FG Trade/E+ via Getty Images

Introduction

This article is born from a repeating request on the comments section of previous articles to compare StoneCo (NASDAQ:STNE) with PagSeguro (NYSE:PAGS). Whilst both businesses are successful Brazilian fintechs that have consistently taken market share from the incumbent big banks in a financial industry that was (is) highly consolidated (and therefore highly profitable), there are a number of differences between StoneCo and PagSeguro, and these must be appreciated before comparing the two companies.

PagSeguro – A Brief History

PagSeguro was launched in 2006 as an online payment platform to provide the digital payment infrastructure necessary for e-commerce growth in Brazil for UOL. Founded in 1996, UOL is Brazil’s largest Internet content, digital products and services company. In January of 2007 UOL acquired BrPay, a Brazilian electronic payment company that was incorporated into PagSeguro six months later.

The birth of PagSeguro is credited on their website to have given online consumers in Brazil the initial confidence to share their sensitive personal and financial data online, allowing them to shop online easily and safely, such was the brand power of UOL at the time.

In 2013, they expanded from online payments into POS (Point of sales) payments, allowing merchants to receive in-person payments. Focusing primarily on individual entrepreneurs, Micro-Merchants and SMEs, they started selling a range of POS and mobile POS. The devices offered competitive transaction fees and access to their end-to-end digital banking ecosystem, with a free PagBank digital account offered that was similar to a regular checking account.

Their main target markets included underserved clients who had been ignored or underserved by the incumbents, and their digital banking ecosystem serves both consumers and merchants on a single platform.

Once on their platform, merchants can offer consumers 37 cash-in methods, choose to obtain early payment of their card receivables on consumer instalment transactions, and manage their cash balances on the free PagBank digital account, which offers eight cash-out options including wire and peer to peer transfers, QR code payments, bill payments, top up prepaid mobile phone credit, online purchasing through their eWallet, and in-person and online purchases or cash withdrawals using the PagSeguro prepaid and cash cards. PagSeguro primarily makes money from payment processing take rates, working-capital loans to its merchants, and credit card loans to its customers at PagBank

On January 26, 2018, PagSeguro Digital completed its Initial Public Offering. 50,925,642 new shares were offered by PagSeguro Digital and 70,267,746 shares were offered by the controlling shareholder UOL.

StoneCo – A Brief History

When StoneCo was launched in 2012, founders André Street and Eduardo Pontes had already spent over a decade working in the electronic payment and payment processing fields in Brazil. They closed their previous business and built StoneCo with their accumulated know-how, and also stressing the importance of human connection, wanting to be a customer-centric company.

They offered their payment processing technology alongside a terminal, allowing merchants to receive in-person payments. An added innovation was developing hubs in strategically located sites that allowed their target client base of SME merchants, which historically are not regarded as being tech savvy, to gain the comfort of having physical support close by if required. This helped build confidence, and allowed the business to scale quickly. Later this hubs strategy was partially replicated by PagSeguro.

StoneCo continued adding services to their core offering such as banking (yet they do not have a banking licence. They leverage off their banking partner, which we assume is likely Banco Inter, which they have a minority stake in), as well as a growing their software offering that subsequently led to the acquisition of Linx to gain exposure to their technology and retail customer base.

StoneCo describe themselves as providing an end-to-end, cloud-based technology platform for merchants to conduct electronic commerce using in-store, online, and mobile channels. The cloud-based platform helps its clients to connect, facilitate transactions, receive payments, and grow their businesses. The company makes money by charging fees for its services. These include transaction payment processing, prepayment financing, subscription, and equipment rentals. The company’s target audience is small- and medium-sized enterprises.

What are the differences between PagSeguro and StoneCo?

Firstly, both businesses should be congratulated on the success they have achieved, and also on the impact they are making in the Brazilian financial industry. These companies are helping many consumers and businesses that previously had been left unbanked by the banking incumbents. This can create opportunities that previously did not exist for this segment of the economy by providing access to the potential benefits, and obviously risks, of having access to financial tools.

It seems wise to initially focus on their differences, as most references assume the businesses are very similar.

Client Focus Differences

PagSeguro started by focusing on the micro customer segment, an area that previously had been neglected by the incumbent banks. This is a low TPV (total payment volume) per merchant business, but is a higher margin per client segment. These characteristics are reflected in their financials. In recent years it has pushed into larger SME clients, no doubt to attack into StoneCo’s core market, and to enjoy the benefits of having higher TPV per client economics.

StoneCo primarily focused on SME (Small to medium enterprises) clients, but in recent years it has pushed into the micro client segment, no doubt to attack PagSeguro’s core client base, and to enjoy the higher take rates this client offers. StoneCo also offers payment processing services to larger platform companies and sub acquirers via their key accounts segment. These are clients that offer very large volume at very low take rates. Sub acquirers are now not seen as being a core business, hence key accounts are becoming a smaller share of TPV, though it still remains >20% of total TPV in their Q3’22 results.

Business Model Differences

- StoneCo has pushed more into software, whilst PagSeguro has pushed more into offering a deeper and wider range of financial services, leveraging its banking licence

- Whilst StoneCo is now offering a wider range of financial services, they hold considerably less deposits, and do not yet have a fully working credit product.

- Indeed StoneCo actually doesn’t have a banking licence, hence cannot use deposits to fund credit card receivables. This ensures PagSeguro has a cost of funding advantage that is visible in the financials

- StoneCo has not been afraid to acquire assets they don’t possess via investments in Banco Inter and Linx in recent years. PagSeguro has focused much more on organic investments

- Overall StoneCo has been more aggressive, and PagSeguro has been steadier and more cost focused

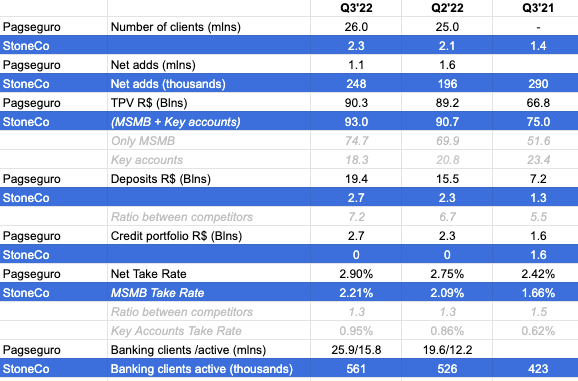

Below, we include some selected data to compare PagSeguro with StoneCo.

Comparing Selected Financial Data of PAGS & STNE from their Quarterly Earnings Presentations (PAGS & STNE Quarterly Earnings Reports)

Some points visible from the above data are:

- PAGS has many more clients with only a little more revenue. TPV/client is lower for PAGS than STNE

- Yet PAGS has a much higher take rate by focusing on the micro merchant. The bigger the client, the lower the take rate

- PagSeguro has a much larger deposit base. This acts as a source of competitive advantage relative to STNE as their financial expenses are 53% of their financial income, whilst for STNE they are 67% (looking at Q3’22 data)

- Adding the four main expenses of cost of service, admin, financial expenses and selling costs for Q3’22 you find that PAGS costs amount to 87% of revenue, whilst for STNE they add up to 91% of revenues. PAGS seems to manage a tighter ship, and strongly supported by their lower cost of funding

- STNE’s focus on software is increasing their subscription business line, potentially making the company less cyclical in the future, and also the client stickier

Strategy Differences

- PAGS are now focused on reducing the number of unprofitable nano merchants. This is visible through the decreasing number of active merchants they report quarter on quarter, and the increasing TPV per merchant they report. They comment they are prioritising recurrence and profitability vs. net adds

- PAGS is building out a cross border solution for payment processing, something STNE has not done yet, focusing instead on software and the Brazilian home market. Nevertheless, software is naturally a more international business model

- PAGS in the last year has focused credit growth in payroll lending, particularly in public sector employees, & FGTS (severance pay, early prepayment).

- In Q3’22 PAGS claim the credit book is now 100% secured. Secured credit cards are now available to all consumers and merchants, cards secured by PagBank CDs (cash deposits). They claim secured products have been fostering up-selling and cross-selling

- Both Banco Inter and StoneCo are working together to explore and engage in partnership opportunities aimed at bringing Inter consumers to Stone merchants, as well as maximize the value proposition for both Inter’s consumer and Stone’s seller ecosystems. StoneCo wants to attract the bank’s clients to its payments services. Indeed Inter offers Stone’s processing services to its clients and merchants who use Stone to process credit and debit cards, and they are being offered connections to Inter’s online marketplace.

Market share

- STNE had been losing market share to PAGS and Cielo over the last year in Brazilian cards TPV. In the last quarter STNE gained market share, but still less than Cielo and PAGS.

- PAGS & STNE now hold 11% market share respectively of the TPV volume in Brazil

- Cielo increased market share from 26.1% to 26.5% from Q4’21 to Q2’22, whilst STNE lost 11.2% to 10.9%. Meanwhile PAGS rose from 9.9% to 10.7%.

- During Q3’22 STNE increased its take rate considerably more than Cielo, which could explain why it didn’t gain as much market share. However, according to PAGS data it raised pricing higher than any competitor and yet still took market share. We note micro customers may have less options than larger customers, hence maybe less price elastic

Macro

- Both STNE & PAGS are suffering from increasing Brazilian interest rates. We note inflation seemed to have peaked at 12.13% in April’22 for Brazil. In October’22 it was 6.47%.

- Hence, we expect the current stabilisation in rates at their higher level to start to descend, leading to potentially higher profits at businesses like STNE and PAGS as their financial expenses decrease

Assets – Reviewing the PAGS Balance Sheet

- Main assets for both companies continue to be credit card receivables (29.3 bln R$ in Q2’22 for PAGS)

- For PAGS the credit portfolio is about a tenth of the size at 2.3 bln R$ as presented Q2/22.

- Note in Q3’22 two thirds of PAGS assets were funded by deposits and equity.

- The remainder of the assets are funded by payables to merchants, PagBank balance accounts, and borrowings.

- PagBank is now the second largest digital bank in Brazil. The first still being Nubank (NU) with 62M clients. PagBank has 25M clients, followed by Banco Inter (INTR) third with 21M clients.

Concluding thoughts

Whilst STNE and PAGS have been successful in disrupting the consolidated Brazilian financial industry over the last decade, STNE and PAGS have different business models that are reflected in their aggregate financials.

STNE has been more aggressive in growing in different business lines such as software and financial services, whilst PAGS has focused more on financial services. This makes STNE potentially less cyclical, but raises more execution risks, which STNE has suffered over the last two years.

PAGS has steadily but consistently been becoming more profitable and taking market share as it tries to focus on recurring and more profitable customers. However, the financial industry is a cyclical one, and PAGS will therefore tend to be a volatile stock relative to the market, as most financial companies that take credit risk on their balance sheet are. Nevertheless it has shown itself to be a first rate player. Any business that can consistently increase profitability and take market share is a star business. STNE has started to regain its stride in recent quarters and achieved the same successful combination in Q3’22. We believe both can continue to take share and increase profitability as they compete primarily versus the incumbents that have for so long dominated the Brazilian financial landscape.

Be the first to comment