AegeanBlue

Last week, Coffee Holding (NASDAQ:JVA), a small company specializing in the highly competitive coffee roasting, packaging and distribution business surprised market participants by announcing a reverse merger transaction with Delta Corp Holdings Limited (“Delta”) which brands itself a “fast-growing, asset-light third-party logistics company”:

Delta is a fully-integrated, global business engaged in logistics, fuel supply and asset management related services, primarily servicing the international supply chains of commodity, energy, and capital goods producers. Delta has been in operation since 2019 and its businesses facilitate the global trade of energy, raw materials, intermediate goods, and agricultural products. Delta is a multinational business with over 80 personnel and has a global footprint through a network of offices in ten countries throughout Europe, the Middle East and Asia.

Delta’s business is asset-light, and it relies on its people, technology, customer relationships and differentiated service offerings to drive its business and its growth. Delta believes its asset-light business model differentiates it from competitors and leads to greater profitability while reducing risk. Delta has leadership positions in niche markets where it has a unique competitive advantage which allows it to leverage its broad portfolio of service offerings to reduce its customers’ logistics costs while enhancing its profitability.

Delta operates its business through three segments: Bulk Logistics, Energy Logistics and Asset Management. Each segment is headed by proven management teams which share a commitment to the value of client focus and a vision of setting a new standard of excellence within the sectors in which Delta operates. Delta seeks high-growth niche opportunities within its core business offerings or adjacent industries and leverages its diverse service offering to penetrate its markets.

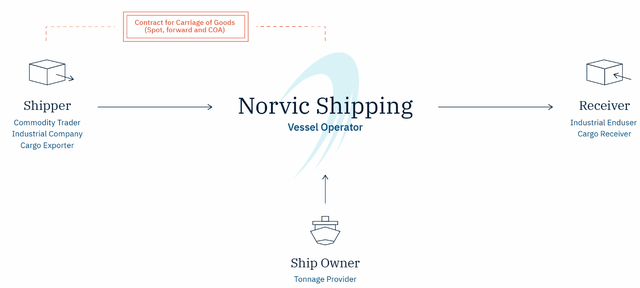

In layman’s terms, Delta appears to be mostly a shipping business founded in 2019 by a number of former leading employees of Norvic Shipping, which apparently provided the blueprint for Delta’s business model:

Norvic Shipping

Neither Norvic Shipping nor Delta own any of the vessels employed by them. Consequently, their profit margin is largely determined by the difference between the charter-in rates for the vessels and rates charged to customers.

That said, Delta has also established bunkering operations last year and acquired Singapore-based startup Quantship, “a pioneering AI platform, which utilizes cutting edge quant algorithms to unlock value in freight markets”.

Just recently, the company started a carbon credit trading desk “to support the growing ESG demands of ship owners and cargo charterers“.

While the business model provides more flexibility to respond to inevitable market fluctuations, it is not necessarily bullet-proof as rapidly dropping charter rates (like experienced in the dry bulk markets in recent months) might leave the company with expensive chartered-in vessels for some time.

In the merger press release, Delta claimed $532 million in revenue and $45 million in net income for 2021 but investors should keep in mind that 2021 was an exceptional year for dry bulk shippers with rates at levels not seen in more than a decade. In contrast, Delta’s net income was below $5 million in 2020.

Given the recent weakness in dry bulk charter rates, I would expect Delta’s results for 2022 to show very meaningful year-over-year declines with net income being a fraction of last year’s number.

With the company lacking hard assets and considering the volatility of the shipping markets, Delta’s implied merger valuation of close to $600 million looks mind-boggling, particularly with closest U.S. exchange-traded peer Pangaea Logistics Solutions (PANL) trading at a fraction of that number despite owning 24 dry bulk carriers.

Quite frankly, I have no idea how the company’s financial advisors arrived at their numbers but Coffee Holding’s upcoming S-4 filing with the SEC should provide more insights.

While it’s difficult to assign a more reasonable valuation to Delta without any kind of financial statements at hand, even an enterprise value of just $100 million appears rather generous to me at this point given the company’s apparent dependence on its leadership team and key customer relationships.

Coffee Holdings will become a wholly-owned subsidiary of a newly-formed, Nasdaq-listed holding company with no changes to corporate leadership.

Upon closing of the transaction which is currently expected in Q1/2023, the ticker symbol will be changed to “DLOG”. Existing shareholders of Coffee Holdings are going to own 4.79% of the combined company subject to dilution from a potential $50 million earnout payment due to former Delta equity holders in common stock should the company’s 2023 net income reach $70 million or more.

Bottom Line

While I have no doubt about Delta being a perfectly legal and viable entity, the valuation assigned to the business in the proposed reverse merger transaction doesn’t make any sense to me.

As evidenced by the muted reaction in Coffee Holding’s common shares, market participants appear to be skeptical, too but even at the current trading price, the combined company would be valued at more than $300 million which looks wildly exaggerated to me at this point.

Even at a little more than half of the $595 million valuation assigned to the company by its advisors, I would assume early investors in Delta being happy sellers once the transaction has closed.

In any way, Delta’s desire to become a publicly-traded entity doesn’t bode well for existing Coffee Holdings shareholders as the company is either looking to raise capital or provide early investors the possibility to exit their holdings or even both.

Lastly, I wouldn’t be surprised to see senior officers Andrew and David Gordon buying back Coffee Holdings from Delta for a tiny fraction of the agreed purchase price thus increasing their stake in the company founded by their father and grandfather to 100% while getting rid of the expenses and disclosure requirements associated with a publicly-listed company.

Given the issues discussed above, I would strongly advise equity holders in Coffee Holdings to consider selling their shares should the agreed 20-day “Go-Shop Period” (From the date of the Merger Agreement until October 19, 2022) not result in a superior offer for the business.

I will revisit the shares once Coffee Holdings has filed its form S-4 with the SEC which could take a couple of weeks or even months.

Be the first to comment