Michael Vi

On August 8th, before the market opens, the management team at Palantir Technologies (NYSE:PLTR) is due to report financial performance covering the second quarter of the company’s 2022 fiscal year. Heading into this earnings release, analysts have some pretty interesting expectations for the firm. For years, this big data analytics company has been growing at a rapid pace and the current expectation is for this trend to continue. In fact, analysts currently think that the company will outperform even management’s own expectations on the top line. Long term, the company is likely to do quite well for investors. But this doesn’t necessarily mean that shares are worth buying into at this moment. Although growth should continue to be strong for the next few years, shares are looking rather pricey, especially after rising materially in recent months. Because of this, I have decided to reiterate my ‘hold’ rating on the firm, with the expectation that performance should more or less match the broader market for the foreseeable future.

A look at expectations

On May 10th of this year, I wrote an article about Palantir Technologies wherein I claimed that shares were starting to look enticing. This followed a 21.3% decline in the company’s share price on May 9th, following management releasing results for the first quarter of the company’s 2021 fiscal year that, unfortunately, missed expectations. Although revenue came in $2.85 million higher than anticipated, earnings per share missed by $0.02. Although this may not seem like that big of a deal, the modest miss on the bottom line caused shares to plunge, highlighting for investors the real risk that comes with paying a hefty premium for a growth story. Even when a company reports financial results that comes in materially stronger than what the firm achieved one year earlier, it can still experience a meaningful drop in price in response to a shift in investor sentiment. Although the company was starting to look appealing, it was not quite cheap enough for me to change my rating from a ‘hold’ to a ‘buy’. Since the publication of my article, however, the business has experienced tremendous upside, with shares skyrocketing by 38.5% at a time when the broader market has moved up a more modest 2.1%.

This increase in price was not driven by any significant contributor. It did, however, take place at a time when the company did announce multiple awards that have ultimately been added to its backlog. For instance, on June 2nd, the company announced an expanded partnership with U.S. Space Systems Command To ensure the continuous delivery of the company’s data and decisions platform to support national security objectives through March of 2023. That deal added $53.9 million to the company’s 2021 award that was worth $121.5 million. This was followed up on March 28th by the announcement that it was one of two companies awarded a prime contract by the U.S. Army to build a prototype for the Tactical Intelligence Targeting Access Node At a cost of $36 million spread over a 14-month timeframe. And on July 28th, the company announced a $99.9 million contract spanning two years that will allow it to expand its work with the U.S. Army Research Laboratory aimed at implementing data and artificial intelligence and machine learning capabilities for users across combatant commands.

These are all positive developments for the company. But on their own, they are difficult to justify such a surge in the company’s market capitalization. Some of this increase might also have been driven by expectations for the current fiscal quarter. At present, analysts are anticipating the announcement of revenue totaling $471.72 million for the second quarter of the company’s 2022 fiscal year. That represents an increase of 25.6% over the $375.6 million the firm generated the same quarter one year earlier. It’s also slightly above the $470 million management is currently forecasting for the quarter.

When it comes to profitability, the picture is a little less certain. This is because management has not provided any guidance when it comes to net income or earnings per share. They did say that the adjusted operating margin of the company should be around 20% for the quarter, a figure that should eventually climb to 27% for the entirety of the 2022 fiscal year. But beyond that, there has been no clarity on profitability for the quarter. At present, analysts expect the business to report a loss per share of $0.04. If this comes to fruition, it would translate to a net loss for the quarter of roughly $81.5 million. This assumes, of course, that the company has not issued any additional stock since the end of the first quarter. This is a rather risky assumption sentence, from the first quarter of 2021 through the first quarter of 2022, the business increased its number of shares outstanding by 11.8%. So it is possible that the loss could be a bit larger if estimates are hit. Even if the loss is slightly larger, it’s unlikely that the picture will be as bad as the second quarter of 2021. That quarter, the company generated a net loss of $138.6 million.

As I mentioned already, Palantir Technologies had mixed financial results last time. Revenue of $446.4 million came in far higher than the $341.2 million generated in the first quarter of 2021. And this figure even beat expectations by $2.85 million. Even so, the net loss for the company in that quarter was $101.4 million or $0.05 per share. This should serve as a reminder of how small a difference in reality versus expectations can impact a company’s share price in a short time frame. If shares do drop considerably, it might make sense for investors to buy in. But at present, even management’s own rosy guidance for the near term hardly justifies the valuation of the company today.

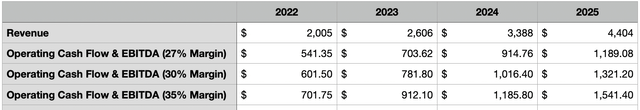

This leads me to another thing that investors should keep an eye on. And that is guidance for the future. Unlike many companies, the management team at Palantir Technologies is not afraid to say what they think the future holds. Their current expectation is for revenue to grow at an annualized rate of at least 30% per year from 2021 through 2025. That would take the company up to $2.01 billion this year and as high as $4.40 billion by 2025 if that growth is evenly distributed. But given the nature of growth, it’s likely that this would be somewhat front-loaded this year and next.

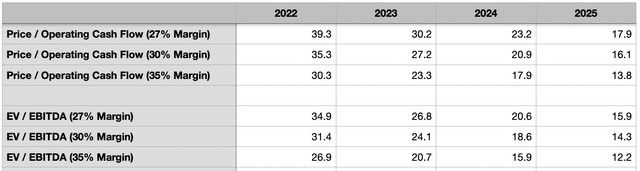

Naturally, this should lead investors to keep an eye out on expectations for the future from a sales perspective. But profitability will ultimately be the most important thing to focus on. In the prior article that I wrote about the firm, I took different scenarios when it came to the firm’s adjusted operating margin and priced it on a price to operating cash flow basis and on an EV to EBITDA basis with the adjusted operating margin serving as a proxy for both of those. For more details, I would recommend you read that particular article. But for the purpose of this analysis, I did update the numbers using current share prices and the company’s performance from its latest quarter to revalue the business. And as you can see, it’s not until the year 2024 that shares really start to become reasonably priced.

Takeaway

At this point in time, I believe that Palantir Technologies is one of the most interesting companies on the market. Truly, investors who are interested in big data and who like companies with government exposure, should view this as an attractive long-term play. But as we have seen already, the company is subjected to tremendous volatility even when overall performance is good by comparison to where it was in prior periods. In the event that the stock was cheaper, I could totally see myself buying into it. But given where shares are priced right now, I still can’t get past the multiple and can’t rate it any higher than a ‘hold’ for now.

Be the first to comment