gawrav

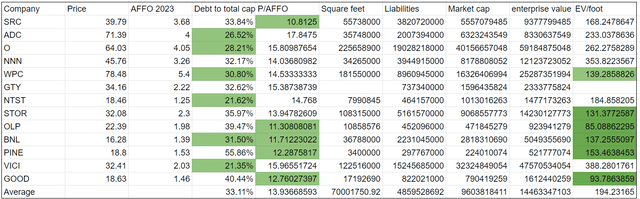

Triple net lease remains a well-positioned REIT sector due to its low valuation, recession resistance and protection from cost inflation. I have dug into quite a few triple nets lately and continue to be amazed at the level of mispricing in this sector. As I compile the data, it is increasingly clear to me that the little nuances matter substantially.

Pricing and earnings have both changed resulting in some movement in leadership regarding what is the most attractively valued. One Liberty Properties (NYSE:OLP) and Broadstone Net Lease (NYSE:BNL) are now on the leaderboard with just over 11X P/AFFO. They also have attractive enterprise value per square foot and substantial exposure to industrial which is arguably the most favorable fundamentally among major triple net property types.

I don’t like to rely on metrics alone as there is often nuance under the surface that impacts the viability of an investment. Thus, the rest of this article will dig into both OLP and BNL to ascertain if they are really as good as they appear.

One Liberty Properties

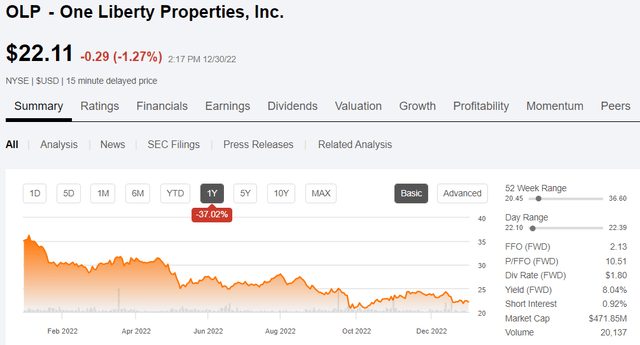

OLP’s stock price collapsed in 2022.

In contrast, its fundamentals held steady. That is the good kind of cheapness. It is not a company struggling it is a company getting cheap.

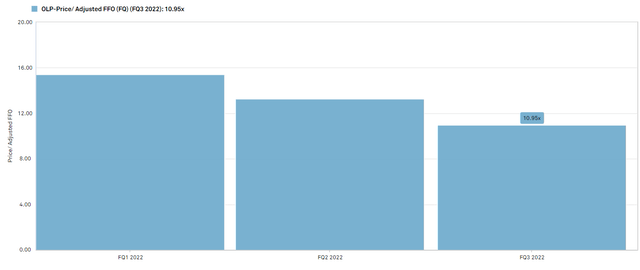

It went from an AFFO multiple of just about 16X at the start of the year to around 11X at 3Q22.

S&P Global Market Intelligence

The same price decline caused OLP’s yield to jump up to 8% and due to the steady AFFO, that dividend is well covered.

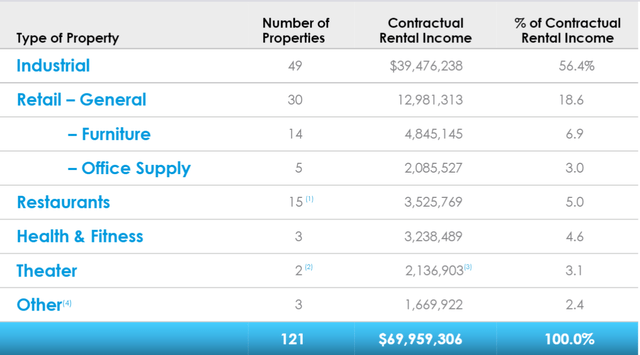

Another clear benefit to OLP is its property sector breakdown.

3% in theaters is not ideal and likely responsible for a significant portion of the stock decline, but at the end of the day that is just 3% of the portfolio.

The bulk of it is industrial at a 57% weighting. I believe the number is closer to 60% today as OLP has been acquiring exclusively industrial and mostly selling retail.

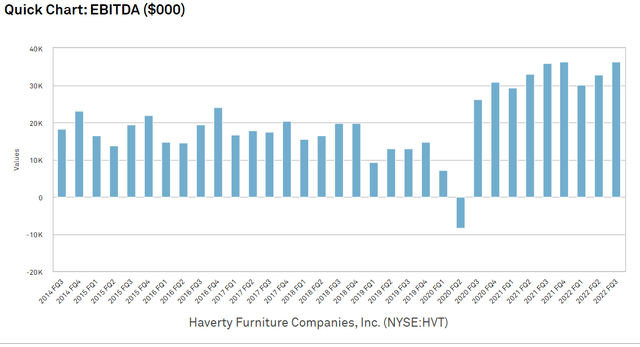

Furniture is also a category that I view as fairly risky, but most of that exposure is in Haverty (HVT) which looks like a reasonably good tenant. As a publicly traded company we have access to its key financials.

HVT has been growing EBITDA.

S&P Global Market Intelligence

HVT is one of few stocks that was actually up in 2022 and it is quite low debt.

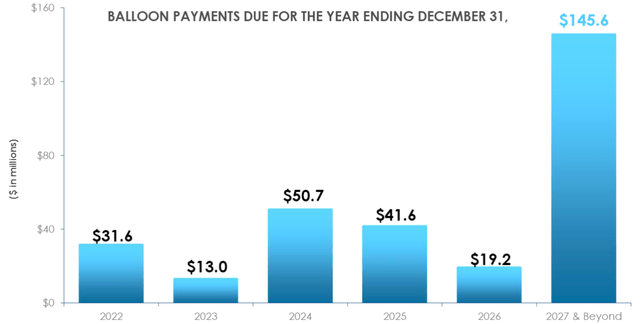

Based on square footage, OLP’s occupancy rate on September 30, 2022 is approximately 98.4%. It has a weighted average remaining lease term of about 6 years and its debt is similarly termed out.

Acquisition strategy

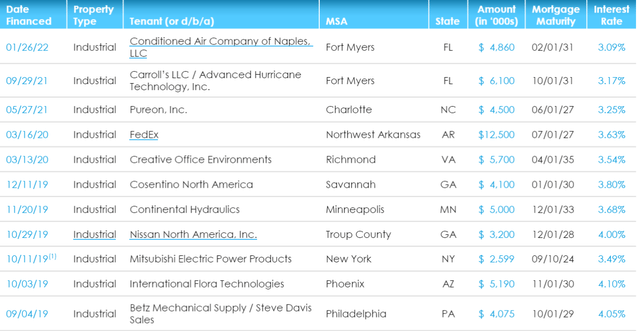

OLP employs a different capital strategy than its peers. Most triple nets like to consolidate debt at the corporate level in the form of senior notes or lines of credit. OLP puts the debt directly on the properties in the form of mortgages. Below is their property acquisition list.

Below you can see that OLP put mortgages on the properties shortly after each acquisition.

Notably, each mortgage is at about a 300 basis point spread below the acquisition cap rate which brings OLP’s return on equity to greater than 9% for most of these acquisitions.

There are 2 main benefits to this mortgage style of debt instead of corporate level debt.

- Mortgages generally come at cheaper rates

- If a property fails, the debt can be erased with the property as the debt is not recourse to the company.

The primary negative and the reason most triple nets prefer corporate level debt is that it makes transactions more cumbersome. It can be difficult to sell properties that are encumbered by debt.

Overall, I like the strategy. These are long term assets anyway, so them being harder to sell is not as much of an issue and I am happy to get the savings on cost of capital.

Growth

As is the case broadly right now, external growth may be a bit challenging to find right now due to cap rates remaining stubbornly low despite the higher rate environment. OLP’s industrial focus will help in this regard as industrial real estate tends to re-lease favorably.

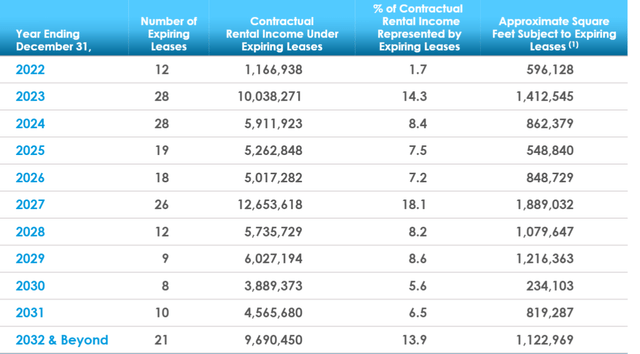

In 2023 14.3% of OLP’s rent rolls over so this may be a nice opportunity to bump up rent on their industrial portfolio.

Aside from that, I would not anticipate much growth in the near term.

It is largely just steady earnings fully covering a very large dividend. Based on the property quality and valuation I would tend to think OLP is a great investment at this time. Unfortunately, our due diligence also uncovered a yellow flag.

Yellow Flag

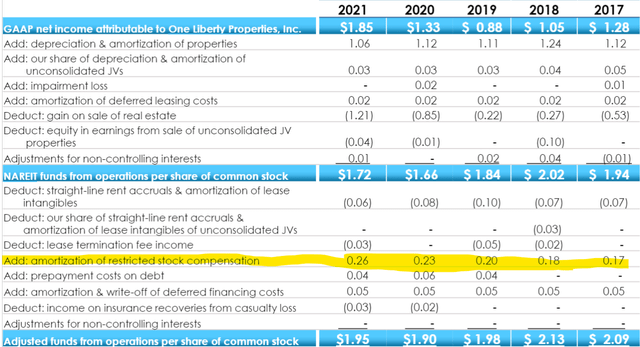

As you know, AFFO is not a standardized metric in the way that FFO and GAAP earnings are. Companies can add back certain other items and at times they throw in something tricky.

In OLP’s case, they add back stock compensation and oh my goodness is there a lot of it.

$0.26 per share of stock comp in 2021 and it seems to be a consistent upward trend since 2017.

That is a real expense, so real AFFO is not the stated $1.95, but rather $1.69.

Therefore, using real earnings, OLP is trading at 13X rather than 11X. It is merely an okay value relative to peers. Probably fine, but nothing special. Let’s see if Broadstone holds up any better to the due diligence.

Broadstone Net Lease

I wrote about BNL back in November so I will refer you to that article for the company overview. Since November, BNL has gotten even cheaper along with the rest of the market and today the valuation is quite compelling.

- 11.7X AFFO

- 31.50% debt to total capital

- $137 enterprise value per square foot

Most of the triple net REITs trading below 12X AFFO have high debt which is partially why they trade cheaply. BNL stands out a bit as having both that cheap AFFO valuation and fairly low debt.

EV per square foot is a metric that I am increasingly using because I believe it provides a good image of valuation in practical terms. It directly addresses how much real estate one’s investment dollars are buying.

A quick note on this is that it will vary by location and by property type so a lower number per square foot doesn’t necessarily mean it is discounted.

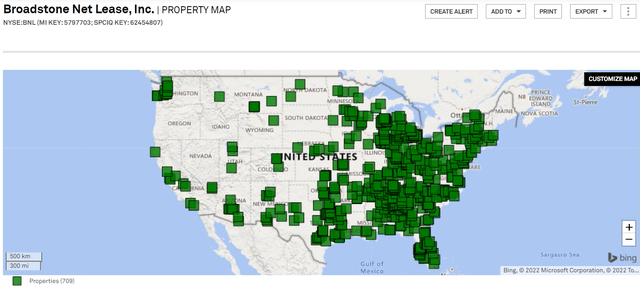

BNL’s properties are distributed proportionally with the U.S. population.

S&P Global Market Intelligence

This is quite typical of triple net REITs as triple net properties (industrial, retail, and office) directly service the population. On a location basis, BNL’s enterprise value per foot should be in-line with peers.

There are 2 reasons I think it is cheaper.

- High industrial concentration

- Legitimate discount to NAV

Industrial properties are physically less expensive to build as they tend to be large footprint with metal walls, some pillars and a roof. Institutional grade industrial warehouses will typically go for somewhere around $70 to $150 per foot with exception to special areas like Los Angeles where they might be closer to $300 per foot.

Naturally the industrial focused triple nets, GOOD, WPC, OLP and BNL trade at significantly lower EV per foot than the retail focused ones as retail is often closer to $200-$300 per foot.

The rest of BNL’s low EV/foot can be attributed to the stock trading at 79% of NAV. It trades at a 7.7% implied cap rate while the properties in its portfolio would individually go for closer to 6% cap rates.

This affords investors the opportunity to buy the portfolio of properties at $137 when it is really worth closer to $170 per foot.

Aside from the valuation, I find BNL attractive for 3 reasons:

- High industrial contingent implies better organic growth

- Excellent property level performance when tested by the pandemic

- Institutional style company structure

In group meetings with REITs I have often witnessed their interactions with sell-side analysts. The sell-side analyst often functions as a liaison between the REIT and the buy side investors as they understand both how the REIT works at a molecular level and how investors think. In these meetings, they often give REITs advice on how to make themselves more marketable to institutional investors and BNL’s parameters match up perfectly with the typical advice.

- Diversified geographically and by tenant

- Healthy leverage (30%-40% typically desired and BNL is at low end)

- Excellent corporate governance

They check all the boxes on what is deemed appropriate

- No poison pill

- Separation of CEO and chairman roles

- Declassified board

- Succession plan

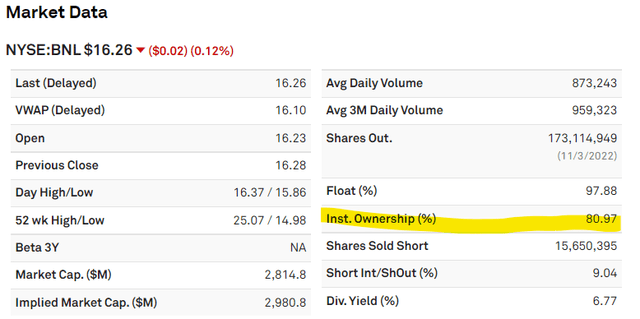

The result is that despite being still quite new to the public markets BNL is already up to 81% institutional ownership

S&P Global Market Intelligence

This is a properly run REIT that has been heavily vetted by the professionals, yet it is trading at a multiple closer to where sloppy governance REITs trade.

I think BNL is a great buy here.

Be the first to comment