ebrink/E+ via Getty Images

Thesis

Owens Corning (NYSE:OC) is a strong buy for five primary reasons:

-

Porter’s 5 forces show they are competitive and do not pose any serious supply chain or market threats. This includes a diverse product line that crosses many different applications and industries.

-

Their capital allocation is perfect with increasing dividends, share buybacks, and CapEx investments with high returns.

- They have strong and consistent financial growth over the last ten years, are peer leaders in PEG and RoC, and continue to beat earning expectations.

- An average fair value of $95 per share was calculated by a 10-year Unlevered DCF analysis using CAPM and WACC with extremely conservative assumptions. Mildly optimistic assumptions show value of $152. Combined with dividends and share buybacks, this stock is easily on sale for 50% off.

-

They have some mild risks in supply and customer base, and growth, but they are tackling this through global onboarding and business acquisitions.

Product Line

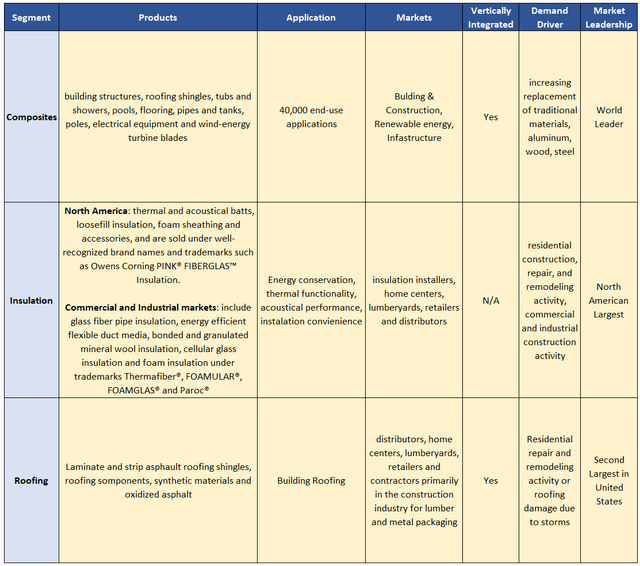

Owens Corning is a medium-cap, global building and construction materials leader and manufacturer in the Industrials sector. Founded in 1938 and based in Toledo Ohio, OC employs approximately 20,000 employees in 33 different countries and recorded $8.5b in net sales in 2021. Their product line revenue breakdown consists of three primary segments: 27% Composites, 36% Insulations and 37% Roofing in 2021. OC end users and customers reside primarily within three markets: building and construction, renewable energy and infrastructure. The following chart outlines key factors for each product segment:

Product Segment Breakdown (Author)

Composites

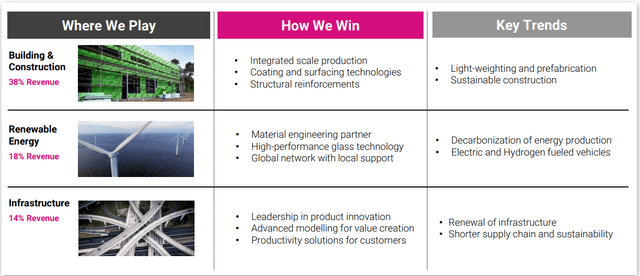

The composites segment of OC is a key player for entrance in higher growth opportunities such as renewable energy and other sustainable solutions. A snippet from the 2021 investor day presentation shows the product breakdown and key trends associated. It is important to note that they are a world leader in the industry. With 27% of revenue coming from a world leading, high growth potential industry, means OC is far from done growing their business. Substantiality is extremely important to OC as well and should prove to be a key element moving forward.

Composites – 2021 Investor Day (Owens Corning)

Insulation

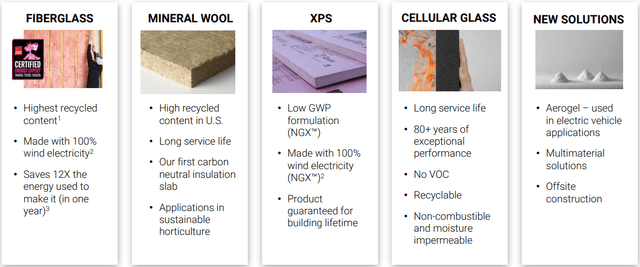

36% of revenue comes from OC’s bread and butter, insulation. This is where the iconic trademarked PINK fiberglass and other products are located. Being a North American leader means the majority of your residential, commercial, and industrial buildings will contain OC insulation solutions. Apart from sustainability, another common theme for OC is continual research efforts into new products. Fiberglass may be their expertise, but they do not shy away from successfully providing newer solutions such as Aerogel.

Insulation Product Breakdown (Owens Corning)

Roofing

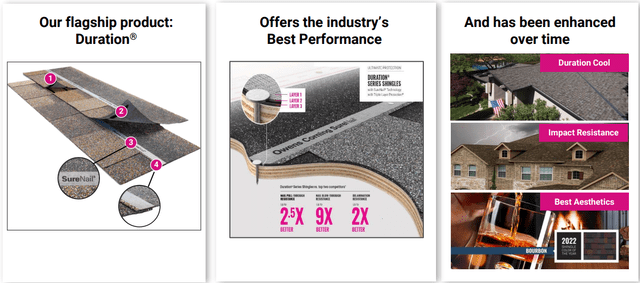

The last 37% of revenue is through roofing solutions. This segment is a little bit more competitive for OC with them being the second largest in the US. They do apply same focus here with sustainable and product differentiation through research and design. They are a company that also heavily relies on their intellectual property through patents such as their SureNail and Duration roofing products.

Roofing – 2021 Investor Day (Owens Corning)

Industry Outlook

OC has done a fantastic job diversifying itself through many different industries that will see continuous growth over a lifetime. Building & Construction, Renewable energy and infrastructure may not see as much hype as something like tech, semiconductors, or EVs, but the industries OC associates itself are here to stay. While it may make sense to take a look at future growth of these industries, I personally feel like there is a general assumption that these industries will be in constant demand with seasonal trends. To me, a better approach would be to see how OC fares in these industries and look at future risks that may knock them out of competition. For this, we can look at a qualitive approach in Porter’s 5 forces. We also can look at margins at competitors and other key financial indicators.

Porter’s 5 Forces

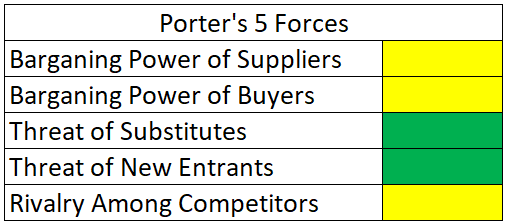

Porter’s 5 Forces (Author)

As mentioned, Porter’s 5 forces allows us to take a qualitative approach on identifying competition risk. The color key for each category signifies potential threats. Green signifies there is no immediate threat with yellow indicating caution or room for improvement. A red indication was not given for OC, but this generally signifies immediate threat.

Bargaining Power of Suppliers

OC receives a yellow indicator for their “Bargaining Power of Suppliers” force. For the concerning topics, OC is heavily reliant on certain commodities and other goods such as asphalt, chemicals, and resins that have limited number of suppliers. In fact, OC stated in their 10-k, they have some materials that are supplied by a single source. This raises concern if the single sourced supplier has a traumatic issue, cutting off OC of their only material source. Although, with OC being so internally diversified, a single supplier issue should never bankrupt the company, but I would like to see OC to multisource every single material to reduce this risk. 100% multisource materials would motivate me enough to upgrade this indicator to a green.

For the highlights, OC has close ties and incorporates a Supplier Finance Program, allowing suppliers to receive their money at a faster rate. I would imagine suppliers enjoy this benefit with OC, meaning they’d be more likely to enjoy business with them.

Bargaining Power of Buyers

A yellow indicator is given to the “Bargaining Power of Buyers”. Customer commitments are short term for OC, leading to an insignificant manufacturing backlog, which means they do not benefit from visibility of orders. This can produce a couple of problems like the inability to quickly adjust costs in response to a decline in sales. The nature of their industry and products essentially makes planning for the future tough. Furthermore, insulation and roofing are dependent on a limited number of customers who account for a significant portion of sales. In 2021, one customer represented 11% of annual sales with other customers representing smaller portions. This is a little concerning and like their suppliers, I would like to see OC diversify their customer base more before upgrading this to a green.

Another note is OC’s risk in sales through various geographic markets. However, they are doing a good job addressing this. For example, on July 13, 2021, OC acquired vliepa GmbH, who specialize in the coating, printing, and finishing of nonwovens, paper and materials in Europe. This broadens the company’s global nonwovens portfolio to better serve European customers.

Threat of Substitutes

I have the “Threat of Substitutes” as a green indicator. As mentioned, sustainability and continuous product research is what separates OC from its competitors. With continuous new product launches and R&D expenses, OC respects the threat of innovation and matches it. I believe OC is doing a fantastic job in this regard.

Product Growth (Owens Corning)

Threat of New Entrants

I have OC rated a green in this category. For the positives, they have several patents and the ability to sell in bulk due to economies of scale. With them being industry leaders in their product lines, newer companies will have a hard time competing. There is a risk of low switching costs however. OC is aware that global competitors may have the ability to create similar products at a lower price. Although, I will question the quality of these products as well. I am not too worried about threats of new companies to OC. Something revolutionary would have to come along, and if it does, OC seems smart enough to jump on it themselves.

Rivalry Among Competitors

The Risk Factors section in OC’s 10-k lists potential threats to competitors. Some of their competitors have superior financial, technical, and marketing resources versus OC. Since they are a global company, they do face competition from manufactures producing similar products at lower costs. Furthermore, as mentioned, OC is heavily reliant on intellectual property including, trademarks and trade secrets. Usually a good thing, but this can still be concerning as former employees can improperly disclose this information to current contractors, and suppliers. Nothing seems to jump out as a major red flag but to dive deeper on OC’s performance among competitors, Seeking Alpha’s profitability and Growth ratings prove to be useful.

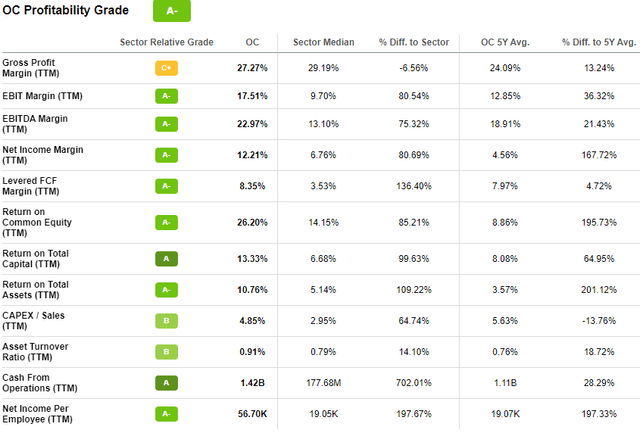

Profitability Grade (Seeking Alpha)

OC Profitability report card is pretty much perfect. I guess their gross profit margin is slightly lower than competitors, but they are winners in pretty much every category. It’s clear they are very good at investing capital by looking at their returns, and they are cash flow machine.

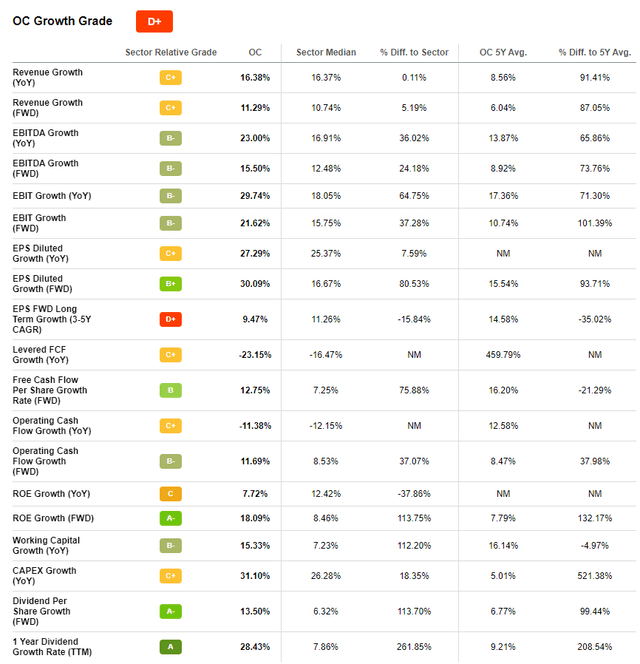

Their growth compared to the competition seems middle to the pack however.

Though they seem lackluster in revenue growth, they are still good at growing their dividend and returning to shareholders. They also excel with earnings and generating cash flow. I’d prefer to see these metrics perform well over revenue, so I am not completely turned away here.

Overall, there are good nuggets here but there is room for improvement regarding growth. For this, I have “Rivalry Among Competitors” force a yellow.

Capital Allocation Strategy

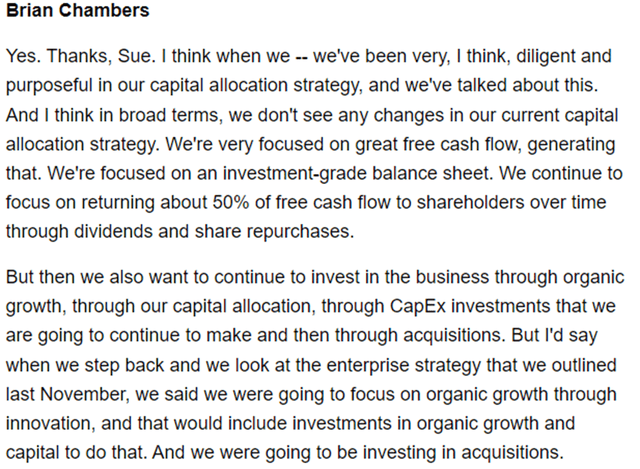

After diving into the product lines and competition in industry, OC definitely has some good going for it. But what makes OC especially attractive is their capital allocation strategy. Outlined in Brian Chambers comments in the Q2 2022 earnings transcripts, OC plans on continuing to allocate capital through the following avenues: Returning 50% of cash flow through dividends and share buybacks and further allocation in CapEx projects and acquiring more businesses.

Q2 Earnings Transcript (Seeking Alpha)

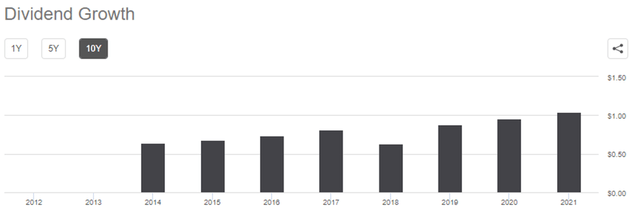

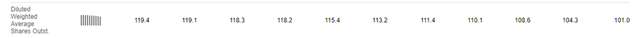

Regarding dividends, OC has done a fantastic job of increasing theirs over the past 10 years and plans to continue this trend. Their share buybacks have been very consistent as well. OC realizes their current stock price is undervalued which means they will owe less to the investor over time. This also helps to reverse dilution. These strategies greatly reward the long-term investor.

Dividend Growth (Seeking Alpha)

Shares Outstanding (Seeking Alpha)

Concerns about business growth can occur when an established company is buying back shares and paying dividends. Since this is essentially cash outlaid to reward the investor, there is less cash going into business growth. But we can see OC is still focused on expanding their business and product lines to maintain market share from the transcript and investors relation slides.

For an example, they recently acquired Natural Polymers, a manufacturer of spray polyurethane foam insulation for building and construction applications. They’ve also acquired Pultron and WearDeck composites. They do very well with their investments too as they are industry leaders in Return on capital by looking at their profitability grades. I expect this trend to continue as they acquire these new businesses.

Financials

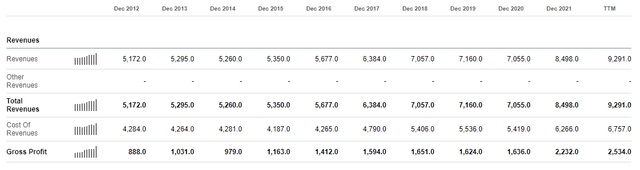

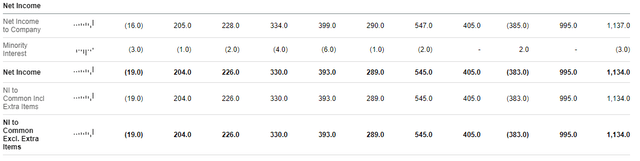

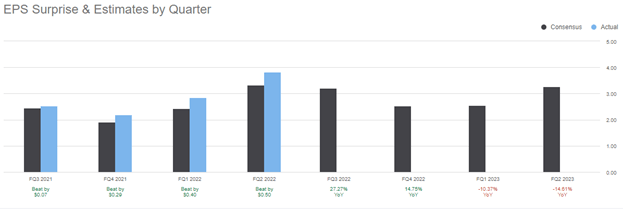

Another attractive portion of OC is their financials. Looking at the income statement, revenue has doubled and gross profit has tripled over the last ten years. Additionally, their net income has 5X over the last ten years. They also continually beat earnings estimates over the last four quarters, indicating analysts might not be giving OC its due justice.

Income Statement (Seeking Alpha) Income Statement (Seeking Alpha) Earnings Surprises (Seeking Alpha)

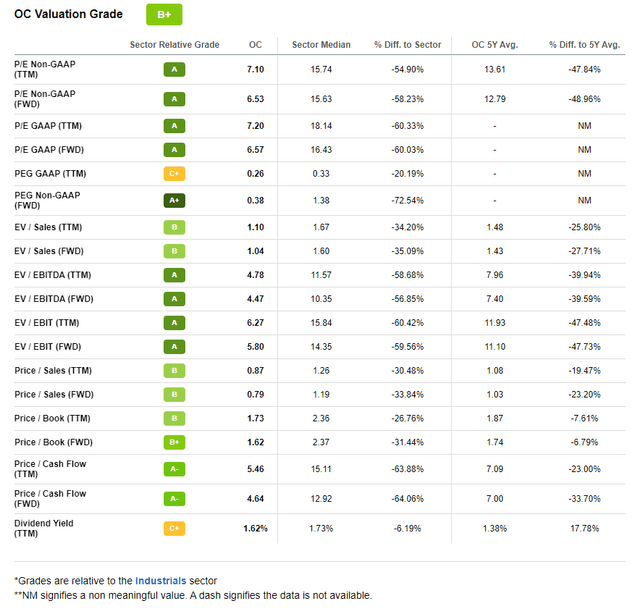

OC looks incredibly undervalued when compared to peers and the overall industrial sector as well. They lead the industry in PEG FWD and are competitive on all fronts. They are a little low in the dividend yield, but I don’t necessarily think this is a bad thing. As mentioned before, OC is taking some dividends and investing in growth and acquisitions, which means growth for the investor as well.

Valuation

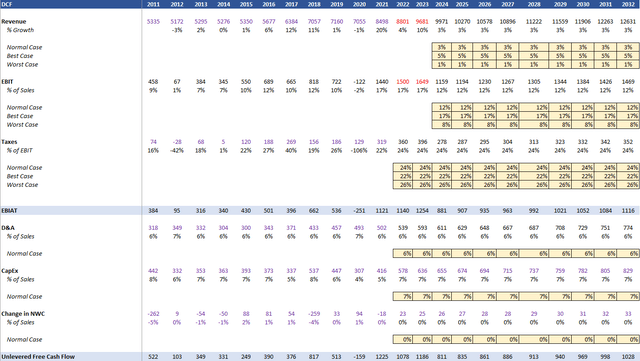

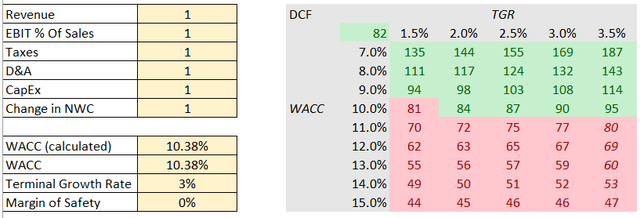

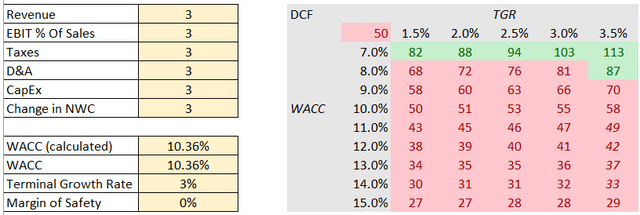

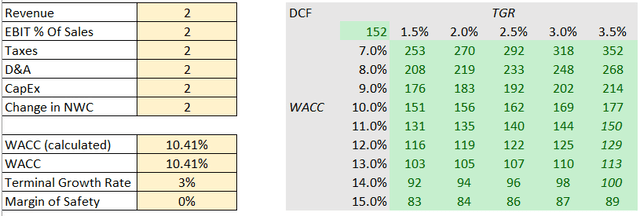

There is a lot of good going for OC. At first glance of their Valuation Grade report, one might assume they are also undervalued as a company. To dig deeper, a fair value of $95 per share was calculated by a 10-year Unlevered DCF analysis using CAPM and averaging a worst case, best case, and normal case scenarios. Revenue and EBIT projections were used from average results of (20) analysts for 2022 and 2023 from Financial Modeling Prep. Personal projections were used thereafter with the following conservative assumptions:

Revenue

- Normal Case Scenario: 3% YOY

- Best Case Scenario: 5% YOY

- Worst Case Scenario: 1% YOY

EBIT

- Normal Case Scenario: 12% YOY

- Best Case Scenario: 17% YOY

- Worst Case Scenario: 8% YOY

Taxes

- Normal Case Scenario: 24% YOY

- Best Case Scenario: 22% YOY

- Worst Case Scenario: 26% YOY

D&A: 6% YOY

CapEx: 7% YOY

Change in NWC: 0% YOY

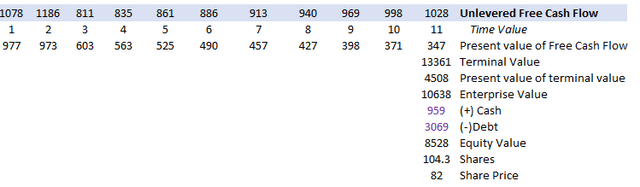

WACC: 10.38% (Generated)

Terminal Growth Rate: 2.5%

Margin of Safety: 0%

Judgement Day: 2032

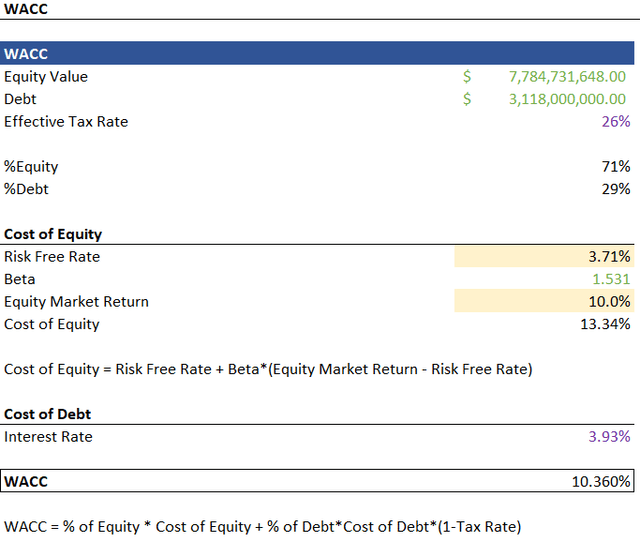

DCF Assumptions (Author) DCF Calculations (Author) WACC Calculation (Author)

After the assumptions were input into the calculator, a fair value of $82 for a normal case scenario, $152 for a best case, and $50 for worst case were found. An average of these three values brings us in the ballpark of $95. Furthermore, sensitivity tables were created for each scenario to see how different WACC effect the stock price.

Normal Case (Author) Worst Case (Author) Best Case (Author)

This is where OC truly shines as a stock pick. As a reminder, this includes measly 3%, 5%,and 1% revenue growth assumptions. Additionally, conservative assumptions for a discount value of 10.4% for WACC were made. OC seems like a safe play with plenty of upside as it sits around the $80 mark. Mildly optimistic assumptions show the stock is hovering $160. Tack on share buybacks and dividends, and this stock seems like it’s on sale for 50% off.

Catalysts

Catalysts include topics covered in Porter’s 5 Forces. If OC fails to expand suppliers and customers, I worry about the riskiness of their supply chain. Furthermore, if they sway away from consistent research and design, sustainability, and new products, I worry about not only their market competition, but growth as well. I don’t see OC failing in any of these based on their track record of managerial decisions and current acquisitions. However, if they do fail, I may be less likely to be attracted to this stock.

Conclusion

I have OC rated as a strong buy for many reasons mentioned. Their product line is essential, diverse, well researched, sustainable and not easily replaced. Though it could be slightly improved, their supply and customer base are vast as well, reducing risk of major supply chain issues. They are world leaders, North American Leaders, and United States leaders in these products, which means as long as they are competitive on the research side, their manufacturing facilities will benefit from economies of scale. Furthermore, their financials are very competitive, and their capital allocation strategy greatly rewards the investor. A growing dividend, share buybacks, smart Capex investments with high return are all things that create value for the long-term holder. There are some concerns with growth, but their composites segment should help lead the way here. There is very little to hate about this company and the best part is the stock price seems to be on sale for 50% off through DCF analysis with conservative assumptions. All things aside, OC is a cashflow machine and should be worth double at $160. Value investors should be licking their chops.

Be the first to comment