Michael Vi

Thesis

The current macro-economic environment is tough. But its together for some than for others. In my opinion, the worst place to hide money as an investor is being invested in a business that is selling a commodity, with little/no business growth and excessive debt (Hello, AT&T (T) and Verizon (VZ)). Respectively, the best opportunities are connected to businesses with competitive products/services, a structural growth tailwind, as well as little/no debt. Palantir (NYSE:PLTR) checks all the boxes.

Reflecting on PLTR’s stock price action YTD, down 56% versus a loss of about 24% for the S&P 500 (SPX), I am not concerned. In fact, I believe PLTR trading at below $10/share is a buying opportunity.

Build For Bad Times

As the leading software company that offers data intelligence to the U.S. military, Palantir has positioned itself as a company ‘build for bad times’. In fact, the more strained international relationships and other macro factors become, the more confident CEO Alex Karp turns on the prospects of Palantir’s business outlook. In a recent interview on CNBC, Karp said that: (emphasis added)

Bad times are incredibly good for Palantir … The general belief I had … just comes from building a software business, and seeing software in action in war where software together with heroism can really slay the giant.

Thus, in other words, Palantir is a business that builds on the resilience of the U.S.’ defense spending budget, as well as the growth potential and profitability margin of a software company.

Accordingly, while the Ukraine-Russia conflict and China-Taiwan tensions pressure the fundamentals of many companies that rely on global trade, Palantir thrives: The U.S. government and allies are increasingly investing in IT-led warfare capabilities, which is Palantir’s core value proposition.

(Side note: the name Palantir is inspired from ‘The Lord of the Rings’ saga, where the palantíri were ‘seeing-stones’ that enabled a powerful form of espionage, and thus information-led warfare.)

Reasons For Outperformance

Reflecting on a slowing global economy, as well as rising interest rates, I believe the next decade will favor those companies that have (1) competitive products, (2) a structural growth opportunity, and (3) no debt/strong balance sheet. Without any one of the above considerations, a company will likely fail to accumulate value for shareholders.

1. Competitive Products

If you have read Palantir co-founder Peter Thiel’s book Zero To One, then you could derive an understanding how Palantir thinks about product innovation and competition: basically, the aim is to build such a great product that competition becomes irrelevant.

In Karp’s Q2 letter to shareholders, the CEO writes: (emphasis added)

A related development is that we are seeing former customers, including some of the world’s largest transportation, banking, and retail enterprises, return to our platforms in increasing numbers after periods of experimentation with other data integration and analytical platforms and approaches.

These customers are returning because they have tried other options and those options have failed. The product has brought them back.

While Karp’s arrogance and self-pride is a contentious topic amongst Palantir investors and market commentators, the CEO’s commitment on product innovation an excellence is without a doubt the winning strategy for building one of the world’s leading software technology companies.

Moreover, having supported governments and commercial institutions with some of the most complex and ‘essential’ workflows — including the planning and execution of special war operations; the scenario analysis and risk management for banks during the financial crisis, and; the structured distribution of COVID-19 vaccines around the world to fight the epidemic — Palantir has managed to claim an essential positioning in the market for data management and analysis.

2. Structural Growth

Palantir’s growth is not necessarily connected to a growing economy. In fact, Palantir’s growth is primarily driven from structural technology trends, that seem relatively uncorrelated to GDP expansion. Sure, having GDP expansion is a nice tailwind. But it is not necessarily a condition of growth — as compared to energy consumption, for example.

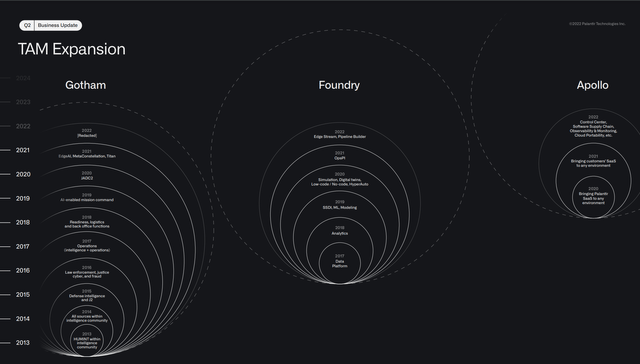

About two years ago, when filing for an IPO, Palantir estimated that its current addressable market – defined by data management/analytics and business intelligence – is valued at around $120 billion. According to IDC estimates, this number is expected to expand to about 250 billion in 2024, reflecting a 4-year CAGR of about 20%. For reference, Palantir’s revenues in Q2 2022 defended a 26% year-over-year growth, reaching $473 million.

If such a growth would persist through 2030, which I do not doubt that it will, Palantir might enjoy a market opportunity of almost $1 trillion. My confidence in such an expansion is supported by accelerating enterprise digitalization, AI adoption, and the metaverse innovation — to name just a few of the structural trends.

Palantir CEO Alex Karp commented that: (emphasis added)

We are working towards a future where all large institutions in the United States and its allies abroad are running significant segments of their operations, if not their operations as a whole, on Palantir.

Most other companies are targeting small segments of the market. We see and intend to capture the whole.

3. No Debt/Strong Balance Sheet

For a long time, balance sheet strength has been ignored by investors — this allowed companies such as AT&T to push beyond $170 billion of net debt, while paying out 5% annual dividends.

But the environment for debtors has changed rapidly and materially in 2022, as central banks around the world have aggressively started to raise interest rates to combat inflation. For reference, the yield on US treasuries (10-year reference) surged from about 1.66% in January to 3.88% as of October 2022. The implications for indebted companies cannot be understated: they will likely paralyzed by debt, unable to allocate capital for business grow or for shareholders distributions, as the cost of debt consumes the earnings power of productive assets. Moreover, as the economy is slowing, and margins contract due to cost inflation, how many companies will have enough capital to absorb losses?

Alex Karp, as well as many famous investors including Michael Burry and Stanley Druckenmiller, have argued that the ‘next deadly tidal wave of macroeconomic risks will wipe out some companies‘. And as a consequence, companies with strong products and balance sheets will attract the losers’ resources, employees, and market share.

As of June 30, Palantir’s balance sheet is very strong. The company recorded $2,458 million of cash and short term investments versus total debt of only $257 million.

Risks

Every investment is a trade-off of risks. And the risk for investing in Palantir is connected to the notorious difficulty to project a company’s fundamentals for multiple years into the future. Moreover, the uncertainty surrounding Palantir’s value proposition adds to the complexity. Investors should also consider that much of Palantir’s current share price volatility is driven by investor sentiment towards stocks. Thus, investors should expect price volatility even though Palantir’s business outlook remains unchanged.

However, I personally believe the risks associated with a PLTR investments are less dangerous than the risks associated to an investment in a business that is selling commodity, enjoys little/no business growth and must service excessive debt — even if the cash flows of the former are more predictable and short-duration.

Conclusion

As the market is selling-off, I am loading up on structural growth companies such as Palantir (PLTR). In my opinion, Palantir is well positioned to capture a major share of the $1 trillion market for data management/analytics and business intelligence (2030 estimate). And, I argue, neither a slowing economy, nor rising interest rates, nor geo-political tensions will pressure Palantir’s outlook. Buy.

Be the first to comment