Bet_Noire

Introduction

Following the oil and gas industry recovering during 2021, earlier in the year it seemed that 2022 offers essentially everything you could want from Occidental Petroleum (NYSE:OXY), as my previous article highlighted. Whilst their very low dividend yield of only 0.75% is anything but headline-grabbing, the same cannot be said for the recent news of Warren Buffett gaining approval to increase his already large stake as high as 50%, which unsurprisingly fuelled significant attention. Following this interesting development, it seems timely to provide a follow-up analysis that not only covers their recently released results for the second quarter of 2022 but also explains why Buffett will not get my shares this cheap.

Executive Summary & Ratings

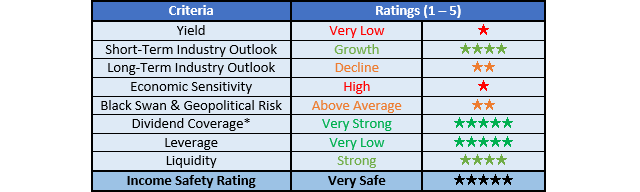

Since many readers are likely short on time, the table below provides a very brief executive summary and ratings for the primary criteria that were assessed. This Google Document provides a list of all my equivalent ratings as well as more information regarding my rating system. The following section provides a detailed analysis for those readers who are wishing to dig deeper into their situation.

Author

*Instead of simply assessing dividend coverage through earnings per share cash flow, I prefer to utilize free cash flow since it provides the toughest criteria and also best captures the true impact upon their financial position.

Detailed Analysis

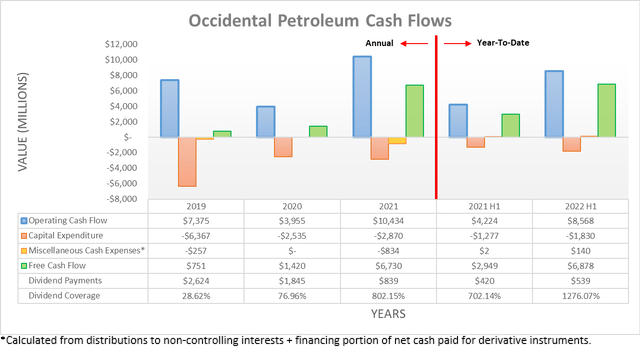

After seeing their highest operating cash flow in recent history during 2021 as oil and gas prices recovered from the severe downturn of 2020, it only powered even higher into 2022 with the first half seeing a result of $8.568b. Apart from being slightly more than double their previous result of $4.224b during the first half of 2021, it is also relatively close to matching their full-year results for 2021 of $10.434b. Thanks to their modest capital expenditure, they were able to translate $6.878b of this into free cash flow to achieve their net debt target and thus see the next phase of their capital allocation strategy begin, as per the commentary from management included below.

“With our near-term debt reduction goal accomplished, we initiated our $3 billion share repurchase program in the second quarter…”

“Considering current commodity price expectations, we expect to repurchase a total of $3 billion of shares and reduce gross debt to the high teens by the end of this year. Once we have completed the $3 billion share repurchase program and reduced our debt to the high teens, we intend to continue returning capital to shareholders in 2023 through a common dividend that is sustainable at $40 WTI as well as through an active share repurchase program.”

-Occidental Petroleum Q2 2022 Conference Call.

Following their net debt target being reached, as subsequently discussed in detail, they were able to close the chapter on their deleveraging focused phase with a more balanced phase beginning that sees both further deleveraging but also higher shareholder returns via share buybacks. Whilst I prefer dividends over share buybacks, thankfully management intends to ramp up the former during 2023 as they move to the next phase of their capital allocation strategy that focuses on shareholder returns over deleveraging.

This solid fundamental improvement seemingly increased the interest of Warren Buffett who seems intent on increasing his ownership materially higher. Whether he ultimately fulfills this entire approval and increases his stake from 20% to 50% remains uncertain but regardless, it seems clear that he wishes to add more shares to the portfolio of Berkshire Hathaway (BRK.A) (BRK.B), and thus given this additional demand for Occidental Petroleum shares, it poses the question, should I sell my shares? On the surface, this may seem to be a reasonable time to sell with oil prices still very strong at north of $90 per barrel, especially given the risks of a recession on the horizon. Whilst not necessarily wrong in a factual sense, nevertheless, I feel that their shares are sufficiently cheap to compensate for this risk and thus metaphorically speaking, Buffett will not be getting my shares.

Despite seeing their share price more than double thus far during 2022 on the back of their booming financial performance to reach its highest level since early 2019 before their poorly timed Anadarko acquisition, their current market capitalization is still only approximately $64b. Despite being a massive value in absolute terms and cementing their position as a large United States oil and gas company, relatively speaking, it still offers very desirable value for investors given the immense free cash flow they routinely generate.

If annualized, the $6.878b of free cash flow they generated during the first half of 2022 represents a massive 20%+ free cash flow yield against their current market capitalization. Despite easily leaving their shares looking cheap with massive prospects for shareholder returns in the next phase of their capital allocation strategy, it stems from these booming operating conditions that are almost certainly going to subside one day, thereby dragging their free cash flow lower. In my eyes, what makes their shares very desirable and thus too cheap to sell is actually their still impressive prospects for shareholder returns even if oil and gas prices soften to significantly lower levels.

Following the Russian invasion of Ukraine that kicked the global energy shortage into overdrive, the outlook for oil and gas industry has seldom been stronger with the world running low on supplies and spare capacity to increase production. Even though the inherent volatility of their industry makes future projections difficult, I nevertheless feel that returning to the softer 2021 operating conditions represents a suitable basis for a bearish scenario. If this eventuates, their resulting $6.73b of free cash flow from 2021 would still see a very high 10%+ free cash flow yield on current cost even if these booming operating conditions completely subside. Since this would still provide impressive scope for dividends and share buybacks during 2023 and beyond, in my eyes, it makes their shares too cheap to sell, especially as they are on the cusp of unlocking the value of this immense free cash flow through deleveraging.

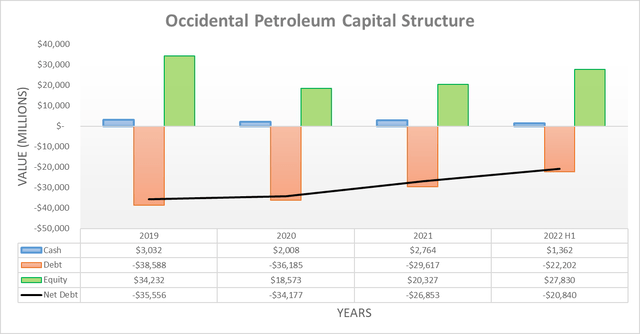

Thanks to their booming cash flow performance, they were able to make significant inroads with their deleveraging mission during the first half of 2022, despite also conducting $451m of share buybacks net of relatively small routine issuances. As alluded to earlier, their net debt is now down to only $20.84b versus its previous level of $26.853b at the end of 2021 and thus is effectively at their target of $20b that they carried heading into 2022, as per my previously linked article. Meanwhile, their total debt or gross debt to borrow the terminology of management currently stands at $22.202b and thus circa $5b above their new target in the “high-teens” they intend to reach during the second half of 2022. This should be possible to reach considering their immense near $7b+ of free cash flow during the first half and minimal dividend payments.

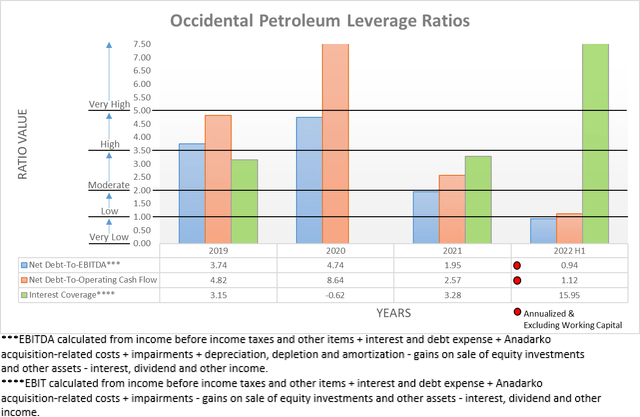

Unsurprisingly, their significant net debt reduction and booming financial performance translated into dramatically lower leverage with their respective net debt-to-EBITDA and net debt-to-operating cash flow down to 0.94 and 1.12 versus their previous respective results of 1.95 and 2.57 at the end of 2021. Apart from the obvious difference, this now sees their net debt-to-EBITDA below the threshold of 1.00 for the very low territory, whilst their net debt-to-operating cash flow is barely above this point and thus should fall beneath this threshold during the third quarter as their net debt sees further reductions.

Once they shave another circa $5b from their total debt during the second half of 2022, it will help keep their leverage under control even if operating conditions were to suffer a severe downturn in the future. This additional stability cements their solid fundamental improvements, which underpins their ability to ramp up their dividends and share buybacks during 2023, thereby unlocking the value of their immense free cash flow.

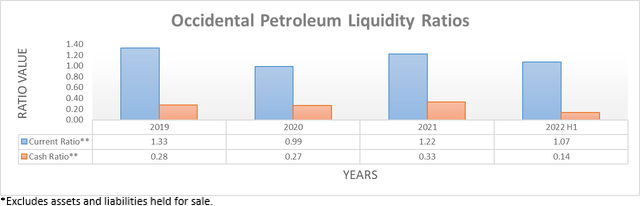

When finally turning to their liquidity, their cash balance decreased during the first half of 2022 to $1.362b versus its previous level of $2.764b at the end of 2021, which dragged their respective current and cash ratios down to 1.07 and 0.14 versus their previous respective results of 1.22 and 0.33. Even though not necessarily ideal, this change is not dramatic and thus their liquidity remains strong, which should persist into the future. Since they are a large company that is generating immense free cash flow and further deleveraging, it enhances their access to debt markets as required, even if central banks further tighten monetary policy and thus their future debt maturities pose no concerns.

Conclusion

Whether Warren Buffett purchases the entire company remains to be seen but regardless, he seems intent to continue increasing his stake, which is not surprising given their immense free cash flow. As they move into the next phase of their capital allocation strategy, their higher focus on shareholder returns stands to unlock the value of this immense free cash flow, which I expect to propel their share price higher. Even though I have great respect for Warren Buffett, he will not get my shares with a free cash flow yield of between a very high 10% and a massive 20%+. Following this analysis, I believe that upgrading my rating to a strong buy is now appropriate given their solid fundamental improvements and clear recognition of value by one of the best investors.

Notes: Unless specified otherwise, all figures in this article were taken from Occidental Petroleum’s SEC filings, all calculated figures were performed by the author.

Be the first to comment