fizkes/iStock via Getty Images

A Quick Take On ON24

ON24 (NYSE:ONTF) reported its Q2 2022 financial results on August 9, 2022, beating expected revenue and EPS estimates.

The company provides a range of online video-enabled software solutions for events and sales & marketing purposes.

Until we see evidence of a return to revenue growth and a meaningful move toward operating breakeven, I’m on Hold for ONTF.

ON24 Overview

San Francisco, California-based ON24 was founded to develop an online video and virtual event system with related sales & marketing customer/prospect engagement technologies for enterprises.

Management is headed by co-founder, president and CEO Sharat Sharan, who has previously held numerous positions in media, entertainment and telecommunications companies.

The company’s primary offerings include:

-

Online webinar software

-

Virtual events

-

Multimedia content

-

Behavioral insights

-

Third-party app ecosystem

The company pursues customer acquisition via a direct sales and marketing organization as well as through ISVs, technology partners and consulting firms.

As of June 30, 2022, ONTF had more than 2,100 customers worldwide.

ON24’s Market & Competition

According to a 2018 market research report by Global Market Insights, the global market for video conferencing is expected to exceed $20 billion by 2024.

This represents a forecast CAGR of 10% from 2018 to 2024.

The main drivers for this expected growth include demand from enterprise applications, which are expected to account for 65% of the growth.

Also, it is likely that these growth figures are substantially lower than the new reality of a pandemic-affected business world, which has adapted to the pandemic with enthusiastic adoption of online conferencing solutions.

Major competitive or other industry participants include:

-

Zoom

-

LogMeIn

-

Intrado

-

Microsoft

-

Cisco

-

Google

-

Cvent

-

Amazon

ON24’s Recent Financial Performance

-

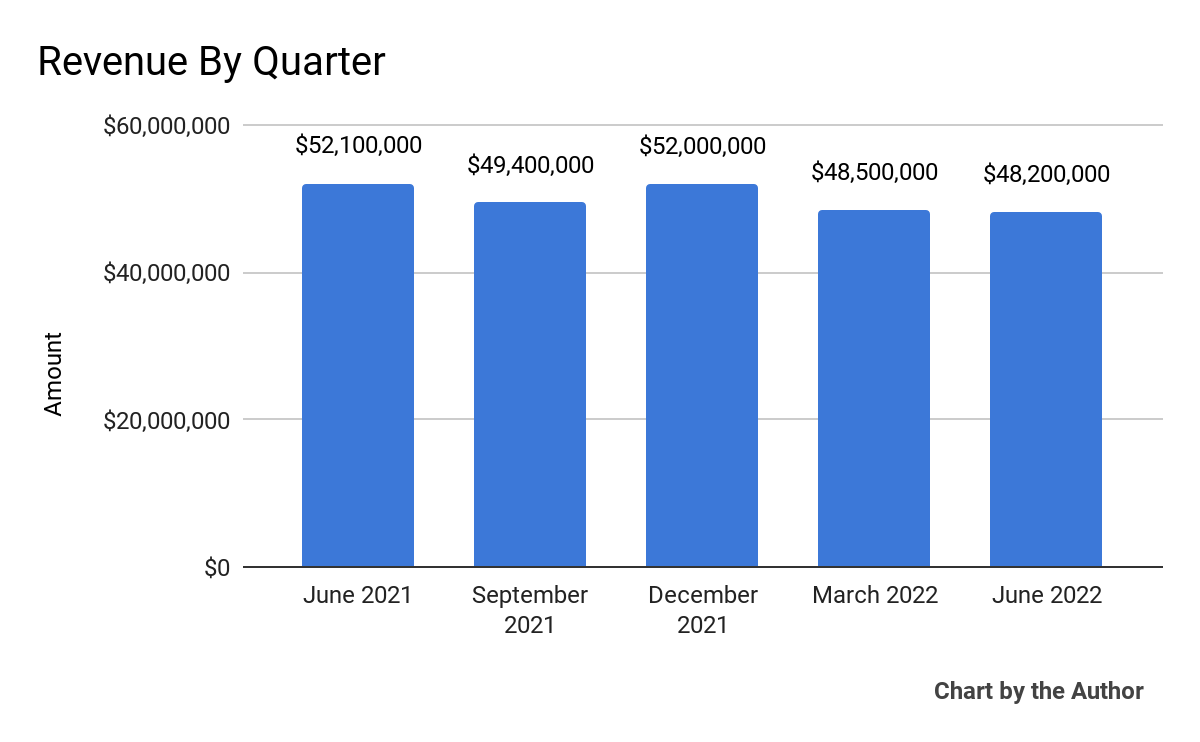

Total revenue by quarter has trended lower in recent quarters:

5 Quarter Total Revenue (Seeking Alpha)

-

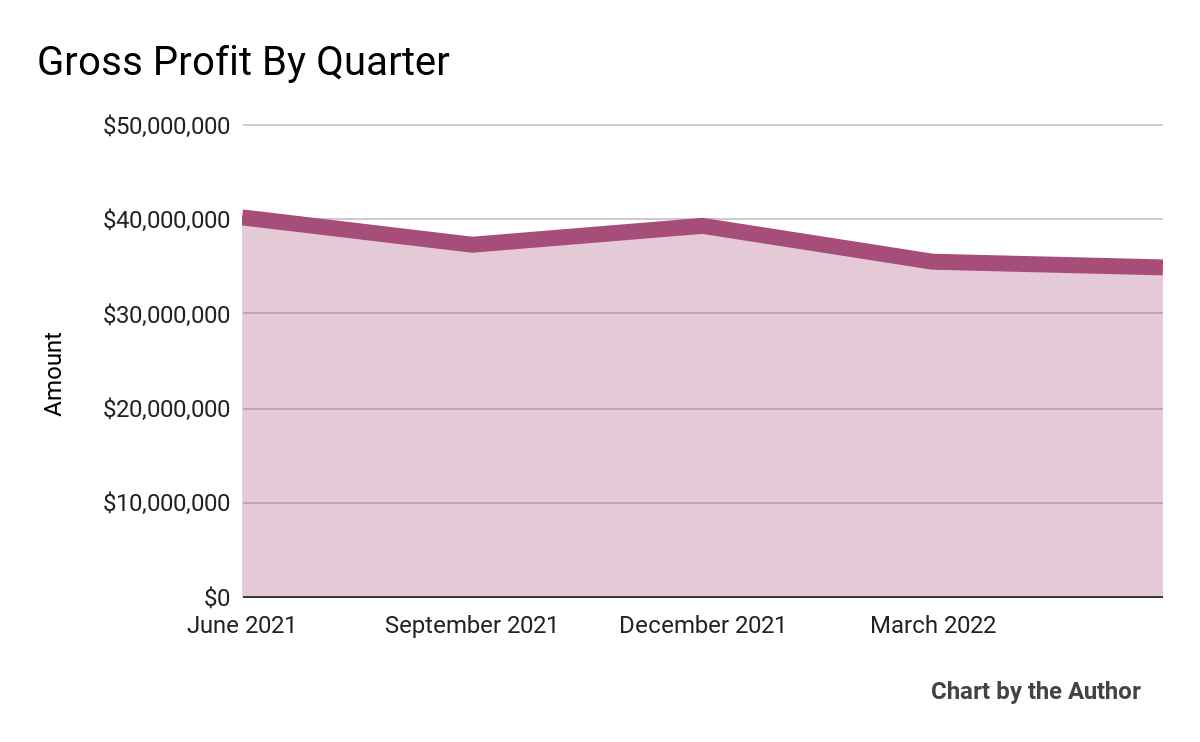

Gross profit by quarter has followed the same trajectory as that of total revenue:

5 Quarter Gross Profit (Seeking Alpha)

-

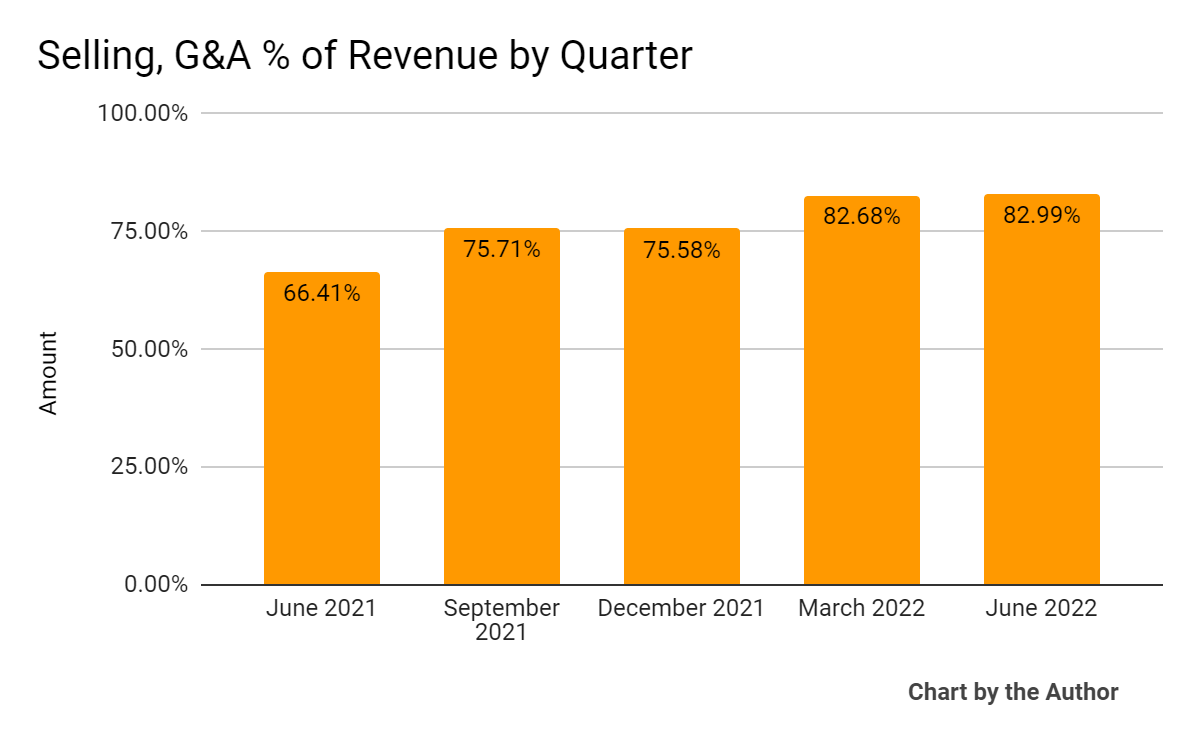

Selling, G&A expenses as a percentage of total revenue by quarter have been rising, as the chart shows below:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

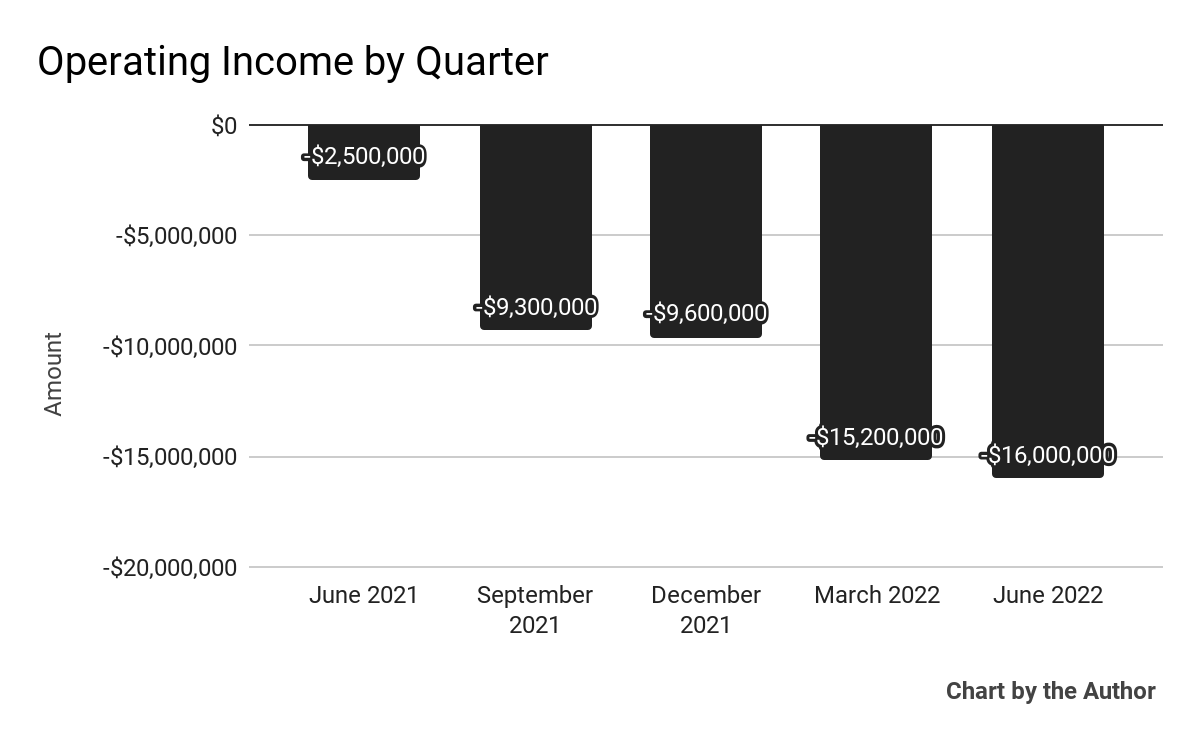

Operating losses by quarter have been worsening in recent quarters:

5 Quarter Operating Income (Seeking Alpha)

-

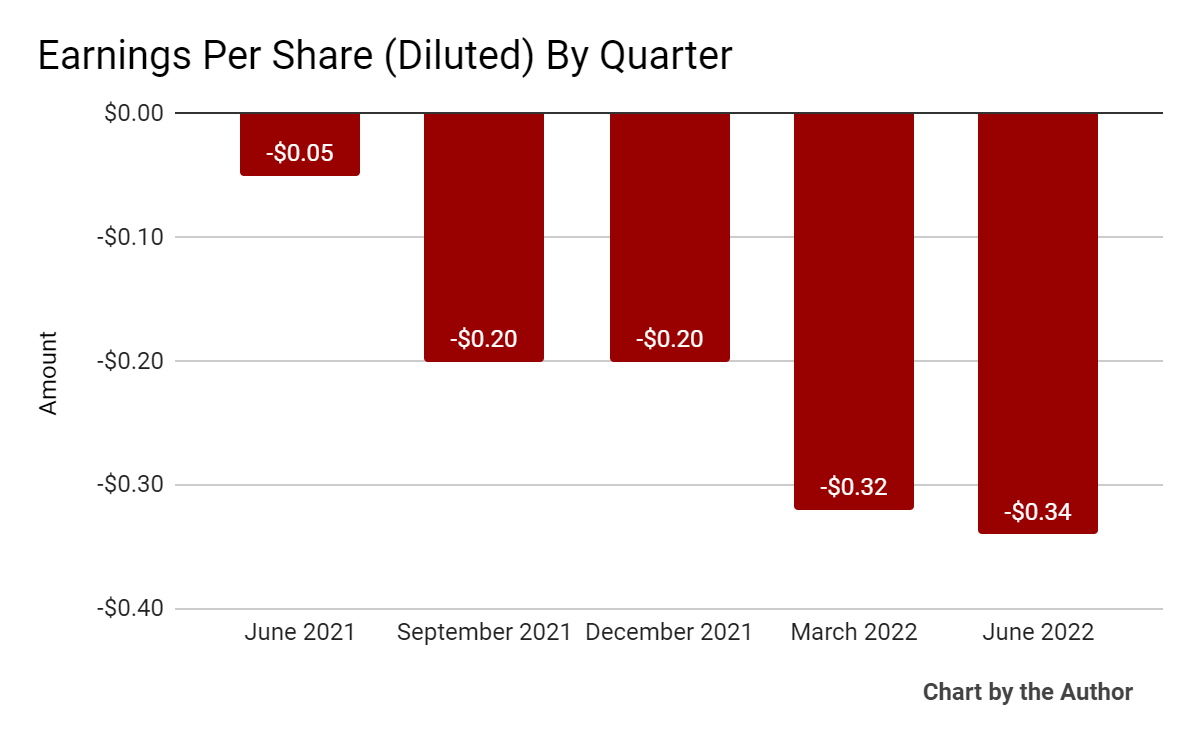

Earnings per share (Diluted) have also continued increasingly negative:

5 Quarter Earnings Per Share (Seeking Alpha)

(All data in above charts is GAAP)

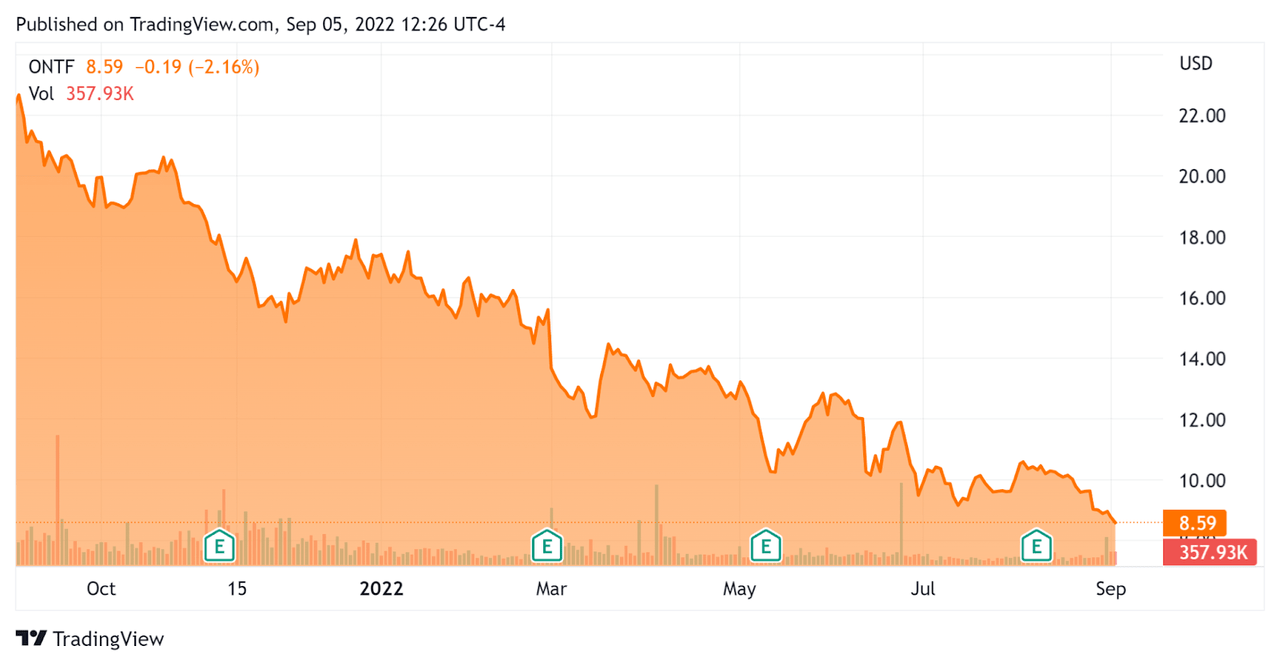

In the past 12 months, ONTF’s stock price has fallen 61.5% vs. the U.S. S&P 500 index’ drop of around 13.5%, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation And Other Metrics For ON24

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure [TTM] |

Amount |

|

Enterprise Value / Sales |

0.37 |

|

Revenue Growth Rate |

0.0% |

|

Net Income Margin |

-25.5% |

|

GAAP EBITDA % |

-22.9% |

|

Market Capitalization |

$407,890,000 |

|

Enterprise Value |

$74,080,000 |

|

Operating Cash Flow |

-$14,820,000 |

|

Earnings Per Share (Fully Diluted) |

-$1.06 |

(Source – Seeking Alpha)

As a reference, a relevant partial public comparable would be Cvent Holding Corp. (CVT); shown below is a comparison of their primary valuation metrics:

|

Metric |

Cvent |

ON24 |

Variance |

|

Net Income Margin |

-19.2% |

-25.54% |

33.3% |

|

Revenue Growth Rate |

4.0% |

-22.9% |

-668.0% |

|

Operating Cash Flow |

$134,250,000 |

-$14,820,000 |

-111.0% |

|

Enterprise Value / Sales |

4.5 |

0.4 |

-91.7% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance metrics may be viewed here.

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

ONTF’s most recent GAAP Rule of 40 calculation was negative (22.9%) as of Q2 2022, so the firm has performed poorly in this regard, per the table below:

|

Rule of 40 – GAAP |

Calculation |

|

Recent Rev. Growth % |

0.0% |

|

GAAP EBITDA % |

-22.9% |

|

Total |

-22.9% |

(Source – Seeking Alpha)

Commentary On ON24

In its last earnings call (Source – Seeking Alpha), covering Q2 2022’s results, management noted that it lost some customers while others have reduced their renewal spend under budget pressures.

In response, the company announced a 5% headcount reduction plan, to be largely completed by the end of Q3.

However, the firm closed the largest deal in its history for a multi-year contract including its newest products. The new customer ‘is a leading learning platform company who helps upscale the workforce of thousands of enterprises.’

As to its financial results, total revenue dropped 7% year-over-year, with professional service revenue dropping the most by category.

Q2 ending ARR (Annual Recurring Revenue) increased by 2% year-over-year as the company is facing longer sales cycles and ‘greater deal scrutiny, particularly with new business at and over the 4100,000 threshold.’

Management did not disclose the company’s net or gross dollar retention rate; rather, it was vaguely characterized as ‘making progress.’ These metrics can provide visibility into churn rates and the company’s efficiency in sales & marketing and cross/up-selling efforts.

The company is reducing its sales and marketing spend due to the current challenging macroeconomic environment, as operating losses and negative earnings have worsened in recent quarters.

For the balance sheet, the firm ended the quarter with $345 million in cash, equivalents and marketable securities, while using free cash of $3.4 million, so management has plenty of resources to get through an economic slowdown.

At quarter end, ON24 still had $21 million remaining out of a $50 million share repurchase program and purchased $7.5 million of shares in Q2 at an average price of $13.27 per share.

Given that the shares have since dropped even further, I would expect the company to continue reacquiring shares in the quarters ahead.

Looking ahead, management reiterated its previous 2022 guidance, with full year revenue expected to be $193 million at the midpoint of the range.

The non-GAAP operating loss estimate has been improved to ($26 million) at the midpoint due to planned cost reductions partially offset by inflationary wage costs.

Regarding valuation, the market is valuing ONTF at an EV/Sales multiple of around 0.4x.

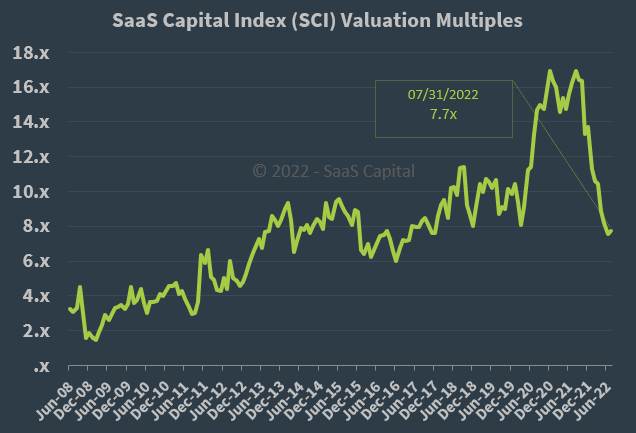

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 7.7x at July 31, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, ONTF is currently valued by the market at a significant discount to the broader SaaS Capital Index, at least as of July 31, 2022.

The primary risk to the company’s outlook is an increasingly likely macroeconomic slowdown or recession, which may slow sales cycles and reduce its future revenue growth trajectory.

Management expects to return to topline revenue growth in 2033.

Until we see evidence of that return to growth as well as a meaningful move toward operating breakeven, I’m on Hold for ONTF.

Be the first to comment