Lemon_tm

Thesis

PagerDuty (NYSE:NYSE:PD) dominates the on-call schedule management and alerting niche of the dev-ops space. PD’s software alerts IT professionals when they are needed to fix production issues. They serve more than 60% of fortune 100 companies. This market dominance mirrors the anecdotal experience I have as a developer, PD is synonymous with on-call alerting.

They’ve been able to parlay this niche dominance into consistent revenue growth north of 30%.

If we believe that PD can continue to dominate this niche and expand its use cases slightly the current price could be an interesting opportunity to open a position.

Growth

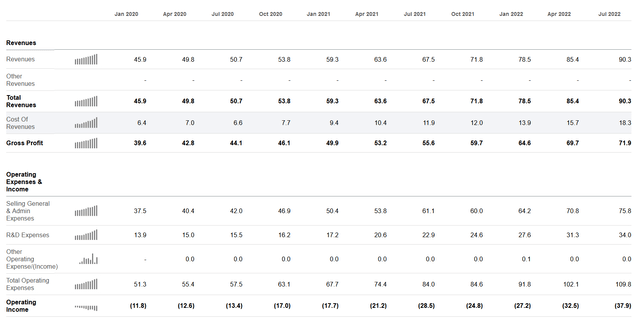

Over the past three years, PD has grown its revenue by increasing its revenue per customer and the number of customers served. However, increasing the spending of existing clients has been much more important. Over the past 3 years, PD grew its customers at a 13.2% CAGR while revenue per customer grew at a 30.8% CAGR.

PD charges on a per-seat basis. Customers pay for each IT professional that leverages the system. As the world becomes increasingly digital more professionals are employed designing, testing, and maintaining software systems. The number of software developers is expected to grow at a 25% CAGR. PD should continue to be a direct beneficiary of this trend. Given the expanding market opportunity and PD’s current leadership position, continued growth in the 20-30% range seems achievable.

I do worry that with many technology companies announcing hiring slowdowns, in the short term revenue growth may slow; since I believe that PD’s current market opportunity is largely tied to the number of IT professionals employed in the US.

Profitability

PD has never been profitable on a GAAP basis. In fact, they’ve been growing more unprofitable since going public.

However, I don’t think GAAP shows the true earning power of a growing SAAS company such as PD.

GAAP requires software companies to run their investments through their income statement. Imagine how a retailer vs a software company grows. The retailer will spend money to open new stores, under GAAP these are expenses are capitalized over the useful life of the store. On the other hand, the software company will hire developers to develop new products and salespeople to sell their existing products. Neither of these expenses is capitalized, implying that the company gets the entire benefit of the sale or development in the year in which it occurred.

This is obviously out of touch with reality in my opinion. For example, in PD’s case, their net revenue retention for a customer is well over 100%. This means that the relationships that a sales team establish actually get more valuable over time not less. Similarly, the improvements made by software developers often have no impact on the top or bottom line in the quarter in which they occur. But they will have a positive impact for much longer than one year in the future.

So what would the net income margin of PD be if it wasn’t currently investing for growth? This is a hard question to answer my guess is around 20%. This is based on looking at the 5Y averages of mature companies in similar areas. In PD’s case, I compared Oracle (ORCL) and VMware (VMW). Neither is a perfect comp for PD, but they both have similar gross profit margins and serve enterprise customers. Is this the real answer? Probably not but I believe it is directionally correct and conservative.

Does PD have a Moat?

When investing in a growing company where we are counting on continued long-term growth and high-profit margins some kind of competitive advantage is critical.

PD has a first-mover advantage in its niche. I believe this translates to their strongest argument for a competitive advantage, switching costs. PD provides a critical dependency for business. It is the critical alarm system for a web company’s business. It has to work. My hypothesis is that companies won’t want to change such a business-critical system unless there is a very compelling value proposition to switching.

I do worry about if this moat will stand up to competition from other developer operations players entering the space. In 2018, Atlassian (TEAM) acquired one of PD’s direct competitors Ops Genie. In order to try and cross-sell into the space. Similarly, GitLab (GTLB) specifically mentions on-call management on its roadmap for creating an all-in-one software IT delivery platform. You can see that they have begun to build out on-call schedule management in their latest release. It would be a compelling value prop if GTLB could provide a comparable feature set to PD as part of its platform.

Ultimately whether a business has a moat is not a binary decision but a subjective scale. My general position is that if the moat isn’t obvious to me it probably isn’t a strong moat.

Insiders have been willing sellers over the past year

There has been $34mm of insider selling in the past year. Including sales around current prices. This includes extensive selling by the CEO and CFO. Many tech founders have a large amount of their net worth wrapped up in the shares of their companies so it’s natural for them to want to sell. However, I do think that it singles that shares are likely not a bargain at current prices. I like to see top insiders at tech companies at least stop heavy selling before buying in.

Valuation

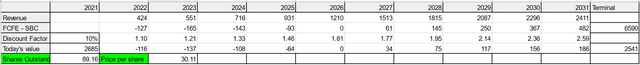

Given the company’s growth history and expanding market. I’m modeling revenue growth of 30% for the next 5 years, declining to a perpetual growth rate of 2.5%. As mentioned I believe that the company can achieve an operating margin of 20% in a steady state. I’ve modeled the operating margin beginning to improve in the third year, then gradually improving to my long-term target. I should also note that I’m using operating a margin as a proxy for my preferred proxy of owner earnings, free cash flow to equity less stock-based compensation.

PD Discounted Cashflow Analysis (Author’s work)

Another short-hand way to look at the valuation of a growth company is the PEG ratio. Using my assumed operating margin of 20% We have $65mm in earning power. Given I expect the company to grow earning power by 30% in the near future it is reasonable to pay a P/E of 30. Given the above assumptions, the fair value of the company is $1950mm or $21.87 per share.

Final thoughts

Overall, I believe PD is about fairly priced. Given the risk in projecting PD’s future cash flows, I would demand a large margin of safety before buying. However, if you believe PD has a real moat then the current price could be a reasonable entry point.

For now, I’ll leave PD on my watch list. Before buying I’d look for the following: a major sell-off, management to stop selling shares, or something that convinces me that PD has a true moat. As mentioned in the growth section I wouldn’t be surprised if there was a temporary slowdown in growth over the next 12 months which might provide a buying opportunity. I’m not sure what exactly would convince me that PD has a moat, but I hope I’ll know it if I see it.

Be the first to comment