gustavofrazao/iStock via Getty Images

Transcript

We brought together senior investors from across BlackRock to talk about the outlook for the rest of the year.

1) A new market environment

There was wide recognition that this regime is different as it relates to macro, as it relates to markets. In a supply-driven macro environment, the tradeoff between growth and inflation is so much harder. And the politicization of everything makes decision-making so much harder as well. And all of that means Goldilocks (steady growth and low inflation) as an outcome is no longer on the table, and buying the dip as an investment trade idea does not apply quite so much either.

2) 60% stock / 40% bond portfolio revisited

The second observation is around this idea that, well, the 60/40 typical portfolio doesn’t quite work as much. If you think about 2022, it’s actually the worst year on record for a 60/40 portfolio, and also as we think about hedging out some of this macro risk which is very very difficult, risks models calibrated to history need to be revisited.

3) Bigger and more changes to portfolios

And the third observation is around this idea that in an environment where we have higher macro volatility, higher market volatility, then more frequent and potentially bigger and more dynamic adjustments to portfolios will be warranted.

______________

Global growth and inflation concerns are keeping investors up at night. This backdrop made for a spirited gathering at our June 14-15, 2022 Outlook Forum, a semiannual meeting we host for BlackRock’s portfolio managers and executives. We made the case we’re entering a new macro and market regime, and debated the implications at our first in-person Forum since the pandemic broke out in early 2020.

A historic shift

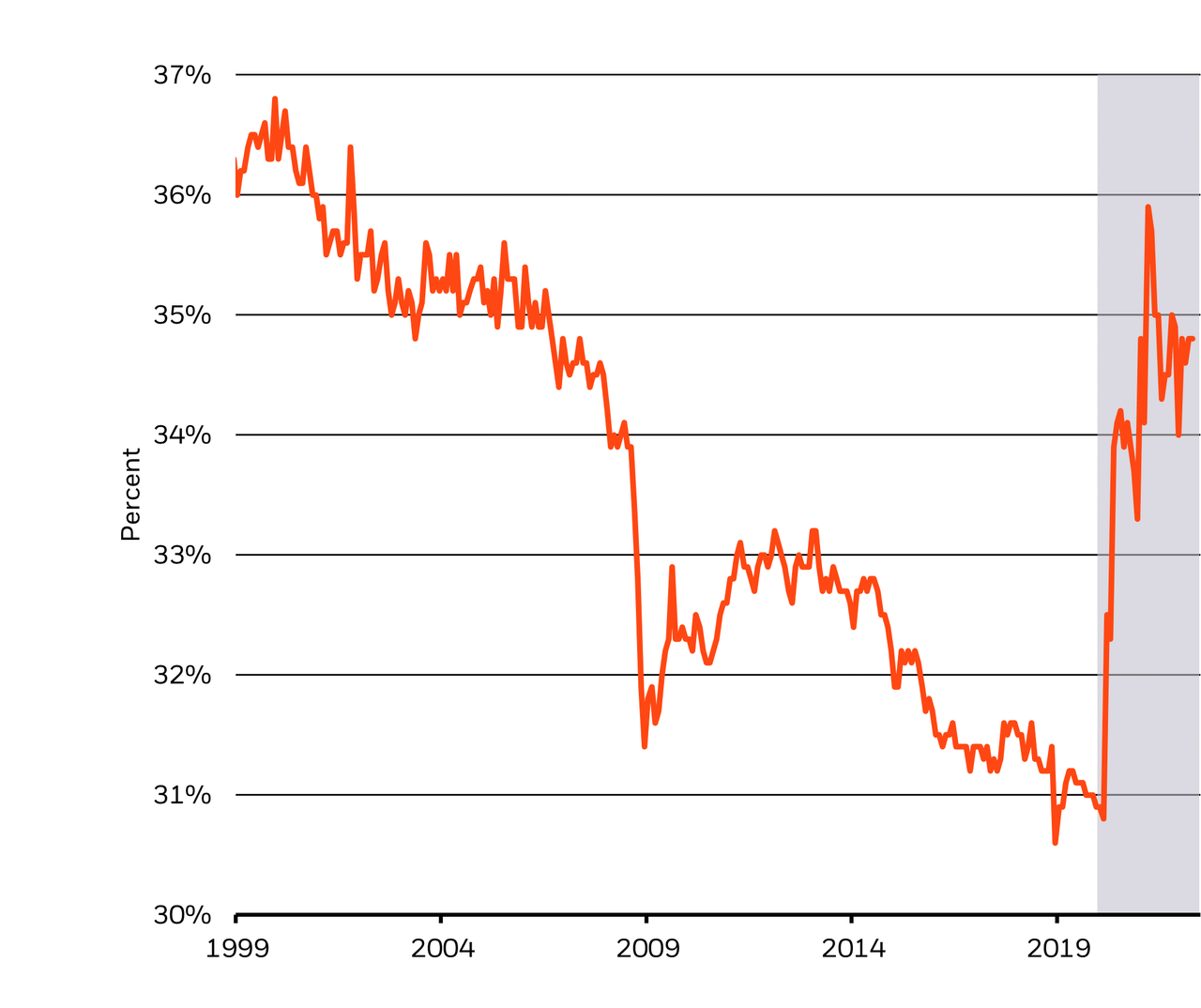

US Nominal Goods Share Of Consumer Spending (BlackRock Investment Institute, U.S. Bureau of Economic Analysis, with data from Haver Analytics, June 2022)

Notes: The chart shows the U.S. goods share of nominal personal consumer expenditure from 1999 through 2022.

Many forum discussions centered on the production constraints driving today’s inflation. The pandemic sparked a massive shift in consumer spending to goods and away from services. See the gray shaded area in the chart. This reallocation occurred as lockdowns limited production and movement – and led to a sectoral re-allocation of resources. The restart of economic activity unleashed pent-up demand for services, creating an ostensibly tight labor market. The war in Ukraine added an additional commodities price shock. These factors pushed up inflation to 40-year highs. Almost all Forum participants said average U.S. inflation would settle above the Federal Reserve’s target of 2% over the next five years. That was a marked change from our November Outlook Forum, when only half forecast this. Participants were divided on how companies will adapt to this new environment – and whether they can maintain historically high margins amid rising input costs and the need to diversify supply chains in a more fragmented world.

Concerns over a global growth slowdown weighed on participants as a stampede of central banks raised rates in an effort to rein in inflation – all in the week the Forum took place. Half of participants saw the restart stalling in the next twoi years, leading to a short and shallow global recession, up significantly from November 2021. Waning U.S. growth was in sharp focus as the risk of the Fed overtightening increases. The flurry of central bank rate hikes has shown many are ignoring the crushing effect this will have on growth, in our view, and we now see the U.S. restart of economic activity stalling.

Signs of a new regime

A quickly changing world complicates matters. The war in Ukraine has exacerbated high inflation caused by the restart’s supply disruptions – and sparked sharply higher commodity prices. Commodity prices are likely to stay elevated, Forum speakers said. Why? Lower production capacity after years of underinvestment as well as ballooning demand for industrial metals needed for the transition to net-zero carbon emission by 2050. The outperformance of traditional energy assets this year does not mean the transition is reversing, speakers said. It reflects higher expected earnings for companies replacing Russian energy supply. Energy use in coming decades will look very different, we believe, and lower-carbon fossil fuels have a large role to play in enabling the transformation.

Geopolitical fragmentation is another tenet of the new regime, and the Ukraine war has accelerated this. The Forum focused on how many emerging market (EM) countries now try to find a middle ground between the U.S. and China or try to play one against the other. EM isn’t what it used to be, anyway. The name itself is a misnomer, as it hides an incredibly diverse set of countries. The old approach of chasing growth and cheap assets in EMs is outdated, Forum participants argued. It’s now about quality investments, income potential and seeking out beneficiaries of “friend-shoring.” Another change: EM dependence on China is declining, buffering some of the effects of China’s lockdowns to prevent the spread of Covid-19.

The road ahead

So, how should investors adjust to all this? Ignore macro peril at your own risk. Most attendees said they expect to see short cycles, more macro volatility and volatile markets. They stressed the need to be make quicker portfolio shifts amid shrinking investment horizons and prioritize liquidity, too. Participants also questioned the classic portfolio construction setup of 60% stocks and 40% bonds. A 40-30-30 split – comprising traditional fixed income, public equities and private assets – is perhaps more apt in the new regime. Simply betting on mean reversion or buying the dip won’t work anymore, many agreed.

Market backdrop

Poor global PMI data reinforced slowdown fears, capping the rise in yields and triggering a rebound in stocks from 2022 lows. UK inflation hit a four-decade high of 9.1%, bolstering pressure on the Bank of England (BoE) to respond aggressively with further tightening. Many developed market (DM) central banks have moved ahead with rapid rate hikes without acknowledging how they could hurt economic activity. Failing to recognize policy trade-offs boosts risks to growth, we think.

Inflation and survey data will be top of mind this week. In the U.S., an update on the Fed’s preferred PCE inflation measure will shape its view of whether inflationary pressures are starting to subside amid a possible softening in activity surveys. Euro area inflation data will likely bolster the ECB’s resolve to tighten policy in July. While we see the ECB raising rates materially in coming meetings, the burden of the energy shock hitting Europe will ultimately force it to rethink its hiking cycle.

Be the first to comment