VioletaStoimenova/E+ via Getty Images

Intro

Both Doximity (NYSE:DOCS) & Teladoc Health Inc. (NYSE:TDOC) operate in the Telehealth field. Both are growing & have changed the way doctors practice. But they are very different businesses. They have different business models, strategies, valuations, & most importantly- different profitability.

Optimism & speculation are necessary evils in capitalism. The DotCom boom changed the world forever. Optimism & speculation provided the capital needed for E-Commerce & other internet companies such as Amazon (AMZN), eBay (EBAY) & countless others. But as always, investors eventually demanded profitability & cash flow. Companies that couldn’t deliver went under & speculators were left holding the bag. Patient long term investors were able to gobble up great companies such as Amazon & Microsoft (MSFT) at significant discounts.

I love watching history repeat itself.

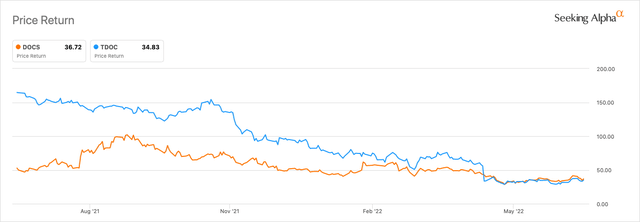

Companies with high hopes & no profits lead the recent declines. Teladoc is down 88% from its all-time high. This selloff was obvious & was a matter of when, not if. Doximity wasn’t immune from this bear market either & is down 62% from its all-time high. Although both businesses are priced at massive discounts compared to a year ago, I believe one has plenty of room to fall & the other has massive long-term upside. In the lines that follow, I will prove why Teladoc is a strong sell & Doximity is a strong buy.

TTM Stock Price (SeekingAlpha)

The Company: Teladoc

Launched in 2002, Teladoc is a multinational telemedicine company the operates a consumer centric business model. The company’s strategy is to bring customers to the platform from as many avenues as possible in order to retain them.

Jason Gorevic was named CEO in 2009 & still holds that title. Over the years, the Teladoc has acquired over 10 companies & competitors to help drive growth. Teladoc also acquired MedecinDirect & CogCubed for undisclosed amounts.

| Consult A Doctor | 2013 | $16.6M |

| Ameridoc | 2014 | $17.2M |

| BetterHelp | 2015 | $3.5M |

| HealthiestYou | 2016 | $45M |

| Best Doctors | 2017 | $440M |

| Advance Medical | 2018 | $352M |

| InTouch Health | 2020 | $600M |

| Livongo Health | 2020 | $18.5B |

The approach for Teladoc is clear: surround customers with as many E-Health services as possible. The strategy is working from a customer acquisition standpoint. In the most recent quarter, Teladoc hosted 4.5 million visits with the same quantity expected for Q2.

What concerns me about the company is how profitability has not followed proportionally with membership growth. Compared to the company’s IPO year, membership visits have grown substantially. FY 2015 totaled 576k total visits. Annualizing the most recent quarter puts Teladoc at 18M total visits for 2022. Compared to 576k from 7 years ago puts membership visits at a CAGR of 64%, a staggering figure.

So Why Is Teladoc A Good Stock To Short With This Level Of Growth?

The first reason I can gather to short Teladoc is the growth of revenue per member. Despite the company’s monstrous growth, revenue per member has grown at a much slower rate. Revenue per member was $0.44 for Q4 2015. RPM was $2.52 for Q1 2022 representing a 29% CAGR. While this does demonstrate a good growth rate & economy of scale, it is not nearly as large. SG&A expenses are also growing at 43% CAGR, a much faster rate than RPM.

This makes me question when profitability will occur. Teladoc has shown no significant improvement of SG&A, which was 52% of revenue for the most recent quarter. Recent net income hasn’t scratched the surface of breaking even for a single quarter, let alone a full FY. Operating margin average -30.8% over the same period & net margin follows at -41.1%. Shares outstanding have also increased substantially. The company had 36M shares outstanding after its IPO & currently has 161M due to acquisitions. This represents a 24% CAGR. So, in terms of shareholder value, RPM is only growing at 5% CAGR if you include share dilution. Because the company’s fundamentals aren’t improving, I believe Teladoc’s stock price still has potential downside.

The second reason to short Teladoc is the potential ceiling for the Telehealth market. In short, Telehealth is healthcare without an in person visit. The Telehealth transition was already in full swing prior to COVID. In this 2017 Forbes article, 20% of those surveyed stated they would eventually switch doctors for the purpose of Telehealth visits. Two years later, Telehealth visits grew by 53%. But as the Pandemic forced millions to stay home, the transition accelerated.

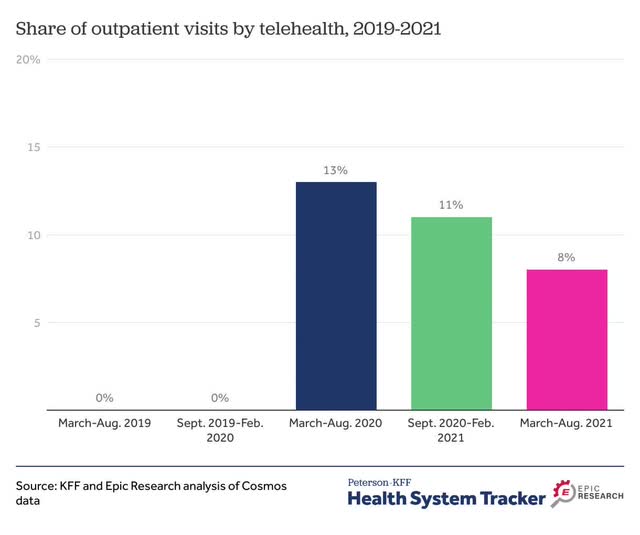

Telehealth exploded during the pandemic but has since cooled off. This June, 2020 US News article showed Telehealth insurance claims grew by 4,347% during COVID. But as the Pandemic continued, the Telehealth explosion cooled off & stabilized.

Telehealth Visits 2019 – 2021 (HealthSystemTracker.org)

The image above shows Telehealth as a percentage of all healthcare visits from August 2020 – August 2021. There are 2 notable things to take away from this graph. The first is that 8% of the population still use Telehealth services. The second is that Telehealth only had a 62% retention rate relative to the height of the pandemic as total use contracted by 5 percentage points.

Since SG&A is constantly increasing & RPM not growing as fast, the only way Teladoc can reach profitability is constant adoption of Telehealth combined with Teladoc increasing market share. I am not saying that Telehealth making up 8% of all visits is a small figure. It is a fantastic accomplishment. I can see the growth continuing if Teladoc had a strong moat around its business. Unfortunately, Doximity has the moat that Teladoc needs.

The Company – Doximity

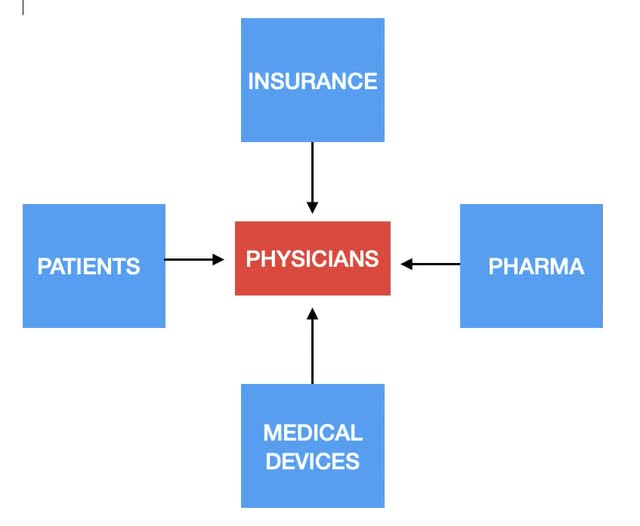

Launched in 2010, Doximity helps its members learn, collaborate, & deliver patient care via telemedicine as well. This E-health medical platform takes the opposite approach from Teladoc by targeting doctors instead of customers. This has resulted in 80% of US physicians using the platform. In just over 10 years, Doximity has practically cornered the networking market for physicians. Wherever the physicians are, business will follow.

While other social networking companies such as LinkedIn (MSFT) offer professional collaboration, the hyper-focused physician business model has proved itself successful. The title of “Doctor” is not easy to obtain & they love to stay within their own network more than almost any other field. In fact, one in four female physicians are married to another doctor, another 11% are married to someone else in the field. For male doctors, 16% are married to another physician.

CEO Jeff Tangney who is not a doctor himself, appears to understand the value of this desire to network for physicians to network with each other. Tangney actually gave out 3.5M shares of stock to various physicians prior to the IPO. He was quoted saying the business is a “Bloomberg for doctors.” Mr. Tangney has been in the medical space since 1998 when he launched a company that was later renamed Epocrates. Epocrates was later sold to Athena for $293M.

This focused business model has proven to be much more successful than the B2C model implemented by Teladoc. One quick peak at the company’s income statement clearly shows how successful it has been. Sales growth has averaged 60% over the last 3 years, & 76% over the last 18 months. Unlike Teladoc, this had led to consistent profits & growing margins. The company’s operating margin has averaged 32% over the last 18 months with net margin averaging nearly 40%.

Doximity Network (Author)

So What Makes Doximity Special?

What is interesting about Doximity is how it is hyper-focused on one network of one profession in one country & the success that has followed. There have been many consumer-focused businesses that have seen huge sales success. For example, Amazon creates such a convenient place for consumers that E-Commerce businesses have no choice but to sell on Amazon.

But healthcare is not like most other businesses. People need healthcare as opposed to wanting another good or service. This creates a unique gravity for physicians that other professions do not have. If your doctor is using Doximity to perform your appointment instead of Teladoc, your willingness to use Doximity will increase substantially. This business first strategy has created an extremely wide moat for Doximity. I believe the moat for Doximity to be stronger than any social networking company, including Facebook (META) relative to their size.

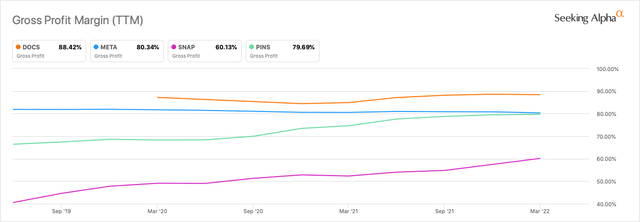

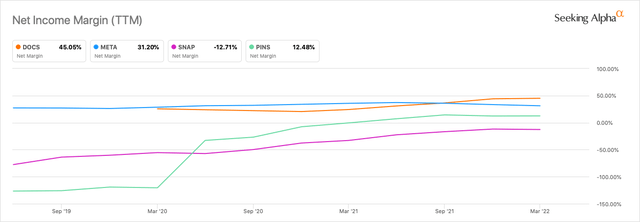

According to Statista & Pew Research, 70% of US adults use Facebook. As of today 80% of physicians use Doximity, up from 25% in 2013. Doximity also has higher gross margin & net margins than these following other US social media companies.

Gross Margin – Doximity & Other Social (SeekingAlpha)

Net Margin – Doximity & Other Social (SeekingAlpha)

While Doximity is in the Telehealth business, the business model goes much further than patient care. Because physicians are on Doximity, insurance & medical device companies follow. CEO Jeff Tangney said, “Our interactive platform allows them to connect efficiently with the right physician about new treatments and patient referrals.” This led to a 157% net revenue retention rate for the last quarter- a staggering figure. He also believes the company is only at 3% penetration for the pharmaceutical TAM.

Doximity has also made a few acquisitions, but have been much less frequent than Teladoc. Most recently Doximity purchased Amion.com for $53M plus other employee incentives. The company also acquired Curative for an unknown amount.

So How Do The Two Compare?

As a general rule of thumb, if I have to choose between B2B vs B2C & all else is equal, I choose B2B every time. Of course these two companies are not equal. I mentioned previously that Teladoc had optimism & Doximity had results. In the lines that follow I will discuss growth, profitability, valuation, insiders & risks.

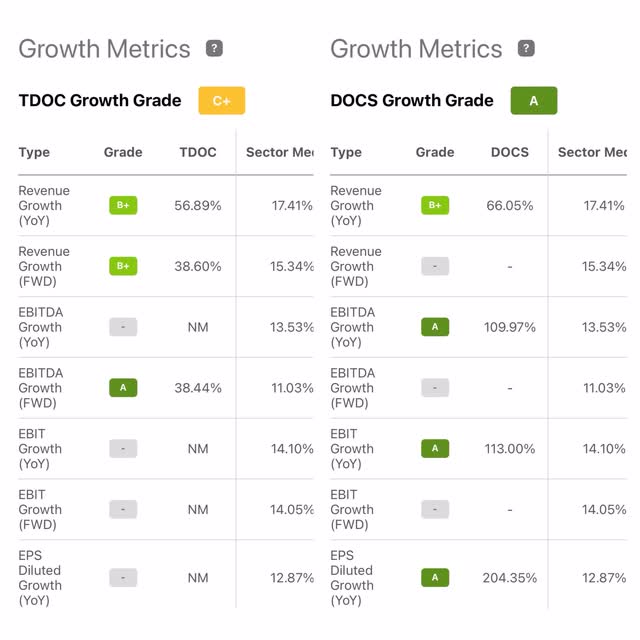

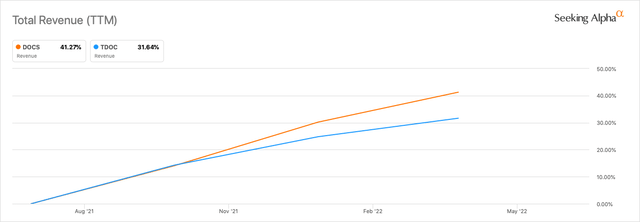

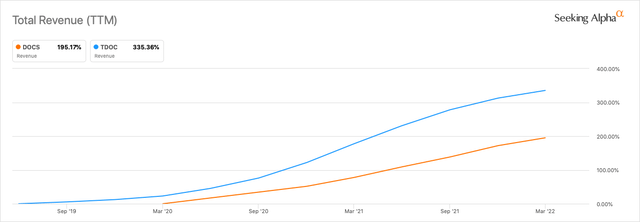

Growth

In terms of growth, Doximity is the clear winner. The company is growing its top line revenue at a faster rate. As you can see below, Teladoc sales have been growing for a longer period. But in the last 12 months, Doximity has been growing at a much faster rate, without 11 acquisitions of course.

Growth Rating (SeekingAlpha)

TTM Revenue Percentage Growth (SeekingAlpha)

3 Year Revenue Percentage Growth (SeekingAlpha)

Profitability

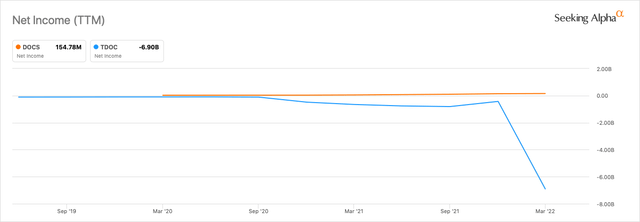

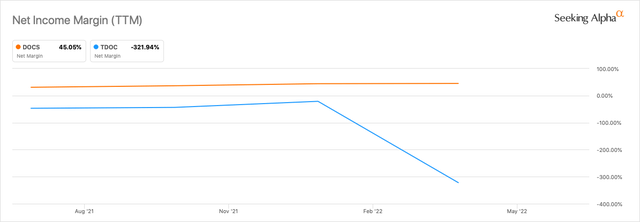

Once again Doximity is the clear winner. Unfortunately I do not see a profitability turn around happening any time soon for Teladoc. SeekingAlpha’s EPS projections shows Teladoc with net losses through 2023.

Profitability Rating (SeekingAlpha)

3 Year Net Income Linear (SeekingAlpha)

TTM Net Margin (SeekingAlpha)

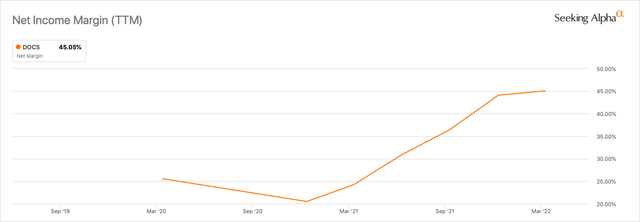

Unfortunately due to the severity of losses for Teladoc, Doximity’s net margin looks flat. For convenience I will insert Doximity’s net income margin by itself, which has nearly doubled in the last 12 months.

TTM Doximity Net Margin Solo (SeekingAlpha)

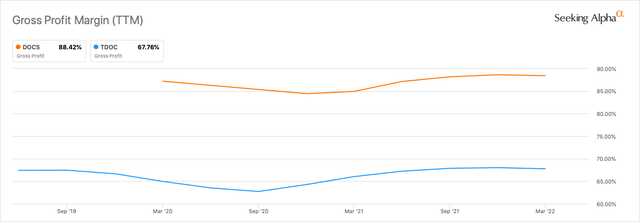

The gross margin for Doximity is astounding & north of 88%. High margin companies at discounts are my favorite form of margin-of-safety. Doximity’s gross margin is a full 20 percentage points higher than Teladoc’s.

3 Year Gross Margin (SeekingAlpha)

Valuation

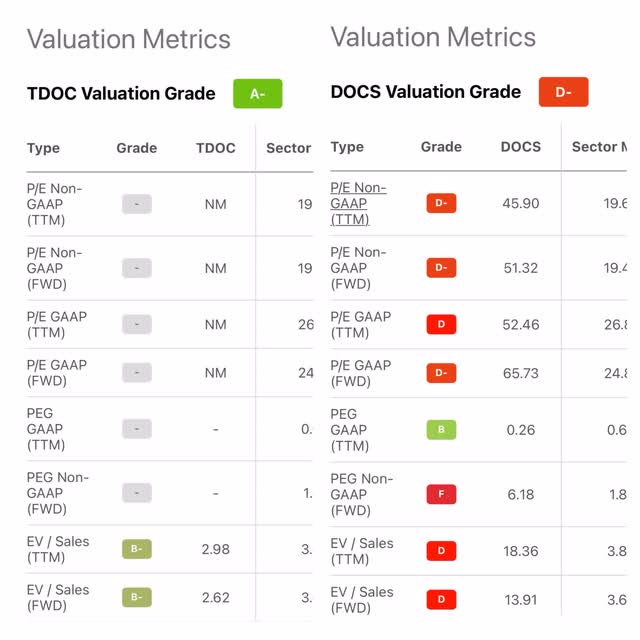

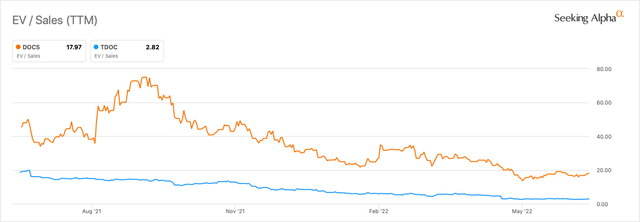

Technically speaking, Teladoc has a better valuation than Doximity. The Ev/S hovers at 3 for Teladoc while Doximity is well into the double digits at 18. Teladoc also has a 0.62 Price/Book, which at the surface looks like a great number. It looks like an even better bargain when compared to Doximity’s Price/Book of 8, more than 1100% higher. But as a forward thinking investor, I look at future upside instead of a liquidation valuation.

Valuation Rating (SeekingAlpha)

Doximity’s EV/S was hovering around 80 a year ago & I didn’t even consider investing at the time. Once this figure passes 20, I tend to look away & wait for a discount. But with the recent selloff & future prospects, I am much more comfortable with the EV/S figure.

TTM EV/S (SeekingAlpha)

By no means does this recent selloff mean that Doximity is a deep value investment. It is still priced at quite a premium. But with the future prospects, this valuation is an entrance price for me. Currently Doximity sits at a FWD P/E of 51.

What Are Insiders Doing?

Insider activity does not give me much hope for Teladoc either. As you can see here, there has been a great deal of selling & options exercised with no buying. In the last 4 years, CEO Jason Gorevic sold $118M worth of stock, $90M of which was in the last 2 years. He has not purchased any stock during that time. In the last 18 months, director Glen Tullman also sold nearly $180M worth of stock. Apparently these Telehealth insiders aren’t too bullish on Teladoc.

Insider activity is also much more encouraging for Doximity. There has been some selling, but there also has been large purchases made by insiders & larger shareholders. It’s nice to see a company where the CEO is purchasing as opposed to leading a fire sale like the CEO of Teladoc.

Risks: Going Long On Doximity

The first risk is a continued selloff in our current bear market. Although Doximity is at a hefty discount from a year ago, an escalation with conflict in Ukraine, an increase of inflation, or a deepening recession will be catalysts for this scenario.

Another possible risk would be a decrease in the ROI for Doximity’s customers. This is an unlikely risk as the most recent transcripts claim a 10x ROI for pharma & 13x ROI for hospitals. Should this ROI slowdown, the company’s revenue retention rate could contract & cause a lower valuation from today. I do not see a significant risk in the networking aspect of the business model. The exclusive networking foundation built from the company will be difficult to penetrate by another competitor. However a hack of the company’s network could cause a short term risk to price until the issue is resolved.

Risks: Going Short On Teladoc

Teladoc has not shown significant signs of fundamental turnaround for me to be concerned with. However, the market can overreact to good news from the company. The market has already displayed what I believe the be excessive optimism for Teladoc.

The second risk to the thesis would be the return of a bull market. A bull market could bring an influx of investor appetite into growth stocks such as Teladoc. Teladoc is a growing business in a growing field. Investors’ risk tolerance may change under certain market conditions.

The Third risk could be a significant acquisition. Teladoc has been no stranger to acquiring competitors or other businesses in the field. If Teladoc were to acquire or merge with another profitable company, this entire thesis could implode if the company becomes profitable.

Conclusion

In my opinion, going long Doximity & shorting Teladoc is the clearest pair trade on the market today. Both are in the Telehealth space, so in general what is good for one is good for both. The two companies do not compete directly with each other, but I do feel that one will eventually overtake the other. In fact, Teladoc CEO Jason Gorevic sits on the Board of Directors for Doximity.

Profitability & cashflow are a must for long term investors. As markets turn from bull to bear, optimism turns into pessimism & hope turns into caution. The recent bear market selloff has taken many high quality, profitable, & wide moat companies down with it. I believe Match (MTCH) & Spark Networks (LOV) to be another great pair trade, which you can read about here. Ironically, the pair trade thesis for the two dating sites are the inverse of the thesis for these two Telehealth companies. There are many pair trades in the market, but I can’t think of a better example than Doximity & Teladoc.

Be the first to comment