Mizina

Investment Thesis

Through strong competitive positioning, Olaplex (NASDAQ:OLPX) has secured significant room for growth in a huge and highly sustainable beauty market. The company features strong revenue growth, abnormally high margins, solid cash flow, and a strong balance sheet. If a year ago strong fundamentals were more than reflected in cosmic multiples, today Olaplex is trading at the industry average level. According to our DCF valuation, the company is trading at a significant discount to its fair market value. We rate shares as a Strong Buy.

Company Profile

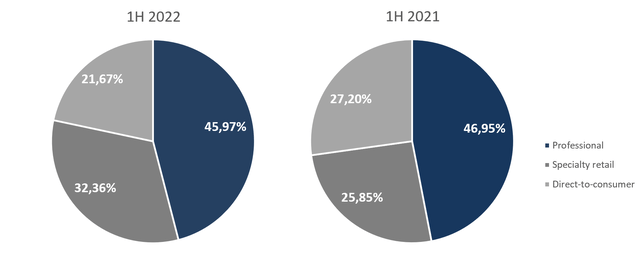

Olaplex Holdings Inc. offers patented shampoos, conditioners, and other products for the treatment, maintenance, and protection of hair. Olaplex markets its products through three sales channels: Professional, Specialty retail, and Direct-to-consumer [DTC]. The company’s two largest customers, Sephora and Beauty Systems Group, account for more than 10% of all sales. The revenue structure is presented below:

Created by the author

Olaplex went public at the end of September 2021. Shareholders of the company sold 73.7 million shares at $21 and raised $1.5 billion. Although the company did not receive any proceeds, Investors’ cash out is not a strong negative signal, as they have sold only part of the shares and created a public market for future deals. Olaplex was founded in 2014 and is based in Santa Barbara, California.

Resistance to Macro Headwinds

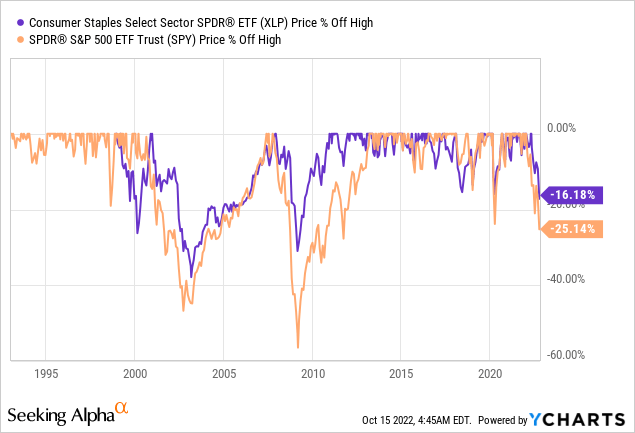

Macroeconomic turbulence is one of the main risks to the stock market and the economy as a whole. Historically, the Consumer Staples sector has been one of the most recession-resistant. In 2008-2009 the Consumer Staples Select Sector SPDR ETF (XLP) sank 27.9% while the S&P 500 fell over 44%. We could observe a relatively low standard deviation of the sector in 2020 as well.

At first glance, this thesis seems inappropriate for Olaplex, since the company has lost more than 60% of its capitalization over the past year. However, a significant drawdown of shares is due to the fact that the market treats the company as a growth story, which for a long time was priced in multiples. Correction to rational levels was expected.

The beauty products market was stable even as America’s unemployment hit 25% in the 1930s. Cosmetics successfully survived several wars, presidential scandals, and the Great Recession of 2008. During the recession in 2001, discussion began on the “lipstick index“, which proved that the beauty industry was immune to economic problems.

At Olaplex’s latest conference call, CEO JuE Wong noted that Prestige beauty was the only industry in the U.S. with rising physical sales in the last quarter despite high inflation and a contraction in consumer spending. This once again confirms the thesis of a high degree of sustainability of the industry.

Strong Positioning in a Competitive Market

The global hair and scalp care market is expected to grow from $86.03 billion in 2021 to $134.30 billion in 2028, which projects a compound annual growth rate of 6.6% during the forecast period. The market is competitive and highly fragmented: despite the presence of such giants as L’Oreal (OTCPK:LRLCF) and Estee Lauder (EL), there are a large number of independent manufactories with a loyal customer base.

Olaplex has pioneered the professional at-home hair care market and has secured significant room for growth. The secret of the company’s success lies in a strong competitive positioning based on a unique product and an exemplary marketing strategy.

The uniqueness of the Olaplex product lies in the developed and patented active ingredient Bis-Aminopropyl Diglycol Dimaleate, which works at the molecular level and improves the condition of the hair by repairing disulfide bonds.

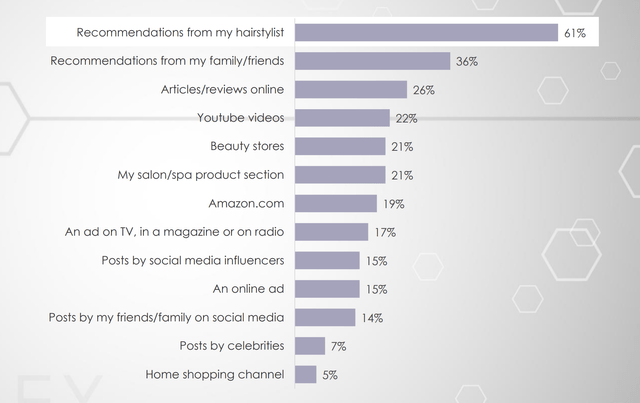

The loyalty of beauty industry professionals also confirms the high quality of the company’s products. The main sales channel is Professionals, which brings about 46% of revenue. According to Olaplex, 61% of customers make product purchase decisions based on recommendations from a stylist.

Company’s Presentation

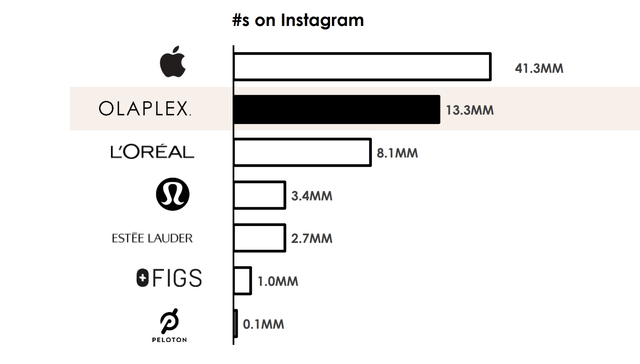

However, it is not enough to have a good product, it is important to convey its value to consumers. Active engagement with social media and the involvement of influencers such as Jennifer Lopez, Kim Kardashian, and Margot Robbie have increased Olaplex’s brand awareness and built a loyal customer base. The amount of content with the Olaplex hashtag on social media is second only to Apple and vastly outnumbers other famous and fast-growing brands.

Company’s Presentation

High brand awareness has enabled Olaplex to achieve outstanding marketing performance: in 2021, for every dollar spent on sales and marketing, the company earned $112 in revenue. In 2020, the figure was $99.

Growth Opportunities

Despite the high growth rate, the potential for further expansion remains. In its price segment, Olaplex is the leading hair care brand and only has a single-digit penetration. In addition, international sales account for only 44% of total revenue. By comparison, Estee Lauder accounts for 75% of its revenue in EMEA and Asia. Olaplex could use the US, the world’s most competitive market, to test hypotheses and launch new products that could then be rolled out to other markets.

In the second quarter, the company introduced a 1-liter size of our No. 4 Shampoo, no. 4C Clarifying Shampoo and No. 5 conditioner. The company’s portfolio includes 13 products, the main ones are OLAPLEX Bond Multiplier (No. 1), OLAPLEX Bond Perfector (No. 2), and OLAPLEX 4-in-1 Moisture Mask. We are likely to see an expansion of the product portfolio, as the management clearly hinted at the last conference call.

“The global prestige hair care category remains in the early stages of long-term growth and OLAPLEX is playing a leading role in developing this market. We are excited about our long-term initiatives to grow awareness, increase penetration in existing channels, growth distribution internationally and expand our portfolio, which only consists of 13 products today, with ample white space for highly incremental future launches.” – JuE Wong, CEO

Financial Performance

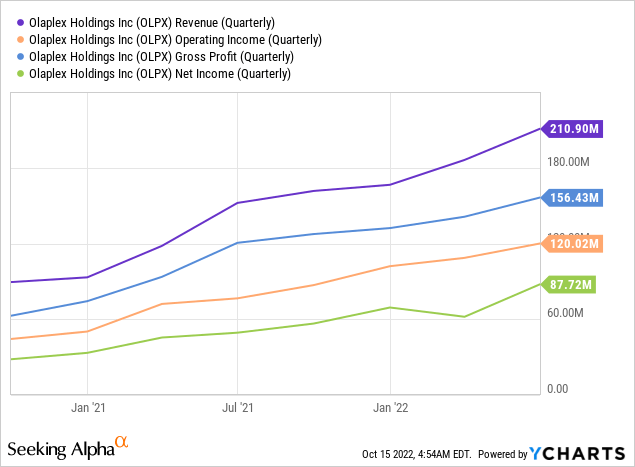

Since its IPO, Olaplex has shown strong revenue growth across all sales channels but has seen a significant slowdown in recent quarters. So, according to the results of the second quarter, the revenue amounted to $210.9 million, which is 38.6% more than a year earlier. The slowdown in growth is natural, as it is due to the high settlement base.

Despite inflation, Olaplex improved its operating leverage and achieved abnormally high margins. At the end of the last reporting period, operating income increased by 56.8% year-over-year to $120 million, operating margin was 56.9% against 50.3% a year earlier. Net income jumped 77.7% to $87.7 million, while net margin increased 9.2 percentage points to 41.6%.

While management expects margins to remain at comparable levels through 2022, the Wall Street consensus sees margins steadily declining over the coming years due to growing competition and rising marketing costs. It was the growing competition risks that caused the recent 10% drop in stocks.

Despite the active expansion, Olaplex generates high cash from operations ($253.1 million TTM) and free cash flow ($250.5 million TTM). In addition, the company has a strong balance sheet with net debt of $465.7 million, which is about the same as TTM EBITDA.

OLPX Stock Valuation

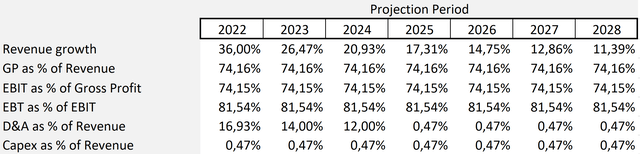

The DCF model is built on several assumptions. FY 2022 sales are expected to increase by $813.7 million in the middle of the forecast range. We assume that absolute revenue growth will remain at the current level until the end of the forecast period.

We assume that the gross margin will remain at the Q2 2022 level until the end of the forecast period – 74.2%, which is quite below the trailing twelve months number. The projected operating margin is in line with the TTM of 55%, below than in 2021 and in Q2 2022.

At the end of the last reporting period, TTM DD&A expenses as a percentage of revenue stood at 16.9%, which we expect to continue until the end of the year. CapEx as a percentage of revenue will be equal to 2021 until the end of the forecast period.

The assumptions are presented below:

Created by the author

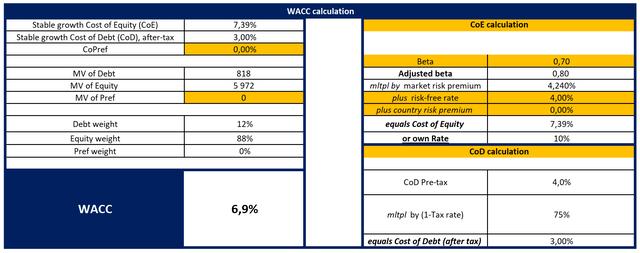

With the cost of equity equal to 7.4%, the Weighted Average Cost of Capital [WACC] is 6.9%. The low cost of equity is due to the low beta of the consumer staples companies.

Created by the author

With a Terminal EV/EBITDA of 12.48x, the model projects a fair market value of $12,067 million, or $18.6 per share, below the Wall Street consensus estimate of $19.4. The upside potential we see is about 107%.

You can see the model here.

Olaplex is trading at a premium on EV/Sales, driven by the company’s high margins. On P/E multiple, Olaplex is trading at the industry average despite double-digit growth.

| Company | Ticker | EV/Sales | EV/EBITDA | P/Cash flow | P/E GAAP |

| Olaplex Holdings | OLPX | 8.74x | 13.71x | 23.21x | 22.65x |

| L’Oreal S.A. | OTCPK:LRLCF | 4.71x | 22.54x | 26.88x | 30.41x |

| Unilever PLC | UL | 2.36x | 12.15x | 13.17x | 18.34x |

| Estee Lauder | EL | 4.47x | 18.57x | 24.59x | 31.96x |

| Coty Inc. | COTY | 1.97x | 12.19x | 7.54x | 95.37x |

| Procter & Gamble Co | PG | 4.05x | 15.10x | 17.84x | 21.54x |

(Source: Seeking Alpha)

Risks

- The main risk is increased competition. The beauty industry is a competitive environment and has a large number of players who have more resources than Olaplex. The loss of market positions could lead to a slowdown in growth and a significant revaluation of OLPX shares.

- The top two buyers account for over 10% of Olaplex’s sales. Buyers’ refusal of the company’s products can lead to a decrease in financial performance.

Conclusion

Olaplex is a fast-growing and highly profitable recession-resistant company. In our view, the company is a great bet not only for conservative investors looking to protect capital during a recession but also for growth investors. Until recently, Olaplex’s impressive financials were reflected in its high share price. The company has moved closer to the industry average after the correction. According to our valuation, the upside potential to the fair market value exceeds 100%, which is in line with the Wall Street consensus. We are bullish on the company.

Be the first to comment