Brandon Bell

Thesis

We urged investors in our previous article in August to use the rally to cut more exposure in Occidental Petroleum (NYSE:OXY) stock, even as Berkshire Hathaway (BRK.A) (BRK.B) CEO Warren Buffett went on the offensive as it added more shares.

Accordingly, OXY fell nearly 20% from its August highs to its September lows. However, OXY buyers stepped in to support the stock as OPEC+ went on the offensive against the oil bears by aiming to cut 2M barrels a day in production. However, we urge investors to be wary of the actual output cut, as the curtailment could be just 10% of the announced reduction.

Furthermore, OPEC+’s move has given the Biden Administration more ammunition to be aggressive with the maneuvers on the Strategic Petroleum Reserve (SPR), with a move to release another 10M to 15M barrels in the works.

Coupled with economists factoring in a recession as the base case now (we have highlighted such a thesis to our members for months), we urge investors to place more emphasis on demand destruction at the current levels. Coupled with highly optimistic Street analysts and unrealistically low valuations in OXY heading into a recession, we postulate the real pain has yet to arrive.

Investors sitting on massive gains from the COVID lows are encouraged to leverage the recent rally to cut more exposure. We also gleaned that OXY’s price action has weakened considerably despite the recent recovery. We deduce that the market has already stalled OXY’s buying upside decisively, using the current distribution phase to draw in more unsuspecting OXY bulls.

As such, we reiterate our Sell rating, even as Occidental heads into its Q3 earnings release on November 9.

The Street Is Overly Optimistic As We Head Into A Recession

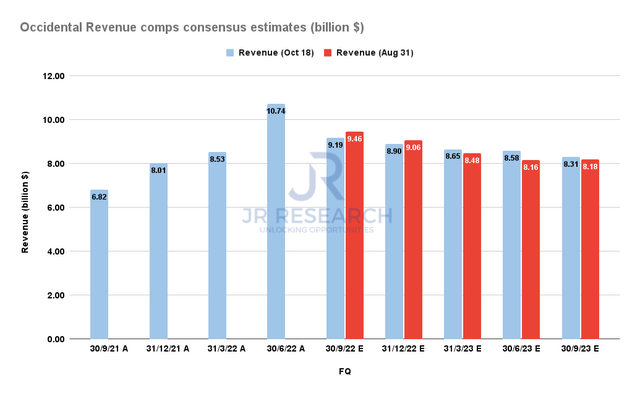

Occidental Revenue comps consensus estimates (S&P Cap IQ) Occidental Adjusted EBIT comps consensus estimates (S&P Cap IQ)

As seen above, the consensus estimates (neutral) have been upgraded from August’s projections even as we are approaching a global recession. Hence, Wall Street remains confident that Occidental’s revenue and adjusted EBIT growth would withstand the coming recession better than they anticipated in August.

Therefore, we deduce that analysts remain unperturbed by the potential for further demand destruction as they elect to focus more on the supply/demand dynamics in holding up energy prices. However, we urge investors to be very cautious in making such assumptions.

We have consistently highlighted to our members that the equity markets have already priced in a mild-to-moderate recession, with the risks of a severe recession rising recently. Bloomberg Economics also updated in a recent commentary that it is “effectively certain” of a recession over the next twelve months. It accentuated:

A US recession is effectively certain in the next 12 months in new Bloomberg Economics model projections. The latest recession probability models by Bloomberg economists Anna Wong and Eliza Winger forecast a higher recession probability across all timeframes, with the 12-month estimate of a downturn by October 2023 hitting 100%, up from 65% for the comparable period in the previous update. – Bloomberg

If only the recession were just contained in the US. Europe is arguably already in a recession. The IMF and World Bank also warned recently of significant risks to global growth and financial stability through 2023 as the Fed’s aggressive rate hikes threatened to upend the order in emerging markets. Edward Yardeni also cautioned in a recent commentary (October 13): “It’s not often that the whole world’s economy faces a synchronized economic slowdown, but that’s what appears to be occurring.”

Hence, we urge investors not to ignore the significant risks building up in energy stocks, given the over-optimism in the consensus estimates.

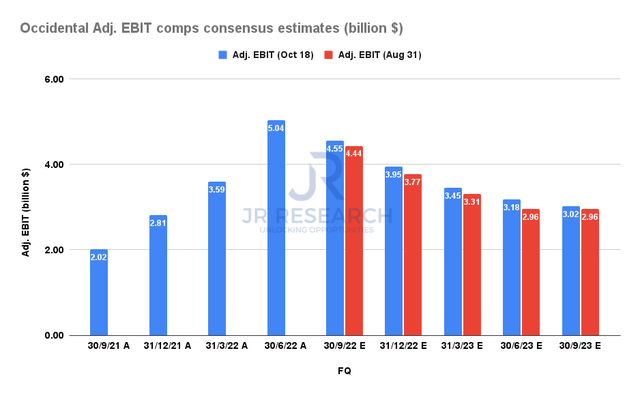

S&P 500 Integrated Oil & Gas Industry net earnings revisions (Yardeni Research, Refinitiv)

As seen above, oil industry analysts remain highly optimistic as they continue to raise earnings estimates for Occidental and its industry peers through September. Therefore, we deduce that these estimates will start to come down rapidly once these analysts who are still in “wonderland” realize that they may have understated the impact of the recession in their coverage.

Make no mistake that the OXY and its peers remain highly cyclical plays and are not immune to a recession, especially a significant one. Therefore, investors looking to add OXY should consider adding after the Street analysts have gone into a panic mode, marking down OXY and its peers’ estimates drastically.

Is OXY Stock A Buy, Sell, Or Hold?

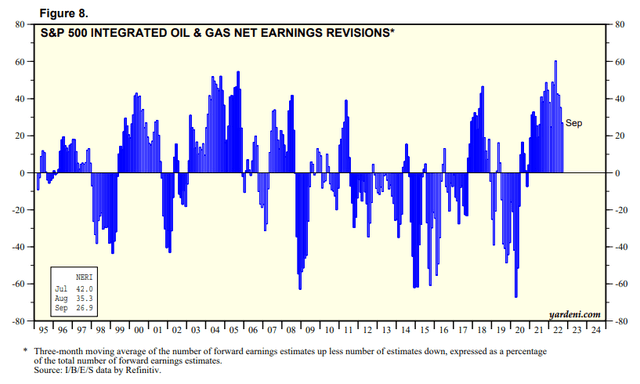

OXY NTM normalized P/E valuation trend (koyfin)

Investors not experienced with cyclical plays need to be wary about so-called “cheap valuations.” And OXY looks pretty cheap at 7.2x NTM earnings, well below its 10Y mean of 37x.

Well, that’s because analysts have yet to cut their earnings estimates drastically to reflect the recessionary reality. The market is not dumb. Of course, it knows OXY is trading well below its 10Y mean. Yet, it’s not interested in re-rating OXY over six months. The market knows it’s not wise to ignore the risks of a global recession, and analysts have yet to panic.

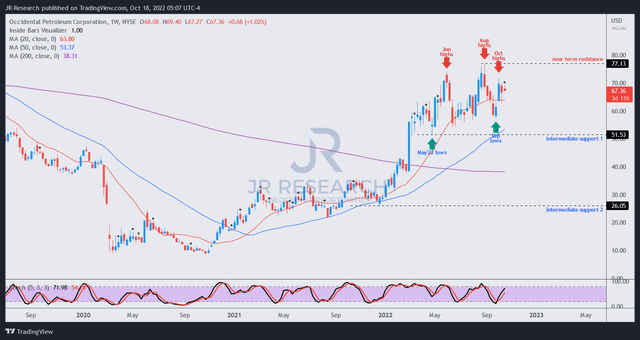

OXY price chart (weekly) (TradingView)

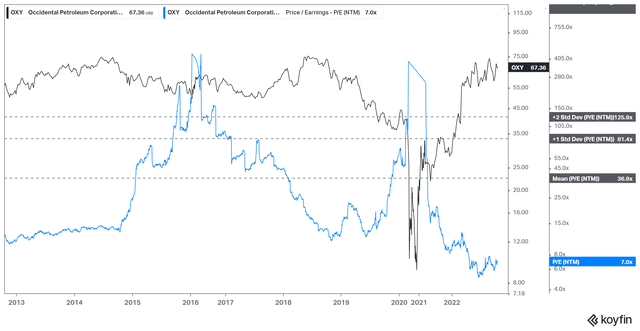

The market seems to have rejected OXY again at its near-term resistance, which formed the highs seen in June and August. Also, the market drew buyers in rapidly drawn at its September lows. However, we deduce that the market is not interested in allowing buying momentum to go higher from here, with the price structures looking increasingly ominous, portending a steeper decline.

Hence, we urge investors to capitalize on the recent sharp rally to cut more exposure. Investors looking to add should wait patiently for the Street analysts to go into a panic frenzy rushing to cut OXY’s estimates. We urge investors to watch the re-test of its “intermediate support 1.” If that level fails, OXY could fall rapidly to the gap toward its “intermediate support 2.”

By then, we believe OXY would likely already have fallen significantly before the Street analysts started to panic (the market is forward-looking). If a base forms constructively, that would be the time for investors to move in and pick up the pieces from the weak bulls who bought at the highs and couldn’t wait to flee.

As such, we reiterate our Sell rating on OXY.

Be the first to comment