Dilok Klaisataporn/iStock via Getty Images

Don’t look now, but WTI has just broken the downtrend and energy stocks are confirming that a bottom is in. The oil market has been through a rough period where participants are trying to find the price level at which demand starts to bottom. The irony in all this is that no one has a good gauge as to what demand is today. Let’s take a look at the US implied demand data, for a second, and let us explain why the market is catching onto the irony.

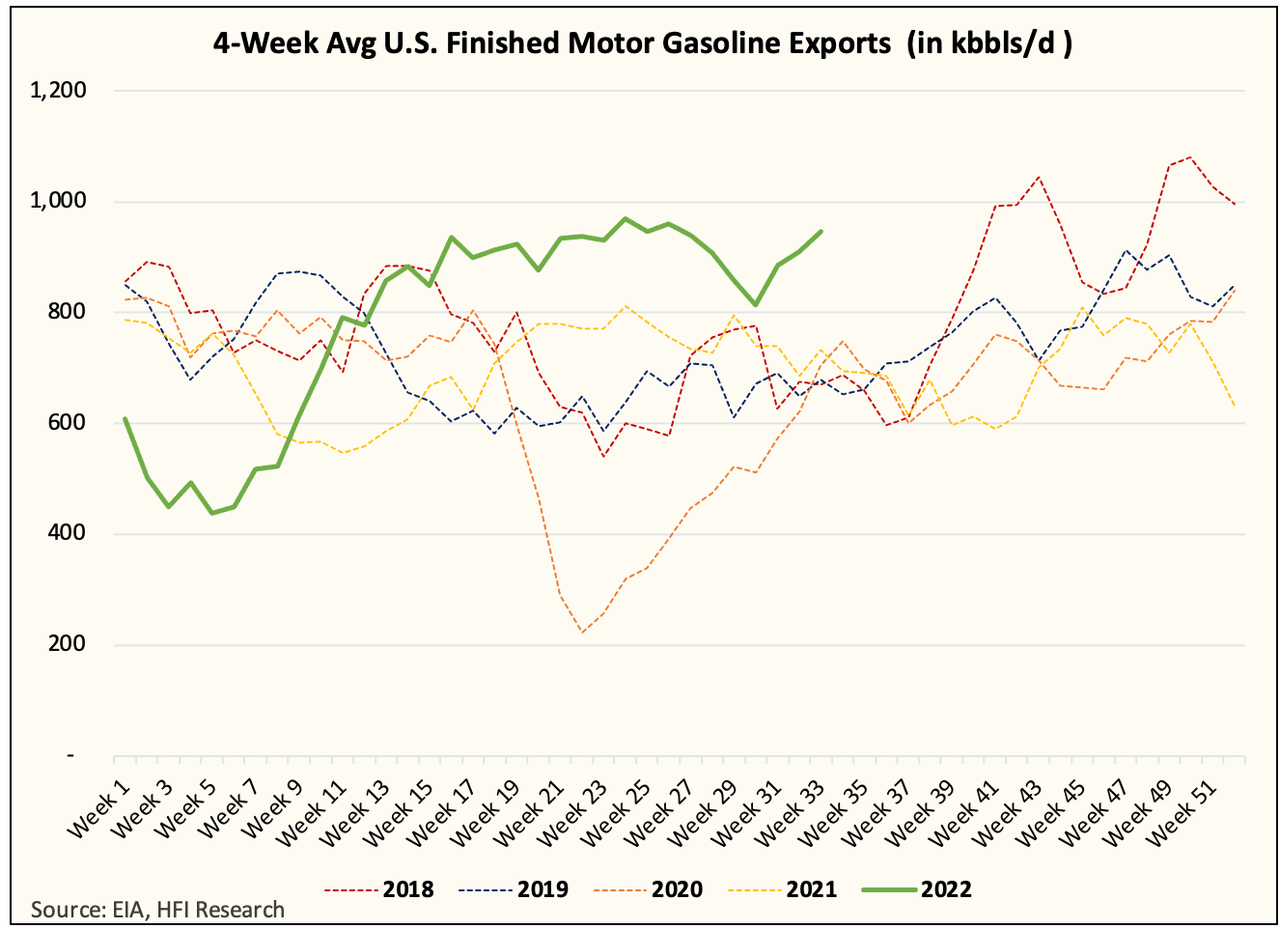

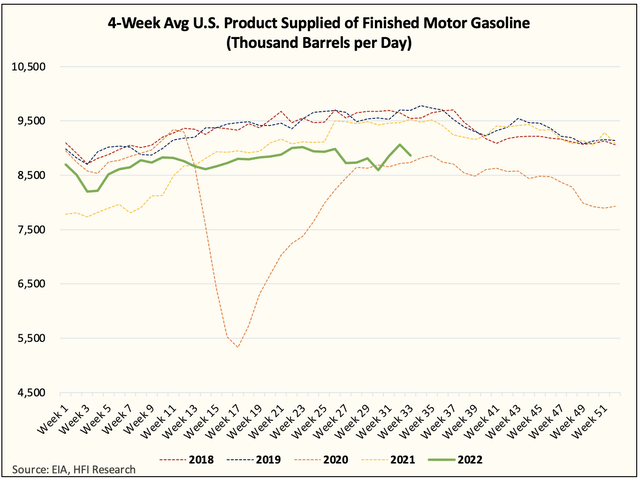

In a report we wrote on August 3 titled, “US gasoline demand falls below 2020 but there are far more questions than answers.” We detailed how logically and physically, there was no way that the U.S. implied gasoline demand fell below that of July 2020 on a 4-week moving average basis. A week later, we realized that the issue was related to the U.S. Energy Information Administration (“EIA”) overstating gasoline exports.

Fast forwarding to today, following two weeks of “recovering” gasoline demand, we saw a sizable drop of 914k b/d w-o-w. Well, we will just show you two charts below:

4-week average U.S. gasoline exports:

EIA, HFIR

4-week average US implied gasoline demand:

Again, we’ve said this before, but we will say it again. EIA is likely overstating gasoline exports by ~250k b/d to ~300k b/d. This would push U.S. gasoline demand higher but still average below that of 2019 and 2021. So demand destruction is happening, but it’s not anywhere near 2020.

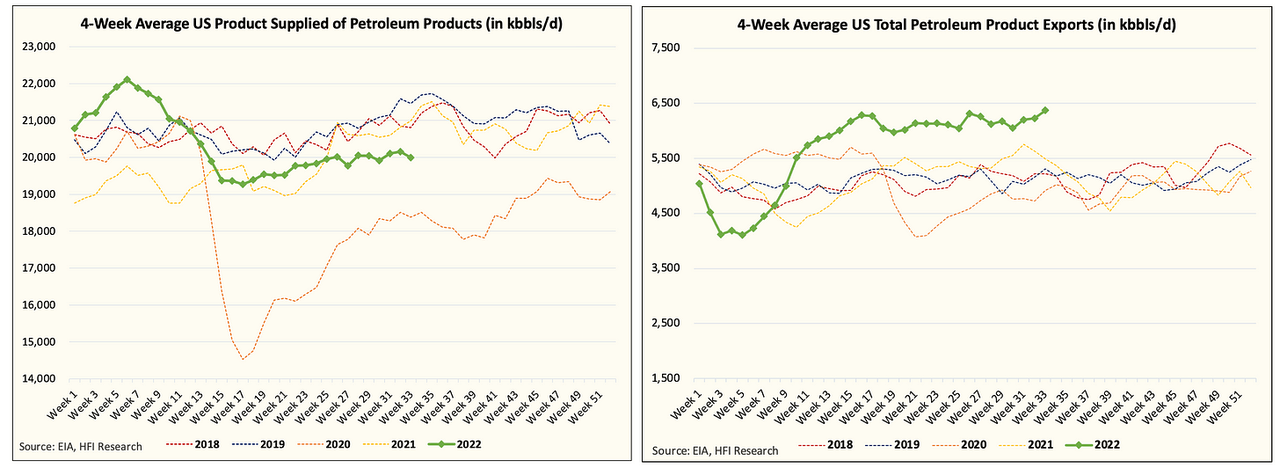

The same mental exercise could be done for the U.S. implied oil demand and U.S. product exports:

EIA, HFIR

The Irony…

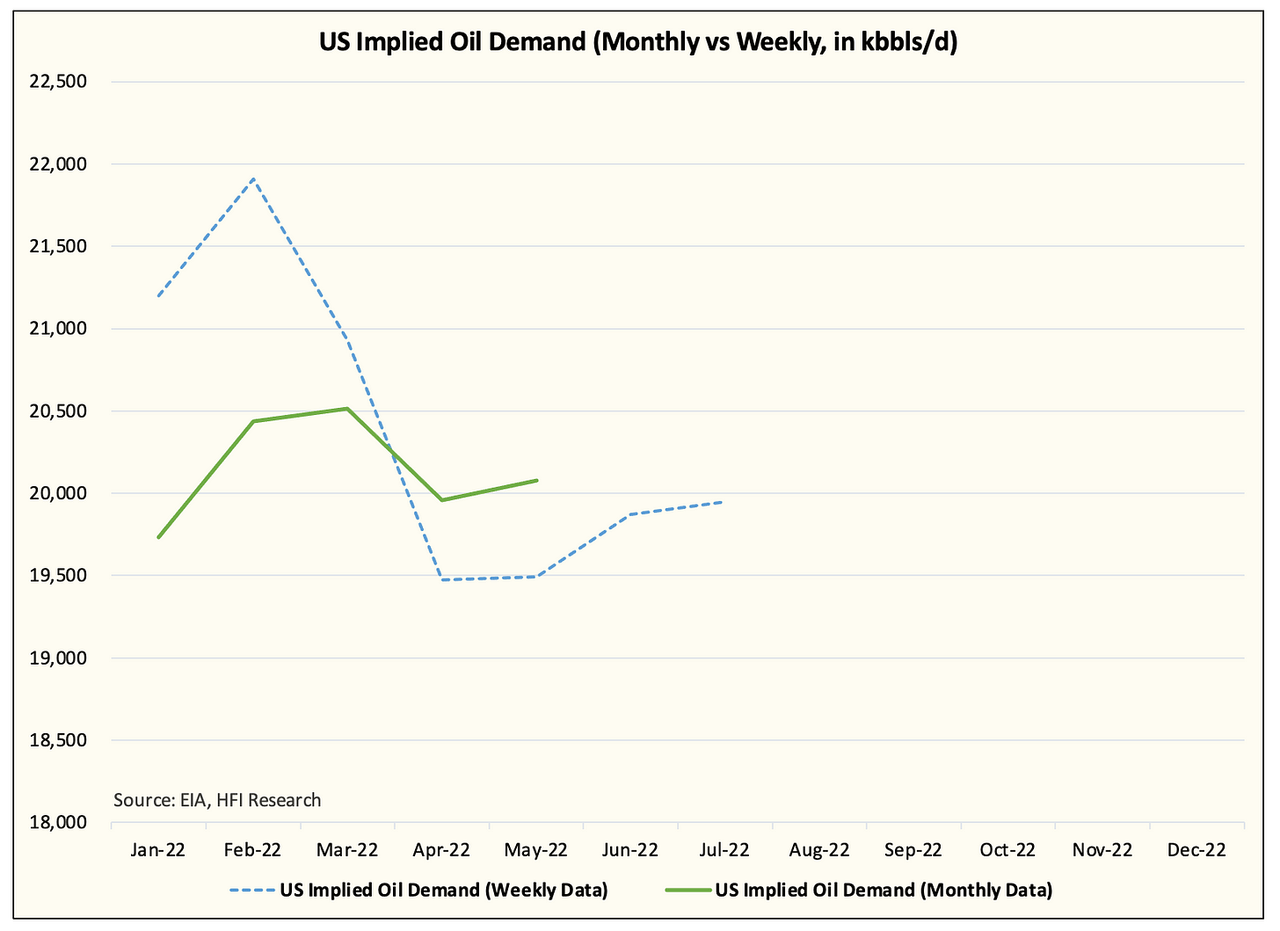

If what we said is true, then it should be validated by the EIA monthly report. Next week will show us what June demand data looks like and we suspect it will be higher than what the weekly data shows.

EIA, HFIR

But the real irony in all this is that in order for the U.S. to export, it implies that someone is willing to buy/import it. Think back to 2020, for example, the reason the price war the Saudis started worked so well and so fast is that demand destruction coupled with Saudis overly discounting their crude resulted in competitors having to shut-in production. You can’t sell something for there’s no buyer. When the Saudis targeted Europe and slashed OSP to the tune of -$11/bbl, the Russians could only compete if they slashed their price beyond the $11 discount the Saudis were offering. And since Brent fell to $26, that meant producing and selling barrels for less than $15/bbl. For most producers, that’s below the operating cost, so that was just completely uneconomic. That’s the reason why you saw production shut-in on a global scale. The OPEC+ deal that was agreed to in April 2020 was just a disguise to mask the lower demand.

Now going back to the topic at hand, in order for us to export a record amount, there have to be willing buyers on the other end. As a result, the elevated product exports either imply: 1) EIA is overstating product exports; or 2) global oil demand can’t be anywhere close to 2020.

This is why we think the market is starting to catch onto this irony. If EIA is overstating exports, then the U.S. implied oil demand is understated. If EIA is not overstating exports, then global oil demand is healthy.

The end result is that demand is not as bad as you think.

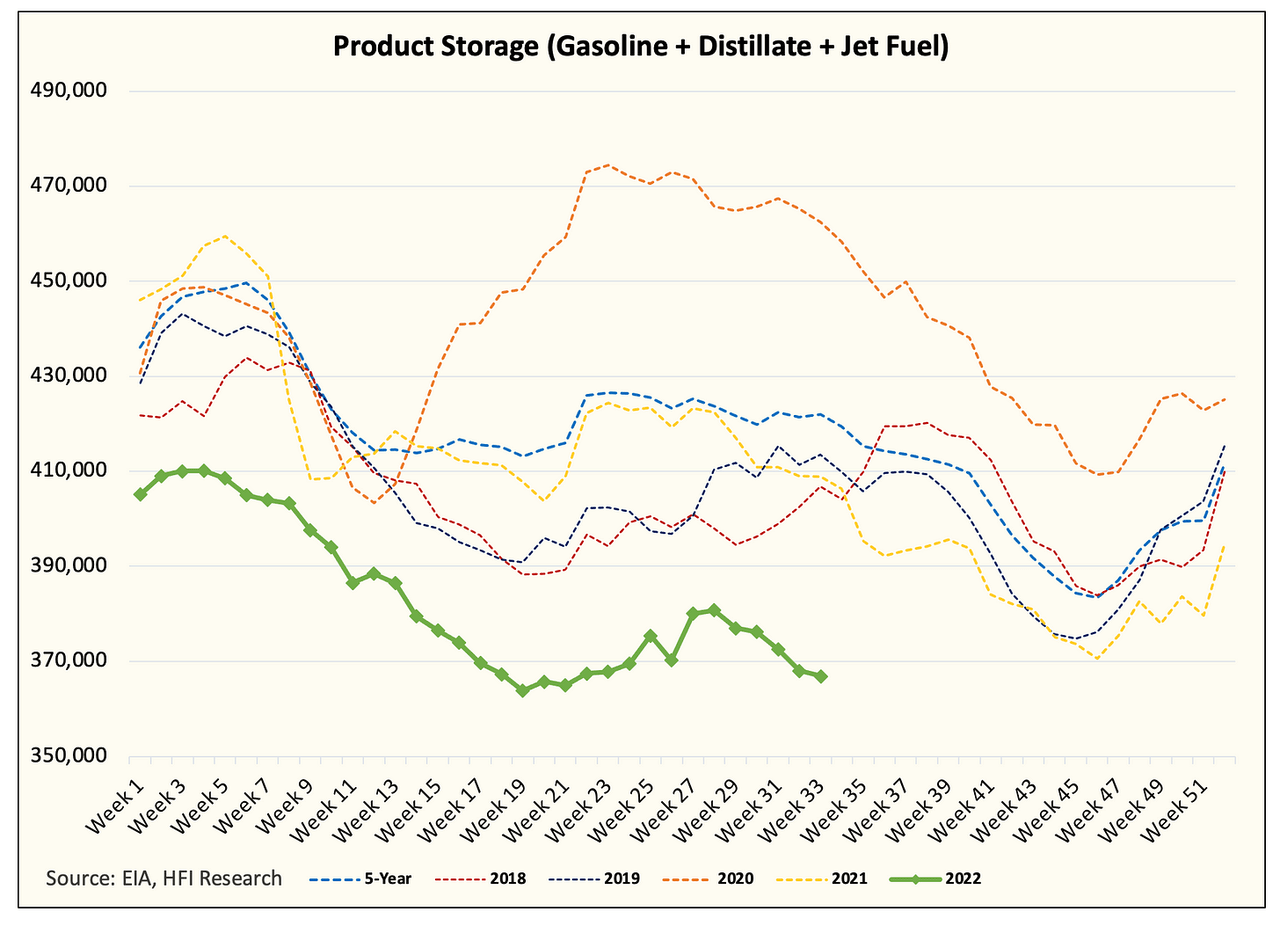

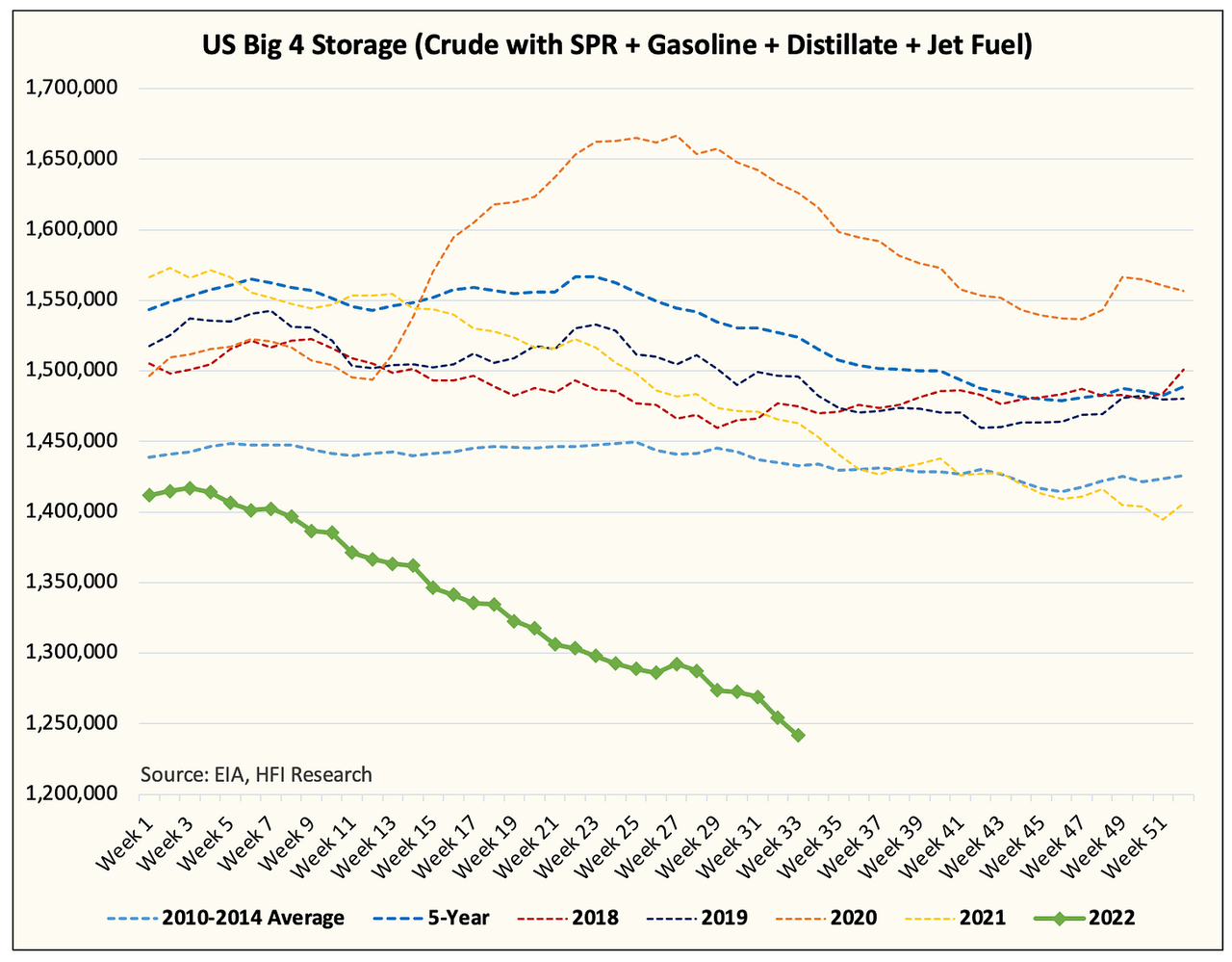

In our many years of analyzing and following EIA data, one fact has always remained true: storage is the only figure that’s accurate.

EIA, HFIR

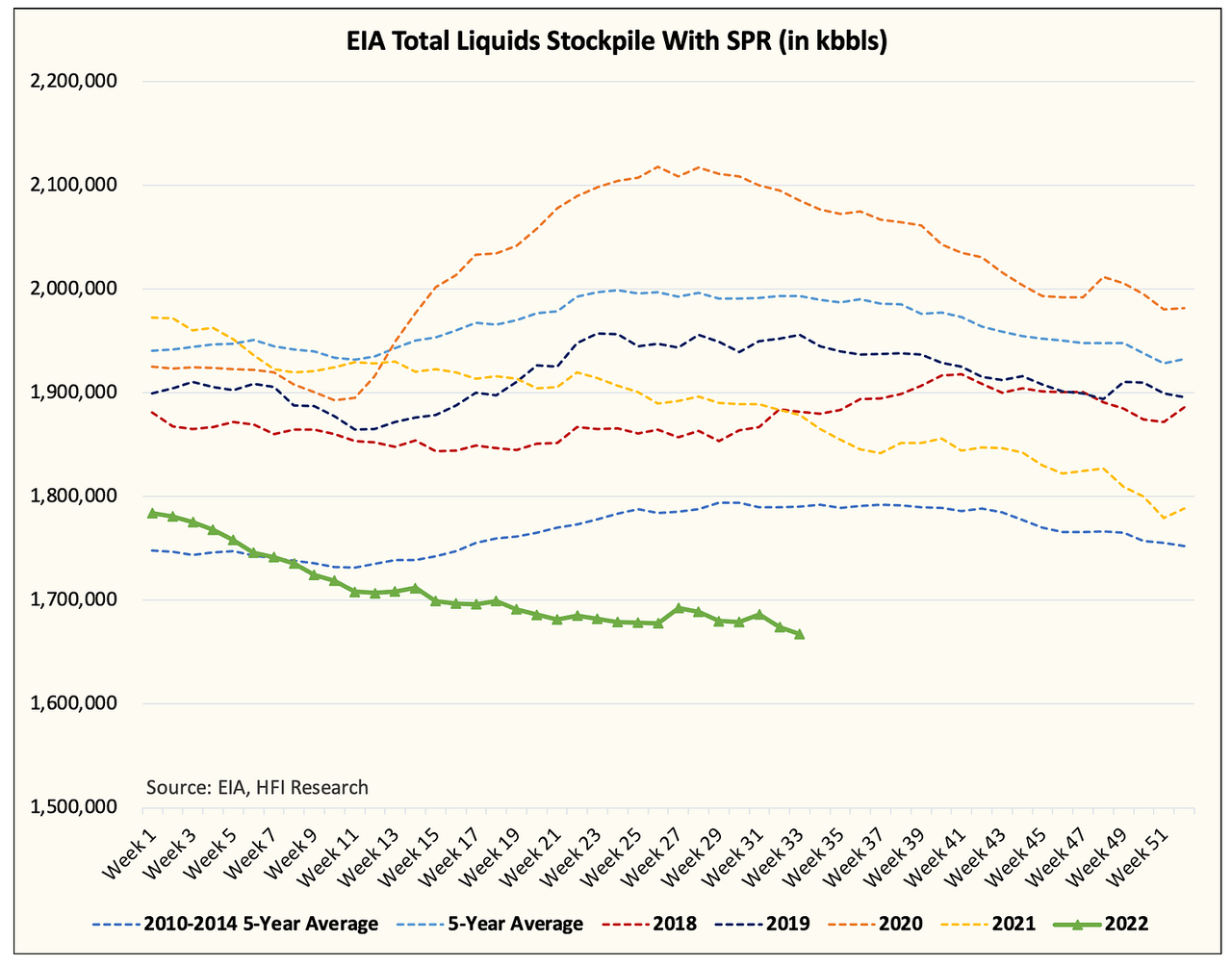

And storage is painting an obviously clear picture.

EIA, HFIR

EIA, HFIR

Conclusion

Our conclusion is simple and straightforward. Global oil demand is not as strong as we had expected (below 2021), but they are nowhere near 2020. Either EIA is overstating product exports or it’s not, and there’s plenty of demand for U.S. product exports. The result is the same, and storage is reflecting reality.

The market is starting to catch onto this irony, and for energy stocks and oil, we have bottomed and are going to trend higher going forward.

Be the first to comment