YinYang/iStock via Getty Images

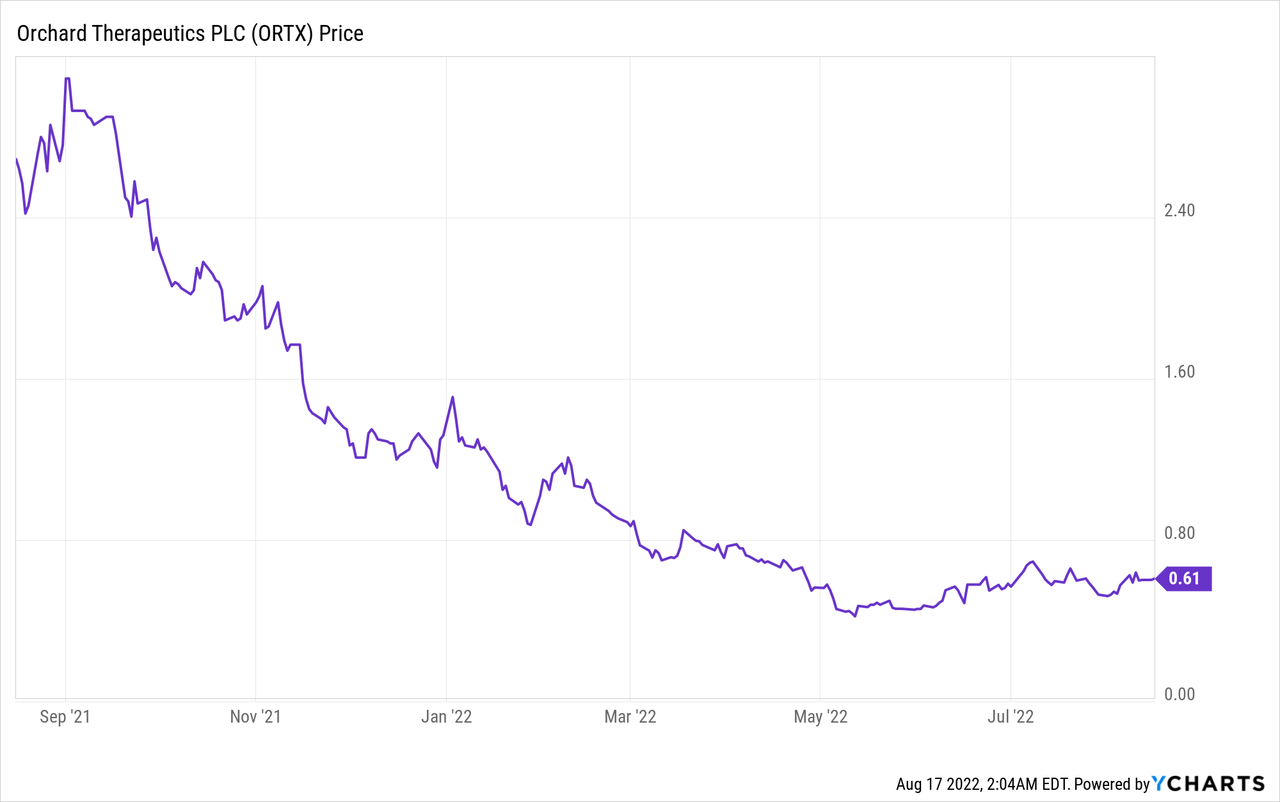

I became interested in ORTX after Singapore’s Temasek Holdings or the country’s biggest and state-owned investment fund boosted its holdings of Orchard Therapeutics Plc (NASDAQ:ORTX) from 1 million to 4.32 million shares at around $0.58 in the second quarter of this year. They may have bought the May dip as per in the chart below, but the stock remains down, by 78% during the last year.

This downtrend suggests that there is a low demand for its shares by investors, probably as profit margins are all negative and revenues for the second quarter of 2022 (Q2) have decreased to $4.4M from $5.5M on a sequential or quarter-to-quarter basis.

However, it has been improving revenues on a year-on-year basis, which signifies some progress in its products and services. Thus, the aim of this thesis is to provide further analysis, and I start by providing an overview of Orchard’s therapy.

Libmeldy to Combat MDL

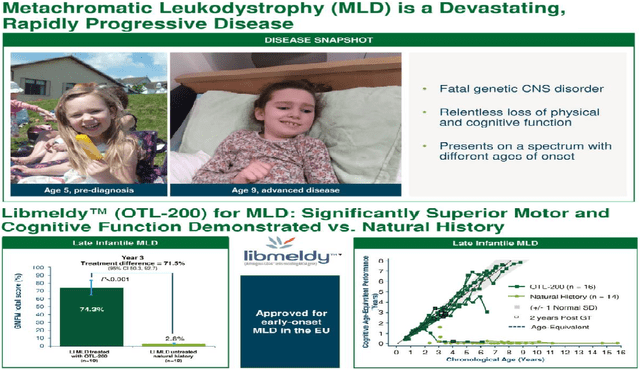

Orchard specializes in treating metachromatic leukodystrophy (“MDL”) which is characterized by mutations in the ARSA gene in turn leading to a reduction in related enzyme activity in affected children. This is a very rare genetic disease that can be fatal as it causes neurological damage and regression in cognitive (brain) development.

It appears either at the late infantile or early juvenile stage, sometimes without any early clinical manifestations (symptoms) of the disease, but, in other cases, it entails cognitive decline or memory loss. In its most severe and common forms, young children quickly lose the ability to walk and interact with people around them, and many die before adolescence.

MDL and Gene therapy (seekingalpha.com)

As a solution, Libmeldy also referred to as OTL-200 is the first European-approved therapy for patients with early-stage MLD who meet certain clinical eligibility criteria. In Europe, it was approved by the European Medicines Agency (“EMA”) in December 2020, making it the first and only approved treatment for this disease as there is no FDA-approved equivalent currently.

For this matter, Orchard is working with the FDA and anticipates approval for 2023, but, it is also important to consider alternative treatments.

Alternative Treatments

Libmeldy is a gene-based therapy that is based first on harvesting stem cells from the blood of patients. The next step is to modify them in order to replace the defective ARSA gene I mentioned earlier with a functional version. The final step is re-introduction into the body in a single intravenous infusion.

This makes it less invasive for patients compared to alternatives or more classical treatment methods for combating MLD, ranging from bone marrow, stem cell transplant, or cord blood. Also, these are still undergoing development and can only slow the progression of the disease, not stop it.

In these circumstances, one would think that with the FDA approving Libmeldy in 2023 for the highly-lucrative U.S. market, Orchard would suddenly start to reap a lot of sales. However, it is more complicated.

First, one problem with Libmeldy is its high cost of £2.8 million ($3.37 million), a reason why it has been labeled as the “World’s most expensive drug” after it was approved by the U.K.’s NHS or National Health Service. Thus, given that its revenues are around $5 million, this means that it has only been able to sell only one to two therapies.

Second, in the U.S., there are also other emerging therapies some of which are based on enzyme replacement developed by ArmaGen Technologies. There are also other gene-based therapies being developed, but most of these are in the preclinical phase.

Even then, these alternative therapies are being continuously developed as they have the capability to address different forms of the disease, not necessarily in its most severe form. At the same time, the classical treatments I mentioned earlier are also being refined in order to be rendered less invasive and can for example be used to treat motor function problems for children inflicted by MDL while leaving the cognitive part to more expensive gene therapy.

Therefore, while it does not face competition, Libmeldy’s high price means that Orchard will not rapidly capture market share, but rather see a gradual progression in sales, somewhat similar to the progression of its quarterly income figures since 2020 unless it finds some way to reduce prices and get more volume sales.

Revenue and Profitability

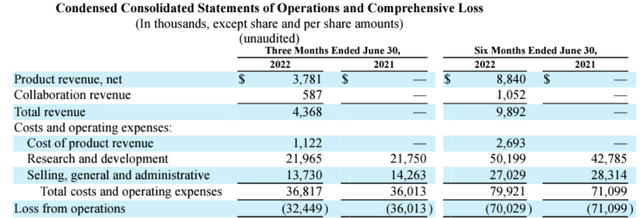

To deliver on revenue growth for Libmeldy in Europe, Orchard has secured agreements with health authorities in Germany, Italy, and the UK, for facilitating access and reimbursement for eligible patients. Currently, patient identification is in progress, and Orchard’s therapy is being assessed for reimbursement purposes in France, Spain, Belgium, Netherlands, Luxembourg, Austria, Finland, Norway, and Sweden. According to Orchard’s SEC filings, this will deliver more treatments in the second half of this year compared to the first one. Thus, H2-2022 should see more revenues than the $8.84 million for the first half as per the table below.

In addition to Libmeldy for MDL, Orchard has another product approved in the EU, which is Strimvelis. This is another gene therapy for the treatment of ADA-SCID, a condition whereby the body’s defenses stop working because of a deficiency in the genes. Thus, out of the total revenue of $3.8 million from product sales for Q2, $0.6 million was from Strimvelis and the rest from Libmeldy.

Statement of operations (www.seekingalpha.com)

As for expenses, these included the cost of product sales of $1.1 million, including manufacturing and royalties paid to third parties. Additionally, R&D expenses of $22.0 million for Q2, were up only by $0.2 million for the same period in 2021 with the expectation being for costs to decline in the H2-2022 due to updating of the research portfolio and associated workforce reduction as part of a restructuration.

In this respect, in addition to lab work and clinical trials, R&D also includes costs pertaining to regulatory activities in order to get Libmeldy approved in the U.S, including commercialization efforts for a potential launch in 2023. Thanks to the restructuring-related savings, the company was able to reduce operating expenses by $0.8 million in Q2, thereby reducing losses.

I find this cost reduction rationale as opposed to a business-as-normal strategy to be more aligned to the current high wage inflation impacting the U.K. where Orchard is based. Such an approach allows the company to use existing cash and not increase debt levels.

Valuations and Risks

Another positive is collaboration revenue of $0.6 million for OTL-105 with Pharming Group N.V. (NASDAQ:PHAR) in exchange for R&D work covering stem cell gene therapy for the treatment of hereditary angioedema, a life-threatening rare disorder.

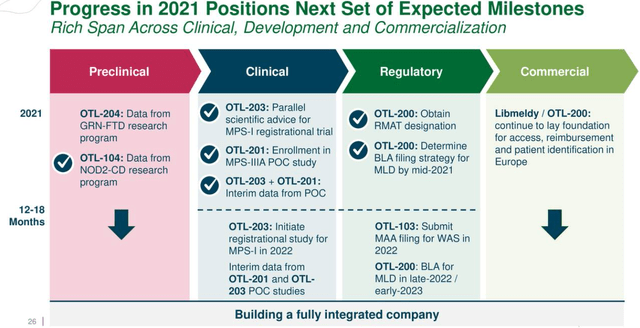

This shows that Orchard has a rich pipeline with other therapies at the preclinical, clinical, and regulatory levels (diagram below) which it can monetize as part of collaborations.

Progress and Milestones dated September 2021 (seekingalpha.com)

For investors, this pipeline signifies that in addition to getting approval by the FDA for Libmeldy, there are other catalysts that can propel the stock higher. To this end, the Pharma partnership I mentioned above has the potential to earn the company up to $189.5 million in milestone payments. Consequently, with a price-to-book value of only 0.53x, in my view, the company is undervalued. It could flirt back with the $1 level on new developments.

However, except for the collaboration route, investors should note that the company does not have the means to advance its rich pipeline above which dates back to September 2021, and as part of the March 2022 restructuring, it committed to focusing on severe neurometabolic diseases and early research programs, while discontinuing investment for OTL-103, OTL-102, and Strimvelis.

This disinvestment only provided a temporary respite to the stock and there is a possibility that with any delay in the approval of its therapy in other parts of Europe or the U.S., there could be further volatility. For this matter, Orchard has a market capitalization of less than $100 million and is a penny stock. Thus, it comes at higher trading risks and as such, some brokerages may not offer it to their clients.

Still, with cash of $170.9 million at the end of June, after consuming $26.4 million of cash in operations in Q2 (as a loss-making entity) and after the restructuring, the company has sufficient money to fund operating expenses and capital expenditure into 2024. Hence, since its financial position remains adequate, I consider that this is a stock to put on your watchlist.

Conclusion

Finally, as a pioneer in gene therapy for a rare disease facing no real competition, Orchard cannot be ignored, especially at the current unit price of $0.58. This said, before investing, a more cautious approach would be to wait for FDA approval as well as for the biotech to reduce the price of its expensive therapy to increase the probability of adoption in clinics. This would eventually depend on the cost of sales, which currently appear to be on the high side. Alternatively, Orchard may partner with a commercialization firm in the U.S. in order to reduce the amount it has to spend on marketing.

Be the first to comment