sefa ozel/iStock via Getty Images

Investment Thesis

Occidental Petroleum (NYSE:OXY) is one of the big bets that Warren Buffett has made in oil and gas, alongside Chevron (CVX). Buffett had Occidental warrants with a strike price of $59.62 that he exercised. Additionally, Buffett made additional stock purchases that came at somewhere around ~$31 to ~$59 per share.

At the time of writing, Occidental’s share price is $56, this is not looking too dissimilar to the range that Buffett made his purchases of Occidental’s common. That’s not to say that Buffett is right. He is human too.

That insight aside, I nonetheless believe that Occidental Petroleum is well-positioned for this strong oil environment, particularly now given the recent share price weakness.

I rate this stock a buy.

Occidental’s Recent Performance

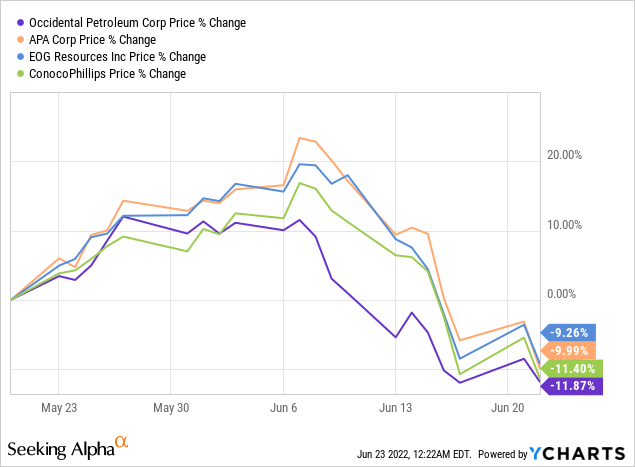

Above I’ve chosen a few peers to compare with Occidental. What you see above is indiscriminate selling. Investors are not considering near-term prospects, valuations, or anything else. Investors are simply crowing for the exits.

They may be right or wrong. However, I believe that they are wrong. But first, let’s discuss the bear case.

The Bear Case to Oil Companies

There are two bearish considerations that I believe we should be mindful of.

Higher interest rates could trigger a recession and curtail fuel demand. And alongside this WTI prices have come back to approximately $100.

Those two dynamics are the bearish considerations that investors are thinking most acutely about.

Further complicating issues, investors are in a limbo period where most companies are yet to report their results. What is more, we know that the market has become incredibly short-sighted, living from one data point to the next.

And until oil companies start reporting their earnings results and commentaries on their guidance, investors are in an anxious state.

Occidental Near-Term Prospects

Occidental is an oil and gas exploration and production company. The vast majority of its adjusted earnings come from its Oil and Gas segment. Within the Oil and Gas segment, the single largest contributor is its domestic sales.

Consequently, Occidental is a pure-play Oil and Gas business with heavy exposure to US sales.

Hence, even though Occidental has 19% of its adjusted segment profits, before corporate allocations, coming from its Chemical this is not what Occidental is about.

Or better said, that’s not going to meaningfully move the needle on the investment thesis.

What’s more, keep in mind that back in Q1 2022, WTI prices averaged $94.29. While right now, prices are closer to $100. So you are in a situation where despite oil prices being higher by approximately 6% than they were for the average of Q1 2022, Occidental’s share price is actually lower than it was in Q1.

And the reason for this is investor perception. Back in Q1, WTI prices were trending higher. While now WTI prices have turned sharply lower. So even though the end result is that WTI prices are higher than they were, investors are frightful of the trend in WTI prices.

Occidental’s Shareholder Return Policy

Occidental’s balance sheet holds approximately $24 billion of net debt. This very high level of debt will get in the way of Occidental substantially increasing its shareholders’ capital.

To illustrate, during the quarter, Occidental’s dividend on the common stocks amounted to approximately $15 million or $0.13. This equals an annualized yield of 0.9%.

Meanwhile, repurchases of the common amounted to $36 million. Or about 2.7% on an annualized basis.

That means that if we were to assume a steady state of annual distributions, shareholders would get about a 3.6% yield on an annualized basis.

That being said, during the earnings call, management said,

It is reasonable to expect that we can meet out near-term debt targets [of sub $20 billion net debt] and then initiate our share repurchase program during the second quarter. Once we complete our near-term debt reduction target and repurchased $3 billion of shares, we will continue to allocate free cash flow to repaying debt as we lower gross debt to the high teens in billions.

Essentially, management is openly declaring that while seeking to repurchase $3 billion worth of shares starting Q2 2022, this will be done alongside lowering its billion-dollar debt profile into the high teens.

Again, given that Occidental’s net debt stood at close to $24 billion, and Occidental’s free cash flow is somewhere around $3.5 to $4.0 billion per quarter, this implies that Occidental’s ability to substantially return capital to shareholders at a rapid rate will not be all that attractive.

OXY Stock Valuation – Priced at 3.5x Free Cash Flow

Needless to say that it’s impossible to predict oil prices for 2022. The best we can do is assume that oil prices remain level with what they are right now.

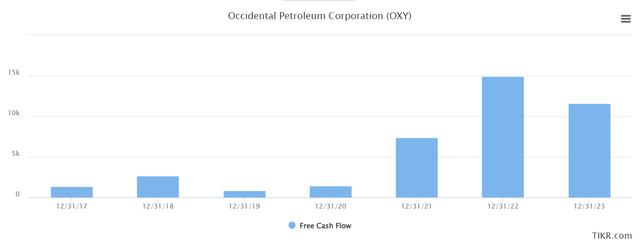

TIKR

This would put Occidental on a path to approximately 3.5x free cash flows. While this is not the cheapest oil company around, particularly given the sell-off in the last few days, it is still very far from fully priced.

Indeed, any rational investors would normally gladly pick up an oil and gas company trading at low single digits to free cash flow.

The Bottom Line

Occidental is very cheaply priced at somewhere close to 3.5x free cash flow. The one blemish in the investment thesis is that Occidental carries a significant amount of debt that needs to be paid down significantly before Occidental can in earnest ramp up its capital return program.

That being said, Occidental has signaled its ambition to return capital to shareholders starting Q2. Although that will be done so alongside paying down its debt. Hence, once again, this will reduce the capital available to return to shareholders.

All in all, there’s a lot to be bullish on this company right now. Particularly knowing that it gets Warren Buffett’s stamp of approval. So, you are getting a company that is strong, and you are paying somewhere very close to Buffett’s entry point, in terms of price, and at a really low multiple to free cash flow.

Be the first to comment