It is time to end the shorts.

SixFootSwede/iStock via Getty Images

Few things have provided more fun and accuracy than predicting that investors should dump Orchid Island Capital (NYSE:ORC) before they get wrecked.

We’ve got everything we could want:

- Multiple quarters of book value getting slammed.

- A reverse stock split.

- Dividend cuts.

It’s been a bear’s dream come true.

However, today, we’re going neutral on ORC. That doesn’t mean we expect them to fly back to over $23 (where they started the year). We’re not stupid. Going neutral simply means the risk/reward ratio that justified being bearish before is no longer in place. We’re not going to hit shares with a bullish rating, but we will end the bearish ones.

Seeking Alpha

Shares have been absolutely pummeled. Prices down over 50% year-to-date. That makes sense given the reduction in book value and dividends along with the general fear level in the market. However, the worst has already happened. The bear case occurred. This is the damage. It’s here, in the share price, already.

As of Friday, our estimate for BV per share is about $13.70. Our service has generally done very well on BV estimates throughout the sector. We will have the occasional miss, but we’re setting the bar for accuracy. If that estimate is right, then the price-to-book ratio is about .86. That’s not huge, given ORC’s tendency to lose book value faster than a child can lose a phone at the swimming pool. However, it’s a big enough margin of safety that the risk/reward ratio is no longer stacked firmly against investors. I remember all too well telling investors to dump ORC before the price-to-book ratio collapse. I remember it like it was only last month. Perhaps, because it was? I highlighted shares in 3 High Yielders to Dump After an Epic Rally.

We called out three REITs in our ratings from 08/01/2022:

Seeking Alpha

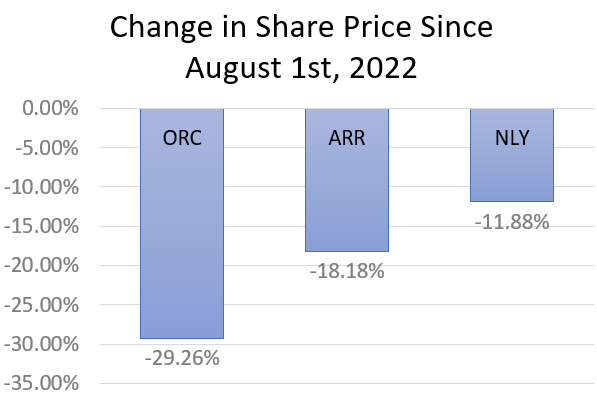

How did ORC, ARR, and NLY perform since then? Here’s the chart:

Investment performance

It was a good call to be bearish. To be fair, ORC and ARR have paid out monthly dividends to cushion that blow. So that’s something. Not much compared to the decline in share price, but it is something. Something small.

Why Neutral Today?

The negative events we were forecasting have largely come to pass. Sure, the dividend might get cut again within the not-so-distant future. If you assume a 16.7% dividend yield is safe, I can’t help you. However, the most obvious cut already occurred.

The price-to-book ratio fell from an absolutely absurd premium to a material discount to book.

The drop in book value included a dramatic widening of agency MBS spreads (relative to Treasuries), which is better for reinvesting capital. Some investors expect spreads to widen out dramatically as a result of the Federal Reserve’s plan to reduce exposure to agency MBS as it shoves the economy over a cliff.

However, we expected spreads to widen in advance of that event. That came to pass, with agency MBS spreads widening dramatically year-to-date. We can’t say precisely how far those spreads will widen. However, a mortgage REIT which closed all positions today (to clean up the accounting) would have impressive earnings. If they opened new positions (buying assets and entering into interest rate swaps), they would report very impressive net interest margins. That can be a hassle as the liquidity on lower-coupon fixed-rate MBS pools declines materially. Liquidity for newer MBS is much stronger. However, the expected yields at market prices should still be comparable.

What investors are seeing now is mortgage REITs posting lower asset yields on assets that trade well below face value, when compared to new assets at much higher yields. The damage already is written into book value, but it’s still flowing through earnings metrics.

Since spreads between agency MBS and Treasuries increased so dramatically, the book value that remains can be more productive. Yet many investors won’t see that. They will focus only on earnings coming from passing through historical costs. This is a challenge for investors to understand throughout the sector and it’s one I may prepare some articles to explain further.

Book Value Today

We’re not predicting that Q3 2022 was a great quarter. Thanks to recent moves in interest rates and spreads, we’re predicting further losses to book value for Q3 2022. Our current estimate (as of Friday) had BV projected at $13.70. That’s down from about $14.35 (adjusted for reverse split) from the end of Q2 2022.

That value will still change by the end of the quarter, but it gives investors a feel for the current valuation.

Conclusion

Orchid Island Capital was in a bad place. They were losing book value from MBS to Treasury spreads widening and from rates rising rapidly. They were in need of a dividend cut and a reverse split. Despite those issues, “investors” decided to pay a premium to book value even though there were safer (in my opinion) peers available at materially lower price-to-book ratios. The consequence of investors overpaying for ORC was a substantial drop in their portfolio value. That’s usually what happens when investors overpay.

As bad as the losses for ORC have been on a fundamental basis, they were not as bad as the decline in the share price. Due to a material swing in the price-to-book ratio, we’re calling off the bearish rating on ORC. Investors who were shorting ORC would be wise to take their gains and walk away. However, I’m not ready to suggest buying shares (other than closing shorts) just yet. The risk is still high, but the potential reward is also high. That’s a relatively balanced picture. It could drop further, or it might recover.

That isn’t “no opinion.” It’s ending a monstrous bearish call that saw ORC get taken behind the woodshed repeatedly. It’s telling investors that waited until this week to panic that they are much too late and telling investors shorting the stock to capture the alpha and change targets.

Be the first to comment