anyaberkut/iStock via Getty Images

In case you missed it, I wrote a flattering piece on Orion Office REIT (NYSE:ONL) around six months back, recommending shares in this “newbie” that spun its assets from the mega-monster net lease REIT, Realty Income (O).

You can read the entire article here, but to summarize, we initiated as a “Strong Buy” with returns of 25% annually forecasted.

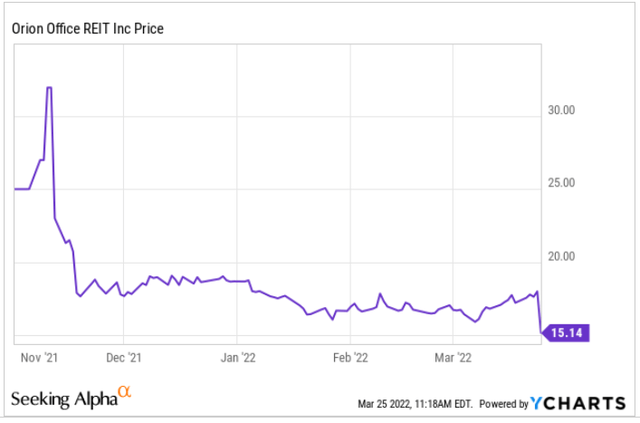

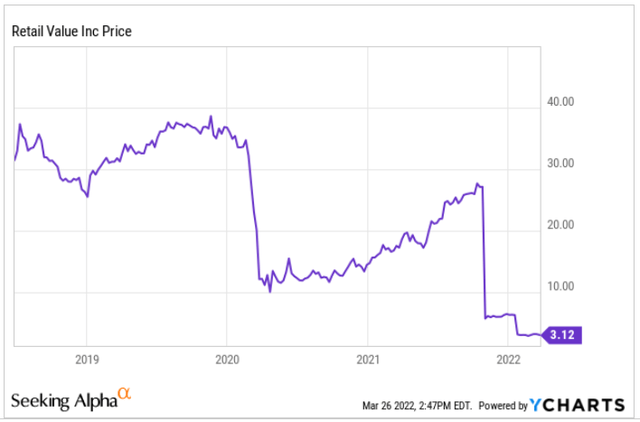

A picture is better than 1,000 words…

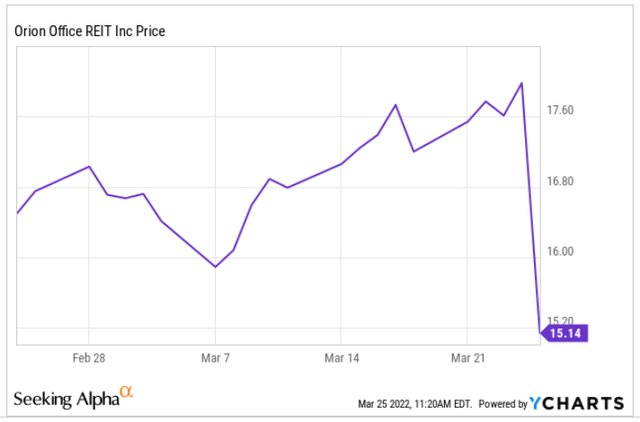

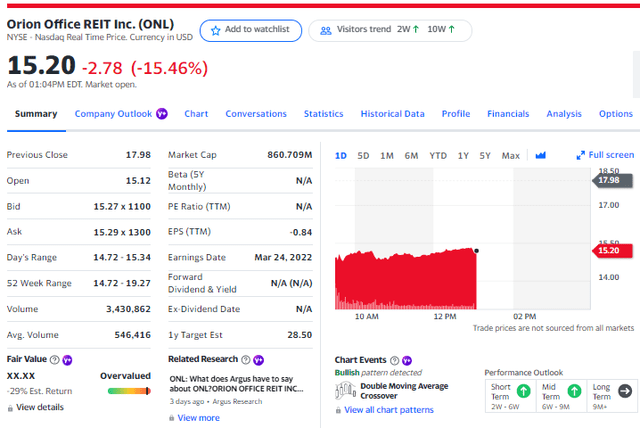

ONL has been a bomb since listing (spinning from O) and shares are now down another 16% today, as I write this article:

Before I get into the earnings news, that includes the dividend announcement, I thought it would be helpful to provide a few nuggets regarding previous REIT-to-REIT spins.

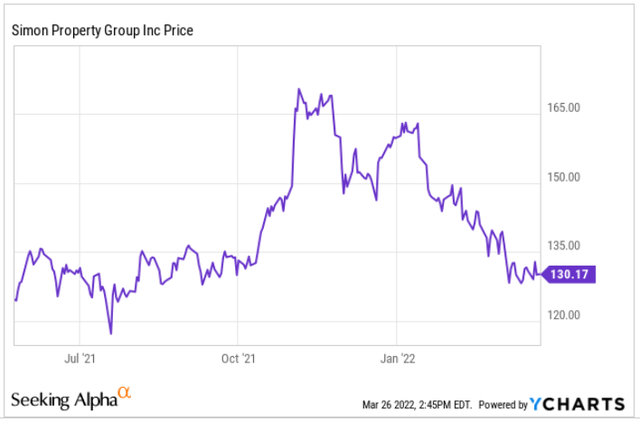

First off, some of you may recall when Simon Property Group (SPG) spun out 54 malls and shopping centers to form Washington Prime. On May 23rd, 2014, shares traded for $191.36.

On September 29th, 2021, shares traded at $0.83 as the company filed bankruptcy. At the same time, shares in Simon traded at $167.43 and are now trading at $130.13. This is an annualized total return of 1.1% (8.75% total).

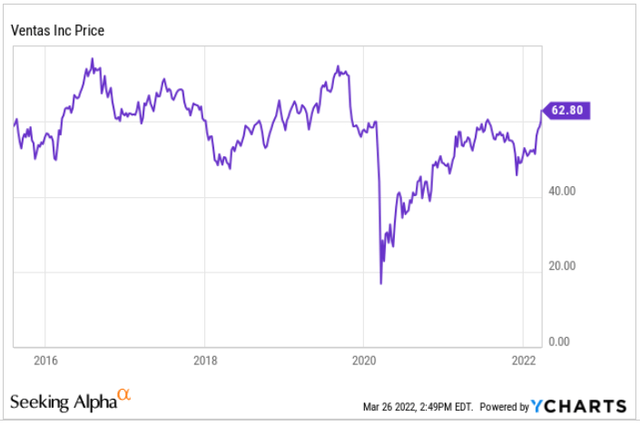

Another example is Site Centers (SITC) that spun off its 38 Continental US Assets & Puerto Rico Portfolio to form Retail Value (RVI).

Another example is Spirit Realty (SRC) than spun off 888 properties to form Spirit MTA (formerly SMTA). Shares in SMTA traded at $9.90 on 5/17/18 and by December 19th, 2019, shares were trading at $0.77, a -92.25% return.

Final example is Ventas (VTR) that spun out 355 skilled nursing properties to form Care Capital Properties (formerly CCP) in August 2015. CCP later sold to Sabra (SBRA) and since the spin (8-6-2015) VTR shares have returned 4.5% annually.

The point of the matter is that NONE of these REIT-to-REIT spin-cos were winners, and in fact, every single one was a loser.

What does that tell you?

Enter ONL

On March 24, ONL announced Q4-21 earnings that included the much-anticipated dividend announcement. While many of you (including me) are fixated on the dividend, let’s save the best for last…

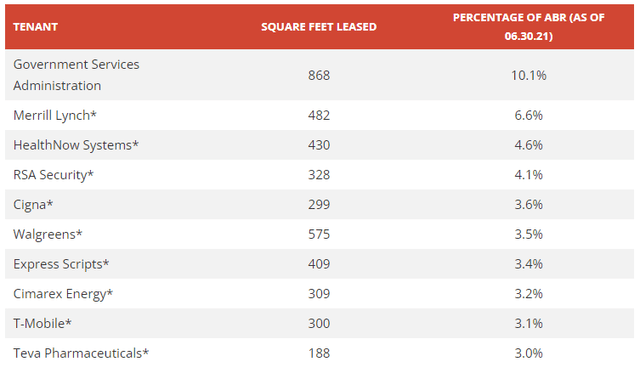

First off remember that ONL is a net lease REIT that owns office properties – 92 to be exact – and all of these free-standing buildings were formerly owned by Realty Income.

There were some positive things regarding the latest earnings results:

- ONL increased the weighted average lease term to 4.1 years.

- ONL signed lease extensions and expansions with key tenants at properties in Plano, TX (2-year extension for 54,000 sf).

- ONL signed lease extensions and expansions with key tenants at properties in Woodlands, TX (for approximately 41,000 square feet of vacant space with an existing tenant, which now leases 92% of the building on an 11-year lease term).

- ONL signed lease extensions and expansions with key tenants at properties in Augusta, GA (existing tenant executed a 5-year extension of the entire approximately 78,000 square feet).

- ONL signed an 11-year lease extension with Merrill Lynch, Pierce, Fenner & Smith Incorporated at three Class A office buildings located near Princeton, NJ, in Hopewell.

- ONL made solid progress on selling non-core assets and is in various stages of negotiation and agreement to sell 3 properties for approximately $21.4 million.

This is very good news for ONL, especially the Woodlands and Princeton lease that extended a lease for 11 years; that demonstrates management’s ability to increase its portfolio weighted average lease term.

PRAXAIR – THE WOODLANDS, TX

Much of the selloff today is related to the struggling office market, and the fact that many tenants have enhanced pricing power.

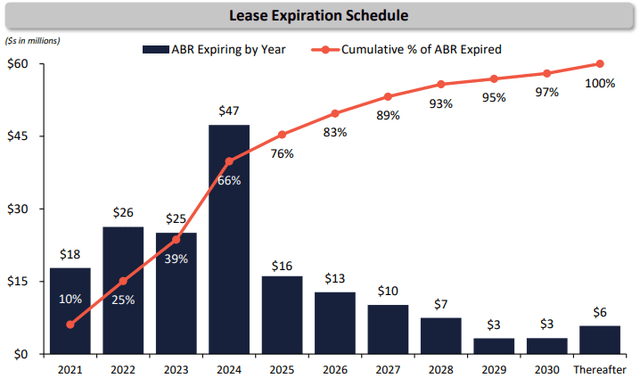

As leases come up for renewal, the cap-ex costs are astronomical, and this means that office landlords must be prepared to face the challenges related to re-leasing space and the demand of tenants that have an enhanced pressure on the REITs’ dividend payout ratio.

(*) Denotes Investment Grade

ONL’s balance sheet is in good shape, with total debt of $647.3 million, comprised of $175.0 million under the bank term loan, $90.0 million under the $425.0 million-capacity revolving credit facility, and $355.0 million under the short-term bridge loan.

Subsequent to year-end, ONL refinanced its short-term bridge loan with a $355 million five-year, 4.971% fixed-rate CMBS loan that is collateralized by 19 properties.

As part of closing the CMBS loan, the company deposited $35.5 million of required lender reserves (primarily for future rent concessions and tenant improvements) and that had an impact to our AFFO model (we had prepared 6 months ago).

As of March 15th, ONL had $346.4 million of liquidity, comprised of $12.4 million cash on hand and $334 million undrawn availability on the revolving credit facility.

The Dividend!

Given the fact that ONL spun out of Realty Income, legacy investors had high hopes that ONL would distribute earnings much like “the monthly dividend company”.

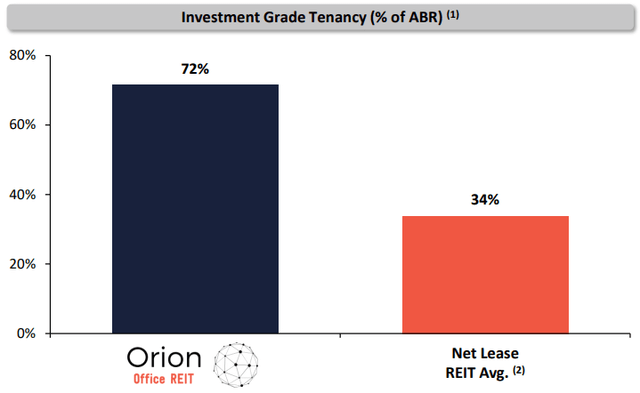

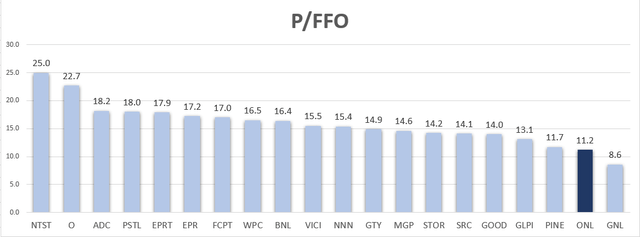

Recognizing that ONL compares itself to other net lease REITs, we were expecting to see a payout ratio of 65% or higher. For comparison, the payout ratio for our broader net lease coverage spectrum is 77.5% (source: iREIT on Alpha).

However, ONL announced that it would pay out a quarterly dividend of $.10 per share which equates to 24% on FFO and 41.6% based on FAD. Translating that to the share price right now (of $15.24), the current yield is just 2.6%.

Now you can see why some folks are running for the hills…

Alternatively, you can pick up shares in VICI Properties (VICI) with a 5.2% yield or Medical Properties (MPW) with a 5.7% yield….

So why own an office REIT that is yielding just 2.6%?

Here’s Why

I pointed out previously that most all REIT-to-REIT spins have been disasters, and the blame can be tied to either the business model (i.e. WPG’s tired malls) or management – and sometimes both.

With regard to ONL’s business model, I recognize that the office sector is suffering, yet I’m a stakeholder recognizing that my eyes are wide open. Many of ONL’s assets are located in sunbelt markets and there are also a few ugly ducklings.

While the company does have sizeable leases coming up for renewal, the opportunity is in the hands of management and their ability to execute, and create value creation. The company employs an active asset management team, and in order to create value, it must continue to drive up the WALT over the portfolio.

As I see it, if the company had announced a 70% payout ratio (vs. 40% based on FAD), shares would be trading up right now. However, as the CFO explained on the earnings call,

“The dividend was sized to permit future growth while preserving meaningful cash flow for reinvestment into the current portfolio and for accretive investments.”

As I mentioned previously, I know the CEO, Paul McDowell, as I followed CapLease (before the company was acquired by ARCP/VEREIT) closely. I do have confidence in Paul’s ability, recognizing of course that he (and his team) has a lot of wood to chop.

What Next?

Given the overall office headwinds, I don’t view ONL as a dividend growth story (like Realty Income).

Although there’s a wide cushion in terms of dividend safety, I consider the company a deep value play in which the multiple should be re-set upward as the company continues to increase its WALT over time. As I type, shares are now trading at $15.20, down 15.5% today:

ONL expects 2022 core FFO per share of $1.66 to $1.74 ($1.70 at the midpoint) and that translates into a P/FFO of 11.2x.

The average payout ratio (‘FFO’) for the office REIT sector is 55% (ONL is 24%) and I suspect that ONL will gradually increase its target payout ratio to 55%, by increasing the dividend by around 5% per year, based on its success at releasing and recycling.

I recognize that many retail investors are dumping ONL to deploy capital into dividend growth names like:

- Realty Income

- VICI Properties

- Innovative Industrial (IIPR)

- NewLake Capital (OTCQX:NLCP)

That makes perfect sense!

Personally, I’m going to watch this play out a bit, recognizing that ONL could pay out more (dividends), however, given the depressed pricing, I see this name as a deeper value play.

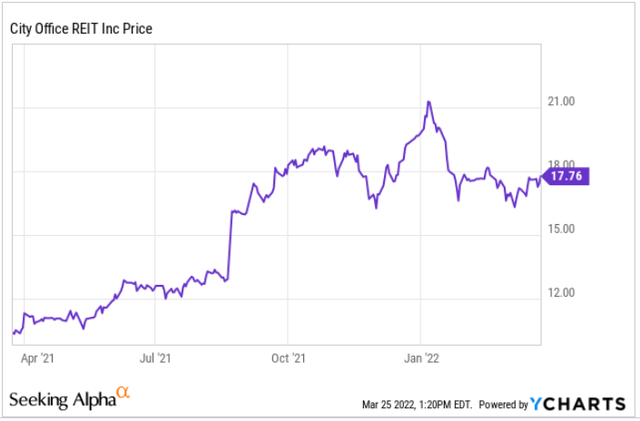

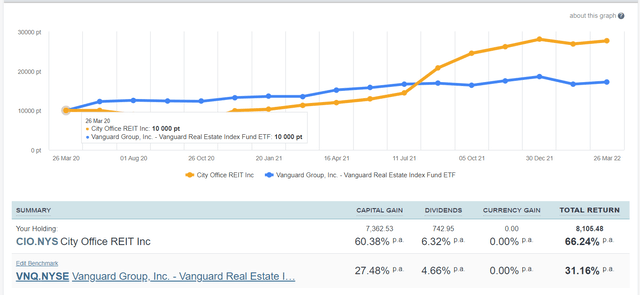

Do you remember my call with City Office (CIO)?

Prior to the pandemic, we were one of the few analysts bullish with the CIO name. Here are a few articles I wrote:

2018: City Office: A Strong-Buy REIT Yielding 8.5%

2019: City Office Is Poised To Profit

When the pandemic hit, we backed up the truck and bought an outsized position in the Small Cap portfolio. This is what happens when you exercise patience:

In Closing

I’m maintaining a Strong Buy, recognizing that ONL is not an income play, it’s a deep value play. For certain investors, fixated on income, I certainly understand the frustration and the reason for unloading shares.

However, I’m going to take another bite at the apple and buy more shares in the Small Cap Portfolio. This is the perfect portfolio for us, because it’s designed for medium risk investors, where most of the picks aren’t SWANs.

Bottom Line: If management can execute and continue to bolster its WALT, the value of the portfolio should increase, and shares should re-rate accordingly. We maintain a Speculative Strong Buy.

Be the first to comment