Michael Vi/iStock Editorial via Getty Images

Thesis

Few companies are as controversial as Palantir (NYSE:PLTR). Some investors believe this company is building the infrastructure for the future, while others believe Palantir’s market potential is limited to government intelligence and does not really have a competitive advantage against competitors. Even more notable, the same investor could alternate between these two views. For example, Cathie Wood once believed in Palantir’s potential and bought as much as 15 million shares. But since then, she has completely sold out her fund’s holdings. What is going on? How should investors think about Palantir. This article should provide more clarity.

For reference, Palantir stock is down more than 70% from ATH. YTD, Palantir is down more than 46%, while over the same period, the S&P 500 has lost only about 11%.

More About Palantir

Arguably a key reason why investors have difficulties building an investment thesis around Palantir is that many actually do not really understand what Palantir does. This is understandable given that the company works, amongst others, with the US Special Forces and the CIA on secret projects.

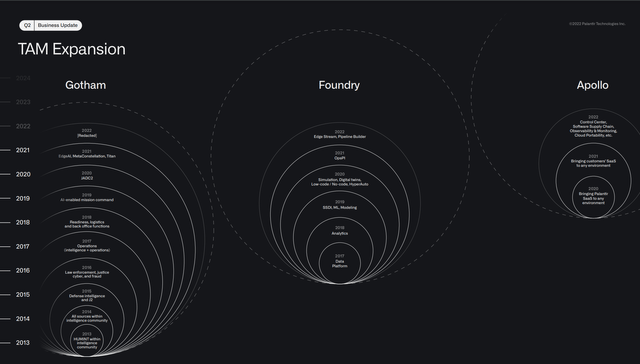

In a nutshell, and somehow simplified, Palantir builds and markets an infrastructure that allows to aggregate and analyze large amounts of unstructured data. Or in other words, Palantir builds an operating system for data management on which users can layer interfaces and visualizations. This allows users to derive value-adding insights and support intelligence-driven decision making. That said, customers use the company’s software to optimize production processes, consumer insights and marketing efforts, capital management and risk oversight.

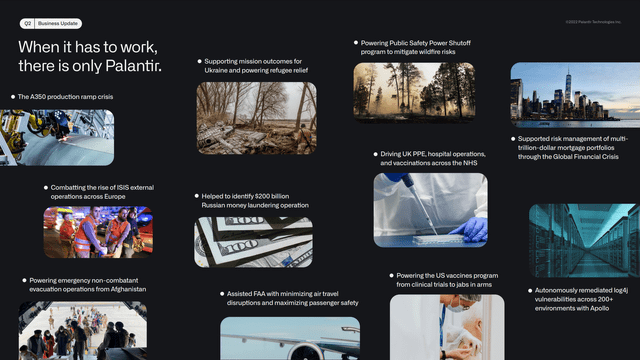

For example, in the past Palantir has supported: the government with the planning and execution of special war operations; banks with scenario analysis and risk management during the financial crisis; the structured distribution of COVID-19 vaccines around the world to fight the epidemic.

Palantir’s Opportunity

Palantir’s market opportunity definitely has the potential to capture a potential that could indicate FAANG potential. In 2020, Palantir said that its addressable market is valued at around $120 billion. According to IDC, the market for data management/analytics and business intelligence (or in other words ‘edge computing’) is estimated at about $250 billion in 2024. And while I have no research to support this, I argue that on the backdrop of accelerating enterprise digitalization, the metaverse innovation and a continued expansion of crypto, Palantir’s market opportunity could be valued at a $1 trillion potential in 2030 (this would indicate about 25% CAGR until 2030)

Reflecting on Palantir’s market opportunity, Alex Karp said:

We are working towards a future where all large institutions in the United States and its allies abroad are running significant segments of their operations, if not their operations as a whole, on Palantir.

Most other companies are targeting small segments of the market.

We see and intend to capture the whole.

Palantir Valuation

Palantir is currently valued at a one-year forward EV/Sales of x9.6 and a Price/Free Cash Flow of almost x75. Accordingly, it is fair to say that PLTR is trading expensively. But investors should consider the valuation in relation to the company’s accelerating business expansion.

Personally, I believe that Palantir’s business could grow at a 25% CAGR for the next 7 years. Accordingly, the company’s sales could reach about $12 billion in 2030. If we consider a net-profit margin of 28%, which is in line with asset-light software firms, Palantir’s net income for 2030 could be as high as $3.3 billion. I believe a x25 P/E multiple for 2030 could be reasonable and so I see a market capitalization of $82.5 billion. (Assuming Palantir’s net-debt position does not change)

An analyst may discount the $82.5 billion with a reasonable rate, which I anchor on 8%, and find that Palantir should be valued at about $48 billion today, or about $22.4/share.

Risks

Investing in Palantir is a speculation, as there is considerable uncertainty related to projecting a company’s fundamentals for multiple years into the future. Moreover, the uncertainty surrounding Palantir’s value proposition adds to the complexity. That said, there is no guarantee that the company will reach my estimated 2030 sales and profitability targets.

Investors should also consider that much of Palantir’s current share price volatility is driven by investor sentiment towards stocks. Accordingly, investors should expect price volatility even though Palantir’s business outlook remains unchanged.

Conclusion

Arguably all FAANG companies have been controversial in their early days. It is the pre-condition of exploring a new market. Has Palantir the market and product potential to grow into a powerhouse that could rival the FAANGs? Personally, I do think so. Or as CEO Karp commented:

We believe that our most significant growth is still yet to com

I estimate that the market for data analytics and business intelligence could grow at a 25% CAGR until 2025 and accordingly I see significant upside for Palantir’s business. If my analysis is correct, Palantir is undervalued. My base-case target price is $22.4/share.

What do you think, could Palantir be an equal to the FAANGs?

Be the first to comment