chinaface/iStock via Getty Images

OIS Is On A Slow Burner

In 2022, Oil States International (NYSE:OIS) will benefit from increased subsea floating and fixed production jobs following the completion activity recovery in the US and other international territories. The backlog in the Offshore/Manufactured Products segment also went up. At the same time, the book-to-bill ratio has remained above one for the past several quarters, thus keeping the revenue generation potential strong. Also, the company exited the nonperforming business in the recent past. So, along with higher revenues, its operating margin should improve in 2022.

The stock is reasonably valued at the current level. In the near term, two critical challenges ahead for the company are the revenue loss from the adverse timing of the underlying project schedules and negative and deteriorated cash flows. I do not think the stock will exhibit strong returns potential in the short term, although investors may hold it for steady returns in the medium term.

Explaining The Current Strategy

OIS’s management has its hopes pinned on the recent bull factors in the energy sector – elevated energy prices, low global oil inventory, and higher drilled and completed well counts in 2022. The Offshore/Manufactured Products segment sees opportunities in the subsea floating and fixed production systems. Demand from its drilling and military customers is on the rise. Read more about its strategic moves in my previous article.

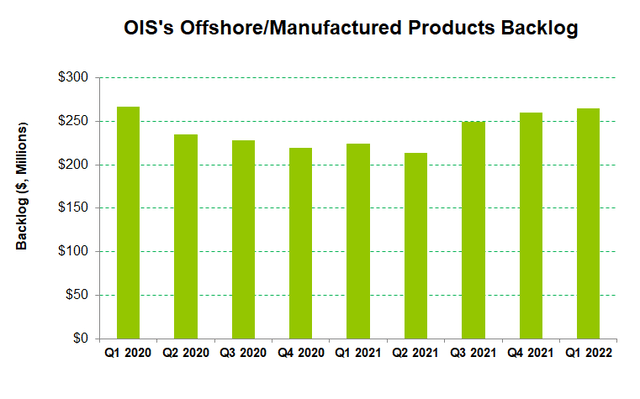

One of the primary reasons the company’s outlook on this segment is positive is the impressive backlog and book-to-bill ratio. In Q1, its book-to-bill ratio was 1.1x, indicating potential revenue growth in the coming quarters. Given increased backlog levels and higher demand for the short-cycle product, expect revenues in this segment to increase in Q2 compared to Q1.

In the Well Site Services, the company exited some of its underperforming service offerings, which resulted in a revenue loss in Q1. As market expansion opportunities unfold, it differentiates its completions service offerings in 2022. In the US, the completion well counts increased by 5% from 2021-end until April. Along with higher revenues, the company expects EBITDA margin to expand by 350 basis points in Q2, backed by improved personnel and equipment utilization.

FY2022 Guidance

OIS expects revenues to increase by more than 25% in FY2022 compared to FY2021. It also expects to generate $65 million to $75 million in FY2022 EBITDA, which would be 84% higher than a year ago.

The US rig count has increased by 21% in 2022, continuing with the momentum gathered in Q4 2021. The crude oil price curve has steeped by 51% in 2022. As estimated by Primary Vision, the frac spread count (or FSC) has mirrored the rig counts growth. Given the improvements in the FSC, revenues and EBITDA margin in OIS’s Well Site Services and Downhole Technologies segments are also likely to grow.

Backlog Is Higher

Backlog in the Offshore/Manufactured Products segment increased moderately in Q1. It increased by 2% compared to Q4 2021, while it was up by 18% year-over-year. The book-to-bill ratio was 1.1x in FY2021. Although a ratio above one indicates better revenue visibility, it was a marginal drop from the previous quarter. The share of other projects (non-energy) was 13% in Q1, which means the company is still heavily dependent on the energy market performance.

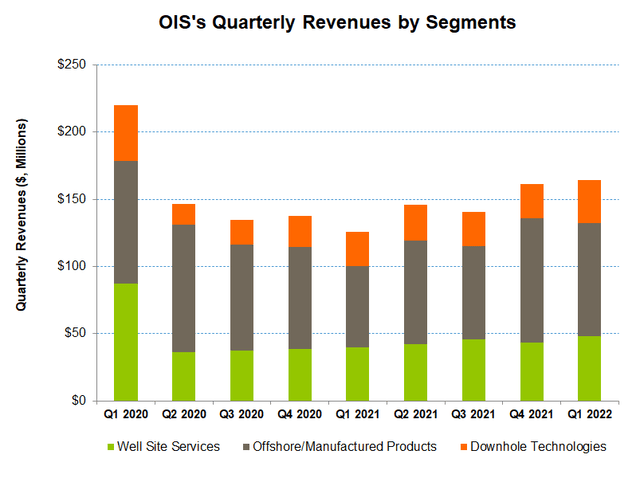

The Q1 Performance Drivers

In Q1, the Downhole Technologies segment outperformed the other segments (revenues up by 23% sequentially) following the increased US completion activity, which led to higher frac plugs and toe valves sales. Also, higher international perforating product sales increased in Q1. The Well Site Services also performed steadily (revenues up 9% quarter-over-quarter). Improved customer activity in the US, Mid-Continent, and Gulf Coast regions resulted in topline growth.

The Offshore/Manufactured Products segment, on the other hand, saw lower revenues (9% down) in Q1, driven by sharply lower revenues from projects due to the adverse timing of the underlying project schedules. However, the segment EBITDA margin expanded due to a better product and service mix.

Cash Flows And Leverage

OIS’s debt-to-equity was 0.26x as of March 31, 2022. This was much lower than the peers’ ratio (0.62x). Its liquidity was $90 million as of March 31, 2022. Approximately 75% of the company’s debt repayment lies in 2026 and after that. So, with low leverage, the financial risks are down in the short term.

In Q1 2022, the company’s cash flow from operations (or CFO) deteriorated and stayed negative compared to a year ago, associated with the activity growth. Consequently, free cash flow (or FCF) turned negative. The company plans to double its capex budget for FY2022 compared to FY2021.

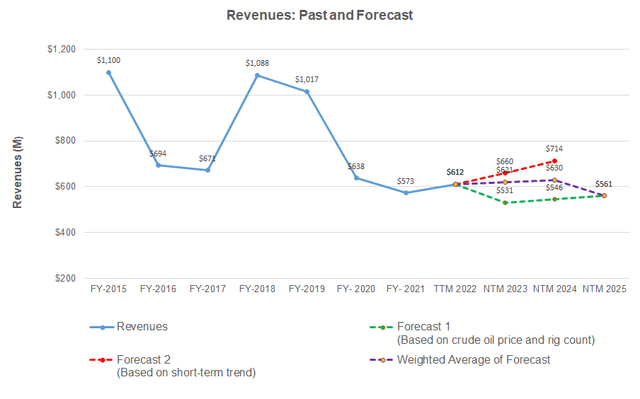

Linear Regression Based Forecast

Author created, Seeking Alpha, Baker Hughes rig count, and EIA

Based on a regression equation between crude oil price & US rig count and OIS’s reported revenues in the past seven and eight quarters, its revenues can increase modestly in the next two years.

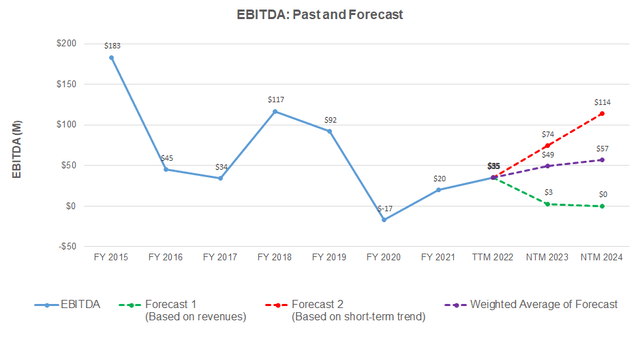

Author created and Seeking Alpha

Based on the revenue forecast, the model suggests that its EBITDA will increase sharply in the next 12 months (NTM 2022). In NTM 2024, the EBITDA growth rate can fall.

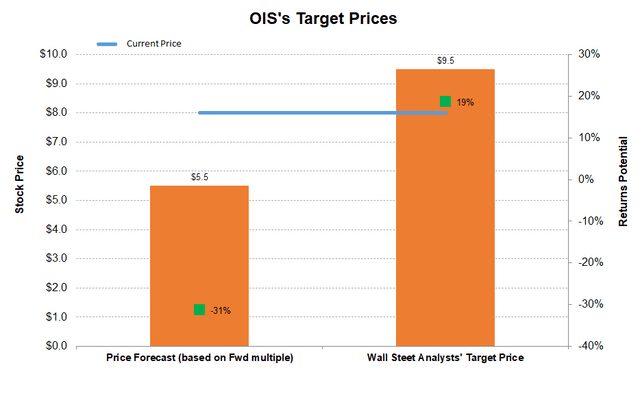

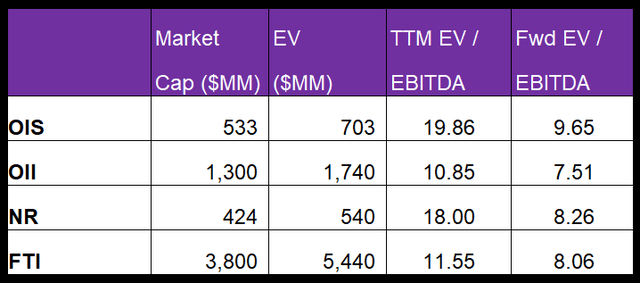

Target Price And Relative Valuation

Author Created and Seeking Alpha

Returns potential using the past average EV/EBITDA multiple (9.6x) is lower (31% downside) than returns potential using the sell-side analysts’ expected returns (19% upside) at the current price.

OIS’s forward EV-to-EBITDA multiple contraction versus the current EV/EBITDA is steeper than peers, typically resulting in a higher EV/EBITDA multiple compared to the peers. The company’s EV/EBITDA multiple (19.8x) is higher than its peers’ (OII, NR, and FTI) average of 13.5x. So, the stock is reasonably valued at this level, although I think the stock has some downside potential at this level.

What’s The Take On OIS?

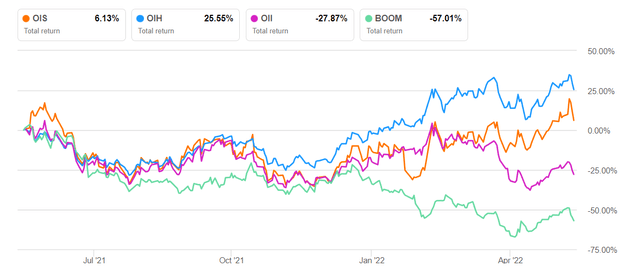

In 2022, the energy sector has turned around as drilling and completion activities improved. Following the recovery, an increase in subsea floating and fixed production systems brought new opportunities for OIS. Enhanced customer activity in the US, Mid-Continent, and Gulf Coast regions resulted in revenue growth at the Well Site Services topline. Along with higher revenues, the company expects its EBITDA margin to expand significantly in 2022. Also, the company exited the nonperforming business in the recent past to achieve a higher operating margin.

However, lower project revenues due to the adverse timing of the underlying project schedules can mitigate some of the topline growth potentials. Cash flows stayed negative in Q1 and deteriorated compared to a year ago. So, the stock underperformed the VanEck Vectors Oil Services ETF (OIH) in the past year. Nonetheless, with low leverage, the financial risks are non-threatening in the short term. I think the stock will remain range-bound in the short term.

Be the first to comment