Cristian Storto Fotografia/iStock via Getty Images

It has been a long time since our last update on LSB Industries (NYSE:NYSE:LXU). As a reminder, we were not particularly optimistic about the chemical company, however, our scenario analysis recap was based on:

- A continuous and supportive mismatch between prices over costs. LSB is delivering a positive pricing delta and profits have never been higher (half-year results just confirmed the trend).

- As a consequence of the Ukraine/Russia conflict, we were forecasting higher margins and a competitive advantage versus its European comps such as Yara International (sell rated) and BASF (buy rated).

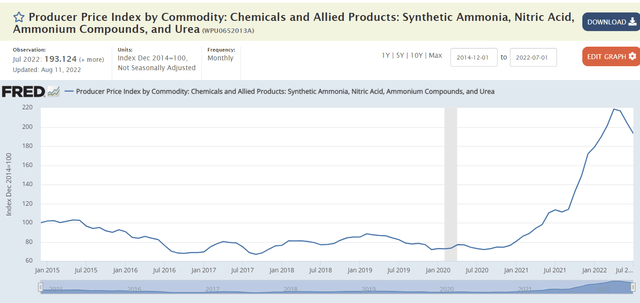

- Based on LSB’s geographical presence, the company is mainly located in the North American region and is less affected by the ongoing European energy crisis. However, as we already mentioned, commodities prices are at sky-high valuations and there is a strong correlation between LSB’s stock price development and chemical price index. Thanks to stats from FRED, LSB’s main products are starting to show some negative price dynamics, and this profit might not be sustained for long.

Chemicals and Allied Products Development (FRED)

It was a good call not to buy LSB at that time. But now, we should emphasize the following:

Looking at history, after a shortage in 2011/2012, many companies built new nitrogen-based fertilizer capacity. After that, supply/demand was imbalanced and prices substantially decreased, leading to the 10 years of poor performance that we were mentioning in our initiation of coverage. In the meantime, no major new plans were announced and supply/demand is back into balance. For non-chemical experts, in order to build additional capacity, many years are required. This is an ongoing supportive catalyst to enhance LSB’s profitability over the short-medium term horizon.

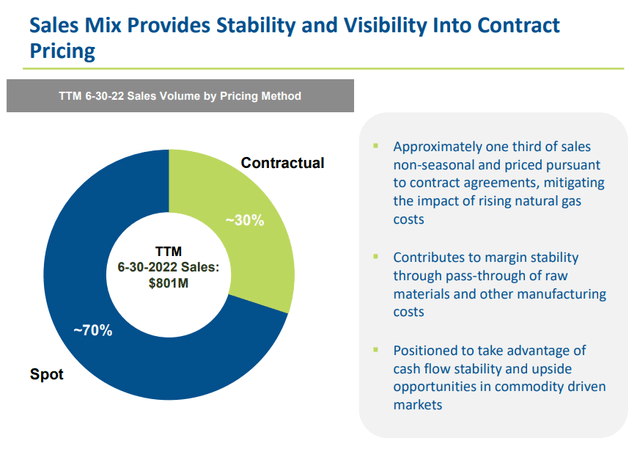

Despite lower volumes and thanks to almost 3/4 of LSB’s sale agreements at a SPOT price, the company is able to generate record cash flow.

Spot vs Fix Price (LSB Investor Presentation)

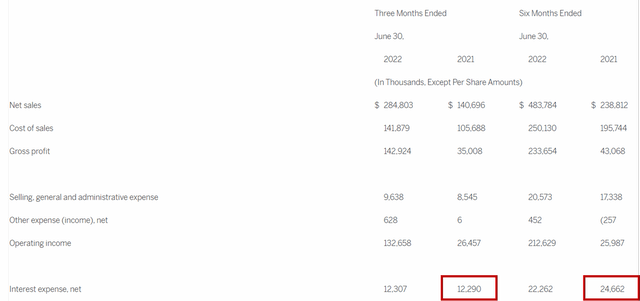

For the above reason, debt was further reduced, and interest expenses were cut by two compared to the first 2021 half-year results.

LSB Interest Expenses (LSB Industries Press Release)

Conclusion and Valuation

Before commenting on LSB’s valuation, we should report that a secondary offer was announced in August. This offer is non-dilutive and LSB management has decided to support this sale by communicating a buyback from the main shareholder. In 2015, LSB was in a crisis and was looking for new financial resources. An insurance company called Security Benefit intervened with a convertible preferred stock. In September 2021, the insurer converted all its shares and now, they decided to sell 13.5 million shares at a $13 price per share. In addition, we should mention that LSB’s outstanding shares will be reduced by 5.5 million and the company used cash-in-hand for the repurchase (LSB was also already repurchasing shares) – these are the Q2 details in the press release:

During Q2, LSB repurchased approximately $13 million of the Company’s stock at an average price of approximately $18 per share under the $50 million share repurchase plan authorized by our Board of Directors on May 16, 2022).

Going to the valuation, the company is trading at an EV/EBITDA (TTM) of 4.7x versus a double-digit number over the recent past. However, all the chemical companies within our coverage were massively derated. We are living in extraordinary times and LSB took full advantage of the ongoing challenges. Our internal team has decided to maintain a neutral rating, preferring other chemical players that underperformed the whole sector, in primis Dow and BASF.

Be the first to comment