icetocker/iStock via Getty Images

Published on the Value Lab 9/7/22

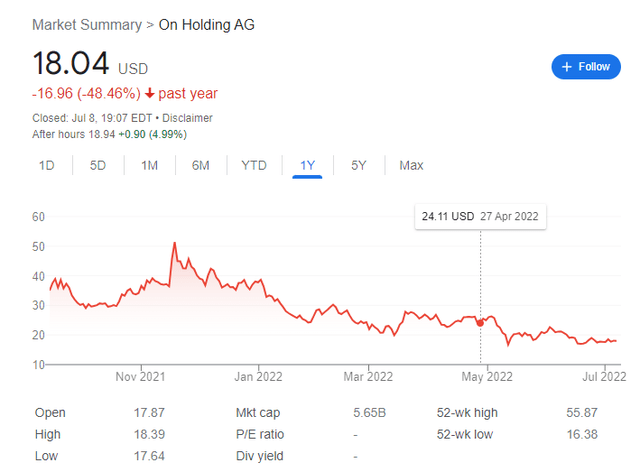

On Holding (NYSE:ONON) is a Swiss company founded in 2010 designing and selling athletic shoes, sports apparel, and accessories. In 2021, it had a successful IPO on the NYSE, raising $746 million in September. The initial offering price was $24.00 per share, reaching $38.00 in September 2021 and currently trading at $18.40 per share, meaning a market cap of $5.6 billion. ONON boasts Roger Federer as one of its co-entrepreneurs who helped design and paste his name on their collection. Does the involvement of arguably the world’s best ever tennis player with a huge and loyal fan base contribute to the business success of the company? In our view, only to a certain extent as we do not see a lot of RF mention in the company publications and social media channels connected to ONON. Moreover, competing in footwear is difficult, and with macro being a major factor for footwear shares, especially premium footwear, we’re not too keen on the company’s fundamental prospects. Priced as it is with a 36.5x forward multiple, we remain very wary.

Key Business Concerns

This market segment is dominated by large companies such as NIKE (NKE) and adidas (OTCQX:ADDYY) (OTCQX:ADDDF). The pandemic had serious consequences by affecting both the supply and demand sides. In 2020, the athletic shoe market declined by 8% due to the COVID-19. The smaller players like ONON may see this post COVID-19 period as an opportunity to increase their market share. Brand power is key in the fight for dominance, so strengthening the brand is imperative to growth and success. The successful ONON IPO raising 746 million provides the financial opportunity for this. The launch of new products and business expansion into new markets will go hand in hand with the strengthening of the brand.

Today, there are three important, essential areas in which producers of athletic wear have to outpace their rivals in the race for a higher market share:

- Technological advancement of products in terms of improved design, performance and durability. Close cooperation with top athletes and scientists to create shoes which have better traction, cushioning and weigh less.

- Social impact of the product, the concern and concentrated continuous effort to source products from manufacturers who treat their workers in a dignified way. Athletic shoe brands like On have to be also transparent in demonstrating this effort to the public, in full detail.

- Impact on the environment, making sure that each new product is more sustainable and uses more recyclable materials than its predecessor. Sustainability means that the customers will use the shoes for a long time, as they are happy with the product and the product lasts a long time. Some producers also organize the return and recycling of old athletic shoes. The new product of On, Cyclon Cloudneo subscription, will give customers a possibility to return the shoes at the end of life for recycling, a sustainability contribution offered by only one peer. Impact on the environment is the reduction in use of plastics and replacement with natural materials or recycled such as On shoes which are made in part from recycled plastic bottles. Packaging is from recycled paper, using less ink and the transportation from the manufacturer is planned in such a way as to use less air transport and more shipping.

The problem is that these avenues of proposition for customers are already heavily saturated in terms of marketing, especially the footwear industry, from which all of ONON’s revenue comes, is one that is connected to very unsavoury concerns around environment and human rights. Nike, among others, has attempted to align itself with ‘woke’ values on many occasions, and with their advertising budgets eclipsing that of competitors, already there is a lot of competition for attention from these markets. Moreover, with macroeconomic concerns and the general understanding that we’re in a recession, discount producers are going to have a big advantage in claiming share. ONON products are by no means discount, and we should expect the hefty growth trajectory required to justify at 36x multiple to struggle to materialise. Ultimately, the Roger Federer association provides a great head start in terms of organic reach, but following up with meaningful marketing will be costly and possibly ineffective given economic direction, interacting poorly with the increasing cost of money that is leading our recession.

On Holding’s Finances

On Holding recorded significant growth in net sales of CHF 267.1, CHF 425.3, and CHF 724.6 in the three years from 2019 to 2021. Yearly growth of 59.2% and 70.4%. Direct to customer sales (DTC) increased from 25% in 2019 to 39% in 2020 to 38% in 2021. With a 67% increase YoY as of Q1 2022 with DTC keeping pace, the 2021 proportion of DTC persists and sales growth does remain substantial. DTC consists of e-commerce and sales through own shops. Most of the DTC increase is due to e-commerce, with recorded 102.2 million visits during 2021 and 66.1 million visits during 2020. This is matched by 5 new own stores opened in 2021, bringing the total of own stores number to 10 stores. The stores are opened in high end shopping centers such as Harrods in London. We hope that On maintains this COVID-19 stimulated increase and keeps DTC digital and physical sales component growing at a steady pace.

On operates and sells online only through its own e-commerce platform, thus enabling it to own the customer data and have an ongoing communication with its customers. In this way it has the ability to enhance CX. This is valuable in the long run, assuming returning loyal customers, but can it support growth and increase market share in the medium and short run? 91% of these e-commerce sales are in Europe and the US which is the largest part of the market, and going DTC in these higher margin markets capitalises well on the margin benefits already offered by DTC rather than wholesale to retailers.

However, EBITDA is falling 20% on account of supply chain disruptions and logistics costs eating into margin. Moreover, with inventory management in a supply disruption environment relying on bloating inventory, cash flows have cratered. Cash burn is running at $60 million per quarter, and current cash reserves have about 10 quarters covered. While that is a decent margin, the company is more than likely going to keep raising equity at prices that have already shrunk more than 50%.

Conclusions

With reflexivity affecting the company as well as major headwinds to EBITDA growth, the 36x forward multiple, predicated on EBITDA that runs at a rate double to this Q1 2022’s EBITDA, seems untenable. A more likely multiple is 72x, and that is assuming that the macroeconomic headwinds don’t get in the way of scaling that EBITDA and achieving volumes. We think that the company is still rather expensive given its market and the economic direction. It is rare to see anyone pay this much for the prospect of growth anymore, and it is difficult to rely on ONON’s growth to begin with. We pass on ONON despite its association with Roger Federer, whose brand value is undeniable, on the basis of concerns on the economics of the business and the macro environment.

Be the first to comment