Kanawa_Studio/E+ via Getty Images

Introduction

Onex (OTCPK:ONEXF) is an asset manager focused on the fast growing private equity and debt markets located in Canada. Onex has a large portion of capital invested in its own private equity funds which has produced great returns and is being undervalued by the market. Onex’s asset management business is still in its infancy and Onex is projecting high growth over the next 5 years which should begin to create fee-related earnings for Onex. Execution for Onex will reap large rewards for shareholders at these levels.

Industry Backdrop

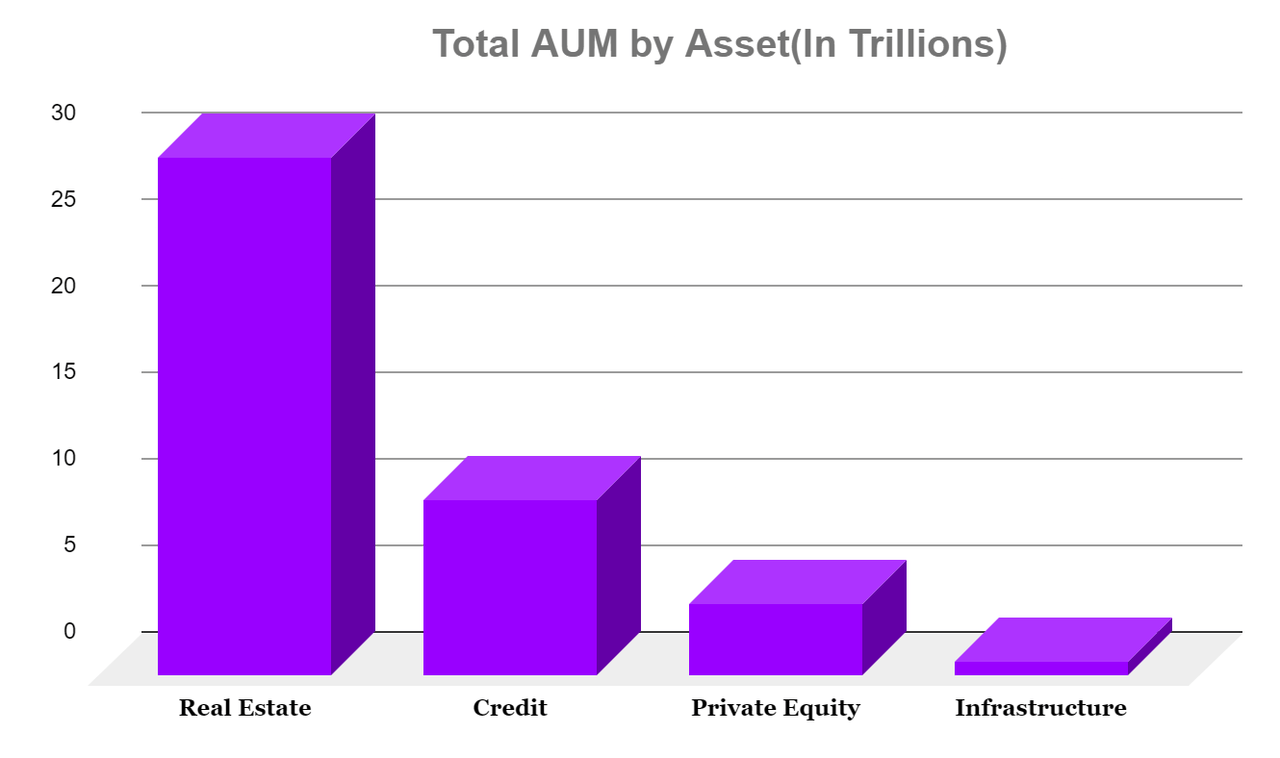

Private Equity and alternative asset management in general is a growth industry due to a number of factors including lower volatility and higher returns than public markets. Assets under management or AUM is the primary measure of market size. Total AUM ending 2021 in the alternate asset space is $45 Trillion. This includes Private Equity, Debt, Real estate and infrastructure.

Source: Data from Ares Asset Management Q4 2021 Presentation

Over the next 5 years growth rates for AUM range from McKinsey projecting a 5% CAGR to Preqin forecasting nearly 15% CAGR over the same period.

The Private Equity industry is very fragmented with the number of firms over 11000. The top 25 players only control 2% of AUM. Private credit, the largest of the alternate asset markets, is much more concentrated with 10% of AUM owned by the top 5 players. AUM has been slowly concentrating which should continue in the future with more M&A activity.

Onex investments

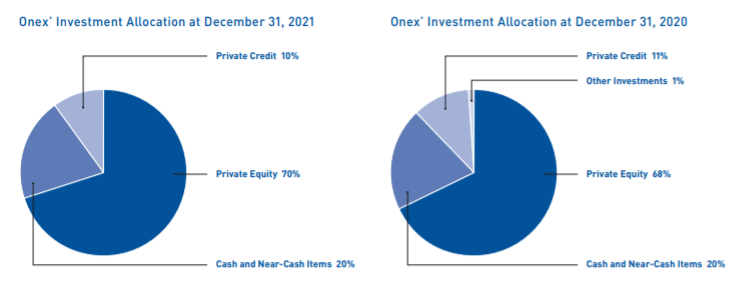

Onex has a large amount of its own capital invested in its own funds which amounts to 8.3 billion as of the end of 2021. Onex’s own capital is mostly focused on their private equity funds and is split 70% private equity, 10% private credit, 20% cash.

Source: Onex 10K 2021

Onex invested capital is trading a deep discount from book value at .73 price/book ratio. This discount started in 2018 after underperformance from Onex’s private equity funds and thus invested capital growth. This was caused by a sharp equity market correction in Q4 2018 and the launch of Onex’s new private equity fund Onex Partners V. Private equity funds tend to have most of their performance at the end of their life rather than the beginning contributing to Onex’s underperformance.

|

Year |

2021 |

2020 |

2019 |

2018 |

2017 |

2016 |

|

Private Equity Return |

32% |

24% |

21% |

-6% |

18% |

20% |

|

B/P |

0.73 |

0.64 |

0.93 |

1.08 |

1.14 |

1.10 |

|

5 Year Invested Capital CAGR |

9% |

6% |

3% |

4% |

9% |

10% |

Source: Author created table. Data from Onex 10-K’s

After 2018 however performance for their funds and invested capital came back to their normal levels. In 2021 their private equity performance was 32% and invested capital over the past 5 years was at a 9% CAGR.

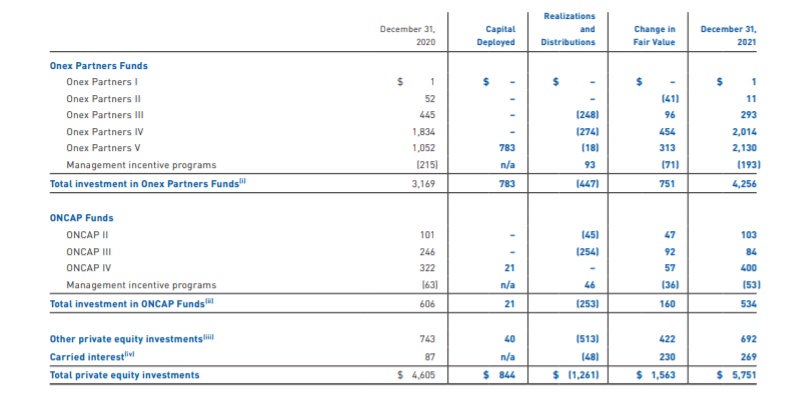

However the book value discount persists. This discount should eventually compress as Onex’s returns of 10% invested capital growth per share persist. Their new funds Onex Partners V and ONCAP IV will be the main contributors. These two funds make up 35% of Onex’s invested capital. Both funds are still in their investing phrase which means more performance should ensue as they mature.

Source: Onex 10K 2021

Onex Asset Management

Onex corporation also manages assets on behalf of institutional investors and high net worth families. These assets amount to 49 billion under AUM and 33 billion under fee paying assets under management or FPAUM. Onex assets under management are split between 46% private Equity, 40% private credit, and 14% public markets.

Onex charges all FPAUM with a management fee and accrued carried interest when they have outperformance on a benchmark return. Onex is entitled to 40% of the carried interest realized from Onex private equity funds, the Partners and managers are entitled to the remaining 60%. Carried interest is calculated as 20% of the gains from each fund after achieving at least an 8% return. The credit segments have similar carried interest allocations.

Asset management is a very attractive business; others like Ares (ARES) and Apollo (APO) enjoy fantastic margins. Currently this segment isn’t really being valued at all by the market, evident by the discount to Onex’s investments. This is due to Onex’s asset management segment having FRE margins close to zero. The key reason for this is Onex is managing so much of its own capital compared to third party capital. Onex’s capital doesn’t charge their own funds with any fees so they don’t contribute to the asset management business. This is great for shareholders as technically our funds aren’t charged fees. The ratio of Onex’s own capital to FRAUM is 4 this is quite low compared to other firms that enjoy higher margins in asset management than Onex.

|

Company |

FRAUM/Book Value 2021 |

|

ONEX |

4 |

|

KKR(KKR) |

6.2 |

|

Carlyle(CG) |

33.9 |

|

Apollo |

36.9 |

|

Ares |

49.2 |

Source: Data from Company 10-K’s

As this ratio increases over time the asset management business will start to generate more fee-related earnings and become a much more valuable piece of Onex. In Onex’s Q4 2021 Earnings call management mentioned the first steps to increase the ratio.

Recent progress includes sales of $40 million of CLO equity in Q4 and the pricing of euro CLO 5, with Onex holding only 5% of the equity tranche. The CLO platform is a great early example of progress toward our goal of improving the ratio of fee-generating AUM to Onex Capital across our platforms, an important step in expanding Onex’s capacity to generate fee-related earnings.

While our CLO platform is quickly pivoting, progress in private equity where funds have 10-plus year lives and successor funds get raised every 4-or-so years, will happen over the long term and in step functions.

– Bobby Le Blanc 2021 Earnings Call

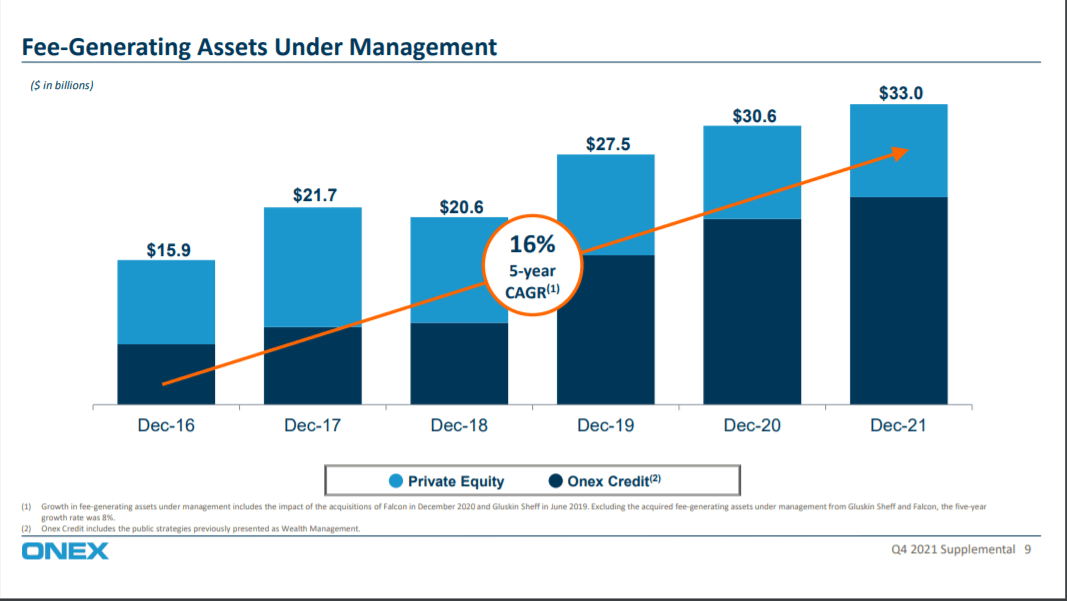

Not only will Onex begin to generate higher FRE margins in the future but FRAUM is growing at a fast clip. Over the past 5 years it has expanded at a CAGR of 16%. This matters because FRAUM is closely tied to fee related revenue. As revenue increases so does earnings.

Source: Onex 2021 Q4 Presentation

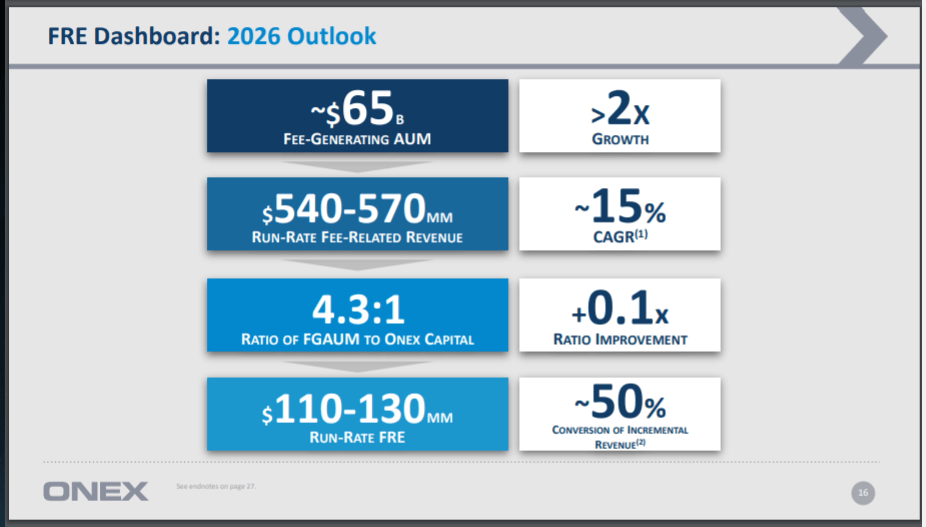

I see Onex’s small size has a competitive advantage as the larger you get in asset management the lower your return tends to be due to the fact that you eventually become the market. This small size of 49B AUM compared to the total market size of 14T should allow Onex to maintain high performance in their funds and grow AUM at a similar pace to the previous 5 years. Management agrees as they are forecasting 15% CAGR of FPAUM growth through 2026 and 22% FRE Margins.

Source: 2021 Onex Investor day presentation

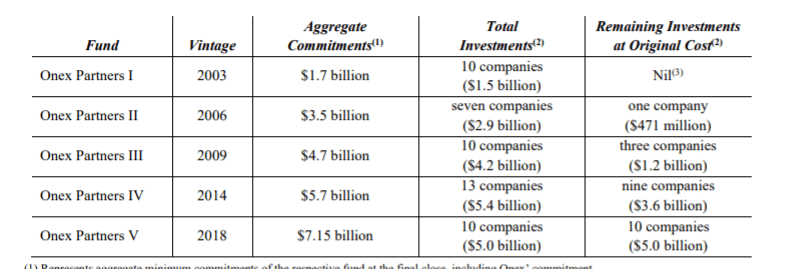

Onex beginning this year is already gearing up to raise their OP VI and ONCAP V funds. Each fund has been larger than the last which shows increasing demand for Onex’s products. Fund OP I raised 1.7B in capital back in 2003 with the most recent fund OP V raising 7.15B in capital in 2018. This not only shows Onex’s ability to raise capital but the desirability of their funds.

Source: Onex 2021 Annual Information Form

Another way to grow AUM is through acquisitions. Due to the fragmentation of the industry there are many targets available. In the past 5 years Onex has made two acquisitions. This should continue in the future.

Overall Onex’s asset management segment is a fast growing area in terms of margins and revenue which is not even being valued by the market.

Management

Management incentives are very important in any business as it makes sure that management is acting in a way that benefits the shareholders.

Onex’s strong incentives include

-

Large investments by the company in each of their private equity funds

-

Onex management was the largest shareholder in Onex with 16% of the share count

-

Onex partners must invest 25% of their carried interest into Onex shares and must hold them for at least three years

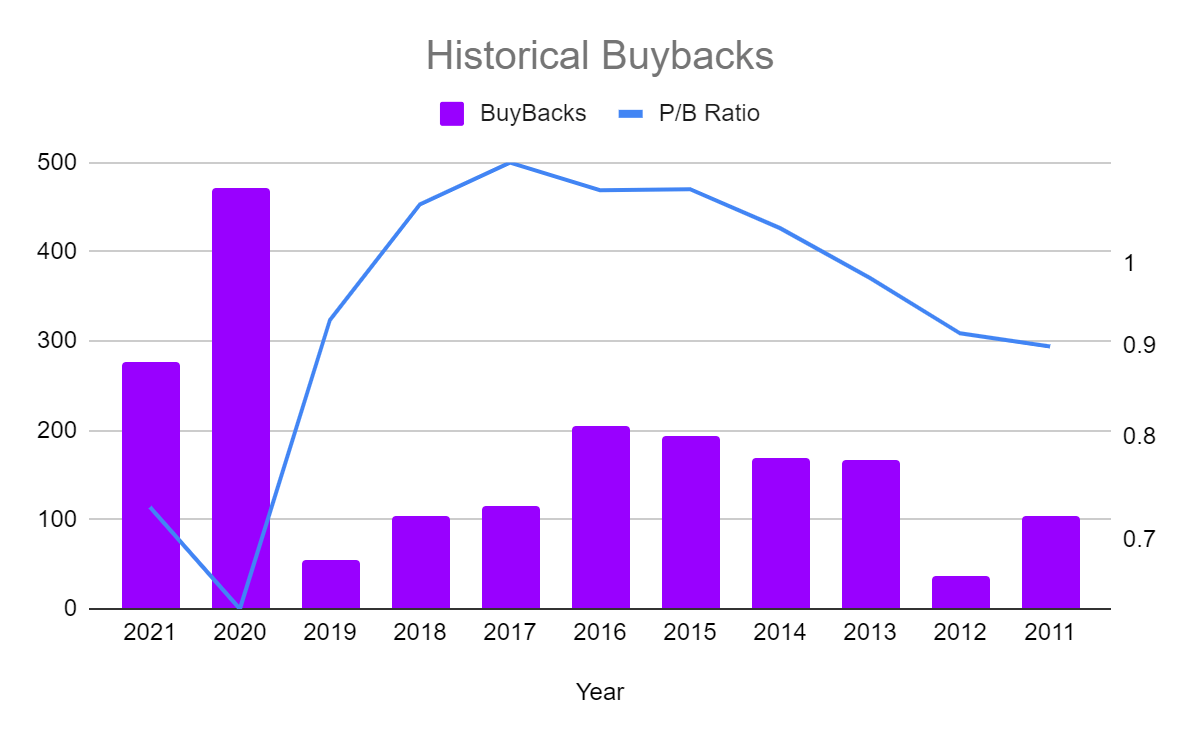

A sign of a good management team is opportunistic buybacks. Opportunistic buybacks are buybacks when the stock is cheap rather than buying a static amount every year. In 2020 when Onex was trading at the highest discount to book in recent memory management turned up the buybacks with record amounts in 2020.

With great past capital allocation and aligned management incentives Management should guide the company, benefiting shareholders rather than just themselves.

Source: Chart created by author. Data from Onex 10-K’s

Risks

There are numerous risks that may cause Onex’s company performance to experience turbulence in the future. These include rising interest rates, execution, and succession.

Higher interest rates

Higher rates threaten to lower the multiple paid for private business; this may lower future returns for private equity. This could lead to lower AUM growth. Another area where interest rates affect private equity is the earnings of the underlying businesses in their funds. Private equity likes to lever up those companies and higher rates will decrease their earnings. Interest however will also affect public markets as well so has long as private equity can maintain superior performance to public markets the AUM growth should remain strong.

Execution

The ability for Onex to continue to raise AUM is the performance of their funds. If the performance dips due to poor investments relative to peers. AUM growth could slow or even decrease.

Succession

Gerald W. Schwartz the founder of Onex and who still sits as the Chairman of the Board and Chief Executive Officer is turning 82 this year. Gerald W. Schwartz has lead Onex since its founding and has done a tremendous job building Onex into one of the largest companies in Canada. He has kept control of the company with multiple voting shares. These shares entitled him to 60% of the vote and the same amount in board seats. Once Gerald steps down not only will the company be led by a new person for the first time in its history the multiple voting shares will cease to carry any special rights. This event could cause a lot of uncertainty in the share price.

Valuation

Onex has two segments that should be valued separately. The asset management business and their investments. I provide three scenarios: worst case, base case and best case. Two things I did not include in either of the scenarios are earnings from carried interest and buybacks. Both these will add to the returns listed below. I did not include them due to their volatile nature.

|

Valuation Table |

|||||

|

Worst Case |

Base Case |

Best Case |

|||

|

Current Share Price(In CAD) |

83 |

Current Share Price(In CAD) |

83 |

Current Share Price(In CAD) |

83 |

|

Book Value Per Share(In CAD) |

115 |

Book Value Per Share(In CAD) |

115 |

Book Value Per Share(In CAD) |

115 |

|

Book Value Growth 5 Year CAGR |

5% |

Book Value Growth 5 Year CAGR |

10% |

Book Value Growth 5 Year CAGR |

10% |

|

5 Year FRAUM Target (In USD) |

33B |

5 Year FRAUM Target (In USD) |

53B |

5 Year FRAUM Target (In USD) |

66B |

|

Assumed FRAUM Growth |

0% |

FRAUM 5 Year CAGR |

10% |

FRAUM 5 Year CAGR |

15% |

|

Blended Fee |

.08% |

Blended Fee |

.085% |

Blended Fee |

.09% |

|

FRE Margin |

0% |

FRE Margin |

15% |

FRE Margin |

25% |

|

FRE Multiple |

0 |

FRE Multiple |

20 |

FRE Multiple |

20 |

|

P/B Multiple |

.5 |

P/B Multiple |

1 |

P/B Multiple |

1.2 |

|

Share Price Target 5 Years (In CAD) |

73 |

Share Price Target 5 Years (In CAD) |

200 |

Share Price Target 5 Years (In CAD) |

265 |

|

Expected Return (5 Year CAGR) |

-3% |

Expected Return (5 Year CAGR) |

19% |

Expected Return (5 Year CAGR) |

26% |

Worst Case

In my worst case scenario invested capital growth is sluggish at 5% due to lower performance in their funds. The sluggish growth leads investors to value the business even less at .5 price/book. Also the asset management business doesn’t grow at all so there is no value attributed to that side of the business. This is an especially aggressive assumption. Even if both these assumptions take place the expected return is -3%. This small loss compared to the rather negative scenario is due to the stock price already pricing in a lot of negativity at a large discount to book.

Base Case

In this scenario invested capital growth returns to the 10% level as fund OP V becomes fully invested and becomes more mature leading to more performance. This growth should return the company to a 1 Price/Book ratio that it was trading at before 2017. This coupled with growth in the asset management business at a 10% CAGR will provide additional value. Management is projecting 15% CAGR in AUM so I am being more conservative with my estimate of AUM. FRE earnings being very stable deserves a 20 multiple. With these conservative assumptions I get to a 19% CAGR which would be quite a return.

Best Case

In the last scenario invested capital growth stays the same however I assume Onex trades at a premium to book. I justify that as Onex before 2018 did trade for a premium to book. Also Onex has a large cash position which should be valued separately from their private equity portfolio. The private equity portfolio is getting a 16% return that deserves a premium maybe 1.4-1.6 times book. The cash position if getting the risk free return should garner a 1 times book. Combining the two portfolios you could justify a 1.2 to 1.6 times book multiple. For the asset management segment I assume 15% AUM growth which is what management is projecting with the same multiple as the base Case.

Conclusion

Private Equity is a growth business projected to expand at a fast clip for the foreseeable future. Onex is at the center of this trend with a growing asset management business and large invested capital position. The market I believe is undervaluing the invested capital while giving no value to the asset management segment. As Onex continues to perform and raise new funds the market should correct this undervaluation.

Side note

The listed on the OTC markets ticker – ONEXF – is very illiquid. The better listing is on the Toronto Stock Exchange ticker (ONEX).

Be the first to comment