metamorworks

The year-long market sell-off has punished small-cap healthcare tickers regardless of their fundamentals or long-term outlook. On one hand, longstanding investors in these tickers are looking at significant losses for the year. On the other hand, the blanket selling has uncovered numerous breaks for investors to get involved in some promising tickers. Countless small-cap healthcare companies are trading at steep discounts with attractive risk-reward profiles. Orchard Therapeutics (NASDAQ:ORTX) is one of these tickers that, after losing approximately 65% of its value over the past twelve months, is trading with a negative enterprise value even though they could become a strong competitor in the gene therapy industry. As a result, I believe ORTX is a solid candidate for the Compounding Healthcare “Bio Boom” Portfolio and worthy of a speculative investment at these prices.

I intend to provide a brief background on Orchard Therapeutics and will present why ORTX deserves a spot in the Bio Boom Portfolio. In addition, I discuss some of ORTX’s downside risks. Finally, I present a game plan for growing my miniature ORTX position.

Background on Orchard Therapeutics

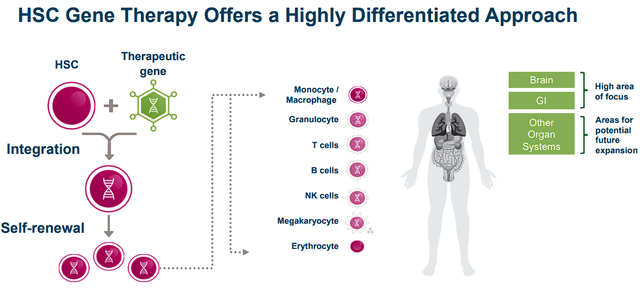

Orchard Therapeutics utilizes hematopoietic stem cell “HSC” gene therapies to develop potential cures for genetic and other severe diseases. Orchard employs the patient’s genetically modified HSCs to cure the primary cause of the patient’s genetic disease with a one-time administration.

Orchard Therapeutics HSC Gene Therapy Approach (Orchard Therapeutics)

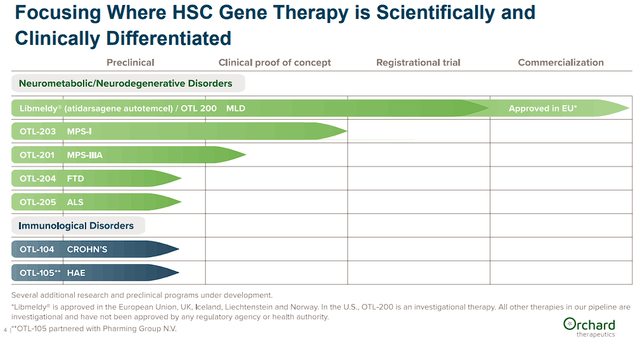

Orchard’s ex vivo autologous gene therapies across several diseases including Metachromatic leukodystrophy “MLD”, Mucopolysaccharidosis type I “MPS-I”, Mucopolysaccharidosis type IIIA “MPS-IIIA/Sanfilippo syndrome type A”, as well as FTD, ALS, Crohn’s, and HAE.

Orchard Therapeutics Pipeline (Orchard Therapeutics)

OTL-200 “Libmeldy” is the company’s ex vivo HSC gene therapy for the treatment of MLD, a life-threatening genetic disease that occurs in around one in every 100K births. The disease impacts the metabolic system that causes the buildup of fats in the brain, liver, gallbladder, and kidneys. Over time, the fatty deposits accumulate in the nervous system, which causes motor dysfunction, seizures, and behavioral and cognitive regression. Sadly, it is projected that “50% of children with the most aggressive form of MLD die within five years of disease onset.” Libmeldy uses a lentiviral vector encoding the ARSA gene to replace the faulty mutations in the ARSA gene, thus improving ARSA enzymatic activity to prevent further deterioration.

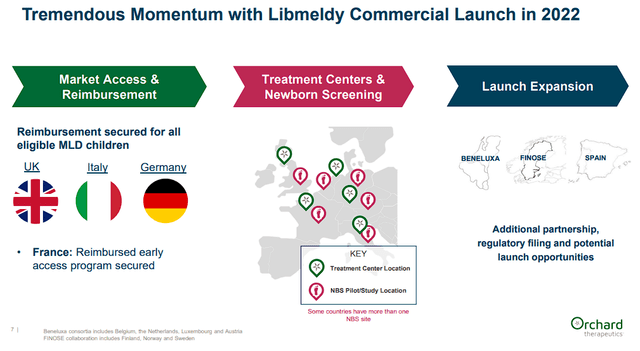

So far, Libmeldy was approved in Europe in 2020 as the first and only approved MLD treatment. Libmeldy is on the market in some European countries and has the potential to expand into other countries and regulatory jurisdictions including Switzerland.

Orchard Therapeutics Libmeldy Commercial Launch Update (Orchard Therapeutics)

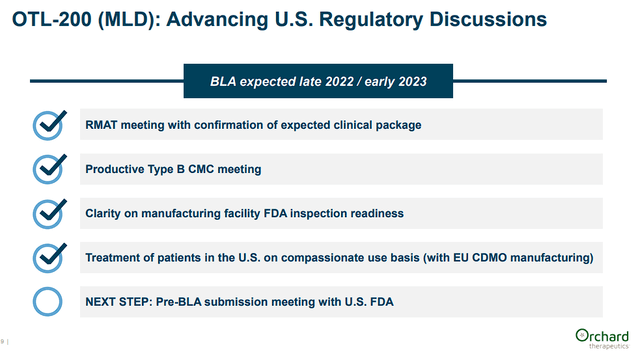

However, Libmeldy has not been approved by the FDA, but the company is expecting to submit a BLA late this year or early 2023.

Orchard Therapeutics Libmeldy With The FDA (Orchard Therapeutics)

The company also has Strimvelis, a gammaretroviral vector-based gene therapy that was approved by the EMA back in 2016 for adenosine deaminase deficiency “ADA-SCID” where patients have a severe combined immunodeficiency. Strimvelis was the first ex vivo autologous gene therapy approved by the EMA after being developed by GSK (GSK), who then sold it to Orchard. The gene therapy has produced some serious adverse reactions including autoimmune responses and a suspected case of leukemia that is believed to be attributable to the gene therapy’s gammaretroviral insertion. The company appears to have stopped supporting its commercial availability.

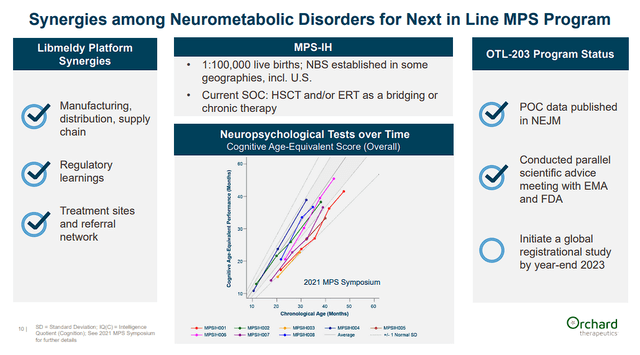

Orchard is also targeting other genetic neurometabolic diseases such as Mucopolysaccharidosis type I “MPS-I” and MPS-IIIA also known as Sanfilippo syndrome type A. Both of these neurometabolic diseases impact several organs and functions. The company believes their clinical success with Libmeldy will synergize with their MPS programs.

Orchard Therapeutics Platform Synergies (Orchard Therapeutics)

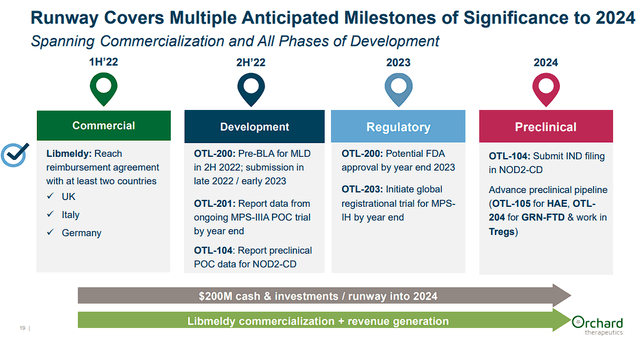

In terms of financials, the company’s commercial launch of Libmeldy is starting to show some traction, which has led to $13M in product revenue year-to-date. However, the company’s OpEx resulted in a $25M loss from operations and a net loss of $47.5M for the quarter. Luckily, the company finished Q3 with roughly $146M in cash and cash equivalents, which the company believes will be adequate to fund the company into Q2 of 2024. The company projects to hit several key milestones between now and the end of 2024 including a potential FDA approval of Libmeldy by the year-end of 2023.

Orchard Therapeutics Upcoming Milestones (Orchard Therapeutics)

ORTX as a Bio Boom Candidate

The Bio Boom Portfolio holds healthcare companies that are typically not profitable and are seen as a speculative ticker, yet, they offer considerable upside due to a potent impending catalyst, expected revenue growth, or a prospective turnaround. Usually, these are small to mid-cap companies with volatile tickers that will offer repetitive trading opportunities that can generate considerable profit while growing a “house money” position over time. These tickers are traded provided they are still in play or until the company advances to the “Bioreactor” growth portfolio.

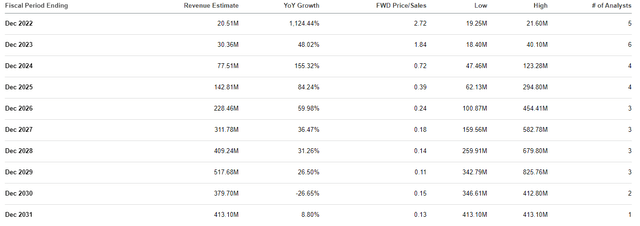

I believe ORTX does have several Bio Boom characteristics that indicate remarkable upside potential from these current prices. First and foremost, I believe ORTX is trading at a discount for its current conditions and future growth. In terms of valuation, ORTX is trading at a roughly $55M market cap with a price-to-book of 0.45 and an enterprise value of about -$32M. What is more, ORTX has a price-to-sales of 2.72x, which is under the industry average of 4x-5x. Looking ahead, the Street expects Orchard to report strong double-digit and triple-digit growth for the remainder of the decade to hit roughly $500M in 2029, which would be a ~0.1x forward price-to-sales.

Orchard Therapeutics Revenue Estimates (Orchard Therapeutics)

If the stock were to be in line with its peers, we could see ORTX trading around $20.50 per share near the end of the decade. Indeed, Orchard will almost certainly have to implement some dilutive funding, and we can’t bank on these estimates. Nevertheless, these estimations do illustrate ORTX’s upside potential, which is an essential feature of a Bio Boom ticker.

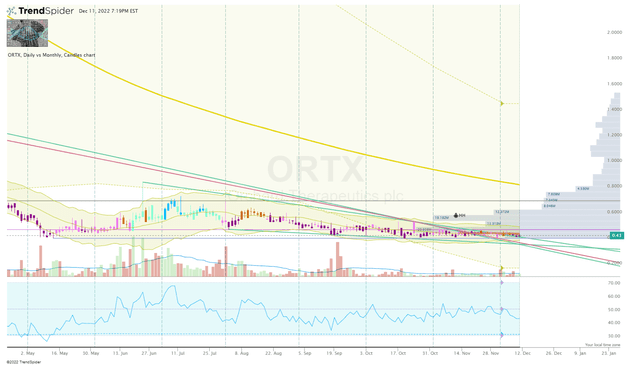

Another characteristic to consider is the ticker’s oversold state, which is attributable to the market-wide sell-off that has crushed small-cap healthcare stocks. In fact, ORTX has lost more than 65% of its value over the past twelve months and has been “basing” at the bottom of the monthly Keltner Channel since May of this year. If the small-cap stocks see a rebound in the coming months, ORTX could make a big move if it chews through the anchored volume up to $0.65 per share.

ORTX Daily Chart (Trendspider)

ORTX Daily Chart Enhanced View (Trendspider)

A breakout move could provide an opening to book significant profit and changeover ORTX to a “house money” status.

Another “Bio Boom” characteristic is ORTX’s long-term investment prospects. Orchard appears to have the platform and pipeline to be a tough competitor in gene therapies. The company’s robust cash position should be enough to get Libmeldy through the FDA and onto the market in the United States, which should have a dramatic impact on the company’s long-term outlook.

Basically, ORTX has traded sideways for most of the year, so a strong catalyst could trigger a powerful move that could permit a quick profit, while still having the foundations needed to become a potential multi-bagger in the coming years.

Downside Risks

ORTX has a number of downside risks that investors need to consider when managing a position. Firstly, Libmeldy is considered the “World’s most expensive drug” with a cost of £2.8M (~$3.37M). This is obviously a concern for payers and could be a huge barrier if Libmeldy is approved in the United States. Indeed, the possibility of curing the disease should outweigh the costs, but insurance companies need to see that the costs of therapy are a better financial option than other forms of treatment. This issue can be a concern for most gene therapies, so Orchard could be dealing with this worry beyond Libmeldy.

One more concern is competition, who are well funded and have imposing technology that could deliver superior treatments or outperform Orchard on the market. Another risk comes from the company’s finances, which could be a threat in the coming years as the company attempts to progress their preclinical and early-stage programs. It is conceivable that Orchard will have to execute some form of dilutive funding in the coming years to support their operations.

Understandably, these issues could turn out to be significant impediments to the company and the ORTX’s performance. As a result, I am giving ORTX a conviction level of 1 out of 5 at this point in time.

My Game Plan

First off, I must concede that ORTX will not be a chief component of the Bio Boom Portfolio, nevertheless, I am willing to grow a position in the coming months as we wait for an update on the BLA filing. I suspect that we will see a brief spike in the share price after they announce an update, but will see some selling pressure in the subsequent trading days. Therefore, I will look to book some profits on a spike in the share price and will reapply those profits at a later date as the share price reverts back to its current trading range, which is currently around $0.45-$0.50 per share. Once I have reapplied the profits, I will look to make diminutive additions intermittently during the course of 2023 when I see a solid reversal setup below my Buy Threshold of $0.75 per share.

My overall objective is to grow a respectable position ahead of a potential FDA approval and remove my initial investment on a spike in the share price in order to transition my ORTX position into a “house money” state for a long-term investment. Thus, I will still have some of my ORTX shares on the table for the stock’s upside potential, but it will only be profits at risk.

It is important to note that ORTX is still speculative with substantial downside risks at this time. It is conceivable an investor could lose the bulk or all of their investment.

Be the first to comment