The Good Brigade

It’s a bleak mid-winter for most of the cyclical stocks as 2022’s bear market has taken its toll on high-beta assets. Nonetheless, with chaos comes opportunity.

Today’s article is a pair-trade analysis. Many of our readers might be surprised at our selections as we’ve been bearish on Ford (NYSE:F) for quite some time now, and we released a bullish article on Tesla (NASDAQ:TSLA) earlier this year.

However, the financial markets are fluid. As such, we’ve changed our minds and we’re now bullish on Ford and bearish on Tesla; here’s why.

A Look At Stock Market Dynamics

Risk aversion is ugly for most investors; unless you understand beta sensitivity. Beta sensitivity measures the covariance between a stock and the market relative to the variance of the broader market. Additionally, beta sensitivity looks at market segmentation, which parts assets into different categories that are independently correlated to different phases of the economic cycle.

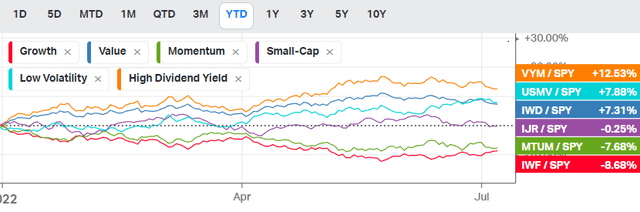

Based on the chart below, it’s relatively straightforward that since the turn of the year, higher dividend stocks, low-volatility, and value stocks have outperformed the S&P 500 on a normalized basis. This is quite common as investors usually seek high-dividend portfolios during inflationary environments, low-volatility portfolios during uncertain markets, and value portfolios in early-to-mid-stage bear markets.

Koyfin

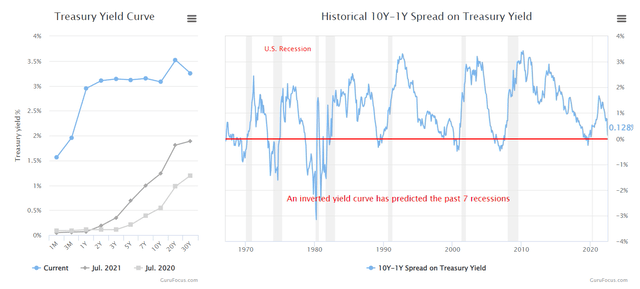

If we consider the yield curve below, it’s clear that the economic climate is expected to contract until further adieu. The higher interest rates would likely cause stock market capital to further center towards the aforementioned factors: high dividend, low volatility, and value.

GuruFocus

Thus, although Ford’s stock exhibits high volatility (Beta of 1.21), it could benefit from its high forward dividend yield of 3.43% and its price-to-book ratio (1.04x), which is at a 16.11% 5-year discount.

On the other end of the spectrum, Tesla pays no dividend, has a high beta (2.11), and is an overvalued stock at a price-to-book of 22.30x.

So, based on market segmentation dynamics, which were initiated by Eugene Fame and Kenneth French and developed by numerous other researchers, Ford stock is likely to proliferate in the current market while Tesla stock could decline.

Operating Differentials

I want to part the operational discussion into sub-headings here as I believe it would make for clearer reading. However, there’s a preliminary discussion that needs to take place first.

Let’s discuss EV and ICE growth before we get into the nitty-gritty.

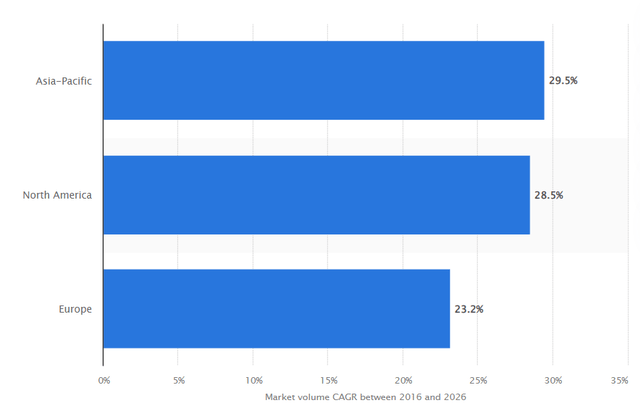

The addressable market for electronic vehicles (EVs) by region is anticipated to grow by north of 20% in Europe, Asia, and North America until 2026. As most of you know, Tesla is an EV pure play, but Ford is still pivoting into EV; specifically, only 2.86% of the company’s North American sales are EV.

Statista

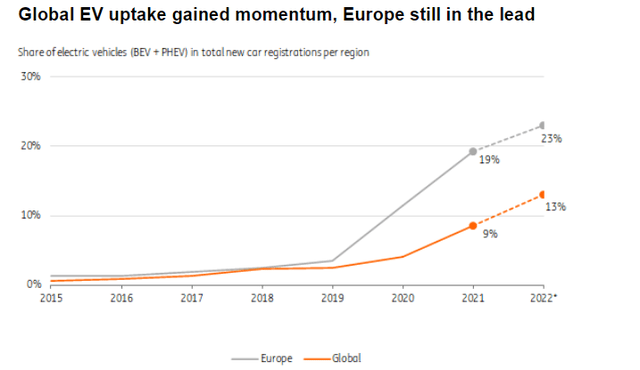

On the other side of the spectrum, the forecasted CAGR for ICE (Internal Combustion) vehicles, geared towards Ford, is at 4.5% until 2027. However, the addressable market is still significantly more prominent, with EV uptake still growing. As an example, a recent report by ING claims that in May this year, only 13% of global car registrations were EVs (although it’s solid progress, it remains a small part of the overall addressable market).

Seeking Alpha; ING

Ford’s Key Operating Metrics

Ford released a report this week, in which it unveiled its worst-ever China sales quarter; this definitely shouldn’t be overlooked. The company’s sales decreased by 22% year-over-year. However, much of the regional sales decline could be re-ignited with China’s $220 billion stimulus plan and pandemic re-openings of the nation’s economy.

Furthermore, Ford delivered a stellar U.S. June sales report, which admittedly shocked me. The company’s U.S. motor sales rose by 31.5%, and its EV sales surged by 76.6%. This report illustrates that Ford possesses resiliency as it can perform well during a cyclical economic downturn.

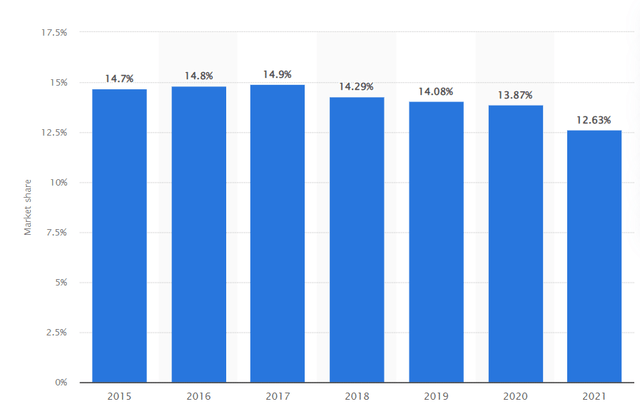

Quantitative metrics convey Ford’s strength. The company’s market share as of last year was dominant. Although the chart is lagged, it provides enough of a trendline to suggest that Ford’s year-end 2022 market share will likely be impressive as its organic growth is noteworthy. For instance, Ford’s profits from continuing operations sit at a 5-year CAGR of 25.18%, which is illustrious considering the company’s maturity level.

Statista

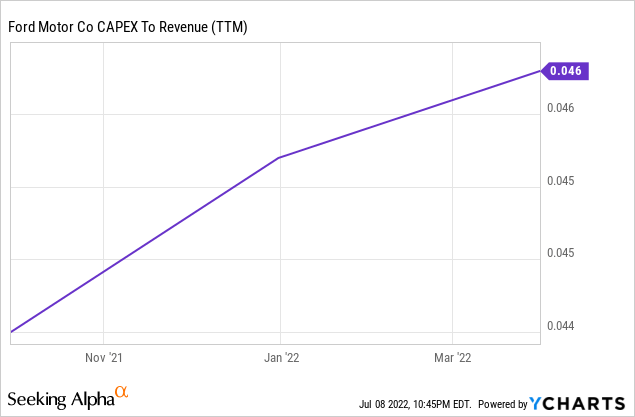

Lastly, Ford’s successfully monetizing its CapEx, as seen by the upward sloping revenue/CapEx ratio below. Ford’s CapEx has surged by 16.87% year-over-year, implying that the company’s growth prospects remain intact.

Tesla’s Key Operating Metrics

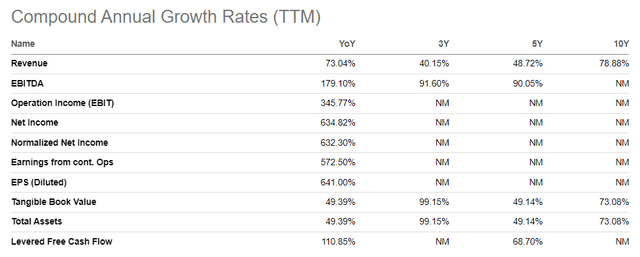

Tesla’s growth in the past decade has been sumptuous; there’s no denying that. However, I feel as though all of that growth has already been priced in by the market; give me a chance to explain why.

Seeking Alpha

We all saw this week that Warren Buffett-backed BYD (OTCPK:BYDDF) had exceeded Tesla in EV sales. Although I’m not claiming that this event in isolation is enough to sway Tesla into a failure, I’m arguing that the industry has reached a hypercompetitive stage. As such, we can’t rely on Tesla’s exponential ex-post growth metrics, and we need to consider the possibility of its income statement receding to a more normalized distribution.

Furthermore, Tesla’s on the back of a weak broad-based sales report. Sure the company’s preliminary June China sales lifted by 1.42x amid manufacturing re-openings. However, the firm’s holistic sales declined by 17.9% (year-over-year) in its second quarter. Although much of Tesla’s receding second-quarter sales was due to lockdowns in China, it’s clear as well that the demand side for EV vehicles is finding calm.

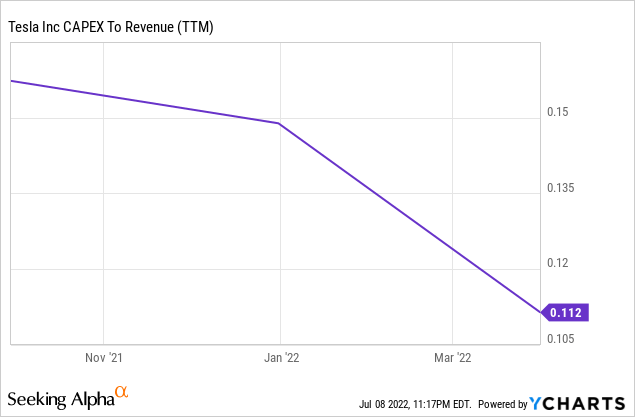

Lastly, Tesla isn’t monetizing its CapEx, as well as Ford. The downward trendline of Tesla’s CapEx to Revenue related to the firm allocating 68.23% less to the line item (than its 5-year average) implies that growth could stagnate soon.

Valuation

Although I mentioned valuation in the “a look at stock market dynamics section,” this should be treated as an independent vantage point (although not mutually exclusive).

The previously mentioned price-to-book metrics were for market segmentation purposes. Yet, a holistic valuation must be performed to juxtapose the two stocks.

Let’s start with Ford. Based on a holistic relative valuation, Ford is trading below its sales, below the generally accepted benchmark for price-to-cash flow (10x), and at a price-to-earnings, which is 63.99% below the sector median.

| Price-to-earnings | 4.06x |

| Price-to-sales | 0.35x |

| Price-to-cash flow | 4.59x |

Source: Seeking Alpha – Ford Valuation

Moving on to Tesla. Tesla needs to be considered differently as it exhibits secular growth prospects; thus, looking at the stock’s price-to-sales and price-to-cash flow metrics are more appropriate as they can be utilized for hypergrowth stocks, whereas most of the other price multiples can’t.

Based on Tesla’s relative valuation metrics, the stock’s trading at a premium to its sales and its cash flow. I’d usually say that it shouldn’t be a worry, considering we’re in a bear market. I’d opine that Tesla’s overvalued status could be a problem for its stock.

| Price-to-sales | 11.85x |

| Price-to-cash flow | 54.89x |

Source: Seeking Alpha – Tesla Valuation

In a nutshell, evidence implies that Ford is undervalued on a relative basis. Although Tesla is in an exponential growth phase, its top-line cash and accrual metrics imply that it’s an overvalued stock.

Concluding Thoughts

Based on an array of quantitative metrics and a robust qualitative overlay, it’s clear that Tesla and Ford face opposing destinies. Ford positions itself as a high-dividend/value play, while Tesla is an overvalued asset with significant commercial headwinds.

I’m not exceptionally bullish on durable goods at the moment. Nevertheless, if I were an auto-centric investor, I’d sell Tesla and buy Ford as a pair trade.

Be the first to comment