Stockfoo

Twitter (NYSE:TWTR) is much in the news in recent days as a result of Elon Musk backing out of his acquisition and Twitter suing Musk to force him to complete the deal. The drama around the acquisition has occurred against a backdrop of a collapse in Twitter’s share price over the past year. Last I analysed Twitter was in May 2021.

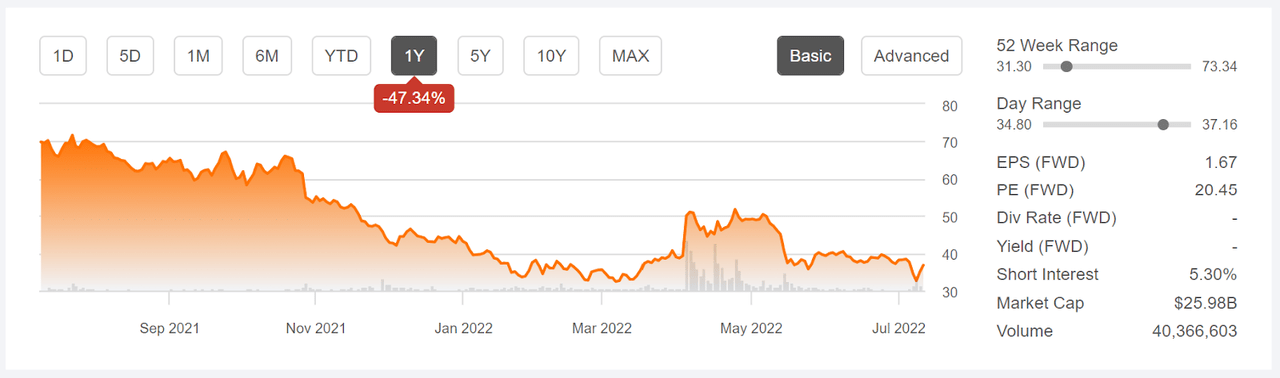

TWTR is down more than 47% over the past 12 months, as compared to a price decline of 21.2% for the NASDAQ 100 (QQQ) and a decline of 13.26% for the S&P 500 (SPY). While the shares spiked upwards in early April on news of Musk buying a 9% stake. On April 25th, Twitter announced that it had entered into a deal to be acquired by Musk at $54.20 per share. TWTR closed at $51.70 on April 25th but has subsequently declined 29% and currently trade at $36.80.

Seeking Alpha

12-Month price history and basic statistics for TWTR (Source: Seeking Alpha)

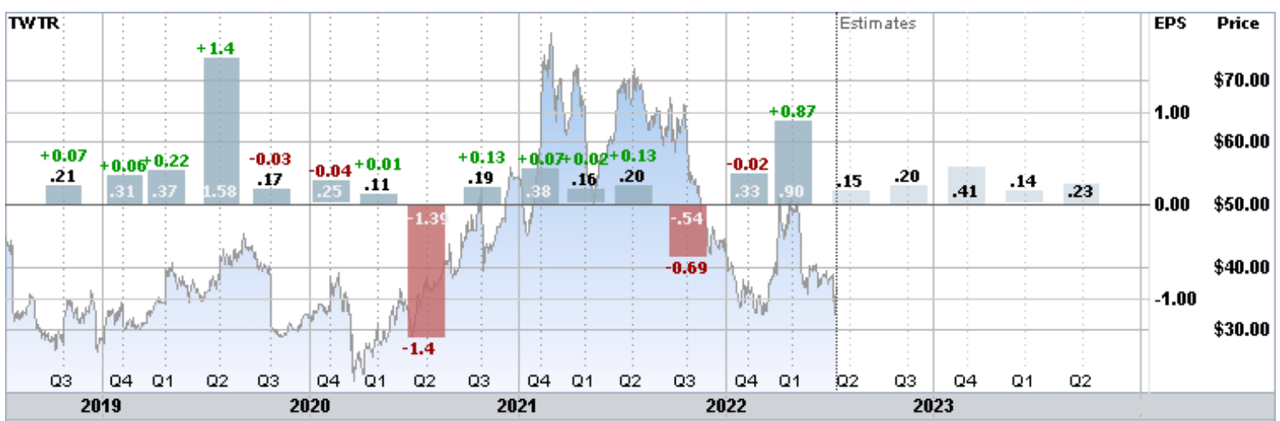

TWTR’s earnings history is so volatile that it is impossible to detect any long-term trend. The company has a history of reporting earnings in individual quarters that are either far above or far below expectations. The instability of the historical earnings make me rather skeptical about the usefulness of forward earnings estimates. Consider, for example, that the trailing 12-month P/E is 140.7 (Source: E-Trade), vs. the forward P/E (using estimated future earnings) of 20.45.

E-Trade

Trailing 4-year and estimated future quarterly EPS for TWTR. Green (red) values are amounts by which EPS beat (missed) the consensus expected value (Source: E-Trade)

Perhaps the biggest question in looking at Twitter is how one discounts the odds on the acquisition going through. This may, in fact, matter more than the fundamentals. Mr. Musk set an anchor price of about $54 per share, but the shares have traded in the mid-to-high $30’s in the months prior to Mr. Musk’s offer and as the deal has unraveled.

I last wrote about TWTR on May 3, 2021, at which time I assigned a bearish / sell rating. At that time, the Wall Street consensus rating on the shares was either bullish or neutral, depending on the source of the consensus. E-Trade’s calculation of the Wall Street consensus rating was bullish and Seeking Alpha’s was neutral. Both had consensus 12-month price targets that were far above the share price at that time (+33% for E-Trade and +27% for Seeking Alpha). By contrast, the consensus view implied by options prices, the market-implied outlook, was decidedly bearish. Considering the high valuation, the large spread in analyst price targets (which reduces confidence in the usefulness of the consensus), I discounted the Wall Street consensus and assigned a bearish overall rating on the shares.

Seeking Alpha

Previous analysis of TWTR and subsequent performance vs. the S&P 500 (Source: Seeking Alpha)

For readers who are unfamiliar with the market-implied outlook, a brief explanation is needed. The price of an option on a stock is largely determined by the market’s consensus estimate of the probability that the stock price will rise above (call option) or fall below (put option) a specific level (the option strike price) between now and when the option expires. By analyzing the prices of call and put options at a range of strike prices, all with the same expiration date, it is possible to calculate a probabilistic price forecast that reconciles the options prices. This is the market-implied outlook. For a deeper explanation and background, I recommend this monograph published by the CFA Institute.

With TWTR reporting Q2 results on July 20th, along with all of the uncertainty around the acquisition, I have calculated an updated market-implied outlook for TWTR to early 2023 and I compare this with the current Wall Street consensus outlook, as in my previous post.

Wall Street Consensus Outlook for TWTR

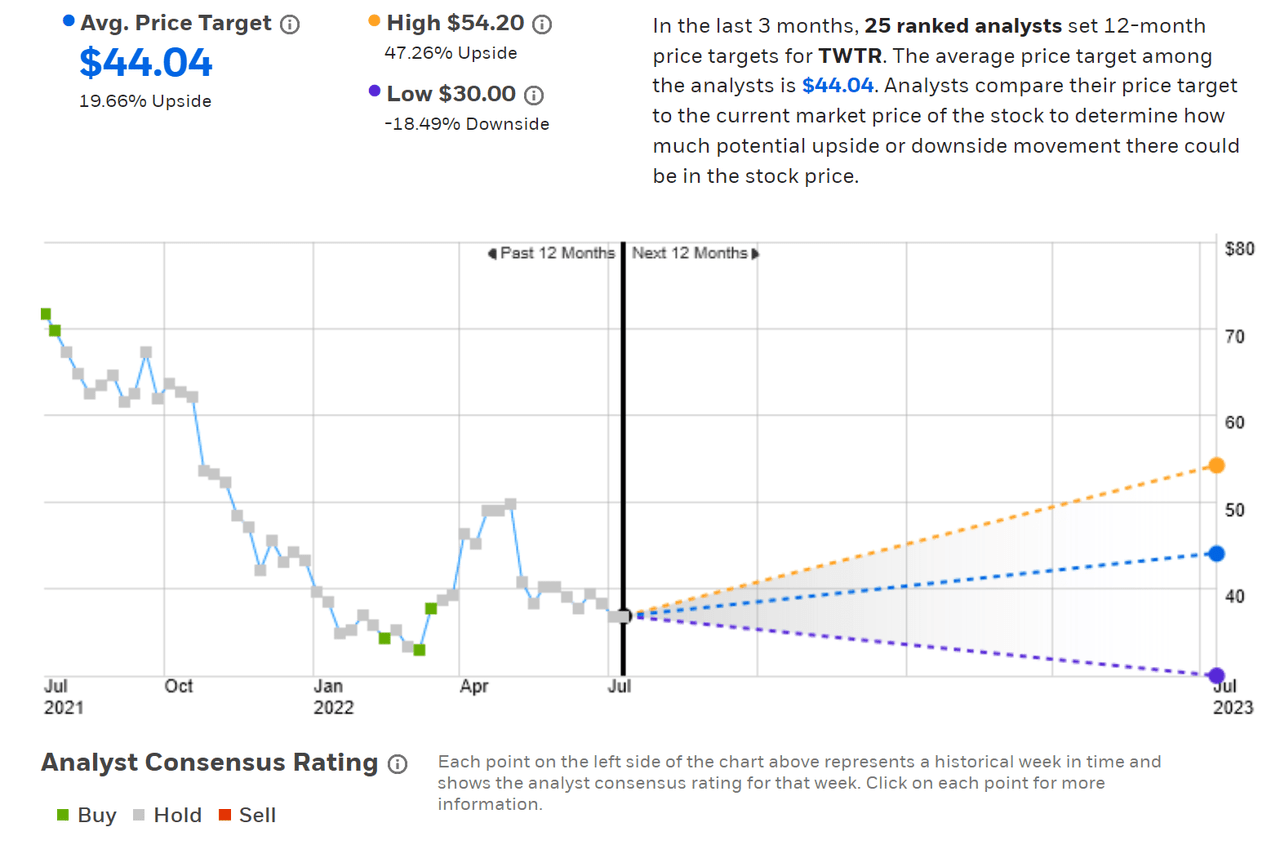

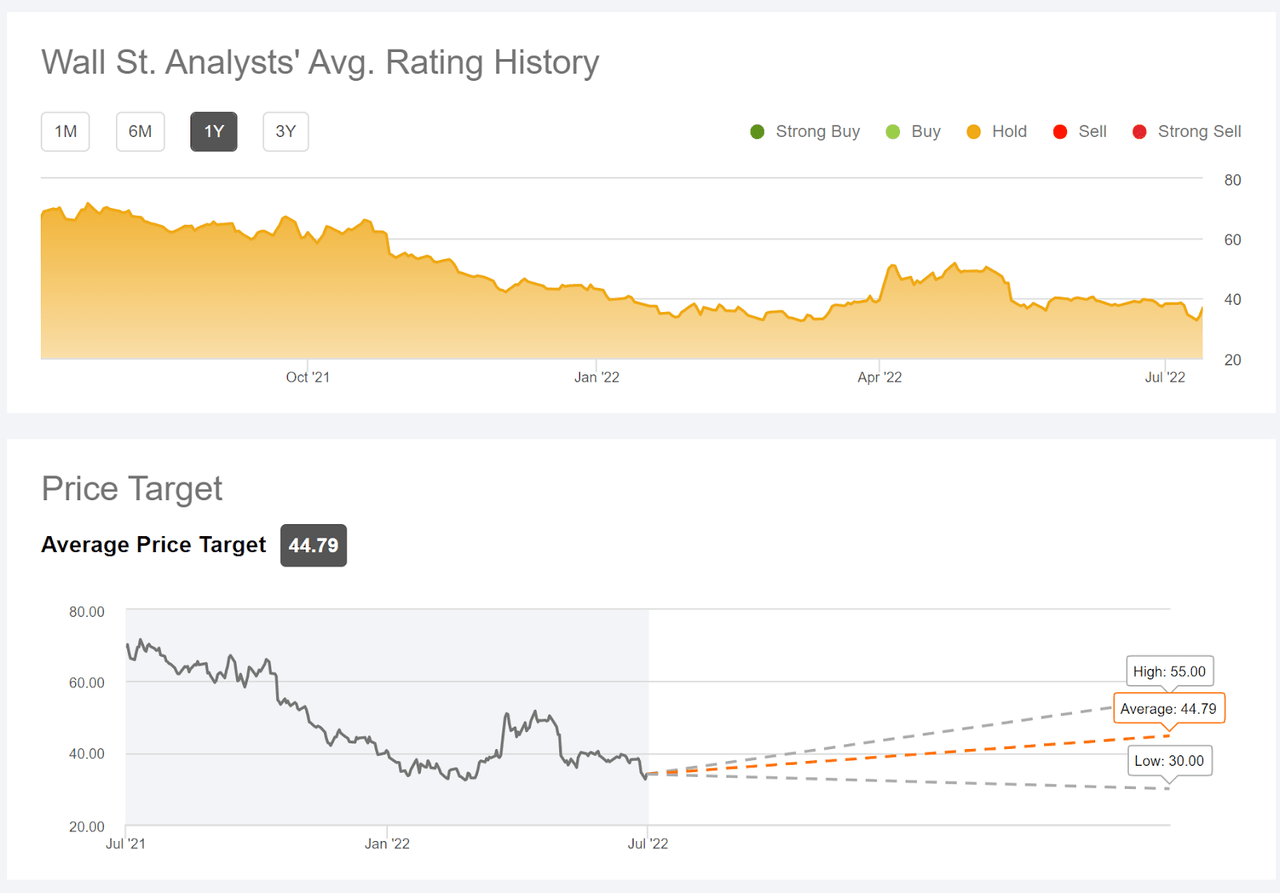

E-Trade calculates the Wall Street consensus outlook by combining the views of 25 ranked analysts who have published ratings and price targets over the past 3 months. The consensus rating for TWTR is neutral, as it has been for most of the past year, and the consensus 12-month price target is 19.7% above the current share price.

E-Trade

Wall Street analyst consensus rating and 12-month price target for TWTR (Source: E-Trade)

Seeking Alpha’s version of the Wall Street consensus outlook is based on ratings and price targets from 36 analysts who have published their views over the past 3 months. The consensus rating is neutral and the consensus 12-month price target is 21.7% above the current share price, very close to E-Trade’s results.

Seeking Alpha

Wall Street analyst consensus rating and 12-month price target for TWTR (Source: Seeking Alpha)

One of the obvious limitations to interpreting the consensus results is that some of the ratings will have been issued before the most recent news emerged (Musk saying he doesn’t want to buy Twitter and Twitter suing Musk). For this reason, I put limited weight on the Wall Street consensus outlook in revisiting my rating.

Market-Implied Outlook for TWTR

I have calculated the market-implied outlook for TWTR for the 6.2-month period from now until January 20, 2023, using the prices of call and put options that expire on this date. Options trading on TWTR is quite heavy, and especially for the options expiring in January, adding confidence in the representativeness of the market-implied outlook.

By contrast to the Wall Street analyst consensus, which includes somewhat stale information, the market-implied outlook represents the up-to-date consensus view implied by the market prices of options.

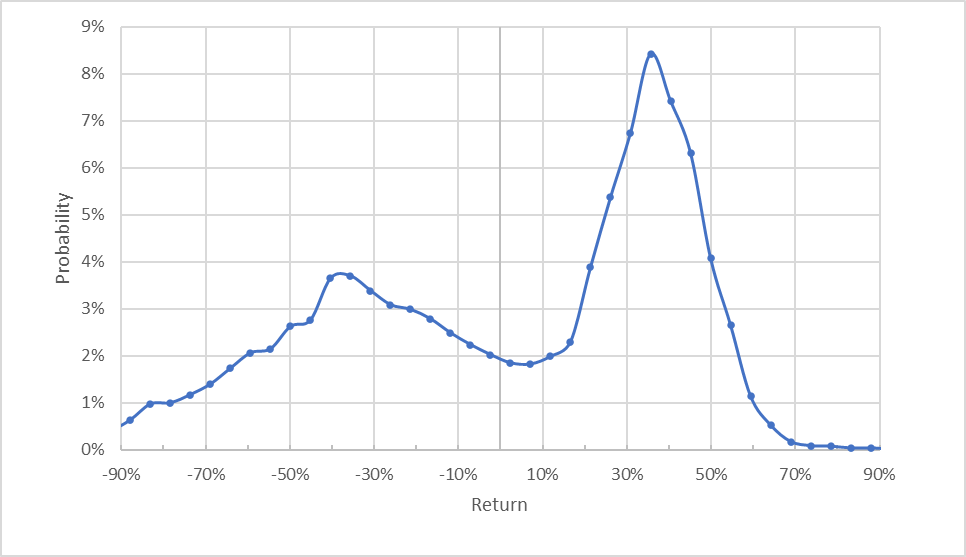

The standard presentation of the market-implied outlook is a probability distribution of price return, with probability on the vertical axis and return on the horizontal.

Geoff Considine

Market-implied price return probabilities for the 6.2-month period from now until January 20, 2023 (Source: Author’s calculations using options quotes from E-Trade)

The first thing to note in this market-implied outlook is the presence of 2 peaks (a bi-modal distribution), implying that there are two distinct outcomes that are most probable. The highest peak (highest probability) corresponds to a price return that is 36% above the current share price. The secondary lower-probability peak corresponds to a price return of -38%. The expected volatility calculated from this distribution is 58%, which is high for a large-cap stock–but of course this makes sense.

The bi-modal distribution in the market-implied outlook is very unusual, but makes sense in this situation. TWTR’s future performance hinges on whether or not Musk is able to walk away from the acquisition. If he manages to do so, the price performance over the next six months is likely to be substantially negative. If he is required to proceed by the courts, TWTR shares will be worth $54.20. The high positive mode corresponds to a share price of $50. The negative mode corresponds to a price of $23. The market-implied outlook suggests that if Must is able to walk away, the share price is likely to take a big hit.

The only time that I have seen a bi-modal market-implied outlook before, in all of the many cases that I have run, was for Activision Blizzard (ATVI) at the end of May. ATVI is also in the midst of being acquired. As I stated in that piece, “What this outlook is showing is that the market anticipates two distinct possible outcomes—one in which the acquisition is on track to close and the share price rises, and one in which the acquisition has failed or been substantially delayed and the share price declines.”

For TWTR, the consensus view of the options market is that the most-probable outcome is for the shares to be at around $50 in the middle of January of 2023. This is somewhat encouraging. Looking at the percentiles of price return (the cumulative probability distribution) is also helpful.

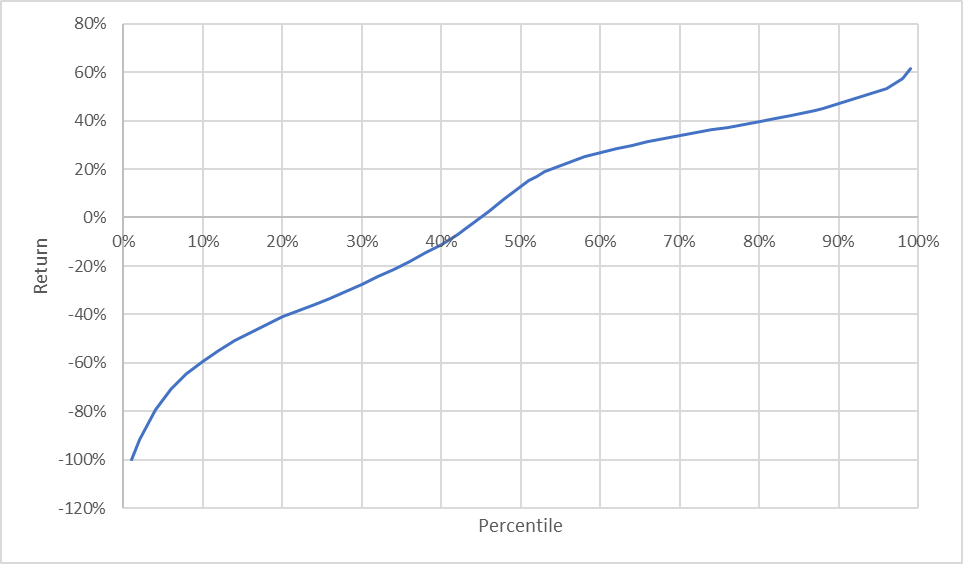

Geoff Considine

Market-implied price return percentiles for the 6.2-month period from now until January 20, 2023 (Source: Author’s calculations using options quotes from E-Trade)

The 50th percentile outcome corresponds to a price return of 12.9% and the percentile of the 0% return is 45%, which means that there is a 55% chance of TWTR providing a positive return over the next 6.2 months. This is encouraging news. The not-so-good news here is that there are elevated probabilities of large losses, as compared to the probabilities of positive returns of the same magnitude. The 10th percentile outcome is a return of -59%, as compared to the 90th percentile outcome, a return of 46.6%.

Theory indicates that the market-implied outlook is expected to have a negative bias because investors, in aggregate, are risk averse and thus tend to pay more than fair value for downside protection. There is no way to measure the magnitude of this bias, or whether it is even present, however. Considering this potential bias, the elevated probabilities of large losses may be somewhat discounted.

Overall, I interpret this market-implied outlook as somewhat bullish, with the consensus market view assigning a considerably higher probability to outcomes that will boost the share price, as opposed to a poor outcome for TWTR in the current dispute with Elon Musk. Even so, the market is still assigning a substantial probability to a bad outcome. With the high expected volatility, TWTR would be a purely speculative bet.

Summary

For most stocks, the expected outcomes are reasonably well-behaved. The analysts put together growth outlooks and the market has a reasonable smooth earnings trajectory to look at in valuing the shares. TWTR has an incredibly variable earnings history, which makes it hard to be confident in a growth trajectory. More significant, however, is that Twitter’s near-term share price is primarily going to be determined by just one thing: whether or not Elon Musk is forced to complete his proposed acquisition. If so, the shares have substantial upside. If not, the future is highly uncertain. The Wall Street consensus rating is neutral, albeit with a consensus 12-month price target that is about 21% above the current share price. As a rule of thumb for a buy rating, I want to see an expected 12-month return that is at least ½ the expected annualized volatility (58% from the market-implied outlook). Taking the Wall Street consensus price target at face value, TWTR does not present an attractive risk-return balance, but it’s not too far off. The market-implied outlook is bi-modal, assigning high probabilities to either substantial gains (which I interpret as resulting from Elon Musk being held to the agreement or paying a substantial penalty) or a significant loss. The positive outcome occurs at a higher probability. The options market is assigning odds that are tilted to the upside. I am upgrading TWTR from a bearish / sell rating to a neutral / hold rating.

Be the first to comment