wildpixel

Thesis

One of the best known equities buy-write funds, namely the Eaton Vance Tax-Managed Buy-Write Opportunities Fund (NYSE:ETV) has announced the board of trustees approval for a proposed acquisition of its sister fund NYSE:EXD:

BOSTON – (BUSINESS WIRE) – The Boards of Trustees of Eaton Vance Tax-Managed Buy-Write Strategy Fund (the Acquired Fund) and Eaton Vance Tax-Managed Buy-Write Opportunities Fund (the Acquiring Fund) have approved a proposal for the Acquired Fund to merge with and into the Acquiring Fund.

The proposed merger is subject to approval by Acquired Fund shareholders at a Special Meeting of Shareholders scheduled for Thursday, February 2, 2023. A proxy statement/prospectus containing information about the meeting and the proposed merger will be mailed to the Acquired Fund’s shareholders of record as of November 21, 2022. No action is needed by shareholders of the Acquiring Fund. Each Fund is a diversified closed-end management investment company sponsored and managed by Eaton Vance Management. Each Fund is listed on the New York Stock Exchange.

The Acquired Fund has the same investment objectives and substantially the same investment policies and restrictions as the Acquiring Fund. Additional information regarding the proposed merger will be contained in the proxy statement/prospectus.

The merger is currently expected to be completed in the first or second quarter of 2023, subject to required shareholder approvals and the satisfaction of applicable regulatory requirements and customary closing conditions.

If the merger is approved, each Acquired Fund shareholder will be issued common shares of the Acquiring Fund at an exchange ratio based on the Funds’ respective net asset values per share. Following the merger, the Acquiring Fund will continue to be managed in accordance with its existing investment objectives and strategies.

ETV is by far the better known name, constituting a gold standard in the equity buy-write space. The merger is not a done deal, with EXD shareholders needing to approve the merger during a special meeting scheduled for February 2023. We expect the approval to go through, given the branding opportunity to be part of ETV and the synergies to be had by a larger AUM. ETV is the larger fund, with around $1.4 billion in assets, while EXD has only around $0.1 bil in assets.

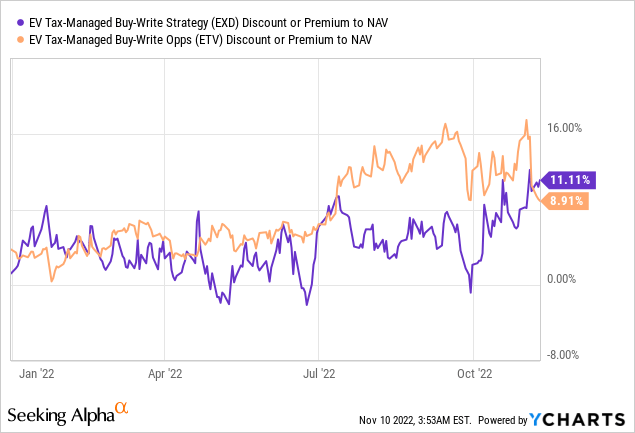

The two funds are trading with similar premiums to NAV, hence the corporate action, if successful, will not affect the market price from that angle:

We can see that until recently the EXD premium was lagging, with a basis as large as 10% at the beginning of October, but the difference is now minute. Usually when we see a smaller fund being merged into a larger “brand name” there is a catch-up in the premium to NAV, and the shareholders in the smaller fund get a nice jump-up in returns. Looks like that action already occurred here.

We like this corporate action and especially what it implies for the asset manager, namely Eaton Vance. Eaton is “cleaning-up” and streamlining the CEF business, which is ultimately beneficial for shareholders. EXD has a small AUM of $100 mm and limited prospects for growth. Given its similar build to ETV it makes sense from an operational and cost management perspective to merge it into a larger vehicle with a similar strategy. We like this take for an asset manager because it speaks to their willingness to pursue what is good for shareholders rather than to clip management fees in many unloved small funds.

Conclusion

The Boards of Trustees of EXD and ETV have approved a merger proposal for the two funds. The proposal is subject to EXD’s shareholders approval, which is to be had at a special meeting in February 2023. We expect that approval to be obtained, with the two funds merging. This corporate action represents a great move for the EXD shareholders who are now seeing themselves merged into a gold standard in the equity buy write space, namely ETV. The positive pricing action in EXD has already happened, with the fund’s premium to NAV rallying by 11% in the past month to match ETV’s. EXD is the smaller fund with only $0.1 bil AUM, being dwarfed by ETV’s $1.4 bil in assets. Given their similar strategies and manager overlap the merger should be fairly seamless. We like this corporate action and it speaks volumes regarding Eaton’s propensity to streamline operations and actually pursue shareholder value creation.

Be the first to comment