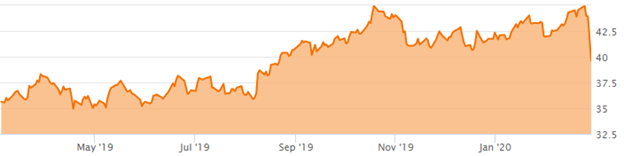

Omega Healthcare Investors, Inc. (OHI); a solid outlier for this year, has steadily ramped up and is now seated just a few flucs away from its all-time high price, despite all the global tensions and general bearish market sentiment.

As a Real Estate Investment Trust (“REIT”), OHI serves as a capital source for the long-term healthcare industry situated all through the United States and the United Kingdom. With OHI boasting the largest share of Skilled Nursing Facilities (“SNFs”), the company is serving as a prime target for a booming growth industry.

Compound annual growth rate (OTCPK:CAGR) for OHI is set at 15.2% starting from December 2002, up to just last month, and is now positioned near its all-time highs, furthering the case that the REIT is a strong contender for a continued share price growth.

Source:

2020 February Investor Presentation

Besides OHI dominating the SNF market, the company is also engaged with the Senior Housing portfolio, set in territories with high obstructions to entry. Omega prides itself as a “Triple-Net” REIT- meaning that they have the ownership for their properties and enhancements, however, their customers are responsible for other expenditures -like insurance and taxes.

Avenues for Growth

Being the biggest SNF-focused REIT, Omega’s portfolio consists of 964 operating facilities with an impressive $1.7 billion dedicated solely to investments for 2019. Despite Omega being the largest holder of SNFs, it still only consists of around 5% of the current market. This says a lot about the potential of OHI itself and the long-term healthcare industry.

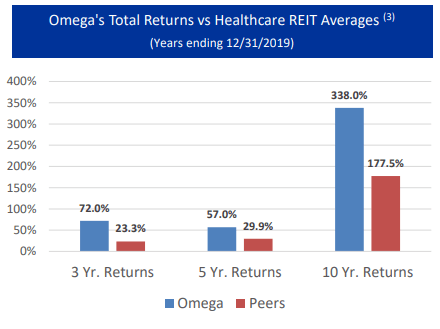

Given the gradual growth of the industry from acquisitions and mergers, the overall setting of SNFs shows a promising venture for further advancement. Shown below is a measure of Omega’s Total Returns compared to Healthcare REIT Averages from KeyBanc Capital Markets The Leaderboard, December 31, 2019.

Source:

2020 February Investor Presentation

Omega’s dominance in the revenue stream is brought by its persistent selective acquisitions and a heavy focus on its current core markets; mainly the senior care facilities. Furthermore, the company has about $12.3 billion overall slated just for their investments, showing how much they value growth.

Additionally, the Company has approximately $170 million committed to its operators for capital improvement and new construction projects to be completed over the next 12-18 months (as of 12/31/2019).

Besides the actual dedication of Omega to its improvement, the company is also situated in a very favorable market. It is well-known that baby boomers are now stepping onto elderly years which is projected to drive long-term demand for SNFs and healthcare facilities in general. An overall increase in occupancy for healthcare facilities will, in turn, move OHI into a better position for the years to come.

Source:

2020 February Investor Presentation

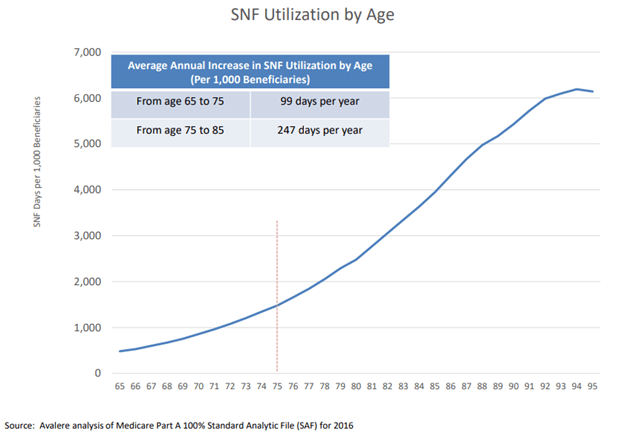

For over 10 years, the SNF industry has been faced with horrible demographics due to the low count of aging from the baby bust generation. Based on birth rates beginning in the 1940s and current SNF utilization information, we believe the industry is at the beginning of a 20+ year secular tailwind

This conviction depends on the following reasons -Medicare usage of SNFs significantly rises at 75 years old and above, wherein usage steadily ramps up until the late ’80s. Serving as a fuel for SNF occupancy, “Baby boomers/Gen X” started turning 75 in 2016. Furthermore, the elderly age group will continue to increase until at least 2040.

This just shows a multi-year growth spurt phase for SNF and healthcare facilities. Maturing demographics would drive SNF residence past limits in under 10 years without endeavors to diminish lengths of tenure and expanded usage of other healthcare sites.

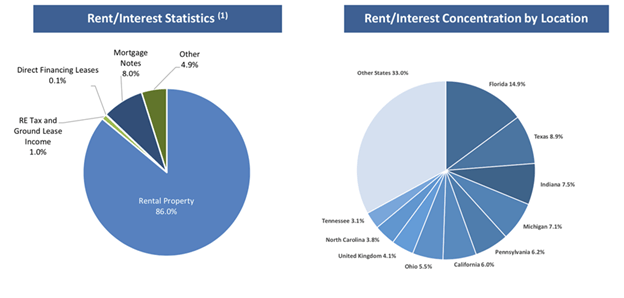

Furthermore, Omega’s investment strategy of having diversified holdings that are selected for long-term value coincides perfectly with the suggested multi-year growth phase. Shown below is OHI’s portfolio for its revenue by type and location.

Source: OHI Site: Our Strategy

As of December 31, 2019, OHI has 964 operating healthcare facilities, located in 40 states and the UK, operated by 71 third-party operators. With Gross real estate investments of approximately $10.4B, the company is focused on leasing long-term care facilities (primarily skilled nursing facilities) to strong regional and local operators. Connections built by the company are based on strong credit profiles with security deposits of three to six months, with monthly reporting requirements to ensure that their partnerships run smoothly.

Furthermore, property-level expenses are part of the operator’s responsibility (labor, insurance, property taxes, capital expenditures) while Omega receives fixed rent payments from tenants, with annual escalators. Operators receive revenues through reimbursement of Medicare, Medicaid and private pay for services.

With regard to financial strength, OHI is pegged at a conservative leverage level, with a steady free cash flow coupled with minimal debt occurrence. Liquidity is also set at about 1.05 billion of cash and credit facility availability.

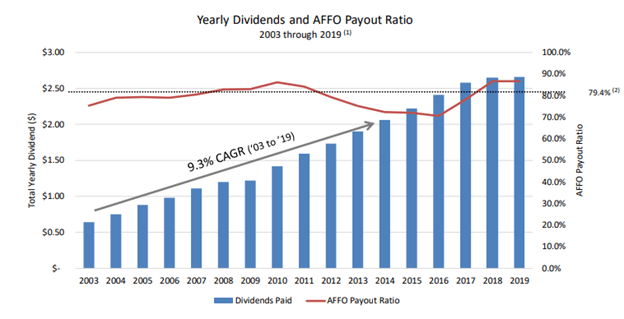

OHI is proven to have a strong dividend growth with an astounding 17 consecutive yearly increases, starting from 2003 up to present, shown below:

Source:

Source:

2020 February Investor Presentation

Price Analysis and Risk

OHI is now pegged at about ~12% below its highs, which is a strong outlier overall, with most stocks plunging to new 52-week lows and just steadily plunging down, owing to global risk sentiment and overall pessimism for the market.

Source:OHI Price Chart

Current short to medium-term risk for OHI is insider selling from its executives just last February 2020, possibly on an attempt to capitalize on the bearish market sentiment and rebuy on a much favorable price from them just when fears subside.

Final thoughts/conclusion

Overall, OHI has favorable near-term supply and demand outlook coupled with an experienced management team (CEO, COO, & CFO) with average tenure over 18+ years to further drive its growth.

The company also has proven itself to execute fully on long-term strategies and a steady hand in making sure that risk is managed to a suitable level for its partnerships handled.

With its current price experiencing a short-term pullback, it looks like investors may pursue this as a good accumulation ground to capitalize on OHI’s growth.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment