Black_Kira

An Intro To Pagaya Technologies

We wrote about Pagaya Technologies Ltd. (NASDAQ:PGY) back in July of this year when we stated that the company remained a risky short despite its lofty valuation at the time. Shares were priced just under $10 at the time and had experienced wild swings both to the upside and downside in what seemed to be short squeezes in the stock. The latest collapse in the share price happened on Tuesday the 20th of September when the stock fell almost 70%. The reason this time seems to stem from a lockup expiration due to the company going public in June of this year in a merger with a SPAC (Special Purpose Acquisition Company). A further restriction is scheduled in December so it will be interesting to see how Pagaya shares trade on that date.

Suffice it to say, bullish investors who liked Pagaya previously must be licking their lips now with shares trading at approximately $2.50 a share. Revenue growth is the principal calling card here for the bulls as well as the fact that the company is definitely operating in a growth industry. Management has made it clear that it wants to be the A1 frontrunner in the banking space so it will be interesting to see if Pagaya can deliver on its potential.

In fact, given the company’s current trajectory, management’s medium-term ambition is $25 billion in annual network volume coupled with a 20% adjusted EBITDA margin. Suffice it to say, if the company gets anywhere near these numbers, the share price is an absolute steal at its current price. Since though, we like the charts to “lead” our investments, here are some areas in which Pagaya still has to prove itself for us to take a long position at this juncture.

Right Environment

As noted in the previous commentary, Pagaya is basically the middle man between its investors (who provide funding) and its partners who receive loan applications from their customers (car dealerships, banks, etc). Through the use of its proprietary AI technology, Pagaya believes it can reach far more borrowers, reduce delinquency rates, and basically enable every party (minus the borrower) to make money. Therefore, this model is entirely based on having that investment capital on hand to ensure successful loan applications can be met. Here are some potential roadblocks however.

In a low-interest rate environment, the search for yield becomes paramount which invariably increases the number of active investors available to Pagaya. However, as interest rates continue to rise, many risk-free investments pay out higher premiums. Not only could this result in more difficulty in raising capital but also keep borrowers from attaining credit due to lack of affordability. The CFO alluded to the above in the recent second-quarter earnings call. Suffice it to say, that $25 billion in network volume will be very difficult to achieve if central banks remain very early in their tightening cycles.

Growth & Market Reaction

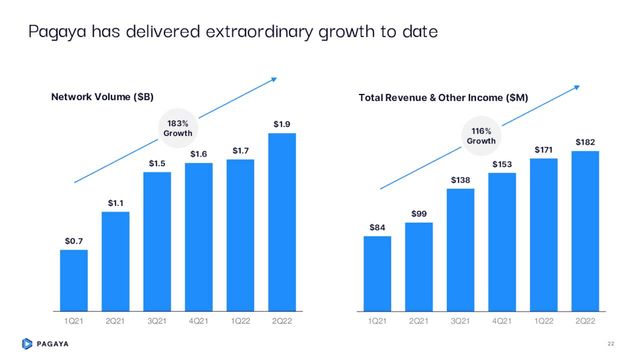

If we take a look at the chart below from the company’s recent Q2 earnings report, we see that network volume, as well as revenue growth, have grown by 183% & 116% respectively over the past six quarters. However, when we zone into the past four quarters, we see that the corresponding growth rates come to 26% & 31% respectively. This is important (slowing growth rates) when trying to stamp a valuation on this growth company. Although, as mentioned, the principal calling card for growth investors in Pagaya is its top-line growth, we need to couple those growth rates with what shares are currently priced at.

For example, management has made it clear that partnering up with US banks is the next significant opportunity for the company. This initiative will obviously need sustained investment where costs will increase over the near term. Although these investments may bear fruit with respect to top-line growth, the market ultimately will want to see a clear line of sight to bottom-line profitability. In Q2, adjusted net profit came in at $3.4 million but the actual GAAP number was negative due to a sizable share-based compensation number. However, even if we take the above-adjusted net profit number and average it out over a 12-month period, Pagaya’s trailing earnings multiple would come in at approximately 92. Suffice it to say, with this valuation, we would be looking for more top-line growth here which means the estimated $700+ million top-line estimate this year is an absolute minimum. (50% annual growth rate)

Pagaya Network Volume & Revenue Growth (Earnings Presentation)

Conclusion

The recent collapse in Pagaya’s share price definitely brings opportunity for the risk-minded investor. Although near-term growth rates have been stalling, management still believes it can report over $710 million in total revenues in this fiscal year. Let’s see if the market begins to bite at these prices once more. We look forward to continued coverage.

Be the first to comment