suefeldberg/iStock via Getty Images

Author’s note: This article was released to CEF/ETF Income Laboratory members on October 14th.

Small-cap value stocks offer investors incredibly cheap valuations and strong potential returns, albeit at an elevated level of risk. There are several small-cap value funds out there, but the Pacer US Small Cap Cash Cows 100 ETF (BATS:CALF) is a particularly strong, effective choice.

CALF invests in small-cap U.S. equities with strong free cash-flow yields. Cash calves, basically. Focusing on cash-flows over other valuation metrics seems like a sensible decision: earnings can be massaged, accounting book value disregards intangibles, but cash-flows are cash-flows, and almost always indicative of fundamental strength or weakness. CALF’s cash-flow focus could potentially lead to strong, market-beating returns moving forward. This has mostly not been the case in the past, although the fund has outperformed relative to small-cap value benchmarks.

CALF’s cheap valuation and strong performance track-record, make the fund a buy.

As a final point, CALF’s small-cap holdings are riskier than average, a dealbreaker for some more conservative investors. For these, the US Cash Cows 100 ETF (COWZ), a similar value fund focusing on U.S. large-caps, might be a more appropriate choice. I last covered COWZ here.

CALF – Basics

- Investment Manager: Pacer ETFs

- Underlying Index: Pacer US Small Cap Cash Cows Index

- Expense Ratio: 0.60%

- Dividend Yield: 1.11%

- Total Returns CAGR 5Y: 6.54%

CALF – Overview

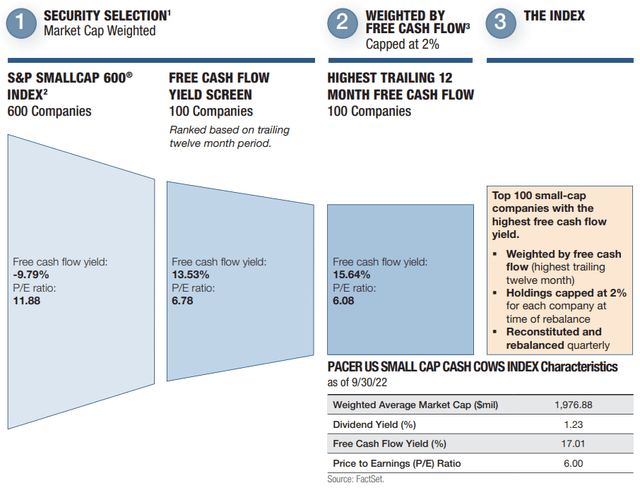

CALF is an equity index ETF, tracking the Pacer US Small Cap Cash Cows Index. It is a bespoke index, specifically designed by PACER for the fund. It is also a relatively simple index, following a 3-step process to build its portfolio. Said process is as follows.

Although the above seems pretty self-explanatory, I thought a quick explanation might be of use. CALF first selects the largest 1500 U.S. equities meeting a basic set of inclusion criteria, centered on liquidity, trading, size, etc. It then selects the 600 smallest of these. From this reduced group, it then selects the 100 companies with the highest 12 month FCF yields. It then weights by free cash-flow yield, up to a 2.0% cap.

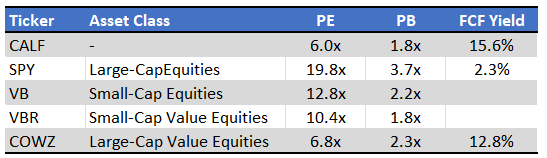

CALF’s underlying index is quite simple, yet potent, with the fund constructing an incredibly cheap portfolio, with very strong cash-flows. As per the above, CALF’s underlying holdings sport a PE ratio of 6.1x, and a FCF yield of 15.7%. Both are very strong figures on an absolute basis, and quite a bit better than the S&P 500, with a PE ratio of 19.8x, and a FCF yield of only 2.3%.

On a more negative note, CALF’s dividend yield is quite low, at 1.1%, excluding a special distribution in late 2021. Such a low yield makes the fund an ineffective income vehicle.

CALF has some diversification, with investments in 100 different securities, and sizable exposure to most industry segments. Segments are as follows.

As with most value funds, CALF is overweight old-economy industries like consumer discretionary and industrials, due to their competitive valuations. CALF’s 14.0% tech allocation is lower than average for a U.S. equity fund, but higher than average for a U.S. value equity fund. As an example, the Vanguard Small-Cap Value ETF (VBR), the segment benchmark, has a smaller 5.8% tech position. In my opinion, the fact that CALF’s tech allocation is higher than that of its peers is a positive, as the resultant industry exposures are more balanced, and more aligned with those of the broader equities market. Tech has an important role to play in almost any investor’s portfolio, but tech is significantly underweight in most value funds, making it difficult for most value investors to have sufficient exposure to said industry in their portfolios. CALF mostly avoids these issues, a benefit for the fund and its shareholders.

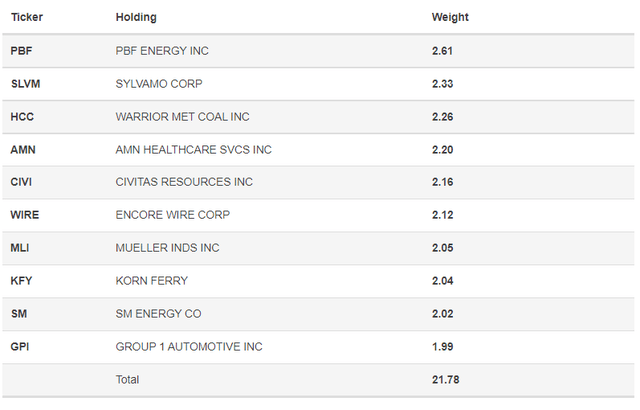

CALF’s concentration is somewhat below average, with the fund’s top ten holdings accounting for 21% of its portfolio. Energy stocks are overrepresented in the fund’s top holdings, as the fund is cash-flow weighted, and some small-cap energy companies are generating tons of cash.

Although CALF has some diversification, it focuses on an incredibly niche equity subsegment: small-cap value. Small-caps comprise roughly 15% of U.S. equity market-cap value. Small-cap value stocks are a small, unrepresentative sample of this 15%. CALF does not provide investors with broad, diversified exposure to U.S. equity markets, which somewhat increases risk, and significantly increases the possibility of significant over or underperformance. CALF’s performance could materially differ from the performance of broader U.S. equity indexes, including the S&P 500, as the fund is simply not representative of U.S. equity markets. From what I’ve seen, CALF does broadly track U.S. equity indexes, but the possibility of a divergence still exists.

Besides the above, not much else stands out about CALF or its holdings.

CALF – Investment Thesis

CALF’s investment thesis is quite simple, and rests on the fund’s cheap valuation and industry beating returns. Let’s have a closer look at each of these three points.

Cheap Valuation

CALF focuses on the small-caps with the highest free cash-flow yields, a standard valuation metric. Focusing on these stocks leads to a fund with a relatively cheap, competitive valuation relative to both broader U.S. equity indexes and small-cap value indexes.

CALF

CALF’s cheap valuation could lead to significant gains, for two reasons.

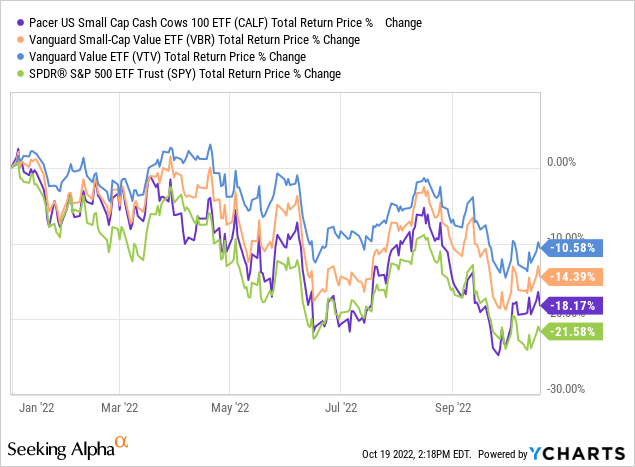

First, valuations can always normalize, straightforwardly leading to significant capital gains. Valuations are dependent on investor sentiment and economic fundamentals, so gains could materialize if any of these improve. Sentiment has improved these past few months, with most value funds and stocks moderately outperforming. Small-cap value funds and stocks have generally outperformed as well, but by quite a bit less. CALF itself has only slightly outperformed relative to the S&P 500 YTD, for example.

In any case, once sentiment improves CALF could, potentially, see strong capital gains, benefitting investors.

The second reason cheap valuations could lead to significant gains is, simply, the fact that investors are entitled to the earnings and cash-flows generated by their equity investments, and these are quite hefty in CALF’s case. CALF’s underlying holdings generate 15.6% in FCF per year, significantly higher than the 2.3% equity average. CALF’s investors are ultimately entitled to these cash-flows regardless of what market participants think or do. CALF’s underlying holdings could always choose to distribute said cash to shareholders, leading to 15.6% in total shareholder returns, plus or minus growth, and capital gains / losses from changes in valuations. These are very hefty potential returns, and are not dependent on fickle market sentiment, but on fundamentals.

Cash-flows also serve to put a floor on a company’s valuation. Companies with significant cash-flows can always choose to increase their dividends or share buybacks plans, and investors know that, so share prices rarely go down too much. Losses remain possible, off course.

CALF’s cheap valuation could lead to strong, market-beating returns moving forward, a significant benefit for the fund and its shareholders.

Industry Beating Returns

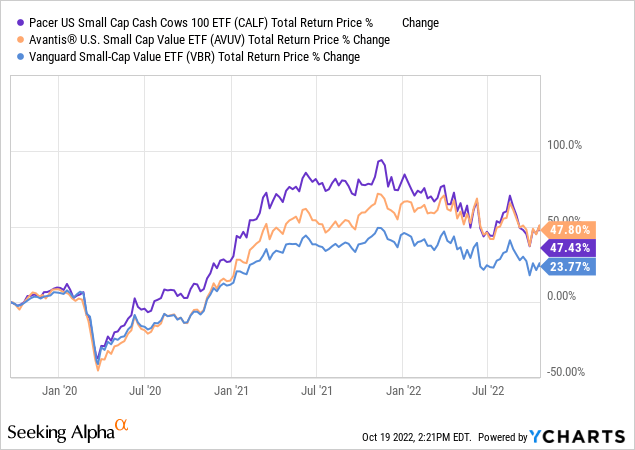

CALF focuses on small-cap value stocks. Although this is a relatively small market niche, there are several funds focusing on the same. These include the Vanguard Small-Cap Value ETF and the Avantis U.S. Small Cap Value ETF (AVUV). Although these three funds are all, in my opinion, buys, CALF’s performance track-record is a bit stronger, and longer, than those of its peers.

CALF itself has significantly outperformed relative to its benchmark, VBR, since inception. On the other hand, CALF has matched AVUV’s performance, so far at least.

In my opinion, CALF’s outperformance is due to the strength and effectiveness of its investment strategy and index. Focusing on stocks with particularly strong FCF yield is theoretically sound, should logically lead to long-term outperformance, and has led to outperformance in the past. Further outperformance is likely, in my opinion at least.

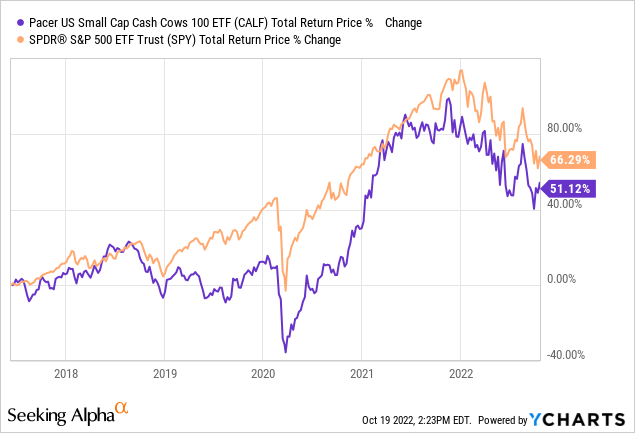

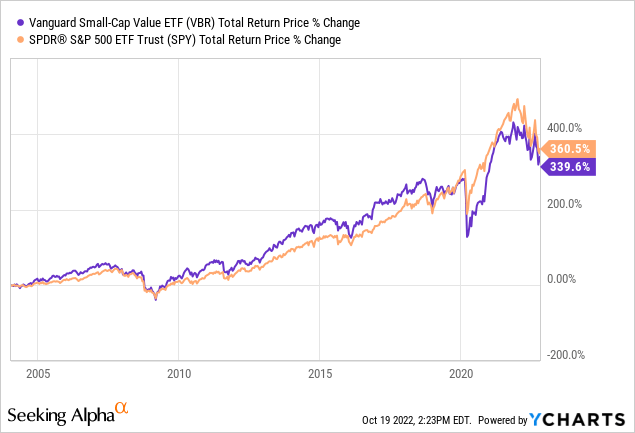

On a more negative note, CALF has moderately underperformed relative to broader equity indexes, including the S&P 500, since inception.

CALF’s underperformance was almost entirely due to bad timing: small-cap value has underperformed these past few years, since the fund’s inception. Importantly, I don’t believe that further underperformance is all that likely, at least not long-term. Small-cap value indexes have matched, sometimes outperformed, broader equity indexes in the very long-term, think decades or more. VBR, the segment benchmark, has effectively the same performance as the S&P 500 since inception, close to two decades ago.

CALF has outperformed relative to VBR, so, considering the above, it seems likely that the fund would have outperformed relative to the S&P 500 if the fund were a bit older. CALF is a relatively young fund, and has only existed during a period of small-cap value underperformance, so its realized performance is somewhat worse than one would expect moving forward, in my opinion at least.

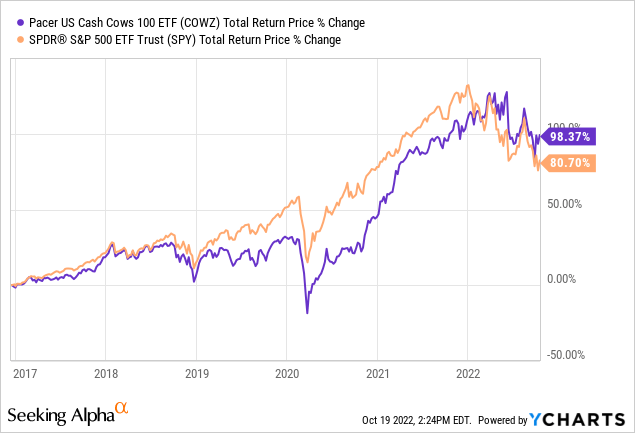

Importantly, CALF’s sister fund, COWZ, does not focus on an underperforming equity market segment, and has outperformed relative to the S&P 500 since inception.

COWZ follows a similar investment strategy to CALF, but focusing on large-cap stocks. The fact that COWZ has outperformed relative to broader large-cap equity indexes is evidence that the strategy works. CALF has only underperformed due to focusing on an underperforming equity market segment, not due to issues with its strategy or index, or at least the evidence points that way.

COWZ has outperformed relative to its benchmark since inception, clear evidence of a strong, effective investment strategy. In my opinion, CALF is likely to outperform relative to its benchmark, small-cap value stocks, moving forward as well. Outperformance relative to broader equity indexes moving forward is less clear, but I’m bullish, on valuation grounds.

As an aside, for investors interested in stocks with strong FCF yields, but put off by CALF’s small-cap focus and performance track-record, COWZ might warrant a second look.

Conclusion

CALF’s cheap valuation and strong performance track-record make the fund a buy. I last covered COWZ here.

Be the first to comment