MAGNIFIER

Posit the enigma that is Overseas Shipholding Group, Inc. (NYSE:OSG). On one hand, demand for the company’s vessels is strong, and expected to remain elevated for the foreseeable future. Strong demand has led to utilization of OSG’s entire fleet and an increased profitability outlook. But on the other hand, OSG’s valuation remains relatively muted. Its equity value, while up YTD, continues to trade below its non-Jones Act and Jones Act counterparts. Curiously, the market refrains from rewarding OSG for its improved outlook.

The market’s subdued reaction, however, is not meant to last. OSG is expected to report Q2 earnings soon (August 5), and the question is not whether results will be good, it is rather, “how good?” The answer will depend mainly on OSG’s effectiveness in securing extended duration time charters for its fleet.

Based on preliminary results of another Jones Act competitor, OSG has likely been very successful. Meaning, the market’s “wait and see” approach towards OSG will likely turn into “FOMO” after earnings are released. And if OSG reverts even somewhat close to a multiple in-line with peers, the stock price has potential to rally as high as ~80%! What is even better is that the downside is pretty much already baked in company’s share price. Therefore, OSG is a Buy with a price target of $3.10/sh.

The Company

OSG is a transporter of crude oil and refined petroleum products between U.S. ports using seaborne tankers and barges. The company owns and/or operates 23 vessels in the U.S. flag trade, under the Jones Act, and 1 in international trade. Briefly, the Jones Act is a U.S. maritime law that regulates ownership, construction, and operation of vessels engaging in U.S. cabotage. Because of the law’s stringent requirements, there are only a handful of oceangoing vessel companies engaged in U.S. port-to-port trade.

OSG’s capital structure consists of $533.5m net debt (at fair market and inclusive of operating and finance leases) and ~$195m equity. The total enterprise value of the company is $728.5m. The largest shareholders of OSG are Cyprus Capital Partners (~18.7%), Saltchuk Resources, Inc. (~17.3%), and Paulson & Co., Inc. (~7.2%). Insiders also hold a material stake (~6.3%) (per the OSG proxy statement as of April 1, 2022). In total, the three largest shareholders and insiders control ~49.5% of the company.

OSG competes for business with both Jones and non-Jones Act competitors. Jones Act competitors include Keystone Shipping Co. (privately-held), American Shipping Company ASA (OTCQX:ASCJF), and Kinder Morgan, Inc. (KMI). Non-Jones Act competitors include Ardmore Shipping Corp. (ASC), Teekay Tankers. Ltd. (TNK), and International Seaways, Inc. (INSW), among others. OSG also faces competition from domestic rail and pipeline companies.

Demand

Demand for U.S. fossil fuels has come roaring back over the last year. Between pent-up consumer demand to travel post-pandemic and the outbreak of war in Ukraine, U.S. O&G producers and refiners have struggled to keep up. This has led to crude topping $125/bbl (CL1:COM) earlier this year and natural gas currently at ~$8.30/mcf (NG1:COM). Unfortunately, most of the U.S. refiners’ output has found its way overseas and not into domestic stocks. For example, distillate (i.e., jet fuel, diesel, gasoline, etc.) inventory levels, particularly on the U.S. East Coast, have fallen significantly since the onset of the pandemic:

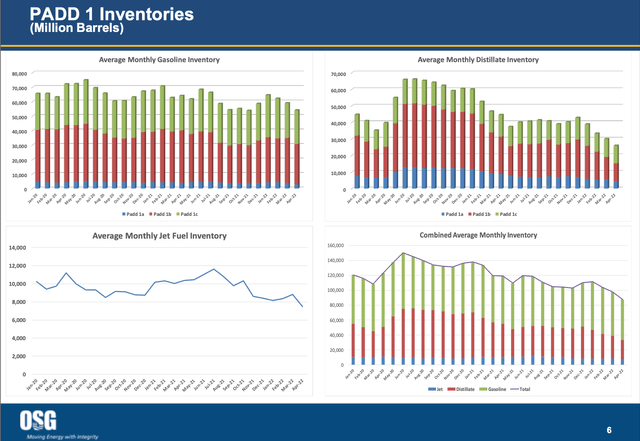

Petroleum Administration for Defense District (“PADD”) 1 reflects inventory levels on the U.S. East Coast (OSG Q1 Earnings Presentation. )

The supply/demand situation on the East Coast has put immense pressure on the fuel prices in the region and created substantial arbitrage opportunities in the market. For example, the United Airlines Holdings, Inc. (UAL) CFO stated in the company’s Q2 conference call that “the cost of jet fuel based on Newark harbor pricing was often several dollars higher per gallon than Gulf Coast jet fuel.” OSG CEO Sam Norton echoed UAL’s observation in the company’s Q2 conference call and added that the spread was “multiple times the transport costs needed to arbitrage [the] differentials.”

Additionally, Norton anticipates that the demand will remain for at least the medium term:

The general consensus is that demand will be relatively resilient. Increases in global refinery output in the months ahead are expected to satisfy demand while gradually rebuilding depleted inventories. Higher refinery output means more product to be shipped which should sustain elevated demand for Jones Act shipping.

The uptick in demand for shipping oil products has driven meaningful price increases for OSG’s services. In June, KMI, a diversified midstream competitor with 16 Jones Act tankers in operation, reported chartering rates between $60k -$65k per day, which is around pre-pandemic levels. Since then, KMI reported in its Q2 conference call that their fleet is 100% utilized and the company is experiencing charter terms as great as 6.2 years.

Fixed time-charters with long durations is excellent for the tanker business as it provides visibility into cash flows and allows for future capital allocation planning. Assuming OSG has had similar luck with fixing year+ charters, the company will be able to provide a lot more detail on its plan to create value for shareholders in the upcoming call.

OSG Valuation

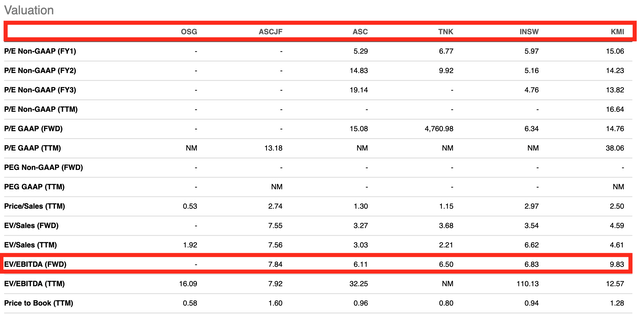

Based on the future demand picture, OSG presents a compelling investment opportunity given its EV/EBITDA trading multiple relative to peers. Currently, the company trades at only 5.8x fwd EV/adj. EBITDA (in Q1, management guided for Q2 TCE revenue of ~$100m and adj. EBITDA of~$30m, and ~$125m-$130m adj. EBITDA on an annualized go-forward basis.) This compares to an average 7.4x for both Jones and non-Jones Act competitors:

OSG Peer Tab – Customized (Seeking Alpha)

OSG trades below the lowest peer in the comp set–ASC–and 1.6x less than the peer average. But what is even more provocative is that when compared to the other two Jones Act peers in the comp set–ASCJF and KMI– OSG trades 3x less than the two. This is truly bizarre considering the strong operating environment and OSG’s path to sustained free cash generation for the foreseeable future. Unlike KMI, however, OSG is a microcap equity with no analyst coverage, is thinly traded, and unprofitable on a GAAP basis for the last twelve months. Therefore, some discount should be expected.

With that said, the strong demand for its services should result in mean reversion, if nothing else. Assuming this occurs, OSG is easily worth ~$4.20/sh, an 80% upside. And even if the company does not trade fully in-line with the comp average, instead moves into the bottom quartile, the upside is still material at ~$3.10/sh, or ~35% higher than today’s market quotation. The $3.10/sh figure is not far off from the $3/sh proposed bid that Saltchuk, OSG second largest shareholder, proposed then withdrew last year. In any event, OSG looks cheap.

Another aspect that makes OSG a compelling opportunity is its cash generation outlook. Using the annual $125m EBITDA figure, it is anticipated OSG will generate ~$50m in free cash over the next twelve months (OSG calculates free cash as adj. EBITDA – CAPEX and debt servicing; exclusive of changes in working capital. In this case, FWD EBITDA $125m – NTM CAPEX $24 – ~$51m debt servicing = $50m. See Q1’22 transcript and slide presentation for more information). Strong cash generation will continue to allow OSG to return cash to shareholders via buybacks as well as pare down debt earlier than scheduled. To this end, the company recently announced a share repurchase plan to buy back up to 5m shares of stock in open market purchases.

For these reasons, OSG is a compelling opportunity for equity investors.

Downside Risks

The most obvious risks to the downside are the macro economic ones on everyone’s mind these days: inflation, recession, and war. In OSG’s case, a continued war in Ukraine might actually keep demand for Jones Act tankers high in light of Western countries reliance on U.S. fossil fuels.

A second risk is execution. Recently, management made the decision not to renew three of it’s chartered-in vessels from ASCJF and to return them at the end of this year. As part of its agreement, OSG had the option to renew the leases on either a one, three, or five-year term–with 1-year available only once–but chose not exercise despite the improving outlook for Jones Act MR tankers. Sure enough, Keystone Shipping Co., one of OSG’s largest competitor, stepped in not even 6 months later and chartered the vessels for its fleet at a 15% higher rate. In short, for OSG stock to materialize substantially in the future, management will need to make more prescient decisions.

Another risk for OSG is the everlasting chance the U.S. repeals the Jones Act. Presently, the Jones Act safeguards cabotage in the U.S. for vessels meeting the requirements under the Act. But the law is under constant scrutiny from those that believe the Act makes domestic seaborne operations uncompetitive and leads to artificially high prices. In fact, there has been legislation put forth in both the U.S. House and Senate in just the last couple years aimed at repealing the Act; however, those bills have yet to make it out of committee. This will remain an ongoing risk to monitor for future developments.

With that said, a greater risk than repealing the Jones Act is the prospective of a blanket waiver of the Act. Historically, a waiver of the Act requires the moving party to show “neces[sity] in the interest of national defense.” However, in March, the Biden Administration ordered 1/mmbbls of oil from the U.S. Strategic Petroleum Reserves to be released per day for 6 months starting in May. As a result, the market speculates that a blanket waiver may be issued so there are enough tankers to move product to end-markets. At this time, there has been no such waiver. Keep in mind, even if there is a waiver, OSG should be relatively insulated from the increased capacity because most of its tankers should be under fixed-time charters rather than voyage charters.

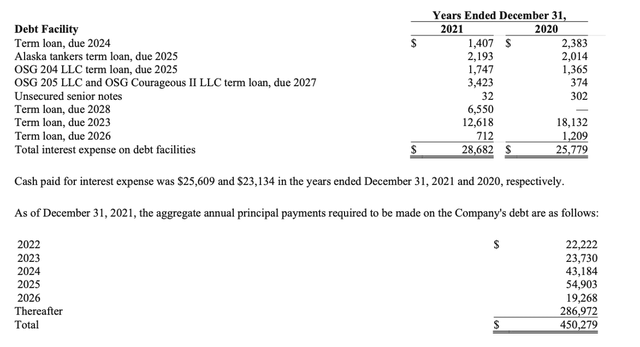

A final risk is OSG’s debt profile. The company has several tranches of debt maturing over the next several years:

The company will need to maintain a healthy adj. EBITDA margin in order to comfortably satisfy debt servicing. Fortunately, tanker demand is expected to remain for the foreseeable future. Therefore, OSG’s insolvency risk is currently minimal.

Conclusion

OSG will have an opportunity to dispel the naysayers and usher buyers into the name when it reports Q2 earnings in August. And based on the foregoing, shares have the fuel to rally substantially into year-end. Therefore, OSG is a Buy and should be seriously considered by long equity investors.

Be the first to comment