NicoElNino

[Please note that all currency references are to Canadian dollar except if indicated otherwise.]

CGI Incorporated (New York symbol (NYSE:GIB) and Toronto symbol GIB.A) is a global provider of information technology and business consulting services. The company was founded in 1976 and listed on the Toronto exchange in 1986 and 1998 in New York. The headquarters is in Montreal, Canada.

CGI has an excellent long-term track record of consistent growth in revenues and profits. It counts among the top global IT consulting and services firms but trades at a considerable valuation discount to its better-known peers.

A global operation

CGI operates globally and offers services that cover strategic information technology (“IT”) consulting systems integration, managed IT services, and infrastructure and business process services. The company employs 88,500 staff and caters to a variety of sectors including banking, insurance, communication, energy, manufacturing, government, health, and retail.

In the 12 months to the end of June 2022, CGI generated revenues of $12.6 billion. Revenue is split roughly 50/50 between managed IT and business process services and consulting and systems integration. The U.S. is responsible for a third of the revenues, followed by Canada (17%), France (15%), the U.K. (11%), Germany (6%), and Finland (6%).

Services delivered to governments make up 34% of the revenue, financial services 24%, manufacturing, and retail 23%, and communications 13%.

A sound long-term track record

CGI has an impressive track record of growing its revenues and profits over time, partly through acquisitions and partly organically.

Over the past 10 years to the end of June 2022, gross profits increased at a compounded annual rate of 14.8% per year, earnings per share by 15.8%, and free cash flow per share by 11.9%. Growth has also been consistent with only a minor blip recorded in 2020.

Profitability has steadily improved over the past decade with both the EBITDA margin and the return on equity at decade highs in the past 12 months.

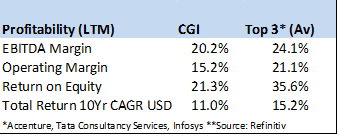

Despite the improvements in profitability, CGI’s profitability still lags behind the publicly listed industry leaders, Accenture, Tata Consultancy Services, and Infosys. Somewhat unsurprising, the total shareholder return (including dividends) over the past 10 years was also lower for CGI than its main competitors (see table).

Profitability (Accenture, Tata, Infosys, Refinitiv)

Organic growth supplemented with regular acquisitions

IT consulting and implementation has a global market size of about $61 billion and is expected to grow at 6.1% per year over the next 5 years. IT services is a much larger market with an estimated value of $1.2 trillion and growing at 7% per year according to the Gartner group.

IT consulting is a competitive market with several large participants that dominate the landscape. Among the biggest names in IT consulting are worldwide operators that include Accenture, ATOS, Boston Consulting Group, Capgemini, Bain, SAP, Tata Consultancy, and Infosys. In a 2022 Forbes survey, CGI was also ranked among the top global IT consulting firms.

The company’s growth strategy rests on four pillars which include the retention and extension of current client contracts, new business wins, and acquisitions. Acquisitions fall into two categories – first smaller transactions that complement existing businesses in local markets close to existing clients and second – large acquisitions that expand CGI’s geographical presence and critical mass.

The largest acquisition in CGI’s history took place in August 2012 when the company paid $2.7 billion and assumed debt of $0.9 billion to acquire the U.K based Logica. This acquisition effectively doubled the size of CGI. At the time of the acquisition, management expected to extract substantial synergies from the acquisition including an immediate 25%-30% accretion to the earnings per share plus additional further cost savings post-integration. These objectives have been met and exceeded as per subsequent announcements.

Since this major acquisition, CGI reverted to small and mid-sized bolt-on acquisitions that amounted to almost $2.5 billion between 2017-2022. So far in the 2022 financial year, CGI has spent $689 million on five acquisitions including the French-listed company – Umanis, which specializes in data and digital business solutions.

The company is controlled by the founder

The founder and executive chair of the Board is Serge Godin. He co-founded CGI in 1976 with Andre Imbeau who is also a member of the board. These gentlemen are both 72 years old.

The President and CEO is George Schindler, age 58; he joined CGI in 2004 when his previous employer American Management Systems was acquired by CGI. Before his appointment in the current role, he was the Chief Operating Officer of CGI and the President of the U.S. and Canadian operations.

Mr. Godin controls the company through his holding of 97% of the Class B shares which carry ten votes per share while Class A subordinate voting shares carry one vote per share. Mr. Godin effectively holds 10.6% of the issued shares and 53.2% of the voting rights. The Caisse de depot et placement du Quebec is another major shareholder with 12.6% of the shares. Other major shareholders are Blackrock, Fidelity, Vanguard, and RBC.

Key aspects of executive compensation are a base salary, a short-term profit participation plan, and a long-term incentive plan. Both the short-term bonus and long-term incentive plans are linked to profitability and growth targets. The executive chair and President had total compensation of $11.0 million and $10.8 million respectively in 2021.

Healthy balance sheet and positive cash flow

The company had shareholders’ equity of $7.0 billion at the end of June 2022; net debt amounted to $3.1 billion while the debt-to-capital ratio was reasonable at 29%.

Cash flow from operations amounted to $1.9 billion over the past 12 months while capital expenditures were $351 million leaving a sound free cash flow balance of $1.55 billion. Cash flow is remarkably stable and remained consistently positive over the past two decades.

CGI does not pay a dividend but maintains a regular share buyback program. Over the past 5 years, the company managed to reduce its share count by 19% spending $5.8 billion in the process. CGI also received regulatory approval to purchase for cancellation over 12 months starting February 2022, around 10% of the Class A subordinate voting shares. One-third of the shares have been purchased by the end of June 2022.

Recent results: Chugging along

In the results up to the end of 30 June 2022 (nine months of the company’s fiscal year), revenues increased by 5.5% to $9.6 billion while adjusted diluted earnings per share increased by 13.1% to $4.57 per share.

Profit margins increased with the EBIT and net profit margins both edging higher. Cash flow from operations and free cash flow were healthy but lower than in the same period last year.

Bookings are also looking solid with $3.4 billion received during the June quarter while the book-to-bill ratio for the trailing 12-month period (that is the value of bookings as a proportion of revenues) was at 105%. The book-to-bill ratio was somewhat lower than the average level achieved over the past five years.

Consensus estimates indicate earnings per share of $6.12 for the year ending September 2022 which will be 12.6% higher than the previous year. Estimates indicate 9%-10% growth for each of the following two years.

Attractive valuation

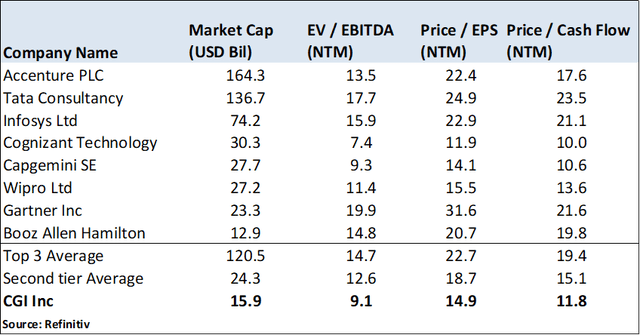

Given CGI’s current price and consensus forecasts for the next 12 months, the business is valued on an EV/EBITDA ratio of 9.1 times, a price-to-cash flow ratio of 11.8 times, and a price-to-earnings ratio of 14.9 times.

Compared to the peer group indicated in the table, CGI trades at a considerable discount to the top tier of IT consultants (Accenture, Tata, Infosys) as well as the second tier.

Growth plus rerating offer decent returns

CGI has grown steadily over the past 10 years and managed to improve its profitability – although it still lags somewhat behind the high bars set by the publicly listed industry leaders.

Based on the medium-term profit growth estimates for CGI of 7%-10% per year as well as the possibility of a valuation rating closer to the peer group, investors could likely expect attractive returns over the medium term.

By Deon Vernooy, CFA, for TSI Wealth Network

Be the first to comment