arild lilleboe

HLX Beefs Up

I discussed Helix Energy’s (NYSE:HLX) strategies in detail in my previous article here. Helix’s Alliance acquisition has prominently placed it among the key oil and gas offshore field abandonment operators in the GoM. Its Robotics business is expected to garner a sizeable part of a fast-expanding market. Some of its well-intervention contracts (including Helix 2 and Q7000) have received contract extensions in recent times. So, I expect the vessel utilization to remain strong in 2023, which will keep the well intervention rate elevated.

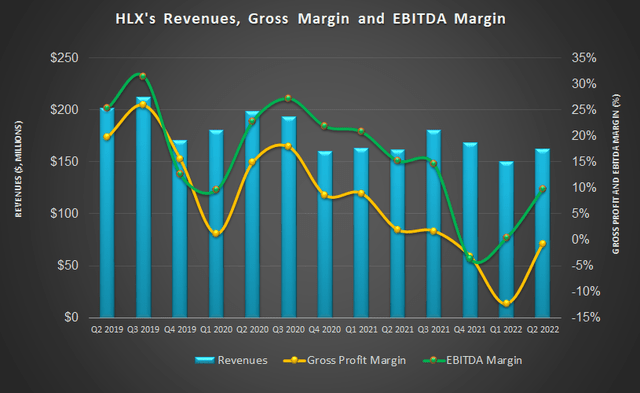

However, project slowness would keep utilization low in the North Sea, while the planned regulatory maintenance period in West Africa would also be a drag on the performance. The downtime issue also caused cash flows to turn negative in 1H 2022. Valuation-wise, the stock looks to have a marginal downside versus its peers. Nonetheless, an improving energy environment should entice investors to hold it for an upside in the medium term.

The Acquisition Benefits

Let us look at Helix’s transition in the near term. After the Alliance group acquisition (May 2022), it became a significant player in oil and gas offshore field abandonment operations. From an oil field service company, it will work on maximizing the remaining reserves. Plus, it will provide specialist support services to the offshore wind market.

The rationale behind the Alliance acquisition lies in the regulatory and commercial pressure, which led to the abandonment and removal of many Gulf of Mexico oil and gas fields. The company’s management believes that demand will be sustained over the long term. In FY2022, Alliance is forecast to generate $30 million to $40 million of EBITDA. FY2023 can earn $30 million to $50 million in EBITDA. However, the company has retained cash on the balance sheet due to poor visibility and uncertainty in the market. It may also repay convertible debts at maturity.

Asset Utilization Is Up

In Q2, HLX witnessed a well intervention rate revival. It was up 30% to 45% over the past six months. The recovery varied from 15% to 70%, varying from case to case. It looks to increase further in 2023. However, the company does not currently offer rates beyond 2024 because it is uncertain of the medium-to-long-term market condition.

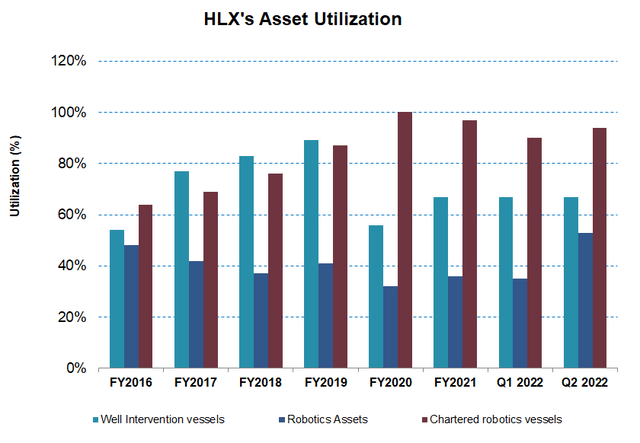

In Q2, HLX’s Well Intervention vessel fleets achieved 67% global utilization, which remained unchanged compared to Q1. While utilization remained high in the Gulf of Mexico and Brazil, it was low (44%) in the North Sea and West Africa. The planned regulatory maintenance period in West Africa caused utilization to remain low. The Q4000 also recorded low utilization (66%) as regulatory maintenance work continued in a multi-well campaign. However, the utilization is expected to improve in 2H 2022, the commencement of a two-well abandonment work. Q4000 and Q5000 should improve utilization in 2H 2022 with contracts and awards. Rates, too, can go 40% to 50% higher than the previous year.

Robotics Business Scenario

In the Robotics business, the trenching vessel base is expected to extend over 300 by 2028. Here, the global market will contract a significant portion of its services. The company also leverages its expertise in Robotics in the renewables market. Its Robotic Jet trenching services would be vital in the offshore wind market. Plus, the segment’s site clearance for the wind farms required before installation would also turn out to be an essential growth driver.

Tracking Q7000 and Brazil Operations

HLX’s most modern vessel, Q7000, completed its regulatory maintenance and inspection program in Q2. It is scheduled to undertake a dry dock in preparation for contracted work in New Zealand in 2023. After that, it will transit to Australia in a well-abandonment campaign in 2H 2023. So, after some uncertainty and a scheduled downtime in early 2023, the vessel’s near-term prospect is set with sufficient work in Australia, West Africa, and Brazil in 2023 and onwards.

HLX’s performance in Brazil was strong, with 99% utilization clocked for Siem Helix 2 in Q2. This included production enhancement work on three wells and abandonment on one. It is contracted to Petrobras (PBR) until the end of 2022. Siem Helix 2 entered a two-year extension of its well-intervention charter and services contracts with PBR in September. The rate may also be revised in December 2022. Brazil’s energy market will also be more diversified, with more operators taking further field ownership.

Analyzing The Q2 drivers

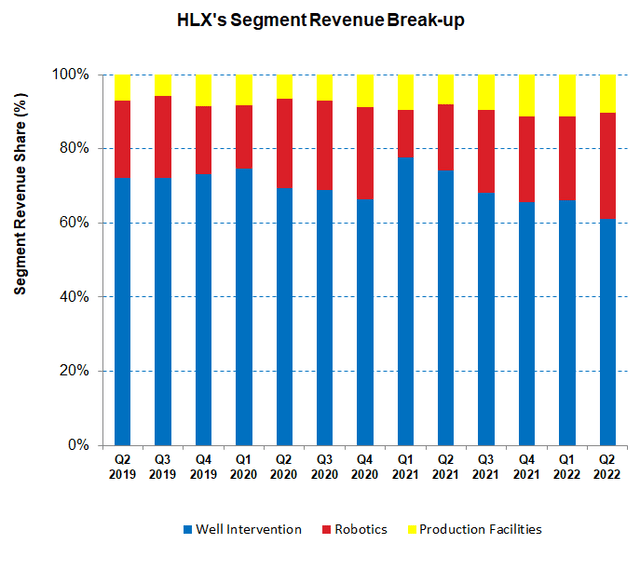

In Q2 2022, HLX’s revenues from the Well Intervention segment remained unchanged compared to Q1 2022, while the segment operating loss lessened. In Q2, the company undertook regulatory maintenance on six vessels in the North Sea. Also, there was uncertainty and low visibility for the Q7000 vessel. Plus, the submarket rates for Siem Helix 1 and Siem Helix 2.

The Robotics segment witnessed a 33% sequential revenue rise in Q2, resulting in operating income zooming by 553% quarter-over-quarter. These assets achieved utilization of 94%, up from 90% in Q1. In the past year until 1H 2022, the segment growth profit margin increased from 3% to 17%.

Cash Flows And Debt

The company’s operating cash flow (or CFO) turned negative in 1H 2022 compared to a positive CFO a year ago. Although revenues did not change much, a rise in working capital requirements and increased expenses on regulatory recertification costs resulted in the CFO’s fall. Naturally, free cash flows deteriorated significantly and turned negative in this period.

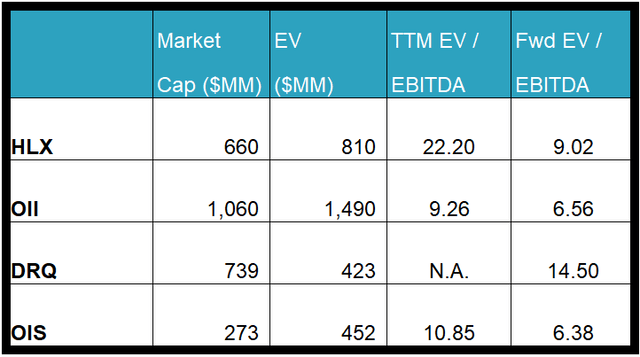

HLX’s liquidity is strong ($321 million). It does not face any significant repayment risk in the near term. Its debt-to-equity ratio (0.17x) is lower than its peers Oceaneering International (OII) and Oil States International (OIS). During Q2, it made a $35 million payment on its senior convertible notes. On July 1, it also increased its ABL facility by $20 million.

Relative Valuation And Target Price

The stock’s forward EV-to-EBITDA multiple contraction versus the current EV/EBITDA is steeper than its peers. This typically results in a higher EV/EBITDA multiple compared to peers. The company’s EV/EBITDA multiple (22.2x) is much higher than its peers’ (OII, DRQ, and OIS) average (10.1x). I believe the stock is reasonably valued at this level with a negative bias.

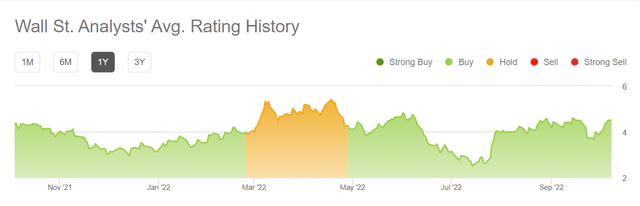

According to the sell-side analysts’ estimates, HLX’s target price is $6.1, which, at the current price, yields ~34% upside. During the past 90- days, five Wall-street analysts rated it a “Buy.” One analyst rated it a “Hold,” while one recommended a “Sell.”

Why Do I Keep My Rating Unchanged?

My previous article was relatively conservative about HLX’s outlook. I discussed that the energy market environment gradually improved with increased drilling in the US Gulf of Mexico and international territories. However, the contracts were short-term. Q7000 would be down with low utilization after the maintenance work, while the primary concerns were seasonality and low volume. I wrote:

The backlog of abandonment continues to grow in the Gulf of Mexico and many other international territories. However, the general oversupply in the oilfield service sector and project slowdown in the North Sea can upset its short-term plans.

After Q2, the momentum has shifted as the industry activity accelerates. The well intervention rate will improve in 2H 2022. Q7000’s outlook is much brighter with an extended work spectrum in 2023. However, some concerns prevail, including project slowdown in international geographies and maintenance work-related downtime. Relative valuation-wise, the stock is not attractive. So, I kept the rating unchanged with a “hold.”

What’s The Take On HLX?

In Q2, Helix’s asset utilization improved sharply versus a quarter ago and is likely to remain strong in Q3, going into 2023. Recently, the company’s Siem Helix 2 entered a two-year extension of its well intervention charter and services contracts with PBR in Brazil. The well intervention rate will also improve in 2H 2022. In the Robotics business, the trenching vessel base is expected to extend significantly in the medium term, which should benefit the company.

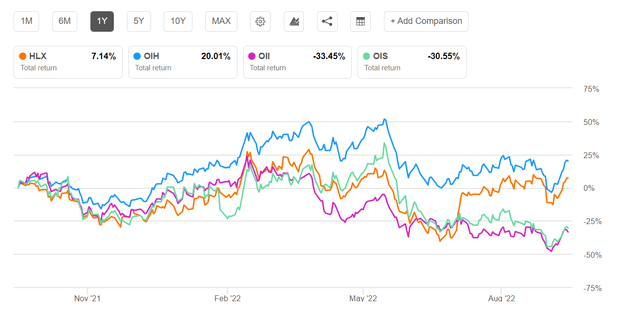

Despite the favorable factors, the general oversupply in the oilfield service sector and project slowdown in the North Sea will remain a drag. So, the stock price underperformed the VanEck Vectors Oil Services ETF (OIH) in the past year. I suggest investors hold it for an upside in the medium term.

Be the first to comment