da-kuk

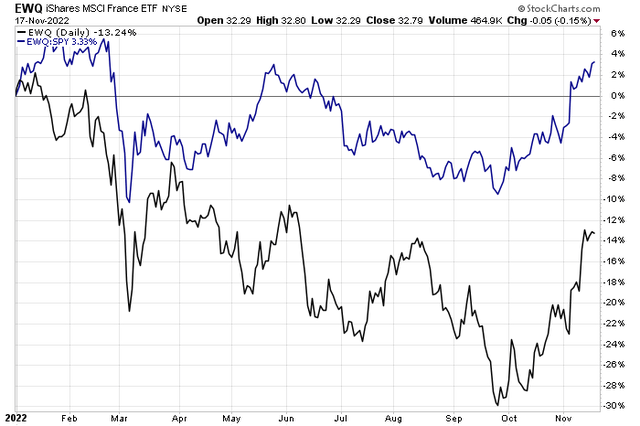

Amid a year of major turmoil across Europe, the French market is actually beating U.S. stocks. The iShares MSCI France ETF (EWQ) is down 13% total return in 2022 – that’s more than three percentage points of alpha versus the S&P 500 ETF (SPY).

One telecom firm headquartered in Paris recently reported in-line earnings and features a big dividend yield. Is there upside in the stock price though? Let’s go through the risks and potential.

France > USA So Far in 2022

According to Bank of America Global Research, Orange (NYSE:ORAN) is the incumbent provider of telecom services in France and also owns a broad portfolio of international telecom assets in both Europe and Africa, the largest of which are in Spain and Poland. The firm also operates a large corporate / IT services business and a tower infrastructure unit.

The France-based $27.0 billion market cap Diversified Telecommunication Services industry company within the Communication Services sector trades at a low 5.6 trailing 12-month GAAP price-to-earnings ratio and pays a high 5.7% dividend yield, according to The Wall Street Journal.

The company is well-positioned to benefit from France’s fiber-to-the-home (FTTH) rollout, but there are concerns about Orange’s ability to generate profits and free cash flow for shareholders. The strength of recurring revenues once the FTTH initiatives are completed is a question mark. Another risk is how large Orange is – its conglomerate nature is more often than not an earnings detractor rather than a synergy generator. More broadly, mobile pricing pressure could weigh on its management team’s execution along with cost-cutting, which are possible perils. On the upside, though, are accretive asset sales, market consolidation across Europe, and favorable legislation.

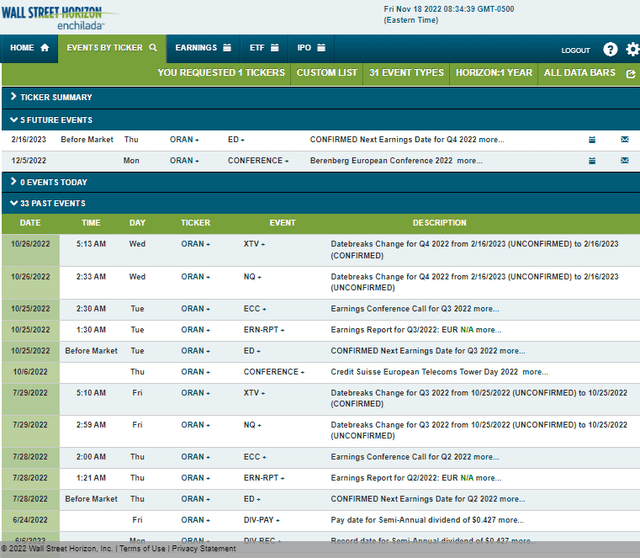

The company reported in-line Q3 results in October which included mixed guidance. Investors should mark February 16 on their calendars for potential volatility – that’s when the new CEO will set an outlook to 2030 on capital allocation and capex.

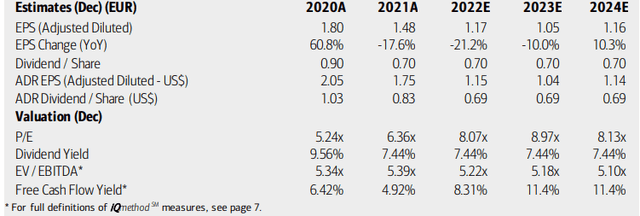

On valuation, analysts at BofA see earnings (ADR USD) falling sharply in 2022 but then troughing next year. A slight rebound is seen in 2024. The dividend is expected to hold steady near $0.69, resulting in a yield still north of 5%. Orange’s earnings multiple remains very low – even below the European market’s P/E while the EV/EBITDA ratio is also attractive. Finally, while there are free cash flow risks, the FCF yield is seen as growing very strong – north of 11%. That should help protect the dividend.

Orange: Earnings, Valuation, Dividend Yield Forecasts

Looking ahead, corporate event data from Wall Street Horizon shows a confirmed Q4 2022 earnings date of Thursday, February 16 before market open. Before that event, however, Orange’s management team is slated to speak at the Berenberg European Conference 2022 from December 5 through 8. Important industry and firm-specific news and updates often cross the news wires at these events, causing share price volatility.

Corporate Event Calendar

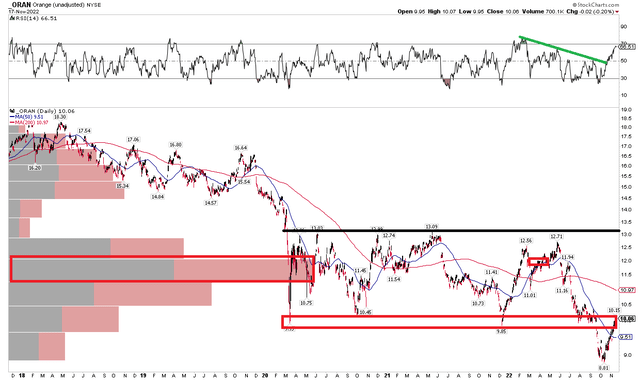

The Technical Take

ORAN shares fell below critical support under $10 recently. I see about $9.85 to $10.50 as a key zone on this ADR. We are right at that level now. If the stock can climb above $10.50, that would help cement the possibility of a bullish false breakdown. Notice how the RSI indicator up top has already broken out –that’s a bullish harbinger of potential stock price upside. Unfortunately for the bulls, I also notice a high volume of shares traded in the $11 to $12 area – another layer of support along with where the falling 200-day moving average comes into play. There are certainly some headwinds for the bulls. Really, the stock needs to get above $13 to break the downtrend.

ORAN: Near Critical Resistance, A Downtrend Persists

The Bottom Line

I like the valuation on ORAN, but there are growth risks in the short-run while the chart leans more bearish than bullish. Keep an eye on this one should it break above $13.

Be the first to comment