bjdlzx

(Note: This was in the newsletter on October 25, 2022.)

Occidental Petroleum (NYSE:OXY) stock has appreciated considerably thanks to the purchases of Warren Buffett. But Warren Buffett did not purchase the stock solely for dividends. The track record of his main investing vehicle demonstrates a belief that Occidental has a bright future. The fact that he was willing to pay the prices he paid demonstrates he sees at least a double in price over the next several years. Therefore, this stock is still in the bargain basement for buy-and-hold investors.

Industry Insiders Are Buying

I tend to follow industry insiders. I have a long list of insiders that are buying. Harold Hamn, whose family owns most of Continental Resources (CLR), is the latest insider to buy the rest of his company and take it private. He is a pioneer of the unconventional part of the industry and so is very familiar with future prospects.

Industry insiders tend to have a long-term view of prospects. Therefore, traders can be “in and out” of a stock several times to make profits both up and down. The industry is known for volatility and poor visibility. Therefore, traders can often make profitable trades.

But for those who want to buy-and-hold while doing other things like family and work, both Warren Buffett and Harold Hamn have opinions on the industry that are well respected. Both make decisions that generally last for years.

Even the midstream companies are not immune to this trend as Diamondback Energy (FANG) recently acquired all the shares of Rattler Midstream (RTLR) that it did not own. That is in addition to an acquisition that it made.

A little further back, the management that built Raging River (OTC:RRENF) and sold it to Baytex Energy (OTCPK:BTEGF) has now taken over Headwater Exploration (OTCPK:CDDRF) to get in on the Clearwater Play in Canada. That emerging basin is probably one of the lowest cost basins in North America.

I follow a lot more of these transactions. But the trend is clear. Unless you are talking about older production, insiders are clearly buying and not selling to get in on “the action”. That tells me that the current business cycle has a while to go before I need to worry about getting out of my positions.

Risks

Everyone appears worried about a recession. The deal is that this recession is going to take place at one of the highest economic activity levels on record. Also, by nature, recessions do not last all that long. This is not 2008 where we were threatened with an economic crash that needed strong medicine quickly.

Instead, what we are doing is taking a clearly overheated economy with asset bubbles underway in both the stock market and real estate and cooling it down. The Federal Reserve can “miss the mark” and bring on lower activity that is still far better than many of the past recessions.

There was clearly a tech correction that has been long overdue. But tech has had a cyclical nature for as long as I can remember. That sector will be back with some glorious “story stocks” in the future. But the current group of overpriced stocks has clearly had their day in the sun (and now reality is setting in as it always does sooner or later).

The other risk is that oil from certain sources finds its way back into the market to produce an oversupply. Right now, it does not look likely that either Russian or other sources like Venezuelan oil are going to be back any time soon to produce a supply in excess of demand.

As a result, people like Warren Buffett and insiders like the ones above believe the advantages outweigh the risks even if the ride will be bumpy.

About Occidental

There has been a lot of fear about lower oil prices and a recession. That makes for a good contrarian buying opportunity.

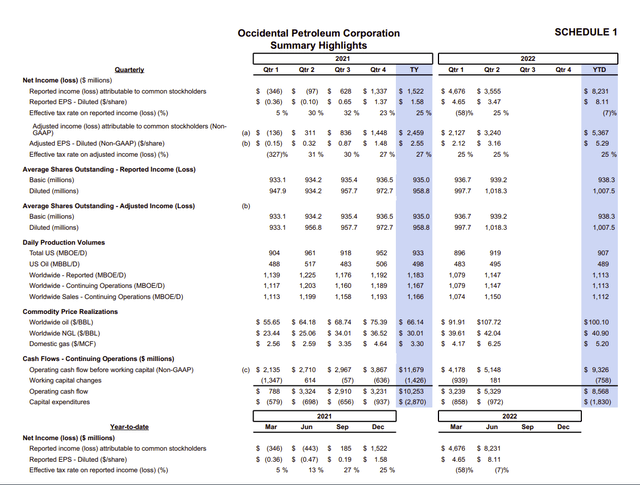

Occidental Petroleum Summary Of Operating Results (Occidental Petroleum Second Quarter 2022, Earnings Press Release)

There has been a lot of worry that future earnings will not be as good as what was posted in the first six months. That includes worry about dilution when the options convert as well as the preferred stock.

As usual, the bears present only half the picture. Management is not done optimizing the Anadarko (APC) acquisition by a long shot. Large acquisitions like that take years to optimize. As I noted previously, there were 10 million unexplored acres at really no value. It was not going to take a lot of value per acre to make the acquisition a deal. That “deal” will likely more than offset the feared dilution. There are plenty of other assets there as well just in case those acres are less than what might be thought possible right now.

In addition, most of us were following the Anadarko escapades that repeatedly got them in the newspapers. Occidental is a far better operator that knows how to stay out of the headlines. The costs are also much better.

But older production does not automatically become low cost because Occidental took over operations. There are things like reworks that aid lowering costs. But much of the benefits of a better operator show as the new wells come online to replace obsolete designs and less than desirable operating practices.

That could mean that even at lower oil prices, Occidental is likely to produce better results from the acquired properties.

The Future

The purchases by insiders in various ways combined with the acquisition that Occidental made seem to point to better earnings in the future even if we have to go through a recession first. Many times, the market fears a far worse scenario than what actually happens. In the current situation, economic activity is doing just fine compared to past recessions. There is no reason that will not continue.

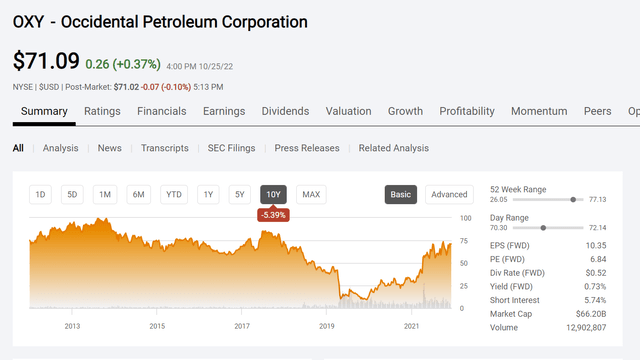

Occidental Petroleum Summary Of Operating Results (Seeking Alpha Website October 25, 2022)

The bears will point to the progress the stock made from its lows and state that it is time to exit. In this industry, taking profits of some sort is nearly always a right move because you do not want to get caught losing all the profits (and more) from something previously unseen appearing.

However, the purchases by knowledgeable people point to a bright future. The very low price-earnings ratio is another indicator that there is more to come. Low price-earnings ratio stocks have a long history of outperforming the market in literally decades of studies.

The other thing is that Occidental management is darn good. When you have decent management, that management often finds ways to report progress that enables the stock to pass the highs of the last cycle plus at least inflation since that last high. In the chart above, that implies a current cycle high in the $140 dollar range. For a large company like Occidental, that is a fantastic future that one seldom sees.

That means the current recession fears point to a buying opportunity until those fears pass. The purchases by Warren Buffett have actually supported the stock price and will likely support it for some time in the future whether or not he buys more. That gives the stock a probable asymmetric return that most investors love.

I will sell when I see those same insiders selling their companies or otherwise exiting the industry. That part of the cycle always happens as well.

Be the first to comment