00% |

| Research and development | $110,524,000.00 | $88,171,000.00 | -$22,353,000.00 | -20.22% |

| General and administrative | $157,961,000.00 | $155,485,000.00 | -$2,476,000.00 | -1.57% |

| Total Expenses | $521,790,000.00 | $514,755,000.00 | -$7,035,000.00 | -1.35% |

PLTR has 3 line items under its operating expenses which include sales and marketing, research and development, and general and administrative. PLTR paid $145.77 million in stock-based compensation throughout Q2 2022. $49.41 million of its issued stock-based compensation went to sales and marketing costs. From its operation expenses, sales and marketing was the only line item that expanded (4%) YoY. You may look at these numbers and say ok; even though sales and marketing increased, the overall expenses decreased, and the loss from operations significantly declined YoY. That would be a fair assessment because it’s correct, but what is sales and marketing supposed to do? As a shareholder, I would hope that if more capital is being allocated to sales and marketing, revenue growth, not just revenue, is expanding.

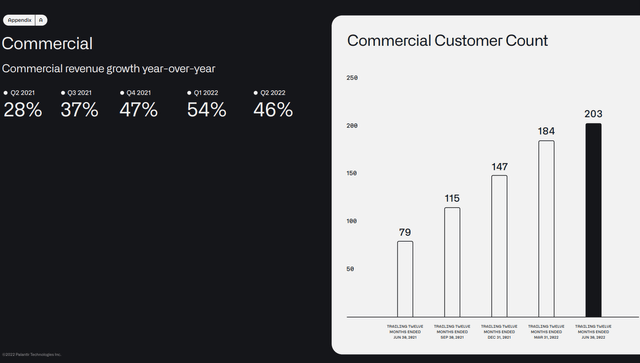

PLTR has focused a portion of its internal resources on growing its commercial business. For the past 4 quarters, we have seen sequential YoY revenue growth on a quarterly basis. In Q1 2021, commercial revenue grew YoY by 19%, in Q2 2021, growth was 28%, Q3 2021, it was 37%, Q4 2021, it was 47%, and in Q1 2022, commercial revenue growth was 54% YoY. The Commercial customer count also continued to increase on a TTM period QoQ. Here is where I see a major red flag. In Q2 2022, PLTR’s commercial revenue growth grew by 46% YoY as its commercial customer count grew by 19 customers. There was a -8% QoQ growth decline, yet sales and marketing costs increased. This is concerning because the commercial segment is a newer business line, PLTR issued $49.41 million of stock to the sales and marketing expenses in Q2, and growth stalled. In fairness, commercial revenue growth was up 46% YoY, but its trend of growth declined QoQ, which is seriously concerning after Alex Karp’s comments about companies they do business with not liking them.

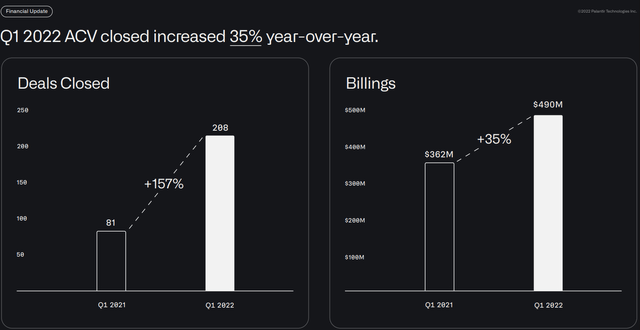

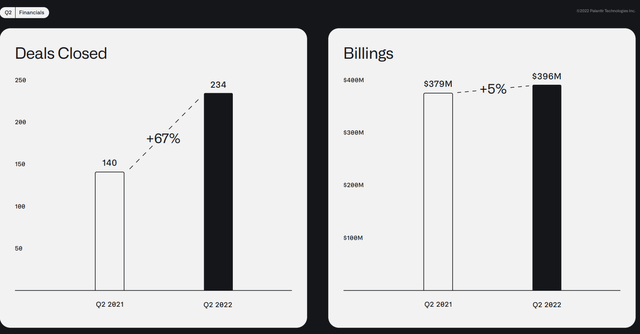

Deals being closed are also a concern, especially since PLTR is spending more on sales and marketing. In Q1 2022, PLTR closed 208 deals YoY compared to 81 deals YoY in Q1 of 2021. YoY billings increased 35% from $362 million in Q1 of 2021 to $490 million in Q1 2022.

My concern on deals being closed includes the actual deals being closed and billings. In Q2, on a YoY basis, deals closed grew by 67%, from 140 to 234. Growth significantly declined on a YoY basis but what is more worrisome is what wasn’t publicized through a dedicated slide. On a QoQ basis, PLTR’s deals closed in Q2 2021 grew by 72.84% as its YoY deals grew from 81 to 140. In Q2 2022, the QoQ growth was 12.5% as deals closed on a YoY basis increased by 26, from 208 to 234. This is also reflected in the billings, as in Q1 2022, there was a 35% YoY growth from $362 million in Q1 2021 to $490 million in Q1 2022. This was a completely different story in Q2 of 2022, as the YoY growth rate in billings was 5% growing from $379 million in Q2 2021 to $396 million in Q2 of 2022.

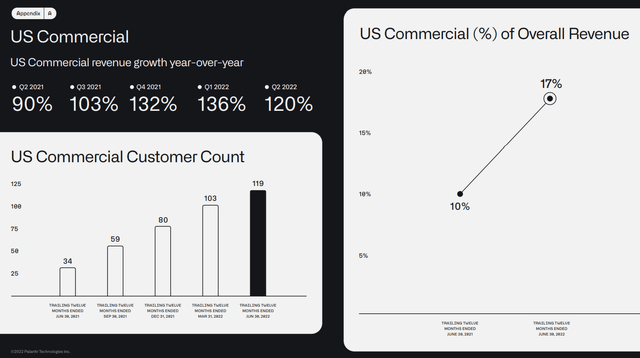

The declining growth rate in deals closed is directly impacting the YoY growth in billings and net dollar retention, which is arguably more important. Net dollar retention is often used by SaaS companies with a paid subscription model to look at the business. Net dollar retention is the combination of the revenue renewal amount and the additional revenue from upselling or cross-selling to existing customers minus churn. On the government side, the revenue growth YoY has been declining, and since that was a much larger portion of the business, this isn’t surprising. The concern once again goes back to the commercial side. From Q2 2021 to Q1 2022, the revenue growth YoY went from 90% to 136%. In Q2 2022, US commercial revenue grew by 120%, which was a QoQ decline of -16%. While part of the revenue growth could be from new contracts kicking in, and I can’t back into the net dollar retention numbers from existing contracts, it’s clear that net dollar retention is declining otherwise, Q2 2022 revenue growth in the US commercial sector would have exceeded 136% YoY.

Currently, these are concerns of mine which could turn into red flags next quarter if there isn’t an improvement. The devil is in the details, and I hope these are just anomalies due to business cycle factors and not a more permanent model of declining growth. PLTR’s sales and marketing expenses continue to increase, but its growth in US commercial is slowing. I am less annoyed about being diluted if growth exceeds expectations and gets us to the end-zone quicker, but that wasn’t the case in Q2, and the stock-based compensation has now become a concern because of declining growth.

There were things to like in the numbers, too bad Palantir’s marketing team didn’t include the slides from Alex Karp’s letter to shareholders

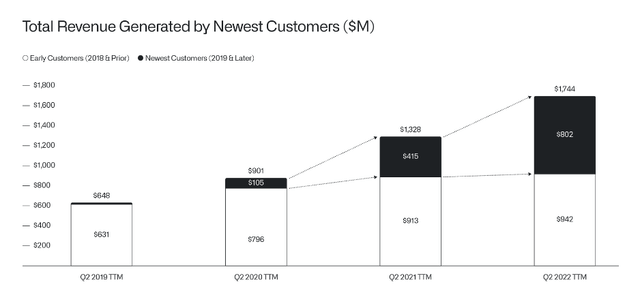

I suggest that shareholders of PLTR go and read Alex Karp’s shareholder letter. PLTR’s marketing team should have included these slides because it really illustrates a promising story. PLTR has separated its customers as pre-2019 and post-2019. Over the past 3 fiscal years on a YoY basis, PLTR has grown its revenue from pre-2019 customers by $311 million (49.29%) from $631 – $942 million. From PLTR’s post-2019 customers, YoY revenue has increased by $785 million (4,617.65%) from $17 million to $802 million over the past 3 fiscal years. This is incredible as 45.99% of PLTR’s revenue over the TTM comes from customers that have been onboarded post-2019.

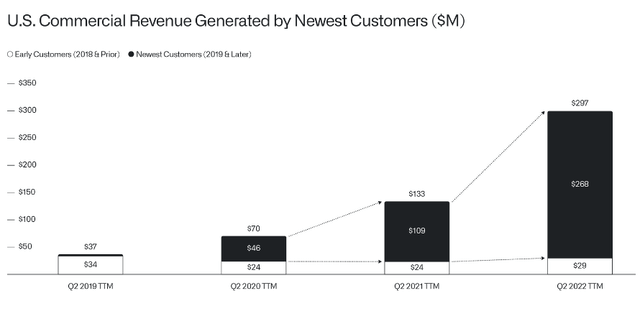

While I do have concerns about the future US commercial side revenue growth, its current statistics are impressive. The large concern was always that PLTR was at its core a military-industrial complex vendor, and questions were always raised about commercial side applications. In 3 short years, PLTR has put those questions to pasture and has proven that the commercial side can be monetized. PLTR’s US commercial revenue has increased by $260 million (702.70%) over the previous 3 fiscal years. 100% of this growth came from new customers as its pre-2019 customer revenue base declined from $34 million to $29 million. PLTR’s US commercial companies onboarded in 2019 forward increased their revenue generated by $265 million (8,833.33%) over the past 3 years on a TTM basis.

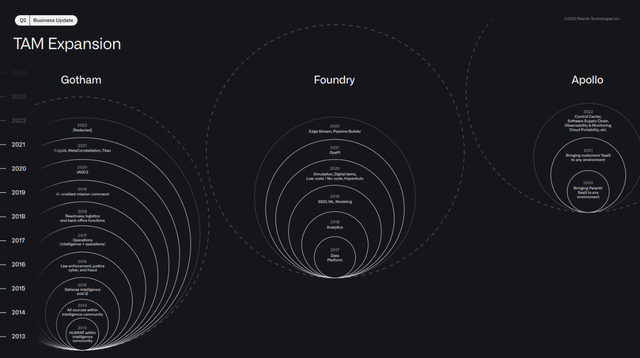

PLTR ended Q2 2022 with $3.5 billion in total remaining deal value, which is a 4% increase YoY, and its remaining performance obligations grew 79% YoY to $1.2 billion. Overall, PLTR is still growing as the government revenue grew YoY by 13% while commercial grew by 46%. PLTR’s average revenue increased by 17%, from $39 million to $46 million per customer in their top-20 customers. PLTR’s healthcare division generated $153 million in revenue for the first half of 2022, which is up $42 million YoY. With every new customer onboarded, PLTR has the potential to drive future value and increase its net dollar retention. PLTR has an expanding total addressable market across its offerings, and there is still a distinct possibility that PLTR can drive large revenue growth well past 2024. PLTR is at a critical point, and I want to see if next quarter is a continuation of decelerating growth or if Q2 was an anomaly.

I believe Alex Karp’s commentary negatively impacted Palantir’s image and perception in the marketplace

If you’re interested, you can listen to Palantir’s Q2 2022 conference call by clicking here.

In what may be 20 minutes of speaking throughout the Q2 call, Alek Karp managed to insult every software company while letting the world know that PLTR’s customer base isn’t fond of them. Alex Karp stated that there isn’t a single company in the world that can produce their software. He also questioned their ability to build competitive products. Microsoft (MSFT), Amazon (AMZN), Alphabet (GOOGL), and International Business Machines (IBM) have direct partnerships with PLTR. Alex Karp stated that if these companies had the ability to build the software that PLTR has created they wouldn’t be partnering with PLTR. Alex Karp expressed a tremendous amount of frustration regarding PLTR’s products only being measured by the revenue and the free cash flow (FCF) generated and not the underlying technology. He believes a premium should be placed on the quality of PLTR’s software, which in his eyes, has an extremely low probability of being replicated.

There is a time and place for everything. Sometimes situations call for a wartime leader and in others a large dose of humility. Even if everything Alex Karp stated is true, why would you insult every competitor and publicly announce that on the commercial and government side, entities don’t want to do business with PLTR, but they have to? This creates a negative stigma about engaging with PLTR which could impact companies doing business with them in the future. When the CEO publicly indicates on a live conference call with analysts, shareholders, and spectators that the United States government has looked for every reason not to purchase PLTR’s software, that PLTR had to sue the United States government twice, and that PLTR onboarded several customers that didn’t like them, what type of message does that send to the marketplace? Alek Karp may be a visionary and essential to PLTR’s future, but he is becoming detrimental to PLTR’s public image, and I am not sure that the damage can be repaired.

The level of defiance throughout Alex Karp’s commentary was shocking as he indicated PLTR will never be the type of company that is built for Wall Street. As PLTR’s CEO, Alex Karp has a fiduciary responsibility to every shareholder. While he indicated that individual investors are a big motivation for him, he doesn’t seem to care how the marketplace perceives PLTR because in his mind no other company can do what PLTR can accomplish. How the marketplace views PLTR is critical, and at the end of the day, financials matter, revenue matters, hitting your estimates matter, and relationships matter. As the CEO, Alex Karp should be focused on bringing products to market that solve problems and expand its customer base to drive revenue. PLTR is a public company and is judged by the marketplace, not Alek Karp’s perception of how the marketplace should value PLTR.

I love when a CEO is passionate about their work, but I don’t believe in being overconfident because that’s when you become vulnerable. Alek Karp made some lofty claims about the world’s largest companies which I wish he kept to himself. He specifically called out MSFT, GOOGL, Oracle (ORCL), and Amazon (AMZN) which wasn’t the best idea. The bottom line is that PLTR has a market cap of $20 billion. GOOGL has $125 billion in cash on its balance sheet and generates $65.19 billion in FCF, while MSFT has $104.75 billion in cash and generates $65.15 billion in FCF. MSFT or GOOGL could write a check tomorrow and buy PLTR for 2x its current market cap, and it wouldn’t even deplete 50% of their cash on hand. These companies don’t have to replicate what PLTR has built, they could buy PLTR in cash if they wanted to compete in PLTR’s space.

There is also increasing competition forming in the marketplace. GOOGL, MSFT, and AMZN have invested in Databricks which is a software company that enables massive-scale data engineering, collaborative data science, full-lifecycle machine learning and business analytics to more than 7,000 organizations worldwide. Databricks has an impressive list of clients and chances are their clouds are built on AWS, Azure, or Google Cloud. If GOOGL, MSFT, or AMZN acquired Databricks it could be detrimental to PLTR’s commercial business. Even if Databricks isn’t acquired, GOOGL, AMZN, and MSFT could choose to work closer with Databricks as they have a vested interest in their success and ultimately build out what was valuable about PLTR’s software through Databricks.

Conclusion

This was a frustrating quarter, and I am seriously questioning my investment in PLTR. I am torn because I see a long road of potential, but my investment thesis is certainly starting to change. The combination of slowing growth on the commercial side and Alex Karp harming PLTR’s public image is not a positive combination. The question around stock-based compensation is now front and center because it is no longer fueling the PLTR growth story. I would love to see PLTR put an end to stock-based compensation and put its cash to work. PLTR has $0 in debt and $2.48 billion in cash. Instead of diluting shareholders any further, PLTR should use its cash to fund its growth for the time being. While this would decrease shareholder equity, maybe it would make management wake up and realize that they are increasing their output in sales and marketing without realizing an ROI on that investment which is diluting its shareholders. I haven’t sold and I am not selling until I see more data. I am planning on giving PLTR a year to turn this around but if the Q3 report is an extension of Q2, I may think about an exit plan where I will just sell covered calls at a desired exit price. I remain optimistic but this quarter wasn’t pretty.

Be the first to comment