mgdwn

This article appeared in the Daily Drilling Report on the 17th of July.

Introduction

Obsidian Energy Ltd. (NYSE:OBE) is another Canadian energy company we probably should have gotten around to covering before now. Particularly since it has a three-letter NYSE listing, making the stock very liquid. To be honest, one of the members of the DDR has been long this stock for a while and has been trying to get my attention. I get in a rut sometimes and can’t see the derrick for the trees. But, I am here now, so let’s have a look.

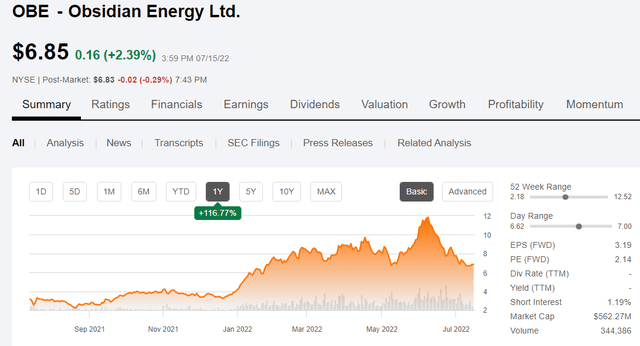

Obsidian Energy price chart (Seeking Alpha)

The share price draws our eye, and puts them in between the other two Canadian companies we have discussed favorably in recent times.

“Tamarack Valley…Modern Day Warriors“

“Whitecap Resources…The XTO Deal”

While you’re bargain hunting, you might give the others a quick read. It’s easy to load up when the stock is in the single digits, and we don’t think that situation will last long.

Recent market adversity has taken the company back to Feb 22 levels, a decline of nearly 50% over the last month. This gives us a shot for growth when the next oil market surge occurs, should we find the company attractive at current prices.

The company appears to be somewhat undercovered by the analyst community, with 2 or 3 ratings being the average of the sources I checked. Most have a BUY or Strong BUY out for the stock as does this one. Price targets range from $7.72 on the low side to $14.82 on the upper. At its current price, if that upper range is realistic, it make the company look pretty attractive.

Clearly, the company today is the same one it was before all the optimism drained out of the energy market a month ago. We think this negative feedback loop has about run its course. The strength shown lately with the oil market rallying midday Thursday of last week, and holding on Friday signals a shift back toward the bull case for oil. Certainly nothing from the Saudi boondoggle chips away at this notion.

A number of key analyst firms, notably Goldman among them have reiterated their $100+ price forecasts for oil through the end of this year. This sets the stage for some serious shopping consistent with market activity. Does Obsidian deserve a place on our buy list?

The thesis for Obsidian

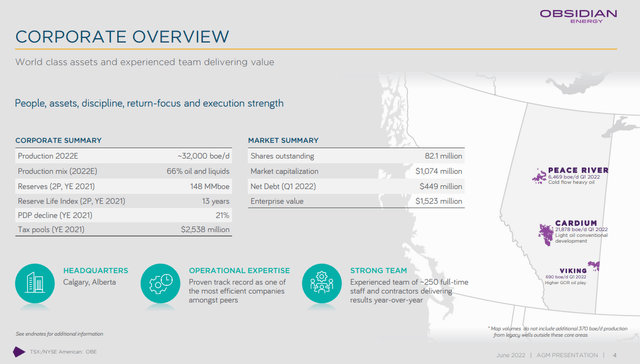

The company operates primarily in three well-known areas of the Canadian energy sector. All of which we have discussed previously with other Canadian operators.

Obsidian energy overview (Obsidian Energy)

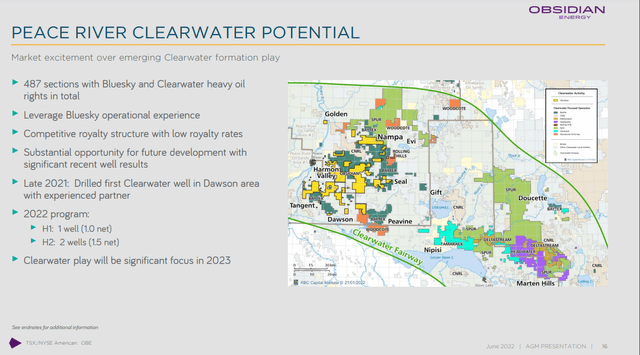

Taking north to south, the first of these is the Peace River Development Area in the Northwest, Alberta area. This is a heavy oil play that used to be the province of the oil majors due to cost, but in recent times has become accessible to smaller companies like Obsidian. As noted in the slide below, the company controls 487 sections that feature highly sought after Bluesky and Clearwater development prospects. Clearwater is noteworthy for its reservoir characteristics that allow for less expensive EOR flooding, which is substantially cheaper than steam injection or SAGD-type wells. Keeping the capital cost down drives margins. When you add in that these wells are very low decline, the capital intensity of these operations declines per unit over time, building a superior Return On Capital Employed-ROCE, profile.

Obsidian Footprint (Obsidian Energy)

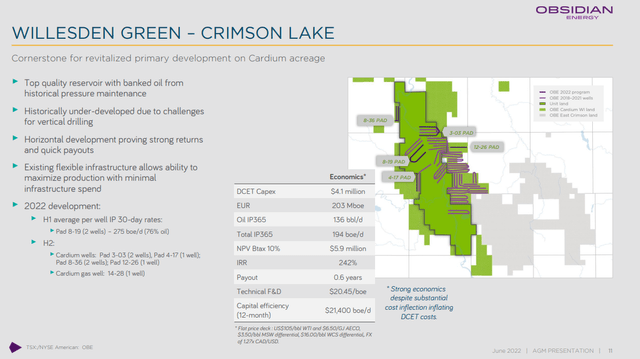

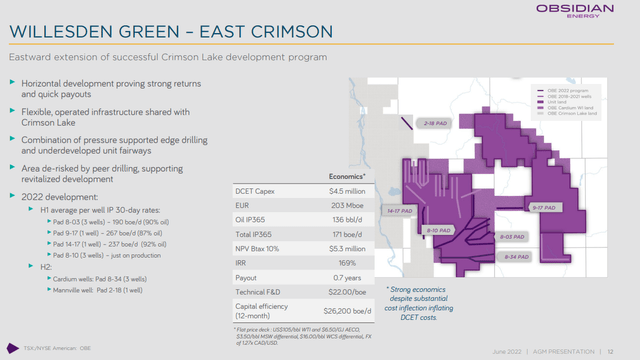

In the West Central Alberta there is Cardium Development Area. It extends over 300 kilometers in the fairway of the Western Canada Sedimentary Basin. Obsidian is currently the largest landowner in this area with 455 net sections of developed and undeveloped land. Cardium, is a light oil play with associated gas. The company has two-drill centers in this play as noted in the slides below. The Cardium is frac country, so it carries higher upfront well costs, but it can also mean very slow decline curves-dependent on a lot of factors.

Obsidian Cardium acreage (Obsidian Energy)

Obsidian Cardium acreage (Obsidian Energy)

As noted in the slides above, the acreage is advantaged by the blockiness of its layout. This enables long laterals, which as the industry has learned is one of the two key factors in enhancing EURs.

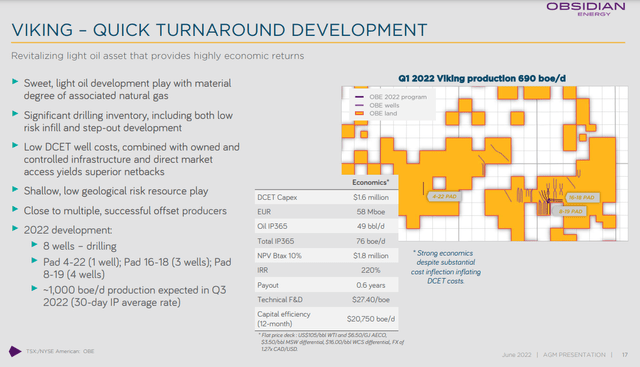

In the south, we have the Viking Development Area, located in eastern Alberta. The company has 144 net sections of developed and undeveloped land in that area. Viking is a light oil, waterflood play that will include 8 new wells in 2022, before diverting capital for the rest of 2022 to the other operating areas, to enhance high oil price returns in 2023.

Obsidian Viking acreage (Obsidian Energy)

A catalyst for 2023

The company is looking to take advantage of current high oil prices and has bumped up their capital substantially, essentially doubling it from about $150 mm to ~$300 mm. Stephen Loukas, CEO was quoted in a June press release commenting on this move:

We entered 2022 with a bullish outlook on commodity prices that anchored our tactical decision to operate four drilling rigs during our first half development program,” said Stephen Loukas, Obsidian Energy’s Interim President and CEO. “Moreover, we secured contracts whereby we obtained the required services and materials to maintain the optionality to continue to operate four drilling rigs through to spring break-up in 2023. Notwithstanding recent service cost inflation, wellhead economics are extremely robust with compelling returns and recycle ratios at current commodity prices.

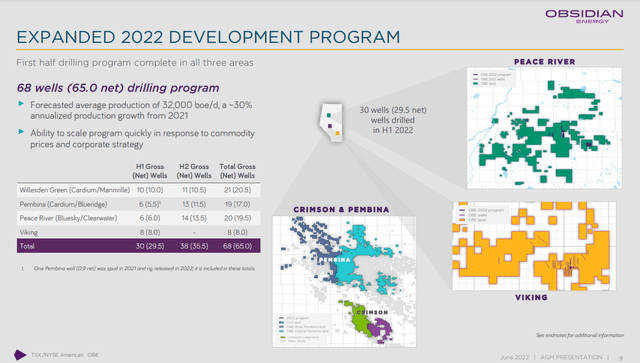

Obsidian Energy 2022 and beyond (Obsidian Energy)

As noted previously, this increased capex will be targeted to the Cardium and Peace River area due to enhanced economics.

If this is as productive as forecast in the slide above, Obsidian daily production would rise to 32K BOEPD, a thirty percent increase YoY.

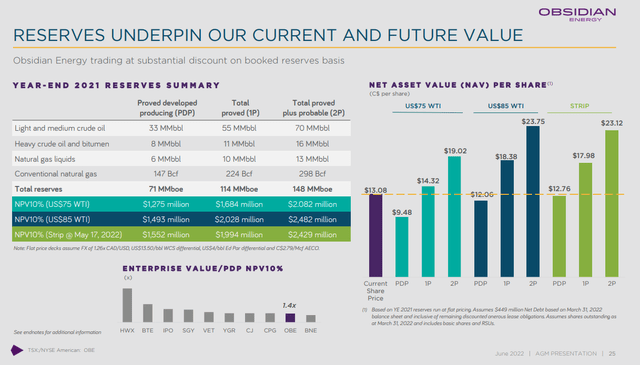

OBE stock price at a discount to 2P reserves value

2P reserves are commonly used in valuing oil companies. With OBE’s present price the 2P basis for the company is at roughly 1/4 of its reserves value at $75 WTI. Using that 2P valuation, the NAV per share is 3X its current price at $75 WTI.

Obsidian Reserves (Obsidian Energy)

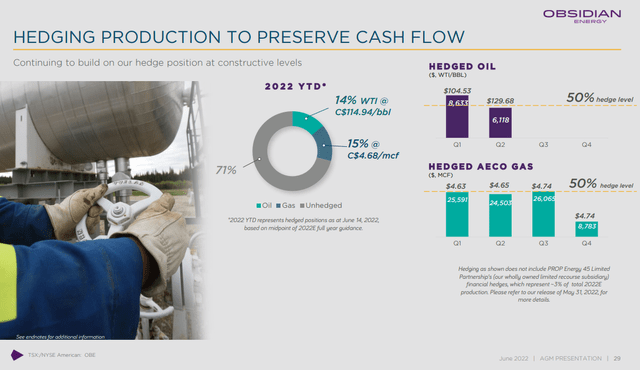

Hedges pave the way for increased profits in 2023

The company is marginally hedged for 2022 exposing most of their production to market prices. They’ve made no comment about hedges in 2023, but it’s a safe bet they will continue to seek market prices for most of it.

Obsidian Hedges (Obsidian Energy)

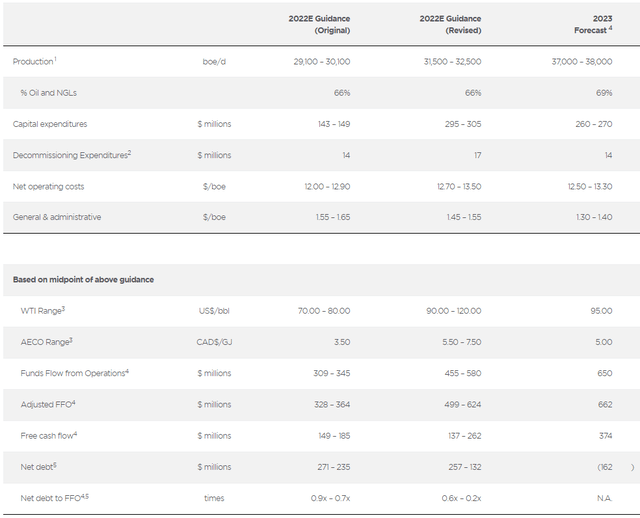

Obsidian Energy 2022 Financials

Using Canadian dollars the company expects to funds from operations (“FFO”) of $499-624 mm, over the course of the year. This will easily cover capex of-max, $305 mm, leaving a lot of cash available to pay down debt, as per their plans.

The company completed an interim debt refinancing in a $260 mm revolver and a $98 mm term loan, with an expiration of Nov 22. With $311 mm drawn, liquidity for Obsidian is about $50 mm, these loans will have new maturities upon completion of the refinancing.

Obsidian Financials (Obsidian Energy)

Your takeaway

Let’s do our usual calculations in the addition to what the company has told us about the NPV of future funds flows from reserves. The FFO multiple is absurdly low at current prices, coming in at 1.6X down to 1.28X depending on where their actual FFO lands out. On a flowing barrels basis, their 2022 exit of 32K BOEPD calcs out to $25K per barrel. Both of these are really good metrics and suggest that the company is way underpriced.

The company is planning for about 20% growth in 2023. With sales prices rising into the $80s and netbacks rising to the mid-$40s in late 2022/23, this should add $175 mm of FFO and about $98 mm of free cash to company coffers in 2023. Running the numbers once again.

Let’s take an average to avoid running it twice. Using the midpoint of the current range and adding $175 mm we get FFO of $737 mm, making the multiple if nothing changes 1.08X. If we give them a multiple of 2X, not unreasonable when you consider competitors are in the 3-5X range, the share price would adjust to about $16 per share and put it right at the upper end of analysts’ estimates. Those entering at current prices would see a 2.5X bump in appreciation. OBE was up smartly in today’s trading (6.89%). This would not put me off the stock, as I think it has further to run.

Be the first to comment