DNY59/iStock via Getty Images

Market Commentary

The third quarter was marked by the ongoing tug of war between investors, policy makers, dictators, and the painful landing of the pandemic-inflated economy. In the short term we expect uncertainty to persist; however, over the long term we know that the future, like always, will be determined by the optimists. Investing, like nearly everything in life, is a form of storytelling. When anyone buys or sells a stock, they are crafting a story about the future.

But, of course, no one can predict the future with any precision, and relying on the past can be just as problematic. Therefore, the stories we tell must be based on what we can clearly discern in the present, no matter how foggy the environs might seem. We then live through these stories as they play out in real life, fact-checking our narrative with reality to identify plot holes, inconsistencies, and elements of truth that help us refine our story.

There are some types of plots that tend to play out more often than others, there are always unexpected twists and, if you are lucky, a deus ex machina. At NZS Capital, we think stories of optimism – where the protagonist is adaptable and creating more value than they take (non-zero sumness) – occur much more often than stories of cynicism and pessimism, where the characters are rigid in their beliefs and extract too much value from society. The market, however, tends to be more cynical than optimistic, which creates cycles of fear.

Investing in the stock market is like buying a ticket to a movie about which we have little a priori knowledge. We can make educated guesses based on the title and trailer, but sometimes a seemingly feel-good rom-com has an unexpected horror subplot. The current market volatility implies a tension between two completely different plots for how our economic future will unfold.

One story is a doomsday movie wherein government policy makers, in an attempt to rewrite their “certified-rotten” pandemic-policy script, send the economy careening off a cliff while geopolitical tensions send humanity into nuclear armageddon. Herein, there is no hero, and the only way out is time and patience. Like Major King riding the bomb in Dr. Strangelove, this movie ends with more uncertainty and questions than with which it began.

The other script, however, has a happier ending. The underpinning of this second narrative is the self-healing ability of the economy, with innovation and hope driving a long cycle of post-WWII-like prosperity, investment in green energy, and a steady increase in global economic resilience. The first story implies that the last forty years of globalization, low interest rates, deflationary forces, and rising inequality will be met with a long and harsh punishment.

In contrast, the second story plays to the evolutionarily ingrained resilience and ingenuity of humans. Of course, there are thousands of ways the future could play out, and we won’t know the ending until the lights come up and the curtains close.

Advantageously managing this uncertainty is what defines our investment process at NZS Capital, as we focus on adaptability, non-zero-sum outcomes, and matching investments to their potential range of outcomes rather than narrowly predicting the future. Like the complex world around us, the global economy is dominated by power laws and extremes.

Humans, however, tend to be linear thinkers, so we can miss emergent, game-changing events unless we train ourselves to look outside our typical mental confines to routinely scan left field and beyond. Some of the best stories of the future may be written in surprising locations and combine different topics and technologies in novel ways. Importantly, in times of volatility, policy changes, and technological disruption, economic resources often shift and refocus on newly emerging areas.

A series of events, such as the world has recently experienced, can create pivot points for society. We continue to see significant opportunities in the engines of the analog-to-digital transition of the global economy, such as software, semiconductors, and the Internet. But, we expect resources and attention to shift to new origins of asymmetry in areas like AI, automation, healthcare, and other parts of the economy.

While we cannot know the precise storyline for what lies ahead, we can appropriately prepare for all potential plot twists. The Optionality tail of our strategies is designed to seek out and take advantage of innovation wherever it is evolving, while the Resilient head of each portfolio is designed to provide enduring growth. We continue to see opportunities across the spectrum of companies that we believe will play key roles in scripting our economic future.

Performance Discussion

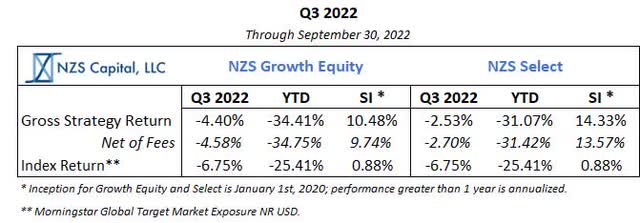

The NZS Capital Growth Equity strategy was down 4.58% net of fees in the third quarter of 2022; in comparison, its global market index benchmark declined by 6.75%. Year to date, the strategy was down 34.75% net while the index fell by 25.41%. Since inception, the strategy has cumulatively risen 31.52% net compared to a 2.44% return in the benchmark. The NZS Capital Select strategy was down 2.70% net in the third quarter of 2022, with a net year-to-date decline of 31.42% and a cumulative net gain of 41.89% since inception.

Thank you for your continued trust, interest, and support.

About NZS CapitalThe research process at NZS Capital is guided by complex adaptive systems and the unpredictability of the world around us. Our lens on the world, which does not rely on narrow predictions of the future, is ideally suited for long-term investors as the global economy transitions from analog to digital. We believe companies that maximize non-zero-sum outcomes for all of their constituents, including employees, customers, suppliers, society, and the environment, will also maximize long-term outcomes for investors. These adaptable businesses will take share as the economy continues its decades long transition from analog to digital, sector by sector. Our view of the world informs our portfolio construction process, which combines a relatively small number of Resilient companies (larger positions) with a long tail of Optionality companies (smaller positions). Resilient businesses have very few predictions underpinning their success and a narrow range of outcomes, while Optionality businesses have a wider range of outcomes and their success hinges upon a more specific view of the future playing out. We believe this combination of long-duration growth and asymmetric upside is well suited to navigating the increasing pace of change throughout the global economy. Our investment framework can be found in Complexity Investing. |

|

There is no guarantee that the information presented is accurate, complete, or timely, nor are there any warranties with regards to the results obtained from its use. Past performance is no guarantee of future results. Investing involves risk, including the possible loss of principal and fluctuation of value. Net returns are calculated by subtracting the highest applicable management fee (.65% annually, or .1625% quarterly) from the gross return. Gross returns are inclusive of reinvestment of dividends or other earnings. Actual fees may vary depending on, among other things, the applicable fee schedule and portfolio size. The fees are available on request and may be found in Form ADV Part 2A. Index performance does not reflect the expenses of managing a portfolio as an index is unmanaged and not available for direct investment. Any projections, market outlooks, or estimates in this presentation are forward-looking statements and are based upon certain assumptions. No forecasts can be guaranteed. Other events that were not taken into account may occur and may significantly affect the returns or performance. Any projections, outlooks, or assumptions should not be construed to be indicative of the actual events which will occur. Opinions and examples are meant as an illustration of broader themes, are not an indication of trading intent, and are subject to change at any time due to changes in market or economic conditions. There is no guarantee that the information supplied is accurate, complete, or timely, nor are there any warranties with regards to the results obtained from its use. An investor should not construe the contents of this newsletter as legal, tax, investment, or other advice. NZS Capital, LLC claims compliance with the Global Investment Performance Standards (GIPS®) GIPS® is a registered trademark of the CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. GIPS® Composite Reports are available upon request by emailing request to info@nzscapital.com. NZS Growth Equity and NZS Select are reported in USD. The benchmark for the NZS Growth Equity Composite and NZS Select Composite is the Morningstar Global Target Market Exposure NR USD. The index is designed to provide exposure to the top 85% market capitalization by free float in each of two economic segments, developed markets and emerging markets. NZS strategies are not sponsored, endorsed, sold or promoted by Morningstar, Inc. or any of its affiliates (all such entities, collectively, “Morningstar Entities”). The Morningstar Entities make no representation or warranty, express or implied, to the owners who invest in the strategy or any member of the public regarding the advisability of investing in the strategy y or to any member of the public regarding the advisability of investing in equity securities generally or in the strategy in particular, or the ability of the strategy to track the Morningstar Global Target Market Exposure Index or the equity markets in general. THE MORNINGSTAR ENTITIES DO NOT GUARANTEE THE ACCURACY AND/OR THE COMPLETENESS OF THE STRATEGIES OR ANY DATA INCLUDED THEREIN AND MORNINGSTAR ENTITIES SHALL HAVE NO LIABILITY FOR ANY ERRORS, OMISSIONS, OR INTERRUPTIONS THEREIN |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment