da-kuk/E+ via Getty Images

Research Thesis

Palantir Technologies Inc. (PLTR) is undoubtedly a controversial company attracting strong bull and bear cases. The recent market sell-off, which penalized more severely high growth stocks, has put one of the best technology disruptors on sale, so I decided to share my investment thesis as a long-term investor in Palantir.

The Part-I of this qualitative research aims to shed some light on the company’s business and is structured around the company’s economic moat and product offerings. Developing a deeper understanding of the company’s core platforms’ fundamentals and practical applications is essential before making any investment-related decision, especially for new investors. In the future, in Part II, I will elaborate more heavily on the quantitative aspects and the internal and external influences.

As a long-term investor, I am not concerned with volatility in the market, the macro-economic outlook, the interest rates environment, and what the stock market will do tomorrow or the year after. Instead, I pay close attention to the company’s fundamentals and the risk/reward profile of the underlying stock. I have been following the company for quite some time now, and the recent sell-off was an excellent opportunity to triple down my investment, qualifying PLTR for a golden seat to my long-term concentrated portfolio. Therefore, I rate PLTR with a strong buy rating with at least a four to six-year investment horizon.

A brief Revision. What does Palantir do?

I guess we all had watched at least one chapter of the legendary movie ‘Lord of the Rings’ when the wizard character ‘Saruman’ used his powerful crystal ball ‘Palantir’ to surveil and manipulate his enemies. As we know, the company has named after this crystal ball, which is also depicted in Palantir’s logo, and this still explains the company’s secrecy until the day it has gone public. Palantir has been considered Silicon Valley’s most secretive unicorn for the past decades. However, since the IPO, the company has opened up and delivered lots of information to the market, giving a strong vote of confidence and a better understanding of its business operations and platforms to the ‘Palantirian’ community.

Palantir develops ‘products for human-driven analysis of real-world data.’ In other words, through its software platforms, the company allows technical and non-technical users within the organizations to understand data in a friendly interface environment. Furthermore, it empowers them through Palantir’s tools to ask and answer critical questions for their operations and other core areas. The ultimate goal is to improve the organization’s decision-making cycle.

With nearly 20 years of existence, Palantir served the US Government and other intelligence communities for counterterrorism and other military operations. Since then, the company has massively expanded and diversified its operations to commercial clients and internationally. Remarkably, Palantir has also diversified geographically, expanding globally, with a significant portion of its revenues generated outside the US.

1. Palantir’s Unique Economic Moat

Valuing a company like Palantir according to the conventional valuation models provides little value as the dynamic and fast-changing environments make the variables incorporated partially obsolete. However, this doesn’t stop analysts from applying different valuation methods and scenarios, as I have also done part of my financial analysis in part II. However, I always start my research by understanding how the company-specific components drive future business activity and growth.

Warren Buffett was once asked what is and how he defines the ‘Moat’ of a business; his answers were:

What we’re trying to do … is we’re trying to find a business with a wide and long-lasting moat around it, surround — protecting a terrific economic castle with an honest lord in charge of the castle.

What we’re trying to find is a business that, for one reason or another — it can be because it’s the low-cost producer in some area, it can be because it has a natural franchise because of surface capabilities, it could be because of its position in the consumers’ mind, it can be because of a technological advantage, or any kind of reason at all, that it has this moat around it.

The legendary investor is known for investing in companies with strong moats, and his strategy has rewarded him richly over the long term. Undoubtedly, the moat is not the only thing an investor should look after, but it is a great place to start. Palantir possesses four core moats, ranging from the proprietary algorithms, the Government, the high switching costs, and the network effect.

Algorithmic Moat

Palantir has built its software and algorithms since 2003, counting almost 20 years now, and this creates a significant barrier for new entrants. Palantir has developed software that differentiates and are miles ahead of the competition. While other companies have placed greater emphasis on Artificial Intelligence (AI) and Machine Learning (ML), in order for the system to make decisions for humans, Palantir’s focus is not to replace human decision making but to empower it through AI/ML.

The company has spent years developing the software and algorithms, and judging retrospectively, Palantir made the right decision as no AI/ML model, or machine can beat a human when it comes to large-scale decision making in organizations such as the US Government, international corporations, and financial institutions. Such decisions require human judgment, experience, instinct, and other qualitative aspects that no machine could accurately grasp.

Government Moat

The Moat also extends to the government arena. So, in order to offer software to government agencies, it requires massive upfront costs and years of development to customize to different needs while being compliant with complex regulations. Not surprisingly, Palantir has established partnerships with several agencies, including the US department of defense, the department of health and human services, the department of veterans affairs, and the SEC.

In addition, the US Government has spent a sizable amount of money prior to hiring Palantir in due diligence, creating another barrier for new competition. Government moats take years to build, and Palantir has become mission-critical for government agencies, driving future growth in government customer lifetime value (CLTV).

A recent example that proves the strength of both the algorithms and Government moats is Palantir’s successful lawsuit with the US Army, which prevented the Army from building its solution and ended up awarding Palantir with a 10-year contract of $876 million. Undoubtedly, it would take massive amounts of capital, years of development, and top talent engineers and expertise for the US army or any other government agency across the globe to reach a level to compete with Palantir’s superior platforms.

Switching Costs Moat

The high installation and training costs support the high switching cost to other vendors. From an operational view, the data integration and software implementation become an integral part of business operations which silently creates significant barriers, making organizations extremely reliable on Palantir over time. Once the client is locked into the system (acquire-expand phase; to be explained in a later section), it is practically complicated to abandon the platforms, which is also validated by the relatively long average contract life.

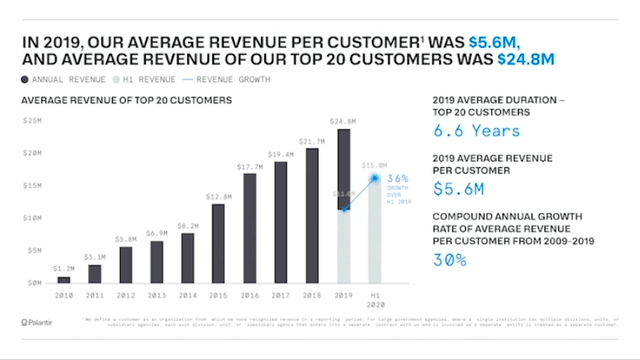

According to the S-1 form, the company’s top 20 customers have a contract life of 6.6 years, and the company is expecting an additional 3.5 years extension period. In addition, according to the latest 10-K Form, the top 3 customers by revenue have been with Palantir for an average of 5.7 years. However, those figures relate to a portion of Palantir’s client base, but we can reasonably assume that the average customer contract life does not deviate much from the 6.6 years, say ~ 5 years. Once the Palantir has established itself within the organization, it becomes its central nervous system, making it impracticable to replace. Not surprisingly, Palantir has reported a 10-year CAGR of 30% since 2009 for its average revenue per customer, signaling that customers tend to expand their CLTV over time.

Average Revenue Per Customer 2019 (Palantir IR)

Last but not least, Palantir, instead of having an extensive application, the company adopts a modular approach and decomposes it into smaller modules targeting specific industries. Furthermore, this modular framework is constantly built as new data integrates through AI/ML, further supporting its ecosystem, making it harder for customers to seek alternative solutions.

Network Effect Moat

The nature and architecture of Palantir’s platforms allow all members across an organization, data scientists, developers, management, and others to access and understand data. More technical staff can make customizations with code while non-technical staff with a no-code background can easily comprehend and understand on time the data accessed. This creates a coherent framework where each user can meaningfully add value to the decision-making cycle spreading across the organization, creating a strong network effect. In simple terms, the more users participate in the decision chain, the more they familiarize themselves with Palantir’s platform, which adds substantially to switching costs.

The network effect gets more intense and personal when Palantir’s engineers work directly with organizations’ staff, either face to face or remotely, so as to gain a deep understanding of the organization’s specific needs. In addition, when engineers are assigned to particular clients, they tend to work with organizations for long periods over the contract life. Further, as Palantir expands its clientele and gains in-depth knowledge for industry-specific matters, it can update the existing platforms, enhance customer experience and meet new demands. Not surprisingly, as Palantir’s knowledge database grows, it is in a position to offer its clients new solutions that they may have never thought of. As a result, such activities enhance customer bonding through strong connections, give the company an edge over specific industries, and make it harder for clients to walk away from contracts.

The ‘Trojan Horse’ starts from Acquire Phase

I would relate Palantir’s strategy with the Trojan Horse from Greek mythology. During the Trojan war, Greeks at Odysseus’s command built a giant wooden horse in just three days and offered it as a peace offering gift to Trojans. Unfortunately, Trojans didn’t realize that Greek soldiers had hidden inside the horse. During the night when Trojans were sleeping peacefully, the Greeks managed to get out, open the gates, and eventually conquer Troy.

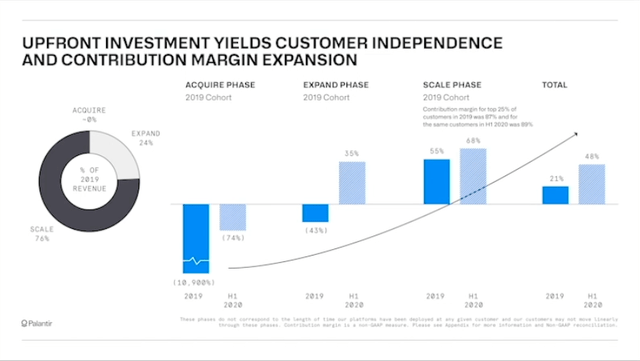

As we already know, Palantir’s business model consists of the Acquire, Expand, and Scale phase. Similarly with Palantir, from the moment clients walk in (acquire phase) with pilot implementation and subsequently entrust their valuable data with the company (expand phase), the client is getting married to Palantir (scale phase). Palantir targets highly scalable clients at the acquire phase and bears all technical costs and relevant risks regardless of the complexity. Thus, this approach creates high entry barriers for competitors and strongly incentivizes new customers to join.

At the acquire phase, Palantir’s strategy is to get the customer to experience the platform through a compelling pilot implementation at low or even no cost. Once revenues exceed the $100 thousand mark, the customer moves to the expansion phase and then advances to the scale phase, where the majority of the revenue occurs. As the customer moves through the three phases across the line, the relevant costs decrease while contribution margins start turning positive. This strategy has worked well for years and, in combination with the solid economic moat analysis above, supports the sustainability of its future operating cash flows and its growth.

Business Model – Phases (Palantir IR)

2. Understanding Palantir’s Product Offerings

It is nearly impossible for Palantir’s clients to hire top engineering talent in-house for data mining and visualization due to the enormously high cost. In addition, the company does not collect nor sell data. In contrast, it assists its clients through its platforms to understand and derive meaningful conclusions from their data to improve their decision-making.

What is Foundry? A thorough walk-through

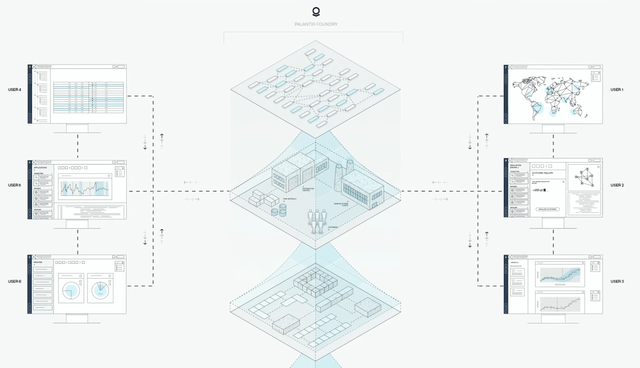

The Foundry Platform is the central decision support infrastructure and breaks into a data integration platform, a suite of analytical tools, and an operational platform of applications. The Foundry is a SaaS platform that hosts and integrates data as well as provides the tools for data analytics, visualizations, and model building, with the ultimate goal to improve the decision-making process.

What does a traditional data project look like?

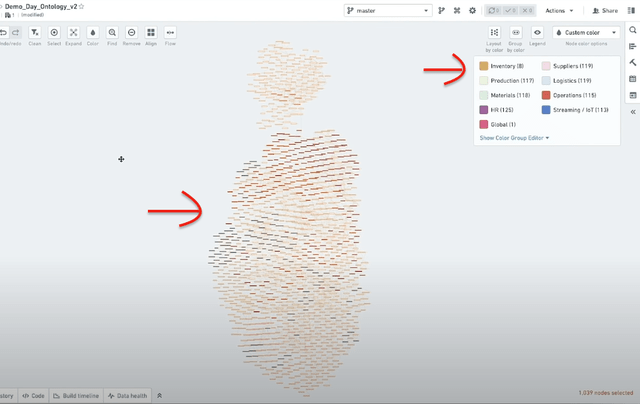

The first arrow in the left points at the organization’s network of interconnections across departments, making it extremely difficult to explore relationships and draw meaningful conclusions. Similarly, the table on the right shows the organization’s departments ranging from operations finance to HR and any other division. As a result, most companies have trouble coping with a vast amount of data all in one place, and this explains why most companies spent years on data projects with mediocre outcomes.

Palantir Foundry Ontology Supply Chain Project (Palantir)

Palantir’s Foundry and Ontology bring a solution

Palantir adopts an entirely different approach to the traditional software and makes the process smooth and seamless. To visualize the process, the photo below represents how the Foundry Operating System (OS) functions, starting from the bottom up. The company transfers its clients’ data into Palantir’s platform through the ‘HyperAuto’ connector for data sync that includes a series of Extract, Transform and Load (ETL) tools. At the data integration stage, the platform can collect any form of structured and unstructured data all across the organization’s databases.

As we move further up to the middle, Ontology is dynamic and captures all changes as organizations evolve. Then, at the Ontology level, the organization forms a ‘digital twin’ and provides two-way communication with the organization’s digital assets and real-life operations. As more data integration into the platform, the Ontology grows and provides a bidirectional communication across functions in real-time, providing a commonly understood shared framework across departments and improved decision making. In simple words, the platform maps all data into a shared framework. On the contrary, traditional ERP systems in the market cannot manage all these changes.

Last but not least, the company’s servers are hosted on the client’s data center, and it is vital to note that the data are owned by the client, remain within the clients’ network, and never be controlled by Palantir.

Palantir Foundry 21 Launch Day Video (Palantir)

How is the decision-making process empowered?

Another functionality that makes the platform impressive is the system-wide simulation engine that supports ‘what if’ analysis. Such functionality empowers the organization to understand the consequences of their actions long before they execute in real life.

Two examples that show how a manufacturing organization can enrich its decision making are as follows:

- The supply chain manager can link a seasonal demand model with the production volume and capacity model to derive conclusions and optimize pricing and, as a result, revenue.

- When a supply chain analyst identifies a demand and supply gap, for instance, slow-moving, excess, or obsolete inventory, he can immediately take corrective action such as reordering inventory, discounting, or even bundling slow-moving items with other trending stock. At no time the distribution center is notified and can proceed with the execution.

In addition, an organization can answer critical supply chain questions and know in advance the consequences if, for example, a key supplier fails to deliver on time:

- What would be the impact on the on-time delivery of finished goods?

- Which locations are most affected?

- Which customers are most affected?

- What is the monetary impact?

Organizations can see through and be proactive when certain events occur. Thus, users across the organization can ask critical questions and see how specific actions will unfold, allowing the users to make optimal data-driven decisions.

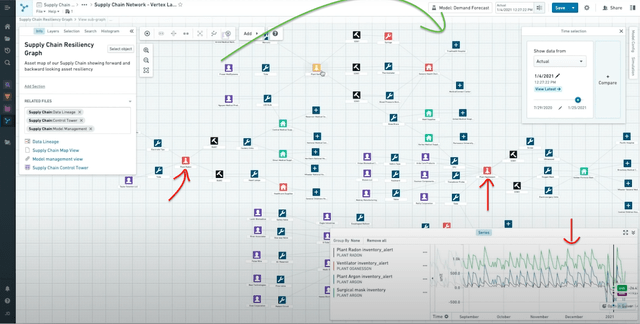

Inevitably, it is inherently hard to understand all cause and effect relations in a supply chain, which explains why even large organizations face several challenges such as delayed orders and inventory management issues. The below interface illustrates the supply chain network of an organization that uses the Foundry platform. Once the inputs, outputs, objectives, connections chains, and models are built, the users can test complex models and scenarios by asking questions.

What is impressive with the interface is that users can easily understand the interconnections and challenges of the entire supply chain from suppliers, customers, manufacturing plants to distribution centers (see green arrow). Furthermore, users can play with the slider (right bottom, see the red arrow pointing downwards), to simulate the impact of their decisions, and as soon as any potential challenges arise, such as inventory shortcomings, unexpected increase in demand, supply constraints, the system alerts users by turning nodes into red (see red arrows pointing upwards).

Palantir Supply Chain Control Tab (www.palantir.com/palantir-foundry/21-launch/)

Real Business Case Study – Scuderia Ferrari

The reason I choose the Scuderia Ferrari (SF) as a case study is simply because it perfectly demonstrates how powerful the Foundry platform is. Due to the nature of SF’s operations with trillions of data points to analyze and make decisions in a very short span, it is an ideal candidate for proving Foundry’s performance and exposing weak areas.

Let’s first have a look at the comments of the Head of ERS Design & Development at SF, Pete May, who has noted about their business and the use of Palantir’s Foundry platform:

A labyrinth of data from disparate sources.. It’s often really difficult to navigate.. Originally, we envisaged using the platform to replace existing tools to do repetitive analysis..

Now we are tending to use the platform on the fly to test New Hypothesis.. It allows engineers to focus on the ideas and possibilities that can really bring positive results..

The real advantage of the Palantir Platform is that we can quickly, with one single frontend, analyze lots of different data..

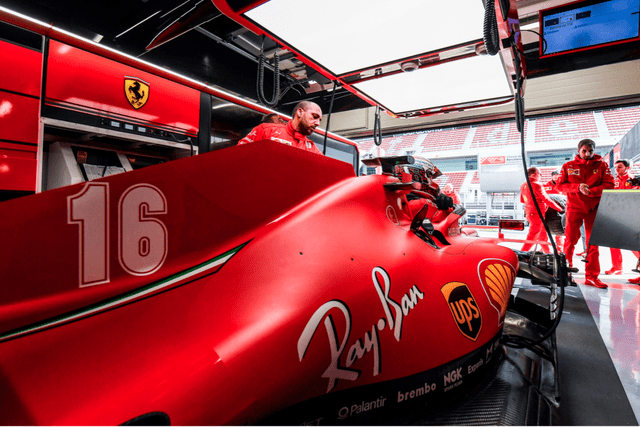

Scuderia Ferrari (Palantir)

What problem does Palantir solve for SF?

To put that in perspective, Formula 1 (F1) teams, such as SF, get very limited time to test their car in the wind tunnel. A wind tunnel is a tool for aerodynamic research to test ideas from computer simulations to real life. The antidote to these challenges is Palantir’s Foundry platform, which can analyze a vast amount of data extremely fast from different sources and capture them on a single front-end so that engineers can improve their decisions.

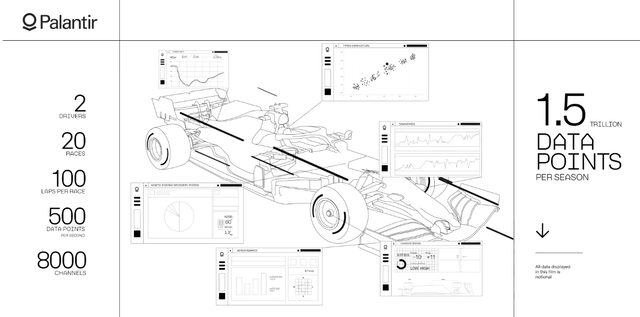

Hundreds of sensors on SF cars are used to monitor, control, and optimize the driving experience by collecting vast amounts of data for brakes, speed, races, and much more. There are more than 1.5 trillion data points per season, as thousands of sensors read thousands of data points per second, leading to complex time series data. Due to the nature of F1 races, engineers need super fast access to critical information to manage the relevant costs better.

Palantir integrates this complex time-series data from sensors, computer simulations, wind and tunnel tests through the Ontology framework, where SF can use a ‘digital twin’ to develop adjustable models that analyze and reveal relationships between data. In other words, the Ontology organizes those data into human-readable objects, like cars similar to the photo below, and provides better visualization and user experience.

Palantir x Scuderia Ferrari (Palantir)

To conclude, in a real 2-hour ‘Grand Prix’ race, with two SF cars and thousands of data points to analyze, the SF team needs to take action under intense time pressure, sometimes down to milliseconds. Thus, having a tool that analyzes fast vast amounts of data, and provides accurate, actionable data in a codeless way, enhances decision-making precision and drives operational performance.

Gotham from an Intelligence tool to OS

The Gotham software is used in several US and its allies’ government sectors, primarily in defense and intelligence. Even though, at the very early stages of Gotham, the software developed for US counterterrorism operations, the segment evolved for more commercial use over time. For example, financial institutions can now use Gotham to conduct fraud investigations and forensic audits.

Why does the US Government rely on Palantir?

The Gotham platform can provide on-time access to valuable data and accelerate decisions in extreme and urgent situations. Gotham connects data from countless resources across the globe, such as satellites, sensors, CCTVs, and processes all this information, that otherwise would be impossible for the human mind to grasp, with the ultimate goal to enhance decision making.

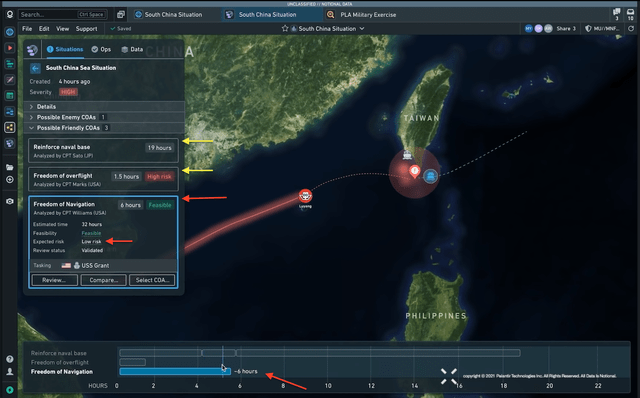

In a recent demo video Palantir has demonstrated how an escalation starting with a routine exercise in the South China Sea (SCS) by the Chinese Military (marked as a red node approaching Taiwan in the photo below) makes US forces rely on the Gotham platform to detect, alert, process and take appropriate action. As a result, through the analysis of ship density, historical baseline averages, and other critical components, the Gotham platform alerts the users for an increasing blockade risk in the area, which may threaten US free trade interest in the SCS.

Understanding the decision-making cycle

After a thorough analysis of the situation, Gotham assists users in taking the optimal decision and course of action by providing choices available and their feasibility, probability of success, and relevant risks. For example, under the notional scenario where Chinese ships may threaten the Free trade interests of the US in the SCS area, the US has the following choices available to act upon:

- ‘Reinforce naval base’; Sending reinforcements to the closest base takes about 11 days, but the US cannot achieve the desired outcome.

- ‘Freedom of overflight’; Sending an aircraft over the Chinese ships (marked as a red node) causes unnecessary tension, which is flagged as high risk by the system.

- ‘Freedom of navigation’; Sending the US or allied ship (marked as a blue node) closer to the situation (marked as red location pin) in Taiwan. This option ranks as ‘feasible’ by the system as it is low risk, with execution being performed in a relatively short time of around 32 hours.

Palantir Gotham Decision Making (Palantir)

Considering that the third option provides the highest probability of success per unit of risk, it classifies as the optimal decision. This example illustrates how the Gotham platform offers a unique OS for global strategic decision-making. Furthermore, Palantir’s user-friendly interfaces, which look like participating in a video game, enhance the understanding element in the decision-making cycle.

Even though the above is a notional scenario, it does not deviate from reality considering the China and Taiwan tensions in SCS. The probability of peaceful reunification is more likely, but tensions like this incentivize the US to expand investments in defense and security.

Apollo – Palantir’s most undervalued platform

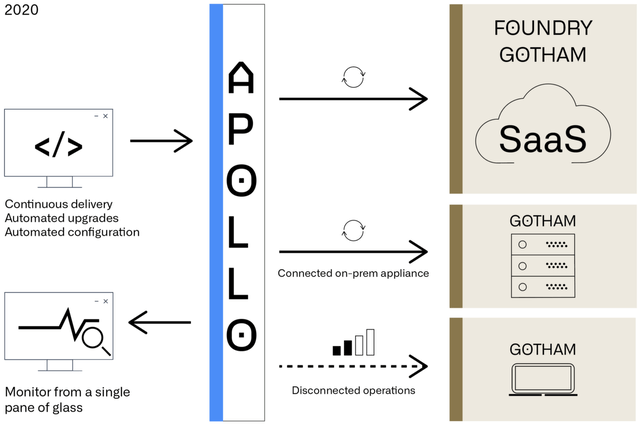

When the Gotham platform launched back in 2008, most enterprise software ran on-premises with occasional updates and manual changes. Fast forward to 2016, when Foundry was introduced, the world moved towards the cloud, and the Foundry platform, a SaaS product, dominated. This third platform Apollo is an independent, stand-alone platform and a continuous delivery system that empowers Gotham and Foundry.

To date, Apollo remains the most undervalued platform Palantir has even built. When companies push a system to Live environments, the ‘build system’ captures and centralizes all of the knowledge on deploying the environment. Thus, companies need to write a new ‘build’ every time they want to update or deploy new systems, making it pretty challenging and not scalable. Apollo has built agents in the AWS cloud, which know how to recognize and deploy a system by monitoring and reading the registry for new releases and deploying new versions. So these Apollo agents that run in AWS are a massive breakthrough for data decentralization as there is no need to centralize deployment targets under one technology.

Apollo updates Gotham and Foundry (Palantir)

Concluding Thoughts

Every serious ‘Palantirian’ investor should devote sufficient time to understanding the company’s product offerings. Undoubtedly, Palantir’s business is highly technical and might be out of someone’s circle of competence. However, in the current digital era, nearly all of us have daily exposure to data applications and information access, making it more feasible for curious investors to understand Palantir’s business.

For example, if the business model of Coca-Cola makes sense to you and you can understand it, it doesn’t matter if you don’t know precisely how Cola’s syrup mixes with other ingredients and sweeteners. Unquestionably, PLTR is not for everyone. Similarly, it took me some time before becoming a shareholder, cutting the learning curve and upgrading PLTR to my long-term, highly concentrated portfolio.

Be the first to comment