imaginima

There are a number of high yield opportunities on the market right now, but not all of them are well-positioned for an inflationary environment. For example, mortgage REITs are sensitive to higher interest rates, and are high-yielding for good reason. However, the market sell-off has been rather broad, and spared stocks have been few and far in between.

This brings me to ONEOK (NYSE:OKE), which is now trading at levels not seen since 2017 outside of the 2020-timeframe. In this article, I highlight what makes OKE a great high yielding name to layer into in this crazy market, so let’s get started.

Why OKE?

ONEOK is a large midstream corporation that owns a premier collection of natural gas liquids systems, connecting suppliers in the Rocky Mountain, Mid-Continent, and Permian Regions of the U.S. to key markets. It also owns an extensive network of gathering, processing, storage and transportation assets. This vertically integrated asset base enables ONEOK to capture profits across the midstream value chain. ONEOK is also a C-Corp, and therefore does not issue its shareholders a K-1 during tax season.

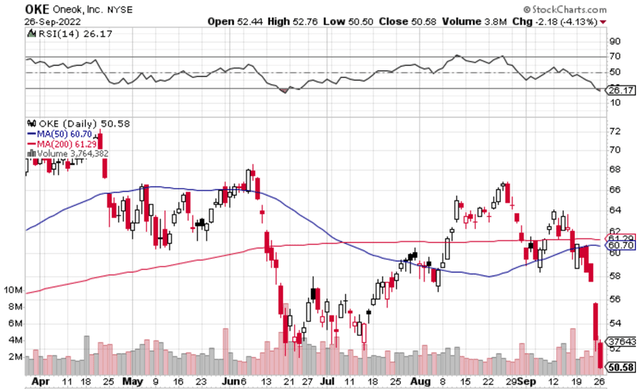

Turning to stock movements, those who were hoping for a rally in OKE stock have been disappointed, as the upward momentum from mid-July to mid-September turned out to be a bear market rally. As shown below, at the current price of $50.58, OKE is now trading materially below its 50- and 200-day moving averages of $60.70 and $61.29, and carries an RSI score of 26, indicating that it’s well in oversold territory.

OKE Stock Technicals (StockCharts)

I view OKE as having been painted by a broad brush by the market, as its fundamentals suggest a strong enterprise. This is reflected by the 11% increase in adjusted EBITDA during the second quarter, driven by impressive 10% NGL volume increases in Rocky Mountain and Gulf Coast/Permian regions, and a 22% increase in natural gas pipelines adjusted EBITDA. Notably, this was achieved despite unseasonable weather in the Rocky Mountain region.

Headwinds to OKE include the potential for a slowing economy and a recession, which could result in reduced volumes. In addition, higher interest rates could raise OKE’s cost of debt and put pressure on the share price as investors gravitate towards “risk-free” treasury bonds. This is offset, however, by OKE’s strong BBB rated balance sheet with a reasonably low net debt to annualized EBITDA ratio of 3.8x, sitting below the 4.0x mark that’s generally regarded as being very safe for midstream companies.

Moreover, OKE should be able to offset higher interest with inflation escalators that management noted as coming on throughout the year, and the business is relatively immune to commodity price volatility due to its fee-based model. Management could also return significant value through share buybacks at the current discounted prices or pursue value-added projects. Morningstar highlighted these strengths as well as a rosy near to medium term outlook in its recent analyst report:

Oneok brings together high-quality assets, some of the strongest near- to medium-term growth prospects in our coverage as Rockies volumes continue their ongoing rebound, a C-Corporation structure, and a well-respected management team in a compelling package. About 90% of the firm’s earnings are fee-based, 80%-90% of its customers are investment-grade, and the firm hedges its limited commodity price exposure.

With the reduced capital program, Oneok does finally have material levels of excess cash flow in 2022, perhaps 18 months behind other U.S. midstream peers to buy back more stock. We estimate there could be up to $400 million in buybacks in 2022, though knowing Oneok’s penchant for finding accretive growth projects, this is also equally likely to be plowed back into attractive growth assets.

Meanwhile, the rout in OKE’s share price has resulted in an attractive 7.4% dividend yield. OKE has an impressive 25-year track record of paying an uninterrupted dividend. Moreover, the dividend is well protected by a 61% payout ratio as a percentage of trailing 12 months’ operating cash flow, and has a 5-year CAGR of 7.6%.

Lastly, I view OKE as being rather cheap at the current price of $50.58 with an EV/EBITDA of 11.4. As shown below, this sits on the low end of OKE’s valuation range over the past three years, especially outside of the 2020 timeframe. Sell side analysts have an average price target of $68.61, translating to a potential one-year 43% total return including dividends.

OKE EV/EBITDA (Seeking Alpha)

Investor Takeaway

ONEOK has gotten painted by a broad brush in the market sell-off. The company has a strong balance sheet, a diversified portfolio of fee-based assets, and a well-covered dividend that offers a 7.4% yield. Its strong outlook combined with low valuation and a high dividend yield sets it up for potential market-beating returns from here.

Be the first to comment