DarrelCamden-Smith/iStock via Getty Images

We’re nearing the start of the Q1 Earnings Season for the Gold Miners Index (GDX), and while most producers that have pre-reported have come in a little light, Orla Mining (NYSE:ORLA) has come out of the gates strong this year. This was evidenced by a sharp increase in production in Q1 after reaching commercial production, reporting an output of ~23,000 ounces of gold. These figures are tracking ahead of my estimates, and Orla should have no issue meeting FY2022 guidance. Given Orla’s position as an industry leader from a margin standpoint with a solid development pipeline, this is a name to keep a close eye on.

Camino Rojo – Stacking (Company Website)

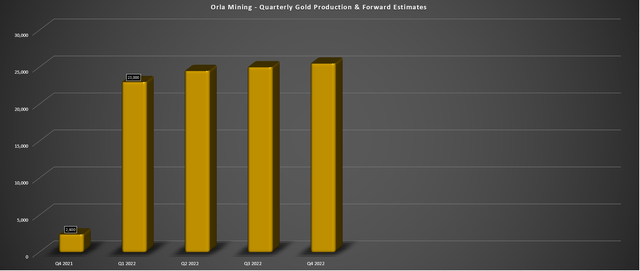

Orla Mining (“Orla”) released its preliminary Q1 results earlier this month, reporting gold production of nearly 7,200 ounces of gold in March and just over 23,000 ounces in Q1 2021. This was a massive improvement from ~2,400 ounces in Q4 during the ramp-up phase, and the company also reached commercial production on time and within budget. In a sector where newer producers have been stumbling in their ramp-up periods over the past year, like Alexco (AXU), Aurcana (OTCQX:AUNFF), Americas G&S (USAS), and Pure Gold (OTCPK:LRTNF), Orla’s solid execution to date is refreshing.

Orla Mining – Quarterly Gold Production & Forward Estimates (Company Filings, Author’s Chart)

Digging into the quarter a little closer, the company noted that it hit a new record for monthly processing throughput in March, with ~539,400 tonnes processed at an average grade of 0.80 grams per tonne of gold. Its daily stacking throughput has also improved materially, up from ~15,100 tonnes per day year-to-date as of the end of February to over 17,400 tonnes per day in March, which is 97% of nameplate capacity (18,000 tonnes per day). Based on the success of the ramp-up period, Orla hopes to hit the 18,000 tonnes per day mark later this quarter.

Camino Rojo – Gold Pour (Company Presentation)

Just as important for any company graduating to producer status, Orla noted that its mined ore tonnes are reconciling well with the block model and processing recoveries are in line with the metallurgical recovery model. This is great news for the company, with investors able to breathe a sigh of relief, at least based on its production results to date.

Finally, just as important as the solid operating metrics, Orla noted that it is confident in meeting its guidance (90,000 to 100,000 ounces at $600 – $700/oz) and expects its Camino Rojo [CR] Oxide Mine to be completed in line with its budget of ~$134 million. In a period where cost blowouts have also been the norm, this should increase investors’ confidence in this team. This is because the company has checked all the boxes for meeting producer status (budget, time) despite a slew of headwinds from supply chain issues to materials inflation and elevated absenteeism (COVID-19).

Camino Rojo Oxide Project

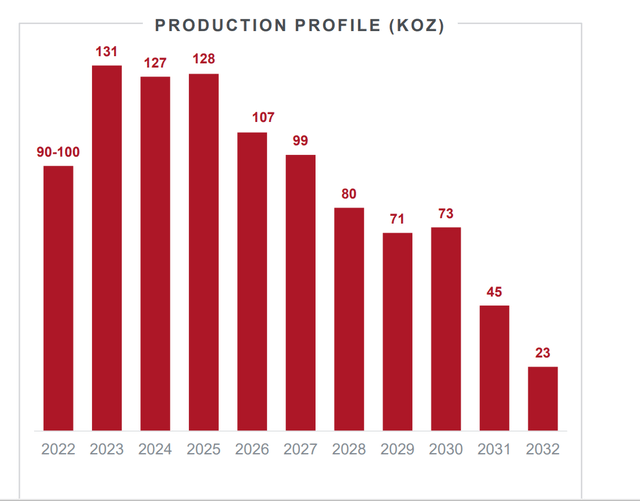

Looking at Orla’s current mine plan below, we can see that while 2022 will be a very solid year for the company if it can maintain its operational excellence, the next three years are expected to be the most exciting, with an average annual production profile of ~128,000 ounces. Even at more conservative gold price assumptions (sub $1,900/oz), this should translate to revenue of more than $220 million per annum and more than $85 million in free cash flow generation. So, among the junior producer space and for comparable companies with similar production profiles, Orla will be a free cash flow machine even if all-in sustaining costs creep up towards the top one-third of its cost guidance range.

Orla Production Profile (Company Presentation)

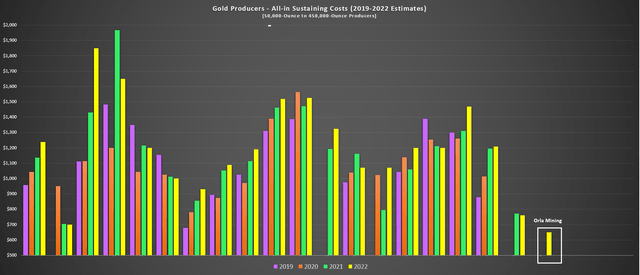

Looking at the chart below, the major stand-out for Orla is costs, with Orla having the lowest costs by a country mile relative to not only more than 50 producers I track but certainly the junior producer peer group. This is because it operates a relatively high-grade, low-strip, heap-leach project and to date, has been executing well on its mine plan. Assuming the company can meet its AISC guidance mid-point of $650/oz in FY2022, it’s quite clear that it would have the lowest costs among the junior and mid-tier producer peer group, with the closest peer being Fortitude Gold (OTCQB:FTCO) at sub $800/oz.

Gold Producers – All-in Sustaining Costs (2019-2022 Estimates) (Company Filings, Author’s Chart)

However, in the case of Fortitude, the company will have to move on from its extremely high grades at Isabella Pearl within a couple of years, so I would expect its all-in sustaining costs to climb above the $1,000/oz range by 2024. These are still respectable costs, but at the same time, Orla’s costs should remain below $750/oz. Moving to Papua New Guinea, K92 Mining (OTCQX:KNTNF) is also a close peer to Orla from a margin standpoint, assuming its Phase 3 Expansion is complete by 2024, which will drive costs below $700/oz. However, I see Mexico as a more attractive jurisdiction than Papua New Guinea, even if only slightly, so Orla has the slight edge here as well.

Finally, it’s important to note that with pervasive inflationary pressures in the mining sector and supply chain issues, and rising fuel prices not helping, producers are becoming a riskier bunch. While the higher gold price is helping, the average producer could actually see limited margin expansion vs. 2020 levels even with gold prices near all-time highs. Fortunately, Orla, while not completely insulated from this, certainly doesn’t have anything to worry about from a margin standpoint. Even if its costs were to rise by $100/oz if inflationary pressures worsen, it would still enjoy industry-leading AISC margins of ~59% at a $1,900/oz gold price.

Valuation

Based on ~300 million fully diluted shares and a share price of $4.85, Orla is not cheap, trading at a market cap of ~$1.46 billion as a sub-100,000-ounce producer. This dwarfs the valuation of larger producers like Victoria Gold (OTCPK:VITFF) and Karora Resources (OTCQX:KRRGF), which, unlike Orla, benefit from being located in Tier-1 jurisdictions (Canada, Australia). However, as discussed previously, Orla has few peers from a margin standpoint, with costs expected to come in well below the $750/oz mark from an AISC standpoint. This is more than 35% below my estimated industry average costs of ~$1,180/oz this year and $1,200/oz in FY2023.

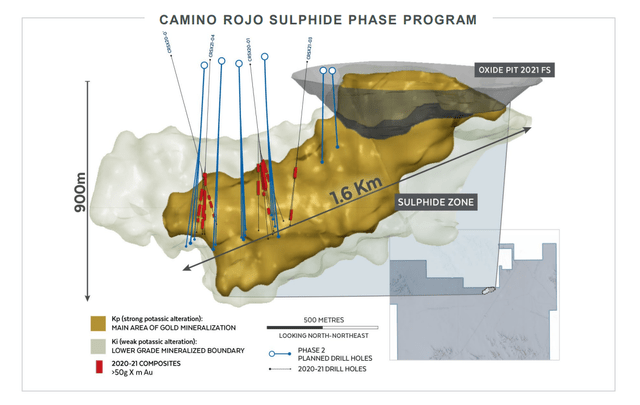

The other major point worth noting is that while Orla looks expensive relative to peers like Victoria and Karora, it has a solid development pipeline with a low-capex, high-grade oxide project in Panama (Cerro Quema), plus a Sulphide Project at Camino Rojo. The most exciting opportunity is the Sulphide Project at Camino Rojo, which lies beneath the current oxide resource and is home to over 7 million M&I gold ounces, with a significant silver component (~61 million ounces). The company hopes to complete a Preliminary Economic Assessment by year-end, which should give a better idea of the economics of this project.

CR Sulphide Project (Company Presentation)

Last year, Orla reported exceptional intercepts from follow-up drilling at the CR Sulphides, with highlight holes including 108 meters at 2.38 grams per tonne gold, 111 meters at 2.63 grams per tonne gold, and 55.5 meters of 4.47 and 4.95 grams per tonne gold, respectively. These hits were well above the average gold-equivalent grade at the Sulphide Project. Given the ~8.0 million-ounce resource here (more than triple the size of CR Oxides, which is the current mine plan), I believe the opportunity at the Sulphide Project alone is north of $1.0 billion, even after factoring in inflationary pressures. Currently, development options being looked at are as follows:

- an underground mining option

- an open-pit option with processing at a separate sulphide facility at CR

- an open-pit option with the material being delivered to Newmont’s (NEM) Penasquito plant

Circling back to the valuation, at a fully-diluted market cap of ~$1.45 billion, Orla is extremely expensive for investors looking solely at its current mine, Camino Rojo Oxide. This is because the current After-Tax NPV (5%) comes in at ~$530 million at $1,775/oz. However, after adding in a combined value of ~$1.25 billion for Camino Rojo Sulphides and Cerro Quema at an 8% discount rate, Orla’s consolidated NPV (5% Mexico/8% Panama) increases to approximately $1.78 billion.

This leaves Orla trading at closer to 0.85x P/NAV on a fully-diluted basis, which isn’t unreasonable for a high-margin producer. However, based on what I believe to be a fair multiple of 0.90x, and a fair value for the stock of US$5.10. Given that I prefer at least a 25% discount to fair value, I do not see enough margin of safety to pay up for the stock here at US$4.85. Instead, I would need to see the stock dip below US$3.80 for it to become more attractive and enter a low-risk buy zone.

Technical Picture

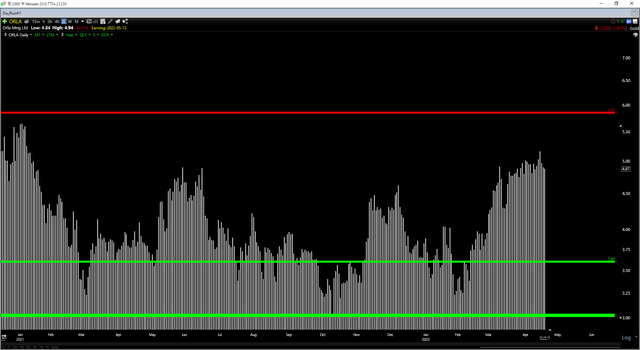

Moving to the technical picture, we can see that this corroborates the view that the stock is not in a low-risk buy zone, with an overbought zone at US$5.85 and no strong support until US$3.60. From a current share price of US$4.85, this translates to $1.25 in potential downside to support and just $1.00 in potential upside to resistance, or a reward/risk ratio of 0.80 to 1.0. Generally, for single-asset producers, which are slightly higher-risk, I prefer a reward/risk ratio of at least 5 to 1. This would require a correction to $3.95 per share.

Orla has had an impressive year thus far and is one of the few junior producers and new producers clearly firing on all cylinders. However, after a more than 60% rally to a fully diluted market cap north of $1.40 billion, I don’t see a ton of upside that would justify paying up for the stock here. So, while I do think Orla Mining is a name to keep a close eye on, I would be patient and wait for a deeper correction rather than pay up for the stock here at US$4.85.

Be the first to comment