Nordroden

Investment Thesis

Olympic Steel (NASDAQ:ZEUS) has outperformed the broader market as it continues to post strong results despite the decline in the prices of metals and a challenging macro-environment. The company’s strong results reflect the success of its revenue diversification strategy which positions it to do well in all market cycles. The stock’s multiple is getting re-rated by the market and I believe there is still significant upside left, with several key catalysts going forward, including end-market customer backlogs, as supply chain issues persist, and the completion of the Winder, Georgia plant and the planned new facilities in Illinois.

Strategic initiatives are well-defined and point to growth

Olympic Steel’s overarching goal is to deliver profitable growth driven by higher-return business and less volatility in its results. To achieve this goal, Olympic Steel is seeking both organic growth initiatives and acquisitions. Since 2018, the company has accelerated some of its growth initiatives through investments and acquisitions. Olympic Steel uses acquisitions to grow its geographical footprint, as was the case with the acquisition of Action Steel, through which the company moved into new geographies like the South and Southwest. Moreover, through the acquisition of Berlin Metals, the company added more products to its specialty metals product segment, adding various types of stainless flat-rolled sheet and prime tin mill products. The management has expressed that it continues to see acquisitions being a catalyst for continued growth in the near term and has expressed its intention to grow its white metals segment through strategic acquisitions in the future. The company’s efforts to make strategic acquisitions should enable it to further diversify its business, expand EBITDA margins, and provide less cyclical financial results.

Additionally, ZEUS is making organic growth investments to expand its capacity and improve efficiencies. These include a second auto stamping press with 50K tons of annual capacity; two new 10K lasers and two new robotic welders; leasing a new 80,000 sq ft white metals facility in Bartlett, IL; and a 30,000 sq ft facility expansion at its Des Moines, IA Pipe & Tube facility. These investments will be phased in over FY22/FY23 and, once fully ramped, are expected to increase EBITDA by ~ $10 million/year.

Growing margins & rising contribution from specialty metal segment reflect the success diversification strategy

Olympic Steel has three reportable segments, namely specialty metals flat products, carbon flat products, and tubular and pipe products. Products in the carbon flat segment are more commoditized in nature, and spot pricing drives a great deal of demand from end customers, which exposes the company to cyclical risks and drives volatility in results as metals prices fluctuate. The other two segments are more stable on pricing as prices are typically higher, and end customers are typically more focused on obtaining a fixed raw material price vs. obtaining the lowest prices. Moreover, the two segments command higher margins compared to the carbon flat segment. For example, from FY17 to FY21, the specialty metals and tubular and pipe segments had average operating margins of 5.8% and 3.6%, respectively, compared to Carbon Flat’s average operating margins of 2.5% over the same period.

| Zeus (Operating Margins) | FY17 | FY18 | FY19 | FY20 | FY21 |

| Carbon Flat products | 2.1% | 4.1% | -0.5% | -1.5% | 8.2% |

| Specialty metals flat products | 4.9% | 4.4% | 3.9% | 3.7% | 12.0% |

| Tubular and pipe products | 2.0% | 3.9% | 6.4% | 3.9% | 1.9% |

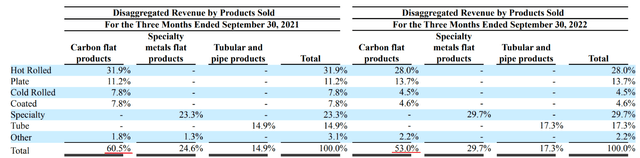

To reduce the volatility in its results and generate continued value for its stakeholders, the company has made concerted efforts to diversify its product portfolio and drive more revenue from the two stable segments. The company has been successful in steadily increasing its revenue exposure toward its specialty metals and tubular and pipe segments. The percentage contribution from Zeus’s carbon flat segment as of Q3 2022 stood at 53.0%, down from 60.5% in Q3 2021. Olympic Steel’s goal is to reduce Carbon Flat revenue share to less than 50% over time, which is on the cards to occur during the next 12 months.

ZEUS’s changing revenue mix (Company Filing)

Q3 results: Positive Outlook Remains as Debt is Reduced

All segments reported solid revenue and EBITDA results; however, year-over-year revenue and EBITDA decreased by 5.1% and 64.5%, respectively. Carbon volumes remained steady in the 200,000+ per quarter range as end-market supply constraints continue to place a cap on higher volumes. ASPs remained at a healthy level, flat year over year, while GP/ton was at a healthy $211/ton vs. FY21 at $342/ton. The company remains mindful of headwinds that include supply chain constraints, a downward-sloping pricing curve, and additional macroeconomic uncertainty. Despite these headwinds, ZEUS has proven its ability to maintain strong performance through diversification into higher-returning products and services. Also of note, ZEUS has been aggressive in reducing debt, down 26% this year, another step in the right direction toward balance sheet stability.

Valuation

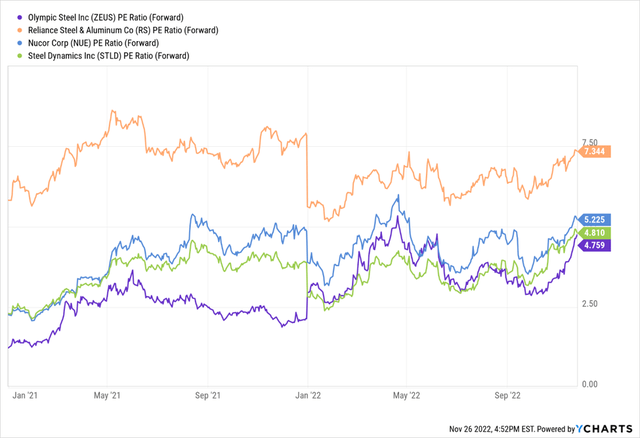

Although ZEUS has outperformed the market in 2022, the company still trades at a discounted forward P/E of 4.76x compared with the sector median of 12.65x. I believe that the market is assigning a lower multiple to the company because of its higher carbon flat products mix, which is exposed to market cyclicality. However, I do believe that the company has significantly reduced its exposure to the commoditized metal segment and justifies a higher multiple than currently assigned by the market.

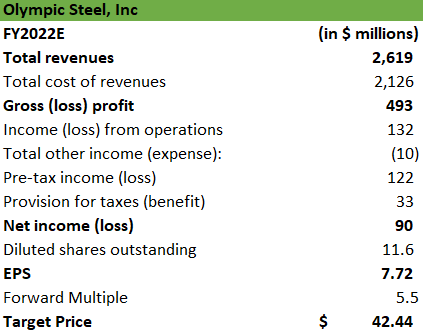

Given the success of the company’s diversification strategy and continued strong results in a challenging environment, I expect the forward P/E to be re-rated to 5.5x, which I believe will be a fair reflection of the company’s position in the market compared to some of its peers. I have multiplied my forward P/E assumption of 5.5x by the FY22 forecasted EPS of $7.72 to come up with the target price of $42.44, reflecting an upside of ∼16% from current levels.

Olympic Steel’s Forecasted FY22 P&L

Forward P/E of ZEUS vs. Peers (Ycharts)

Investment Risk

Metal price volatility

Metal prices are impacted by several factors beyond the company’s control which can lead to significant fluctuations in Olympic Steel’s operating results. The metals market has been really dynamic in 2022, and the elevated levels of prices seen in the earlier part of the year are now normalizing. The price of steel has continued to decline since May as global demand slows down. Although the increase in energy costs and shortages of natural gas can cause restrained steel production, causing a rise in steel prices again, the base case scenario is the normalization of prices amidst a period of macroeconomic downturn. With the carbon flat segment being the single-largest contributor to ZEUS’s revenues, the company is exposed to the risk of deteriorating profitability as average selling prices (ASPs) decline.

Conclusion

ZEUS continues to post strong results despite the normalization of steel prices and sees continued demand across end markets. However, the company remains mindful of headwinds that include supply chain constraints, a downward-sloping pricing curve, and additional macroeconomic uncertainty. Despite these headwinds, I believe the company will continue to expect a healthy demand picture driven by strong customer backlogs, domestic infrastructure spending, and the company’s diversification into the specialty metals segment. Moreover, I expect the company’s P/E to expand to paint a fairer picture of ZEUS’s strong execution and operating model vs its peers. Therefore, I recommend a Buy rating for long-term investors on the stock.

Be the first to comment