Michael Vi

I was very critical of Palantir Technologies Inc. (NYSE:PLTR) after their Q2 earnings call in August, which was reflected in my article (can be read here), where I went from bullish to neutral in the blink of an eye. I indicated that I was still bullish on the company’s business prospects, but was disappointed with how Alex Karp’s (Palantir CEO) commentary and how he conducted himself. After listening to the conference call and reading through the presentation, press release, and Alex Karp’s letter to shareholders, I believed there were many things to like, but the original thesis he outlined was changing.

Since 2022 isn’t playing out according to plan, I need to take a step back and recalculate my projections. Thankfully, the Q3 conference call on 7 November went much better than Q2’s, but the results weren’t overwhelmingly good. For all of the powerful slides of information embedded within the presentation, the bottom line is that Palantir’s revenue growth won’t hit Alek Karp’s projections, and their margins are being impacted. This is causing the narrative to change. PLTR could still become a great long-term investment, but in the short term, I think shareholders will need to endure unwanted volatility.

The ugly part of Q3 and how it is making my projections change

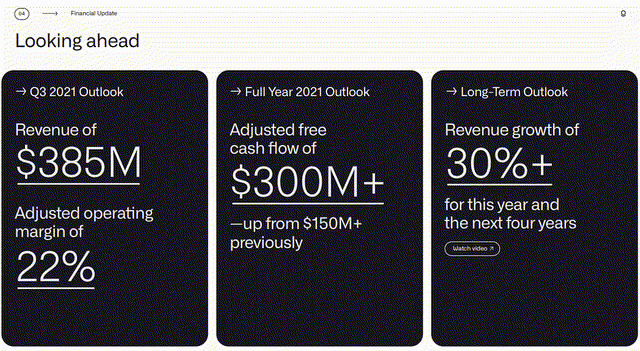

In Q2 of 2021, PLTR reinforced their long-term outlook of 30%+ revenue growth for 2021 and the next 4 years, bringing them through 2025. PLTR had projected that its 2021 Adjusted FCF (free cash flow) would exceed $300 million in 2021, which would be a 100% increase from its previous outlook. I dislike adjusted numbers and would rather look at straight FCF, which is cash from operations minus CapEx or purchases of property and equipment. In 2021, PLTR ended the year generating $1.54 billion in revenue and $321.22 million of FCF for an FCF margin of 20.83%.

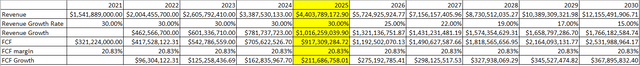

I built a model based on PLTR’s commentary and their 2021 FCF margin. In my model, which is below, I had PLTR’s revenue grow by 30% through 2025, then drop down to 25%, 22%, 19%, 17%, and 15% from years 2026 – 2030. Based on 2021’s FCF margin of 20.83%, if these revenue growth numbers were in the ballpark, PLTR would have generated $2.53 billion of FCF in 2030 from $12.16 billion of revenue. Based on a 25x FCF multiple, PLTR would have a $63.30 billion market cap; at a 35x multiple, PLTR would have an $88.62 billion market; and at a 45x multiple, PLTR would have a $113.94 billion market cap. While Q2 made me switch my view because I was worried about how PLTR would be perceived by potential customers, the future looked interesting as there was a clear roadmap to a much larger market cap into 2030 than PLTR had today. All of this ended after the Q3 2022 conference call, and I now need to build a new model.

Steven Fiorillo, Palantir, Seeking Alpha Palantir

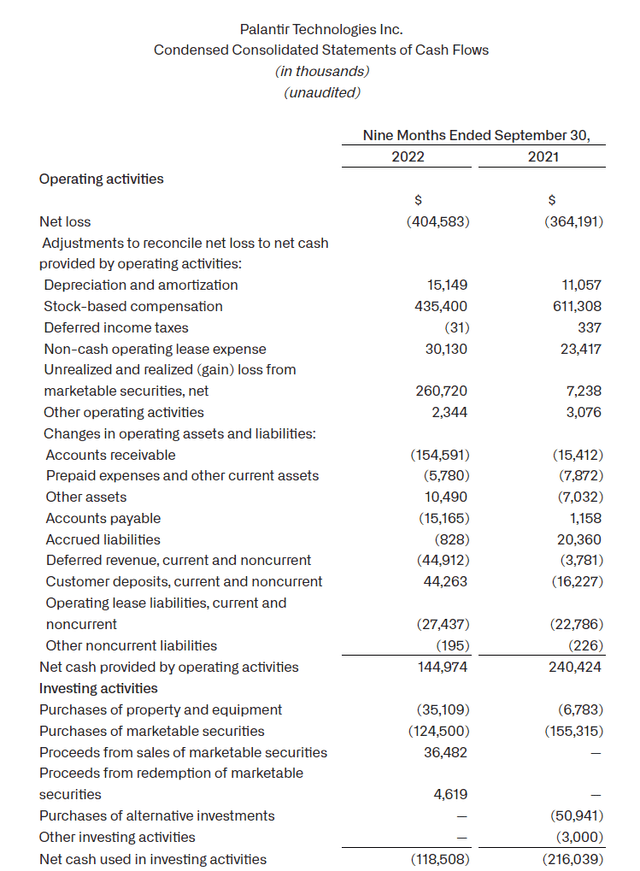

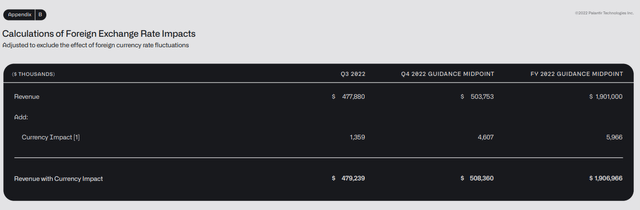

I can no longer use the model I previously based my investment thesis around because PLTR’s projections for revenue growth in 2022 have changed, and their margins have decreased significantly. PLTR is now guiding for $1.9 billion of revenue as its midpoint for the fiscal year of 2022. This is a YoY increase of $359.10 million, which is a 23.29% growth rate. The other issue is that PLTR’s FCF margin has declined in the first 9-months of operations from 21.07% in 2021 to 7.86% in 2022. In the first 9 months of operations in 2021, PLTR generated $1.11 billion of revenue and $233.64 million of FCF for a 21.07% FCF margin. YTD over the first 9 months of 2022, PLR’s revenue has increased by 25.99% YoY ($288.23 million) to $1.4 billion, but its cash from operations has declined by -$95.45 million (-39.70%), and their CapEx has increased by $28.33 million (417.60%), placing its FCF at $109.87 million. PLTR’s FCF margin has declined by -13.20 percentage points to 7.86% from 21.07% YoY. As an investor, I need to readjust my investment thesis based on the new information and determine if 2022 is an anomaly or a new normal.

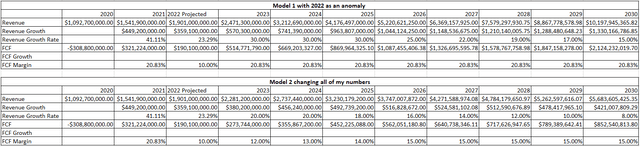

I built 2 models to see where PLTR’s numbers could go. My original cash flow projection called for $2.53 billion of FCF from $12.16 billion of revenue in 2030 based on 2021’s FCF margin, and my revenue assumptions extrapolated past the 2025 projection from PLTR. In model 1, I chalked 2022 up to an anomaly. If I keep the revenue growth rate the same from 2023-2030 and the FCF margin the same as my previous figures, PLTR will generate $10.2 billion of revenue and $2.12 billion of FCF in 2030.

In model 2, I made the assumption that PLTR’s revenue growth is downhill from here, and the entire thesis needs to change. 2022 is now projected to be a 23.29% YoY revenue growth rate for PLTR, so I projected accordingly. Instead of 30% growth rates for 2023 – 2025 ,I placed them at 20%, 20%, and 18%. Then I scaled down to 16%, 14%, 12%, 10%, and 8% for years 2026 – 2030. I completely speculated on the FCF margin and placed it at 10% for 2022, and looked at a 15% FCF margin for 2030. Based on these projections, PLTR would generate $5.68 billion of revenue in 2030 and produce $852.54 million of FCF.

I don’t have a crystal ball, so I don’t know which model is more accurate, but 2022 isn’t what PLTR had hoped for, and it’s certainly not what I had hoped for. PLTR is generating less cash from operations, and its margins are declining, especially its FCF margin. As an investor, I want to see as much cash and FCF generated from operations as possible, and if its revenue is increasing, I would hope that PLTR is generating additional cash from operations. There isn’t enough data yet for me to lean in either direction, and I want to see how Q4 turns out and what the first half of 2023 looks like prior to making any decisions. While I still think PLTR has a lot of potential, its numbers have deflated my investment thesis, and I am not nearly as enthusiastic as I once was.

Steven Fiorillo, Palantir, Seeking Alpha Palantir

The other aspect I am not thrilled about is PLTR’s stock-based compensation (“SBCU”), but not for the reasons you may suspect. PLTR is a growth company and they are competing against Microsoft (MSFT), Alphabet (GOOG, GOOGL), and the rest of Silicon Valley for software engineers, in addition to every other company for quality salespeople. I would much rather have PLTR tap the equity markets and issue stock-based compensation to fuel its growth instead of tapping the debt markets. I am willing to undergo some dilution for this as many other successful companies, including Tesla (TSLA), have operated in this fashion.

The problem is that there is no clear picture of how stock-based compensation is awarded to its employees. We see the line items of where it’s expensed to, but we don’t know how it’s distributed. In the first 9 months of operations in 2022, stock-based comp has declined -$175.91 million (-28.78%) to $435.40 million YoY, and in Q3, it declined by -$44.53 million (-24.09%) to $140.31 million YoY. While PLTR is utilizing stock-based comp less and less, operationally, PLTR isn’t hitting its metrics. Revenue growth is slowing and is projected to come in at 23.29% rather than 30% YoY in 2022, and net dollar retention is stalled at 119% for 2 quarters in a row.

As a shareholder, I am fine with PLTR as a growth company utilizing stock-based compensation if it’s beneficial to the bottom line. In this case, I am not seeing PLTR deliver operationally, while shareholders are diluted and employees are rewarded with additional shares.

By the numbers, 2022 isn’t what I had hoped it would be, Q3 earnings weren’t entirely bad, and Palantir still has tremendous potential, but the real question is, can they capitalize?

Businesses look toward testimonials and customer feedback to provide validation for their product or service. When it comes to enterprise software, real-world use cases and an A-list of clients are critical for future growth. Palantir has changed up its marketing strategy and put together an entire conference called FoundryCon, which was tailored to the U.S commercial market and open to shareholders, global customers, the press, and the general public. Following the opening fireside talk between Alex Karp and Mike Allen (Co-Founder of Axios), presentations from the U.S. Space Systems Command and the National Cancer Institute were delivered, in addition to remarks from companies that included Jacobs, Morgan Stanley, Apache, and Tyson Foods.

Tyson Foods CTO Scott Spradley discussed the strategic outcomes that were achieved through transforming their business and generating $200 million in savings across 20 projects. John Rickerman from Jacobs highlighted that they are on track to save $300,000 annually at one of their sites, which was a 20% savings, and they have 300 sites where the same process can be replicated at. Colonel Jennifer Krolikowski stated that 15,000 people would not have been able to be evacuated from Afghanistan without utilizing PLTR’s software.

PLTR is driving efficiencies and cost benefits for the largest companies and critical government agencies. PLTR is also one of three companies, which includes Amazon (AMZN) and MSFT, that have IL6 Provisional Authorization from the DOD. PLTR’s testimonials are from the largest and most respected entities, and this certainly has an impact on future clients.

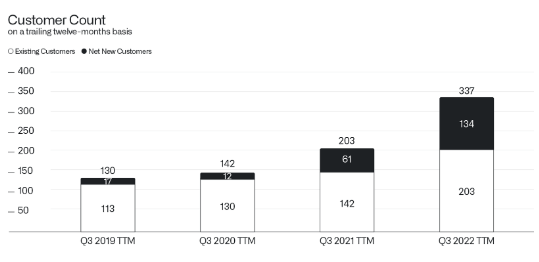

Once again, Alek Karp put one of the most bullish slides in the Q3 shareholder letter rather than the Q3 presentation. Quite frankly, this slide is something many investors are probably overlooking, and it is critical for the bull thesis. On a TTM basis in Q3 2020, PLTR’s new customer base declined by -29.41%, as they only generated 12 new customers vs. 17 in the year prior. PLTR wasn’t a well-known company in 2020, and for those who knew of PLTR, the common perception was that they were a black box company specializing in platforms for the military-industrial complex.

PLTR didn’t go public until the fall of 2020, and after they did, their new customer base exploded as more information about PLTR was circulated, and companies saw successful use cases from their industry peers. In 2021 PLTR added 49 additional new customers on a TTM basis in Q3, up 408.33% YoY, as they finished with 61 new customers. In Q3 of 2022, PLTR experienced a huge increase in new customers. PLTR’s new customer base in Q3 of 2022 on a TTM basis grew by 119.67% or 73 new customers YoY to 134.

I wasn’t thrilled with the net dollar retention being stuck at 119% for 2 consecutive quarters, but seeing the cohort growth in new customers, there will be plenty of chances to upsell customers and add additional functionality to their contracts. Over the last 2 years, PLTR has added 195 new customers, and while new customer growth has decelerated on a percentage basis, it has increased in size YoY. Based on the previous 2 years, PLTR could end up having 450-500 customers by this time next year. If PLTR replicates its 134 new customer growth over the next 12 months, it will put them at 471 customers.

I was very critical of PLTR’s revenue growth and margins due to the level of stock-based compensation that has been issued, but there is certainly a thesis that the growth hasn’t materialized from their newest customers, and 2022 is an anomaly year from a revenue and margin standpoint.

Palantir

No matter how I look at it, PLTR is growing, even though revenue growth will fall short of PLTR’s previous projections. Q3 revenue is up 22% YoY, and the U.S. business is still exploding, as it’s up 31% YoY. In Q3 PLTR’s total contract value closed at $1.3 billion, while they closed 78 deals worth a minimum of $1 million. Of these 78 deals, 32 were at least worth $5 million, and 19 exceeded $10 million. PLTR ended Q3, having closed 273 deals YTD, which is up 63% YoY from 167 in 2021, which drove its total remaining deal value up 14% YoY to $4.1 billion.

For all of the shortcomings, there are many aspects to build a bullish thesis around. I am not closing the door on PLTR as I can argue a bullish case to myself in the same fashion I can create a doom and gloom scenario. At the end of the day, PLTR has $2.4 billion of cash on the balance sheet with $0 of debt and is well capitalized for the future. PLTR doesn’t have a single concern with rising rates impacting their expenses, and there is a path to profitability and large amounts of FCF in the future. The only questions are, will PLTR continue growing in a similar fashion, and will its new customer base eventually drive additional net dollar retention levels?

Conclusion

As a reformed PLTR bull, I am currently neutral on the company. I would need to see revenue get back to the 30%+ projection, margins improve, and expenses either stay in-line or decrease to get bullish again.

That being said, I am not bearish and find Palantir’s current valuation interesting. I plan on adding more shares and dollar cost averaging, as I am not ready to call it a loss and put this investment in the tax-loss harvesting bucket. I need 3 more quarters of data before making a final decision on PLTR, as there is still a path to billions of FCF in 2030, but the current revenue and margin declines are certainly concerning. As PLTR’s numbers have changed, so has my investment thesis, and I will anxiously be awaiting the Q4 earnings report.

Be the first to comment