Justin Sullivan

Thesis

Advanced Micro Devices, Inc. (NASDAQ:AMD) is not one of the widest-moat semiconductor companies available, and there’s little room for more of the multiple expansion that drove a large part of the stock’s returns over the past decade. Nevertheless, AMD remains in an improving competitive position with strong secular tailwinds at its back and will likely be a market-beating investment from the current valuation. That doesn’t change even after a wide miss on Q3 earnings expectations.

Author’s Note: Investors who are unfamiliar with the semiconductor industry and AMD’s position in it can read my semiconductor deep dive for more information.

Q3 Earnings Pre-Announcement

On October 6th, it was reported that AMD will miss its Q3 estimates by a wide margin of about 17%, largely due to weak PC demand. Client (PC) revenue was down 53% since last year, but AMD’s other segments (data center, gaming, and embedded) were still up year-over-year. That includes strong 45% year-over-year growth in data center, which passed client revenue this quarter to become AMD’s largest segment.

Given the weak near-term outlook and the panic that investors might be feeling as a result, it’s worth stepping back to consider a longer-term thesis. In this article, I’ll look at where AMD could be in five years and whether investors should expect strong returns going forward.

Is AMD Expected To Continue Growing?

As most readers probably already know, AMD has done extremely well over the last decade because investors underestimated its ability to compete in logic semiconductor design with its chief rival Intel (INTC). They also underestimated the growth of emerging applications for semiconductors like the data center.

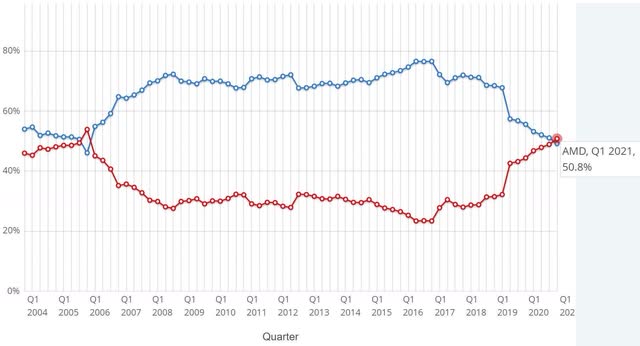

Unlike Intel, AMD is fabless, meaning that it outsources manufacturing to Taiwan Semiconductor Manufacturing Company Limited (TSM) (“TSMC”). Because TSMC is able to manufacture more advanced (smaller) nodes than Intel, AMD was able to work with TSMC to leapfrog Intel in many capabilities. Market share gains against Intel have allowed AMD to become a leader in logic chip design for PCs, and also in higher growth use cases like the data center.

Earlier this year, AMD passed Intel in market share of desktop CPUs and has gained market share rapidly since 2016. Going forward, AMD will likely continue to gain some share in PCs, but now that it has over 50% share there’s less room for rapid growth in this mature market.

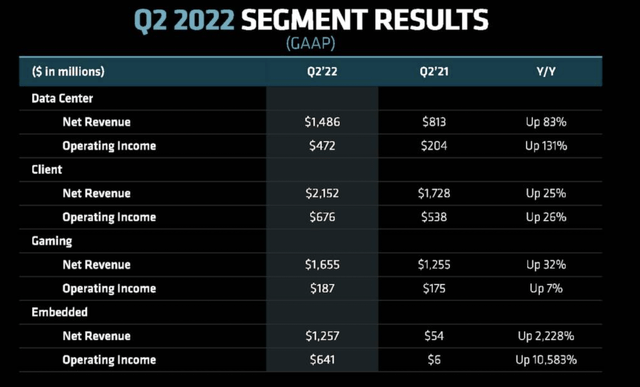

The big growth story going forward is now the data center segment. Even in Q2 (which had stronger client segment growth), data center was growing over twice as fast as the client/gaming segments (the embedded segment growth is currently boosted by an acquisition but will likely grow slower than data center going forward):

Adjusting for AMD’s recently announced Q3 results, data center is now the largest segment in addition to being the fastest growing. Data center becoming the largest segment could actually set AMD up for faster growth in the future, as the data center chip market is expected to continue growing rapidly, at a 9.4% CAGR through 2025. On the other hand, the client segment is expected to struggle in the short term and grow more slowly over the next five years because the PC market is mature.

According to Seeking Alpha, analysts expect AMD to grow revenue at a 10.76% CAGR through 2025, which presumably will be driven in large part by success in the data center. In my opinion, this estimate is likely too conservative relative to the 30% revenue CAGR that AMD achieved over the last five years. Although AMD is growing off of a larger revenue base in a potentially weaker economy, I still believe that growth between 15% and 19% is achievable over the next five years. Assuming that growth lands somewhere in the 11-19% range, AMD is still positioned for respectable growth going forward, even as client revenue has fallen off a cliff.

AMD Stock Key Metrics

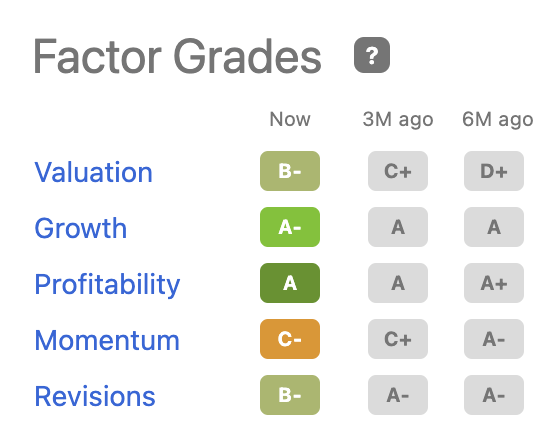

Seeking Alpha

With respect to Seeking Alpha’s factor grades, AMD actually does very well, especially considering that hardly any stocks have good momentum during this market crash.

AMD currently has a P/E of 27. If AMD manages to grow revenue at an 11% CAGR, then its EPS CAGR may be closer to 15%, especially if the company continues to beat analyst estimates as it often has in the past. If the revenue CAGR nears 20%, then the bottom line could grow at a much faster 25-30%. That puts AMD’s PEG somewhere between 1 and 2, which is the range that I would consider fairly valued for a mature but high quality company.

Using past and future 5 year EPS CAGR from Finviz, here’s a comparison of AMD’s valuation and growth expectations relative to peers:

| Ticker | P/E | CAGR Last 5 Yrs | CAGR Next 5 Yrs | PEG |

| AMD | 29 | 45% | 26% | 1.1 |

| NVDA | 43 | 43% | 23% | 1.9 |

| TSM | 16 | 12% | 24% | 0.7 |

| ASML | 34 | 31% | 30% | 1.1 |

| MU | 6 | 84% | -4% | – |

| KLAC | 15 | 30% | 11% | 1.4 |

Source: The Author (EPS CAGR forecast from Finviz)

Aside from Nvidia, the semiconductor industry appears fairly valued relative to its estimated growth, with PEG ratios between 0.7 and 1.4. AMD is right in the middle of the pack at 1.1. Thus, investors are primarily choosing between these companies based on their qualitative market position, as quantitatively they all look quite similar.

Where Will AMD Stock Be In 5 Years?

While the semiconductor industry (SOXX) has crushed the market over the last 10 years with a return of 593%, AMD and its peer Nvidia (NVDA) are in a league of their own, with 10 year returns of 2378% and 4067%, respectively. However, investors shouldn’t expect this level of returns over the next five years.

Over the last 10 years, AMD’s P/S ratio expanded from 0.3 to 4.34. That 14x multiple expansion accounts for over half of AMD’s total return during the past decade. Ten years ago, AMD was not consistently profitable and thus had a rock bottom multiple. Today, AMD boasts industry-leading ROI and will remain consistently profitable for the foreseeable future. That makes it more of a blue chip than a high risk/high reward investment. While there is perhaps some room for further operating margin improvement and further P/S multiple expansion that would likely accompany it, there’s simply no way that AMD’s P/S or P/E multiple will 14x again in the next decade.

That said, AMD could still produce respectable and market-beating returns of a more modest form. If we assume that AMD grows revenue at 15% over the next five years with a 2% buyback yield, and assume that profit margins expand from 15% to 22% with a terminal P/E of 20, my valuation model estimates a market cap of $237B in 5 years, implying 14% annualized returns.

Here are a couple other possible scenarios based on my model:

| In 5 Yrs | Bear | Avg | Bull |

| Estimated Annualized Return | -19% | 14% | 43% |

| P/E | 10 | 20 | 30 |

| Profit Margin | 15% | 22% | 30% |

| Revenue CAGR | 3% | 15% | 25% |

| Buyback Yield | 0% | 2% | 3% |

Source: The Author

Based on these estimates, we can see that there’s a wide range of possibilities for AMD stock. In the worst case, perhaps due to an extremely poor macro environment impacting the cyclical semiconductor industry and/or unexpected success from AMD’s competition, AMD fails to generate much growth and has a very negative return due to multiple contraction. In the best case, AMD extends the massive growth it experienced over the past decade for another five years and crushes the market. In my view, neither of these outcomes is particularly likely compared to the average case, which I discussed above.

Final Thoughts

In the short term, AMD stock may continue to see downward pressure as a result of its recent Q3 earnings miss. It’s likely that some analysts will lower their future growth expectations for AMD and thus downgrade their rating on AMD stock, potentially causing more selling. Of course, the short term is very unpredictable.

Regardless of what happens in the short term, AMD should get back on track alongside the rest of the economy in the next couple years, and it will probably beat the market over the next five years if that happens.

Considering that most of the industry is valued similarly, I recommend other semiconductor stocks instead of AMD to members of my private investing community Tech Investing Edge. This is mostly because I believe that other options have wider moats and more predictable revenue streams. However, there are valid reasons to pick AMD, such as:

- The data center segment that accounts for most of AMD’s revenue may have more growth potential than other parts of the industry

- AMD currently has lower profit margins than other peers of similar quality, and thus may have more room for margin expansion

- AMD was one of the industry’s biggest winners in the past, and winners tend to keep winning.

For investors who want to own AMD, now may be a good time to dollar-coast average (“DCA”) by buying a few more shares.

Be the first to comment