Leonid Ikan

The outlook for Obsidian Energy (NYSE:OBE) has dimmed a bit after it reduced near-term production expectations, primarily due to weather related delays with its 2H 2022 development program. It also increased its guidance around costs for 2022 due to inflationary pressures and incremental acquisitions (of a gas plant and land).

As well, Canadian heavy oil differentials have ballooned, so at current strip Obsidian may only realize around US$40 per barrel for its heavy oil in 2023. This will slow Obsidian’s efforts at debt reduction, but I am still projecting it to be able to reduce its net debt to around US$175 million in net debt (or around 0.6x EBITDAX) by the end of 2023. This is primarily based on Obsidian’s preliminary 2023 forecast, which could be significantly revised due to changes in commodity prices and differentials since then.

I now estimate Obsidian’s value at US$9 to $US11 per share in a long-term (after 2023) $75 WTI oil scenario, while a long-term $70 WTI scenario would put Obsidian’s value around US$1.50 lower than that.

These estimated values are several dollars lower than what I estimated Obsidian’s value at in July, due mainly to a significant decrease in near-term cash flow expectations. However, these estimated values are also still higher than Obsidian’s current share price.

This report uses an exchange rate of US$1.00 to CAD$1.35 and uses US dollars unless otherwise mentioned.

Revised 2022 Guidance

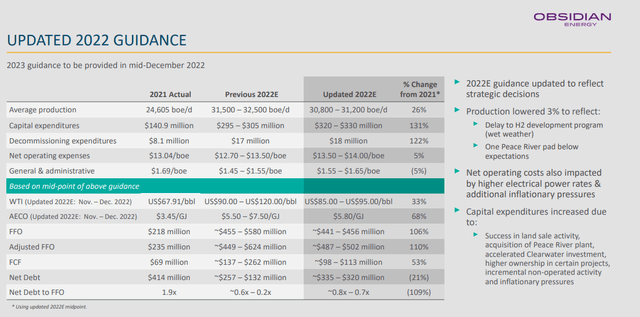

Obsidian revised its 2022 production guidance lower by approximately 3% due to a combination of delayed 2H 2022 development (blamed on wet weather) and lower than expected results on one Peace River pad. It also increased its 2022 capital expenditure budget by CAD$25 million (US$19 million) and its guidance for net operating costs by approximately 5%.

Obsidian’s 2022 Guidance (obsidianenergy.com)

Oil prices have also slid a bit lower, with 2H 2022 WTI oil prices now likely to average around US$88. This leads to a projection that Obsidian will now end 2022 with around US$255 million in net debt.

Updated 2023 Outlook

Obsidian has deferred the release of its 2023 capital budget and associated guidance until January 2023 due to volatility in oil prices and heavy oil differentials.

It is uncertain what changes Obsidian will make to its 2023 capital budget compared to its preliminary forecast. However, for now I will continue to model its 2023 production at approximately 37,000 BOEPD. The current WTI strip for 2023 is in the mid-$70s, while the WCS differential is currently expected to be around negative US$25 for 2023. This is US$12 wider than the actual differential for Q2 2022, and when combined with lower WTI prices and the weaker Canadian dollar as well, may lead to Obsidian only realizing US$40 for its heavy oil in 2023 compared to US$83 in Q2 2022.

Obsidian is thus now projected to generate US$583 million in revenues in 2023, based on its prior plans for 2023.

|

Type |

Units |

$ USD/Unit |

$ Million USD |

|

Light Oil And NGLs [BBLs] |

5,998,775 |

$62.00 |

$372 |

|

Heavy Oil [BBLs] |

3,175,500 |

$40.00 |

$127 |

|

Natural Gas [MCF] |

25,477,000 |

$3.30 |

$84 |

|

Total Revenue |

$583 |

This would result in Obsidian generating around US$310 million EBITDAX in 2023.

|

$ Million USD |

|

|

Revenue |

$583 |

|

Less: Operating Expense |

$138 |

|

Less: Transportation |

$32 |

|

Less: Royalties |

$88 |

|

Less: Cash G&A |

$15 |

|

EBITDAX |

$310 |

After capex, interest costs and decommissioning expenditures, Obsidian would be able to generate around US$80 million in positive cash flow in 2023. This would reduce its net debt to US$175 million by the end of 2023, or 0.6x EBITDAX.

As mentioned before, these calculations are based on Obsidian’s previous (preliminary) plans for 2023, and it may revise its plans significantly in light of heavy oil prices trending lower.

Conclusion

Obsidian Energy is now expected to end 2023 with around US$175 million in net debt, although it may revise its 2023 capital plans. Obsidian’s realized price for heavy oil may end up around US$40 in 2023 based on current strip, which would be less than half of its realized price for heavy oil in Q2 2022.

Despite weaker commodity prices and the wider heavy differentials, Obsidian is still projected to reduce its leverage to around 0.6x EBITDAX at the end of 2023 based on its previous plans. I’d assume that any changes Obsidian makes with its final plans for 2023 would result in improvements in leverage (compared to its previous plans) as well.

Due to the wider differentials and lowered near-term cash flow expectations, I currently estimate Obsidian’s value at approximately US$9 to US$11 per share in a long-term $75 WTI oil scenario. This may be subject to a bit of change if Obsidian significantly revises its plans for 2023.

Be the first to comment