ablokhin

Introduction

Sometimes things just work out. In the case of Old Dominion Freight Line (NASDAQ:ODFL), we’re dealing with a company that I consider to be a terrific low-yield high-growth dividend stock as discussed in many articles (like this one). In this article, I will highlight the company’s operating strengths, which were just confirmed by its 2Q22 earnings. The company is the most profitable stock-listed LTL (less than truckload) operator in North America with yet another decline in its operating ratio, highlighting higher margins in a high-inflation environment. The company saw decent growth in freight, strong pricing gains, and – above all – no weakness in consumer demand or pricing pressure.

In this article, I will break down these numbers and explain why some comments make sense given the macro-economic environment we’re currently in.

So, bear with me!

The Macro Situation

Before we dive into ODFL’s numbers, let me give you some economic background, as it’s much easier to digest the numbers knowing the tailwinds and headwinds the industry is dealing with.

Basically, there are two (related) developments going on:

- The supply chain bullwhip effect.

- Slower economic growth.

According to FreightWaves, the supply chain bullwhip effect…

is a term used in supply chain circles to describe a scenario in which temporary surges in retail demand are magnified and exaggerated by upstream manufacturers and suppliers, who rapidly increase production well beyond the level that can be supported by consumers. Eventually, retailers find themselves with more inventory than they can sell, and what started as a goods shortage ends up as a goods surplus.

After the first lockdowns in 2020, demand came back roaring. Inventories weren’t restocked and manufacturers across all supply chains got overwhelmed with new orders. The need for transportation, raw materials, employment, energy, and much more increased. Now, demand is slowing, which brings me to the second point: slower economic growth.

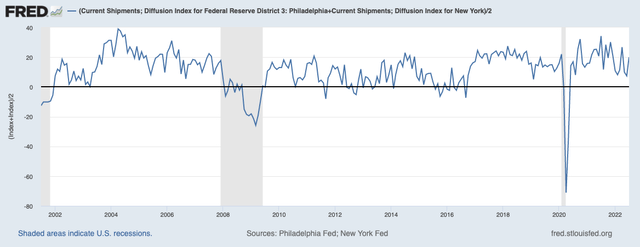

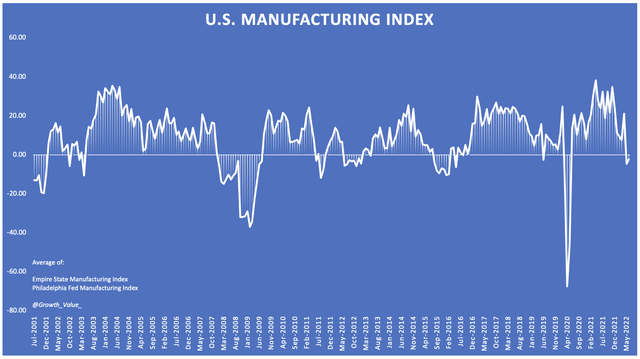

Manufacturing surveys (Empire State & Philadelphia Fed) highlight the high risks of a manufacturing recession. It’s caused by a toxic mix of high inflation, weakening consumer sentiment, and an aggressive Federal Reserve eager to solve inflation by hurting demand – after all, it cannot directly impact supply.

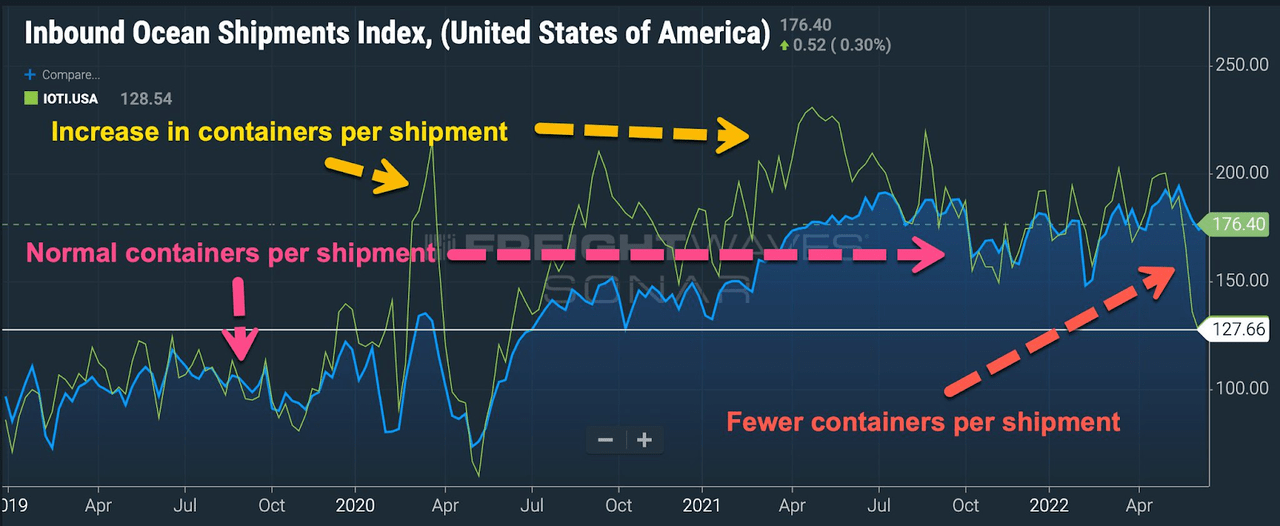

As a result, we started to see fewer containers per ocean shipment last month (the bullwhip effect).

FreightWaves

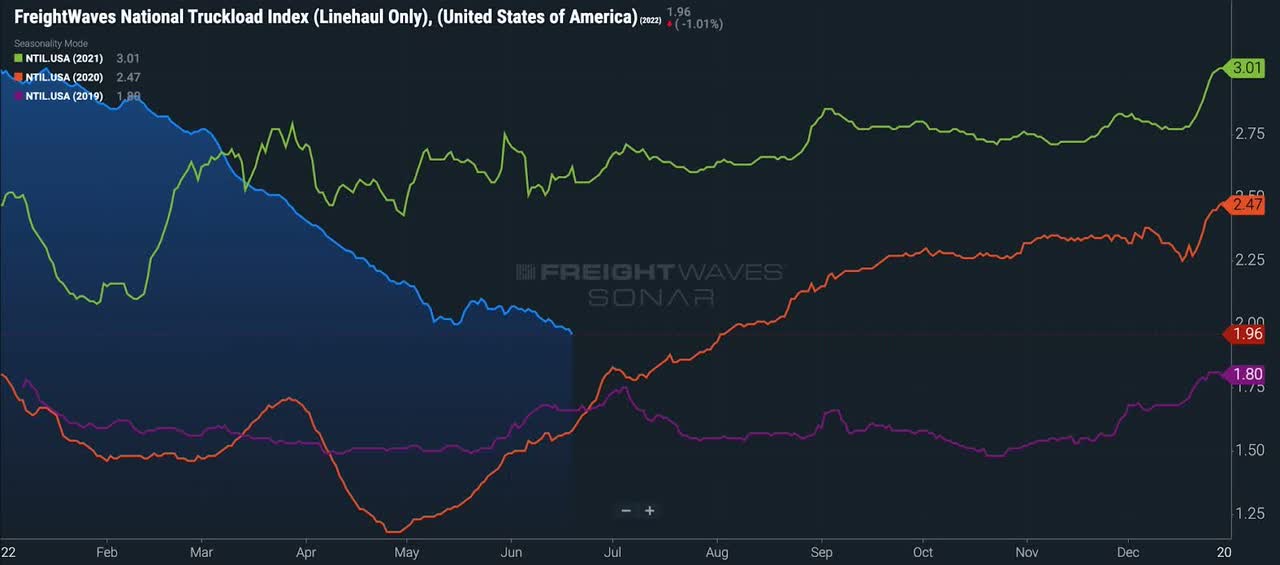

This started to hurt the national truckload index – ODFL does less than truckload, but it’s a good proxy for overall industry health.

FreightWaves

With that said, there is good news. The numbers and comments we are about to discuss show that ODFL is not seeing pricing or demand weakness.

That’s somewhat unusual given the developments, but it’s backed by the shipments part of the Empire State/Philadelphia Fed survey I just mentioned. While overall growth is down, shipments remain strong.

The average in July improved to 20, which is everything except weak.

Federal Reserve Bank of St. Louis

Now, with that said, let’s discuss why ODFL did so well.

Another Stellar Quarter From Old Dominion

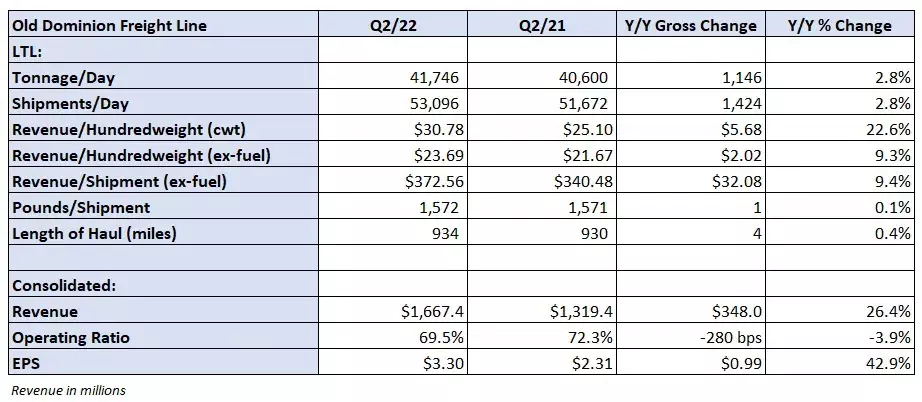

Let’s start with the headline numbers. North Carolina-based ODFL did $3.30 in GAAP EPS. That’s $0.15 higher than expected. This comes after expectations had barely moved. In the past 4 weeks, the company received one earnings downgrade and one upgrade. That’s out of seven estimates for the 2Q22 quarter. Earnings were up 42.9% compared to the prior-year quarter. Needless to say, that’s an impressive number.

FreightWaves

Revenue grew by more than 26% to $1.67 billion, which is roughly in line with expectations.

Moreover, the biggest number of the report was the 69.5% operating ratio, which is the lowest number ever, and the first time the operating ratio makes it below 70%. Bear in mind that the operating ratio measures how much it costs as a percentage of total sales to operate the business. The lower, the better.

Right now, (way more efficient) railroads are close to 60%. Less-efficient truckload companies are between 90% and 100%. This is a truly stellar number.

This operating success isn’t just nice for shareholders, it’s also the reason why ODFL could double its market share in the past 10 years. After all, management isn’t recklessly cutting costs (that’s easy). No, it is maintaining a high service level as well, which is the hard part.

In 2Q22, the on-time performance of ODFL was 99%. The cargo claims ratio improved to just 0.10%.

The company mentioned that despite high pricing, quality and reliability are the major drivers of new contracts. That makes sense as supply chains have been a total mess since the start of the pandemic. Everyone depending on reliable energy can gain an advantage when selecting a reliable shipper, even if it’s not always the cheapest option.

Moreover, the company has 15% to 20% excess capacity in its network, which helps it to take on more orders if needed. It also gives customers some security when it comes to planning.

When it comes to its impressive operating ratio, the company commented:

Our second quarter operating ratio improved to 69.5%, with improvements in both our direct operating cost and overhead cost as a percent of revenue. Within our direct operating costs, improvement in salaries, wages and benefits, as well as purchase transportation cost as a percent of revenue, effectively offset the increase in our operating supplies and expenses. The increase in operating supplies and expenses as a percent of revenue was primarily due to the increase in the cost of diesel fuel and other petroleum-based products.

Moreover, the company believes that its team is “appropriately” sized, which means it expects to drive higher operating efficiencies if demand remains high. It also means that hiring will slow down significantly.

Also, LTL businesses suffered less from labor shortages as working conditions are often better. ODFL, for example, was able to cut back on third-party transportation, which supported margins and it once again underlined its own operating flexibility.

Now, three comments with regard to pricing and demand in the industry – in light of my macro comments earlier:

[…] so far we haven’t seen much of any at all of any customers asking for cheaper rates, or any kind of exception pricing or anything such as that. I think from what we can tell the industry is extremely disciplined.

And…

But we feel good about demand. We’ve talked about that. We’ve had a lot of customer engagement in recent months and we’re hearing good things from our customers. They continue to demand service quality.

One more…

And so as a result we’re not losing business. The volumes are a little bit flatter but I think you can just look and some of that may be demand for existing customers’ products.

With regard to flatter volumes, we’re indeed seeing that weight per shipment was up just 0.1%. I believe this is due to economic weakness, and I would not bet against a deterioration in the remainder of the year.

Hence, it’s a good thing that the market has priced in weakness already. After all, investors and traders know we are in a growth slowing cycle.

ODFL Valuation

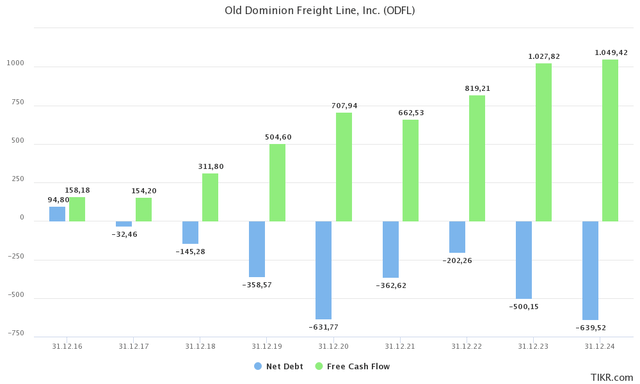

Old Dominion’s market valuation is $31 billion. Next year, the company is expected to lower net financial debt to negative $500 million – meaning more cash than debt. That’s another benefit of ODFL, it consistently generates high free cash flow, despite operating in a cyclical and very capital-intensive industry.

This year, the company is on pace to do $820 million in free cash flow.

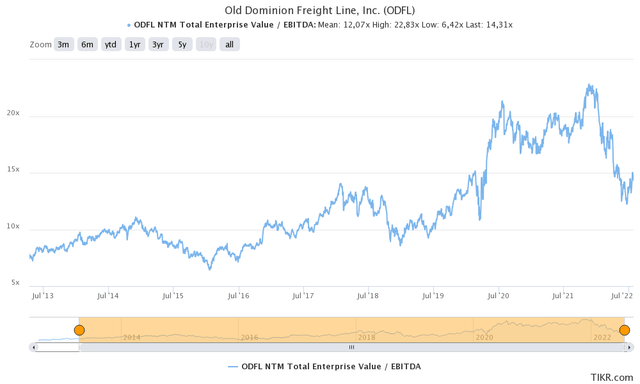

When combining the market cap and 2023 net debt expectations, we get an enterprise value of $30.5 billion. That’s 14.3x expected 2023 EBITDA of $2.14 billion.

This valuation erases the entire post-pandemic surge in the stock’s valuation. Moreover, it comes with 14.2% annual compounding EBITDA growth in the 2012-2024E period.

The problem is that economic growth expectations continue to be a problem. Hence, I will stick to the advice I gave in my last dividend-focused article:

[…] I don’t know if the stock is bottoming. It’s impossible to tell. What I do know is that I like the risk/reward. I have been adding stocks to my portfolio in recent weeks as I believe that buying a favorable risk/reward is a better strategy than trying to buy the bottom. At least when it comes to dividend (growth) investing.

Nonetheless, if you’re interested in buying ODFL, I would suggest breaking up an initial investment, i.e. buy 25% now and add gradually over time. If the stock continues to drop, investors can average down. If the stock suddenly takes off, investors have a foot in the door.

Takeaway

Old Dominion did everything right in its second quarter. Despite high inflation and labor shortages, it managed to improve its operating ratio to a record low below 70%. The company is in a good position to slow down hiring and reduce third-party demand. It sees strong demand and remains confident it can use pricing to its advantage. Moreover, its services remain top-tier thanks to high on-time deliveries and satisfied customers.

If it weren’t for the decline in economic growth expectations, the stock would trade far above its prior all-time high.

Unfortunately, we’re in an uncertain situation, which means ODFL is still a quarter below its all-time high.

I believe this offers fantastic long-term opportunities. However, given the circumstances, investors need to be aware of these economic risks. Other than that, I don’t see a reason to avoid ODFL on a long-term basis as outperformance is almost a certainty in my book.

(Dis)agree? Let me know in the comments!

Be the first to comment